This is a macro market update (I post daily to TikTok). I publish these once a week (beta phase), as well as single stock pieces (1-3x a month) and macro deep-dives. I also publish on TikTok, Youtube, and Twitter!

YouTube here!

Break it DAOwn Now

Ah, DAOs - decentralized autonomous organizations. A lot has been written about them. I am not really discovering anything new in this piece - more so angling the concept to that of which I know which is 1) the creator space and 2) the pitfalls of traditional corporations. The piece is broken out as follows:

What is a DAO?

How to DAO?

How do DAOs operate?

Examples

Bull and Bear Case

What is a DAO?

So what is a DAO? It’s “a group organized around a mission that coordinates through a shared set of rules enforced on a blockchain” as Linda Xie highlights in her piece. At the most basic level, they use collective participation to fund things and get things done.

The big difference between DAOs and the !Traditional Corporation! is that DAOs have:

Smart contracts: They automate some activities through smart contracts (contracts that execute when certain conditions are met) - which basically reduces any need for humans to be ~making decisions~ (which reduces a lot of inefficiencies and overhead costs)

Decentralized decision making: They are also decentralized - so big suits don’t have all the power. People do, primarily through voting through tokens.

Structurally: Think of it like an organization but with some of the parts (Human Resources, Ops Team, Middle Management) fully automated through smart contracts.

Stakeholders vs Suits: Instead of five people in a boardroom making all the decisions, it’s the stakeholders. “Companies are a collection of legal contracts and DAOs are a collection of smart contracts.”

DAOs are meant to be transparent, accessible, global, and have a flat hierarchy, the opposite of the traditional corporation. It blows up the traditional, triangle corporation.

How to DAO?

DAOs can do a lot of different things (and this piece is nowhere near comprehensive) - ranging from managing projects, acting as funds for investments, acting as an exchange, and collective buying etc. They start off with a core team, evolve to a broader community, and eventually open up to the rest of the world.

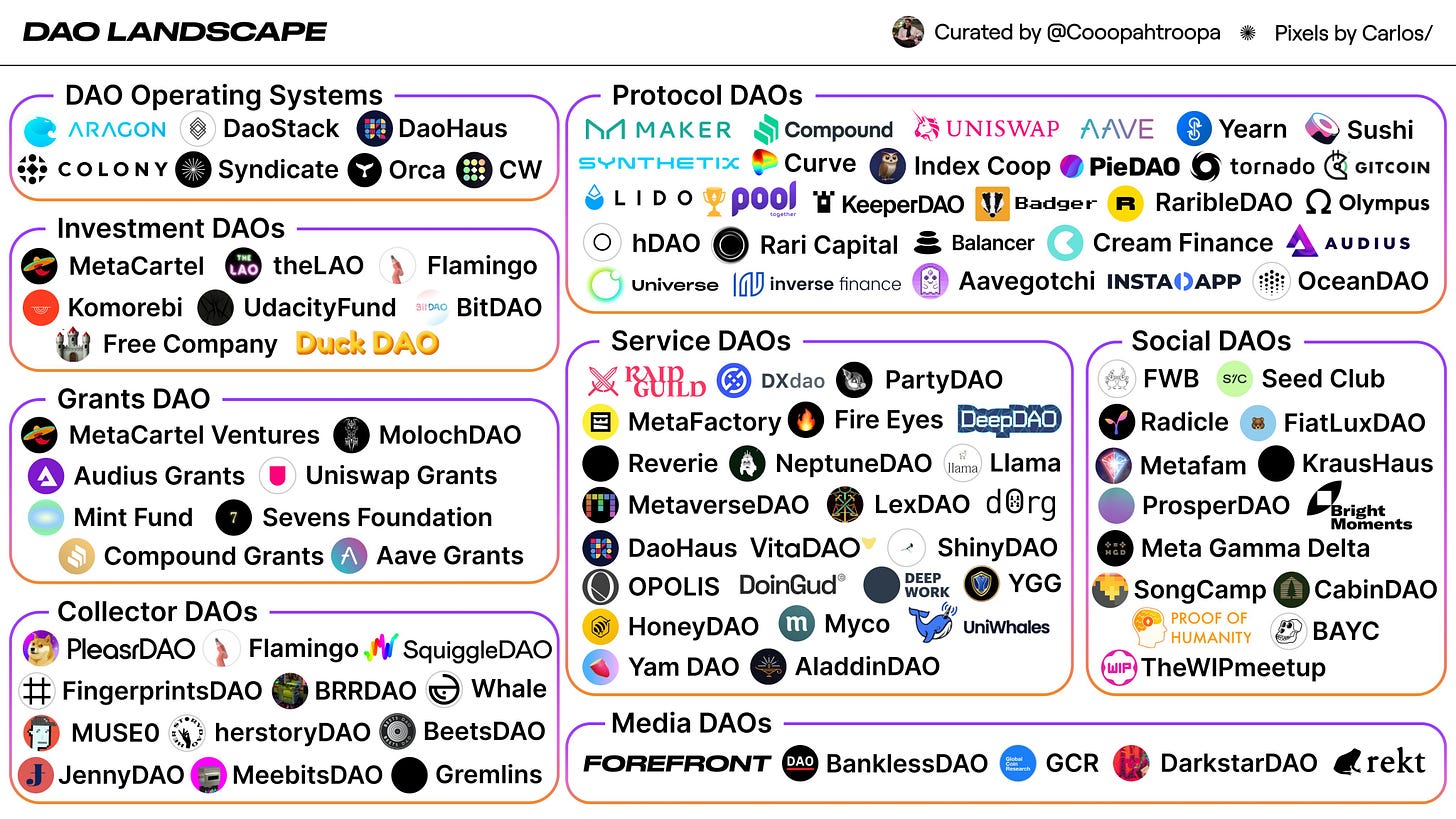

Coopahtroopa did a great piece on this, highlighting that DAOs are “internet communities with a shared cap table and bank account.” DAOs can be used to finance, govern, and share value as Packy points out in his DAO piece.

I kind of think of them like this - with operating system DAOs being the base that the rest of the DAOs spin out from. The other DAOs would be anything ranging from capital allocators (Grant DAOs) to art curators (Collector DAOs) etc.

All of the above DAOs are supported by a variety of different tools such as tools to manage treasuries, voting platforms, governance proposal tools, coordination platforms, and so much more (which Coopahtroopa lays out in his piece here). Corbin Page created this map of core services for DAOs below - breaking out the DAO services into different components.

Just like a corporation, there are many inputs that have to go into the functioning of a DAO - token services, governance, treasury management, etc. DAO ops are INCREDIBLY important. Ops are the lifeblood of an organization.

How do DAOs Operate?

DAOs use three main points of leverage to operate:

Money/Incentives: Invest with the expectation that the tokens appreciate over time and more people join the cause.

Commitment: Buy a minimum amount of tokens to invest - more active you are in the project, the more involved you can be in the direction of the organization (with the knowledge that other members are committed in the same way).

Decentralized Power: Most of the contracts execute based on majority rule - so if a proposal passes with 2/3rds vote, it doesn’t matter what the “leaders” want - the proposal is going to pass anyway - decentralized, transparent power

That meets a lot of our “needs”.

Human nature: we want to know that something at least has the potential to appreciate in power (incentivizing us to invest in it), we want to know that other people are committed, and we want to be a part of the process.

Loyalty is rewarded and incentivized. As much as we worry about our individual self, we still all desire to be connected to community - and DAOs allow for that collective belief in the value of an asset (or idea or concept, etc).

Another important note is that "organizations move at the speed of trust." If everyone is equally invested in the DAO and it’s path forward, trust should be built in (more or less) implying that DAOs can move pretty quickly.

Some Examples

This list is so far from comprehensive. I’ve pulled ones that I found interesting, but fully recognize that I have left out many.

DeFi Projects

MakerDAO: A DeFi project governed by a DAO. It allows users to lend and borrow crypto without a middleman. The token holders can vote on parameters for the system, governance, etc.

Yearn.finance: A suite of products in Decentralized Finance (DeFi) that provides lending aggregation, yield generation, and insurance on the Ethereum blockchain. The protocol is maintained by various independent developers and is governed by YFI holders.

Automated Market Makers

Curve: Generates fees and provides revenue share for locking tokens. The longer you lock your token, the more $$ and voting power.

Uniswap: A Decentralized exchange running on the Ethereum blockchain - users trade through smart contracts, Uniswap doesn’t choose the tokens, and there is no middleman - it’s purely trader to trader. People can be liquidity providers (locking up some tokens on Uniswap in exchange for liquidity tokens) and the transaction fees on the trades pay out to the liquidity providers. They have the UNI token - which gives people governance rights, with a focus on community-led growth and development.

Sushiswap: Something cool happened here - Sushiswap has the same core design as Uniswap - but with a SUSHI token! It *rewards* token holders the same way that companies (theoretically) reward shareholders - hold the token over time, benefit from the upside, and provide liquidity if you choose - BUT you don’t have to. Here you can provide liquidity, but can also benefit from holding the token even if you don’t.

Funds

MolochDAO: Fund projects that advance Ethereum. What’s cool about this DAO is that it has been forked to create other DAOs - similar to The LAO, which also invests in Ethereum projects.

PleasrDAO: Buy NFT art - but it’s so much more than that - “It stands for community, freedom, and decentralization. It’s a collective built by the community, for the community. While its early stages have been collecting iconic works, we look forward to democratizing ownership of the DAO and the pieces within it.”

There are models beyond this like Louis Grx highlights in his thread - and that will only expand from here.

So with all that being said - what is the main conclusion?

The Bull Case

Over $1 billion has been funneled across ~100 DAOs (as of June 2021).

The Extreme: The most extreme bull case would involve DAOs becoming the new LLC. DAOs are relatively tangible and fit into how we *think* of the world currently, which most crypto (candidly) really doesn’t. There are different roles that people can play within the DAO - moderator, promoter, project planner, builders, investor, etc.

The Power of the People: Decentralized coordination seems hard, but just look at what happened with GME and Reddit and what we accomplished with remote work over the past year. Discord groups are terrifying, but there is an element of community embedded in them - and DAOs would capitalize on that sentiment.

Flattened Hierarchy: One of the best things about DAOs is they open up the terminology - you and I can be an investor alongside a traditional VC. Niche communities can allocate capital efficiently and effectively. Communities can also own the space that they operate in. That’s so powerful for elevating access. DAOs could buy sports teams, art, property etc.

Creator Economy: Anecdotally, as a “influencer” (am I that?) I’ve become increasingly frustrated with the Creator Economy at large. There are so many people investing in it that 1) don’t talk to creators or 2) think they know what creators need (they usually don’t). DAOs are an opportunity to break away from the power of platforms and the power of traditional dollars. To the extent it works, it will democratize the space (which is becoming increasingly extractive).

The Time Premium: Liquidity is also really important- why work for a startup, wait for your equity to vest (or work for a traditional corp without any equity at all) when you could join a DAO and directly benefit from the governance.

Changing Demographics: One thing I’ve noticed about the Gen Z (which I mostly am) is that there is inherent dissatisfaction with corporate structures. The traditional structure doesn’t allow the entry-level employee to benefit from any upside, unless you stay for 20+ years - and that option is increasingly unattractive in this ever-changing world. Why would you stay at one place forever when there is so much to learn and do?

The Bear Case

Human Nature: Humans are humans. We saw what happened with The DAO: someone saw a hole in the code and exploited it. It was meant to be the next iteration of an economic organization. But it wasn’t. Hackers hit it, and Ethereum core team had to do a hard fork of the Ethereum blockchain. For all of human history, humans have been self-serving and only really interested in elevating themselves - especially in the individualistic societies of the West.

Legality: A lot of them also are not legally recognized (unless you are in Wyoming or Malta) so they operate without protection for members, which can be bad.

Rug Pulls: I think there is still the worry of the “get-rich-quick” mindset. Corporations actually offer iterations of what DAOs offer - voting rights, board of directors, dividends - DAOs promise to add efficiency and decentralization on top of that. But they also rely on humans incentivized by tokens - and humans are notoriously fickle.

A bit complex: Of course, there are a ton of decisions the DAOs have to make in the build-up - both on-chain and off-chain. It’s still complex - and there are still barriers to entry that have to be navigated.

Final Thoughts

DAOs are community ownership. It’s not a bunch of suits dumping money - it’s collective stakeholders determining the path forward, which is really important. They incentivize through monetary compensation, but also the element of decision making.

But with that too - one human always wants to rise to the top. Napoléon Bonaparte exists within us all. And theoretically, the structure should prevent that from happening - but community is HARD and disruptable.

This is really just the beginning of DAOs - people are working on building accounting standards for DAO reporting, which could credential the system. I would imagine more guardrails like this will come up, with will be important.

Adam Cochran also had a great thread on the problem that DAOs face (with remote work as the backdrop). They require a certain clarity of vision, collective coordination, and a clear process.

Also, things change - and that’s important to remember in the everevolving crypto space. Ho Nam wasn’t speaking about DAOs here - but the sentiment still resonates in this space I think. Are DAOs the next LLC or are the way that we think about businesses going to be disrupted entirely?

It’s a tough space to operate in. We aren’t great at operating in a decentralized way, because instinctually we need people around us. Human nature is social, interactive, and DAOs remove an element of that - but I think we are quickly adapting to the Online as our primary mode of operating in the world.

And with that adaptation, DAOs could easily become our main way of business and ownership - and that would be incredibly powerful.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.