A Guide to the FOMC

rate hikes, accelerated taper, and the curve

What to expect today, and what it all means.

If you’re already subscribed, thank you! If you’d like to subscribe, please do so here:

YouTube/Podcast up later today to discuss results of meeting

Topics covered so far on Everything You Need to Know

Federal Reserve/Monetary Policy related videos

Okay, so what

Alright, so today is FOMC day. This the day where the Federal Open Market Committee announces their process of taking into account all sorts of different economic data (most specifically inflation numbers and job numbers, but it’s more than that) and announces a decision on monetary policy.

Monetary policy is one of the most important market forces, because it does a lot of work driving capital flows - it’s meant to either cool down or heat up the economy. It’s a nudge-nudge, push-push guide to the markets, and because of that, it’s important to understand what it all means.

The Fed has a dual mandate, which guides their decisions around monetary policy:

Price stability (aka inflation metrics, mostly the PCE, but the CPI is noisy as well)

Maximum employment (the job market, especially the labor force participation rate and the COMPOSITION of the labor force participation rate)

This is their dual mandate - price stability and employment. Both of those things have pretty much recovered (at least on paper) - inflation much more so than the jobs market. The CPI print came in at 6.8% y/y last week, mostly driven by energy prices, but with broad increases across all metrics.

Their main goal is to keep a lid on inflation, as well as encourage a diverse and broad labor market. They reach this goal through a few different policy tools (discount rate, open market operations, reserve requirement etc).

The Federal Reserve has definitely noticed how hot things have gotten, and have had a rather hawkish tone recently (aka we know that we’ve gotta make the market cool down). However, it is TBD if that tone will actually show up in the numbers today.

The Fed has to balance a lot more than just price stability and jobs. We have a global economy - and other central banks have their monetary policy meetings this week too.

We already have general expectations for what they are going to do:

Bank of England will hold off because of omicron

European Central Bank will likely also hold off because of omicron

Bank of Japan already has ultra loose monetary policy. This will not change, and it will likely never change

And on the total other side of the distribution, The Fed is likely to taper faster and announce a tightening timeline… the exact opposite of everyone else

So all the other central banks have a policy framework in place - BoE, ECB, and the BoJ are probably not going to let up off the gas pedal. The economies are responding differently - inflation has been especially hot here in the United States (although Europe is going through its own energy crunch). So the big question becomes - can these policies diverge from each other? Can the U.S. have tighten as others keep it loose? What impact would that have on capital flows?

What does contractionary monetary policy look like, and how will the market respond?

Let’s zoom out and then zoom back in.

Where We Have Been

As we all know, Covid happened/is happening. Because of the impact that Covid had on the markets (a lockdown, a huge drop in demand, lost jobs), the Federal Reserve had to step in to provide support to markets - or else things could have gotten really bad. They swooped in with their easy monetary policy toolkit:

Supported market functioning

Bought assets - backstopped certain parts of the market by providing liquidity through purchasing residential and commercial mortgage-backed securities and Treasuries

Lending, backstopping, and overnight liquidity: Including the Primary Dealer Credit Facility , the Money Market Mutual Fund Liquidity Facility, and repo operations

Near zero rates - they made it so banks could lend out as much as possible (essentially) by nudging the fed funds rate to make lending conditions very easy.

Lent to banks - gotta keep the money houses liquid

Lowered discount rate: banks could borrow from the Fed at ultra-low rates

Tossed reserve requirements out the window: banks could lend out as much as they wanted basically

Supported corporations - have to keep businesses up and running

Primary Market Corporate Credit Facility and the Secondary Market Corporate Credit Facility allowed companies to access money - basically, the Fed bought up some corporate bonds, directly intervening

They did a lot more than what was listed - but basically the Fed got into the market in a BIG way.

And this was important to do (despite popular belief, there really does need to be policy intervention during crises) - the market needed some element of support or else it would have likely cratered.

Where We Are Now

However, things have been *very* easy since March of 2020. The Fed rolled back on asset purchases, reducing them by $15b a month, but the environment is definitely still loose, to say the least.

The Fed now has a responsibility to make financial conditions less accommodating in order to ease these inflationary pressures.

Jerome Powell has made it very clear that he is pretty worried about labor market recovery - but with 11 million open jobs and low unemployment rate (despite a not-so-great participation rate), all signs point to tightening.

The Fed has a big decision to make - but it’s a gray decision. It’s very important as to HOW the Fed will conduct their monetary policy.

They’ve already made it pretty apparent that they’ve noticed how hot things are (when flames lick your boot, you gotta call fire eventually). But with this dual mandate described above, they walk a very tight line - if they move too fast on inflation (which could end up being transitory) what happens to jobs? And if they wait on jobs, what happens to inflation?

Think of Goldilocks and her porridge - it can’t be too hot, too cold, it has to be just right. The Fed has to manage both price stability (keeping prices reasonable) and jobs (keeping people employed) which is an incredibly delicate balancing act, at best.

The markets are also veryyyyy sensitive.

The Market Vibe

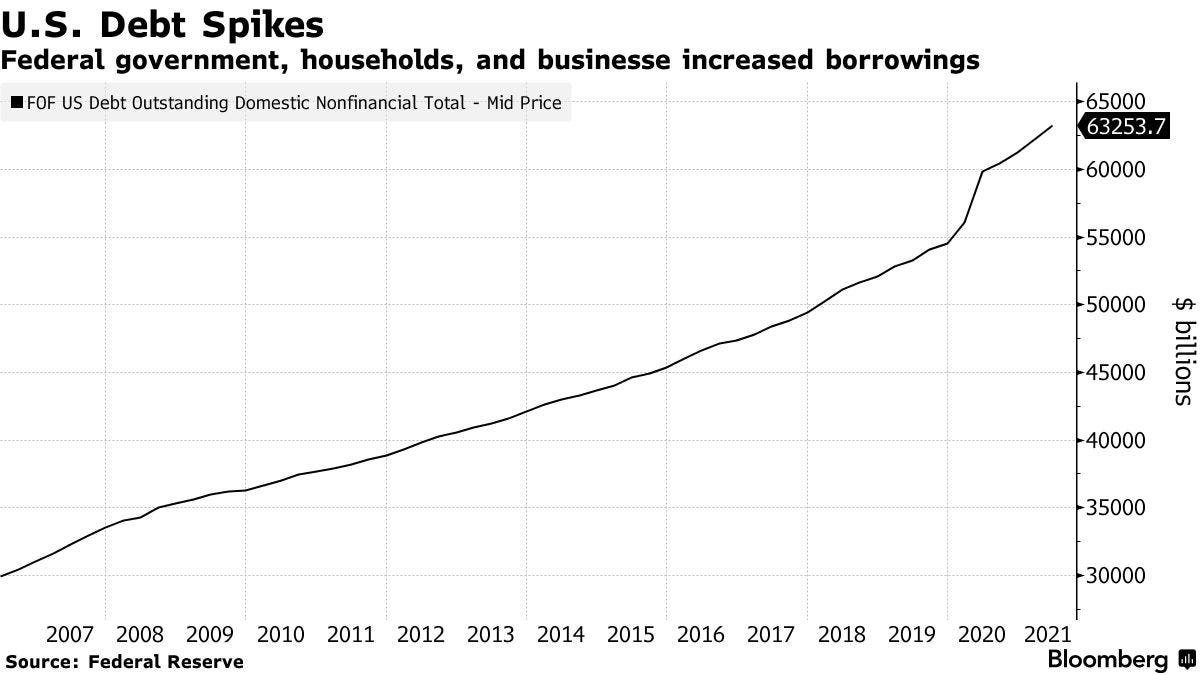

One thing that the Fed enabled during their big 2020 easing was the ability for companies (and the US government) to take on a lot of debt. With debt comes debt servicing costs - and higher interest rates could bite into the ability for companies to afford their borrowing costs.

Massive debt burdens are one headwinds. But the Fed has a series of headwinds facing them:

Bloated balance sheets of corporations, and the questionable ability for them to afford the debt they’ve take on in a higher rate environment

Investment grade bonds, high yield bonds, emerging market bonds - everyone levered up, because rates were so low - why not?

However, with the potential rate hike coming ahead, this could put these bloated companies at risk for some pain.

According to Bloomberg - “The combination (Fed intervention and ultra low rates) has pushed investment-grade bond duration, the so-called sensitivity to interest rates, to near-records and boosted five-year refinancing requirements to all-time highs of around $2.5 trillion”

Most of these bonds have high duration, meaning that they are sensitive to any changes in interest rates. So if things move, asset valuations could crater just because of fickleness of these instruments to any sort of twist and turn.

US Debt build - Not only have corporations taken on some debt, but so has the US government

Low coverage at auctions: Not too many people are interested in government debt at the moment. Of course, US Treasuries are always going to have some sort of bid, because it is the United States, but the central bank has absorbed $3T in Treasuries since Feb 2020.

Once they leave, who is going to step in?

Recovery in the labor force:

This is probably going to be the most impactful part of the equation - because how do you get people to go back to work?

The Fed can come in and mop up Treasuries, but you can’t *really* make people go do construction work or be a teacher.

Demand will eventually temper downwards, but what happens if no one is there to fill the jobs left?

What is the Yield Curve Saying?

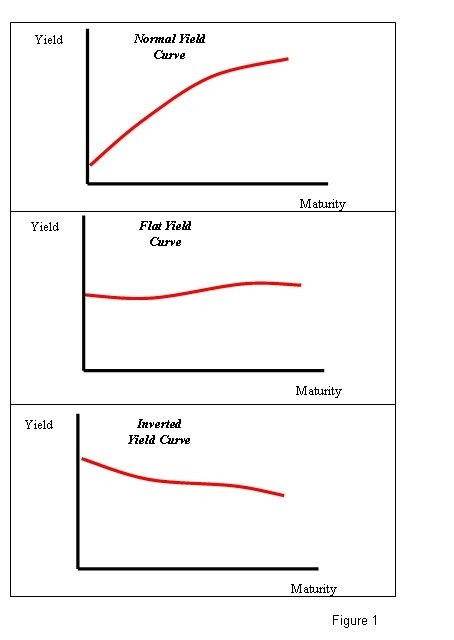

We can look at the yield curve to get a general sense of how markets think that the Fed is going to answer these questions. For a brief primer on the yield curve.

It generally should be upward sloping - you should be compensated more for holding 30Y bonds versus 10Y bonds because there is more uncertainty (and hopefully economic growth) on the 30Y horizon

However, sometimes the yield curve flattens. This means that the bond market doesn’t see a lot of economic opportunity over that timeline - essentially, the market in 10Y will be relatively the same as the market in 30Y.

Also, sometimes the yield curve inverts. This is bad. This means that the bond market is NOT happy - people don’t see economic growth into the future. An inverted yield curve normally signals a Recession.

Right now, the yield curve is flattening. This puts a bit of pressure on the Fed to do their thing, mostly because the market is already signaling to them - “hey we aren’t feeling super good about that lol”.

Based on overnight index swaps and eurodollar futures, the market is pricing in only five 25bp rate increases by the end of 2023 - versus the ten 25bp forecasts that the Fed dot plot has (this will be updated today).

The flatness of the curve suggests that the Fed is not going to be able to do too much before the curve inverts - which would definitely make them stop any action that they were doing. Unless inflation shifts or long term rates move, the Fed is likely to tighten into Recessionary territory - which means that all this talk of rate hikes would have to pretty much immediately stop.

Where We Are Going

With all that being said, inflation is likely to abate soon (or at least chill out).

Energy prices: In an attempt to hedge the CPI report, President Biden came out and said that October’s report didn’t reflect the decline in energy prices (which is true, gasoline prices are down ~25% since) or the decline in the price of automobiles. They could get further easing from Biden’s Strategic Petroleum Reserve release (sort of, if anyone uses it) as well as OPEC+ increased production should help too (sort of, if they can increase considering the already tight limits on spare capacity)

Goods prices: these should hopefully abate as the supply chain normalizes

However, as a caveat, rent prices show no sign of slowing down, especially considering the growth in home prices.

So that should put the Fed in *another* interesting spot - how transitory is transitory?

Consumer demand is likely to temper, and supply chains should work themselves out over time.

Energy prices are easing (even though though energy policy is absolutely atrocious)

However, labor force participation rate sits at 60%, and with no signs of moving upwards. There is continued divergence in real and nominal personal incomes, which will create political pressure around inflation and the Fed.

And finally, real rates are negative. The Fed has wanted to avoid negative rates for a long time - and have sacrificed much in terms of policy control to get inflation up and running (turns out, all it took was a pandemic). The United States has aging demographics, weaning productive output, and exacerbated wealth inequality, all of which puts downward pressure on rates, as Joseph Politano highlights in his piece, Borrower of Last Resort.

So the Fed really has two options, considering the influence of all of the above:

Increase the tapering process (which is already pretty much priced in and expected)

Raise rates (this is more uncertain, as we don’t know how FAST they are going to do this - this will be a bit more clear with the updated dot plot today)

It will be important to see WHEN those hikes sit on the dot plot. The September 2021 SEP (Summary of Economic Projections) report showed the Fed pricing in 1 rate hike in 2022, and 3 in 2023 and 2024 - will they move faster in 2022? 2 instead of 1?

Source: Federal Reserve

The Fed also doesn’t have a ton of room to the upside - real rates are cratering, the yield curve is flattening, and the jobs market is wack. That means that fiscal policy aka the US government is going to have to step in to manage things. Because rates have been so low for so long, they just ~aren’t the same policy the tool that they used to be~.

The Fed has a lot to deal with. And it’s questionable as to if their toolkit will be enough. As Harley Bassman of Simplify ETFs highlights in his recent piece:

“It is likely the Fed has broken the correlation between interest rates and inflation… it is unclear our leveraged economy can handle such a cost.”

What is a solution?

BROUGHT TO YOU BY:

Simplify Asset Management was founded in 2020 to help advisors tackle the most pressing portfolio challenges with an innovative set of options-based strategies. By accounting for real-world investor needs and market behavior, along with the non-linear power of options, our strategies allow for the tailored portfolio outcomes clients are looking for.

*This is not investment advice. See https://www.simplify.us

Final Thoughts

Inflation is likely going to get worse before it gets better. The Fed and the US Government provide a lot of support to the economy, which is good, but every action has an opposite and equal reaction (here, inflation). The workforce is far from recovered, supply chains are in a disarray, and there are overlevered ghost companies that could topple the whole system if they implode from being unable to pay their bills.

The Fed became a support system for the markets over the past several months (which truly, they were before Covid too). The market is sensitive - and the Fed knows that. Now the question is - what are they going to do, what will the pace be - and when will they stop?

As Ed Hyman used to say -

For now, it’s a wait-and-see game, with the market saying one thing and the Fed saying another. There are strategies that you can implement to protect against this volatility, but its also very important to understand the nuances of this volatility - and how the structure of the market could have changed forever as a result of it.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

Couldn’t we see inflation prints stay above projections, causing real interest rates to keep falling…? Is there a stomach for a Taylor principle style strategy from the Fed?

Sad, should have sold Costco calls before this week haha