Consumption On-Demand

the instant-gratification of the flex

Last week I wrote about my theories, and the piece this week is a dive into consumerism and the on-demand economy in context to our role is as a Human in Society.

If you’re already subscribed, thank you! if you’d like to subscribe hit this button here:

YouTube/podcast up soon

My inspo

I don’t think this quite answers Christoper’s questions, but hopefully it builds some sort of framework around it all.

Consumer Spending as Economic Growth

In the United States, ~consumer demand~ is 2/3rds of GDP growth. We grow the economy when people spend money. The big question is what that means when we reach essentially a flatline of supply that can’t match this demand (like how we have now with the supply chain !crisis!)

How does the demand curve respond to excess demand, coupled with not-enoughness of supply? What does it mean if demand cannot be fulfilled?

We are facing that crisis of not-enoughness right now, mostly due to

Logistical bottlenecks (both in terms of production and supply chains)

PEOPLE WANT TO BUY STUFF

Just look at the PCE - the Personal Consumption Expenditure index, which is used by the Federal Reserve to gauge inflation.

You can see the uptick in goods (clothes, electronics) over the past few month versus services (haircut, restaurant, etc) spending. People are buying stuff - they are still going out and spending on services, but mostly, they are buying stuff.

Subjectivity and the Content Diet

So then the question becomes: what are we buying and why?

Subjectivity, in the ~philosophical world~, is how we build the ideas that we have about ourselves and the environment we inhabit - it’s our reality. Our reality is strongly influenced by the content that we consume - which influences the things we buy. And right now, the average American consumes content that instates a few key values:

Conspicuous culture: Keeping up with the Kardashians and other reality TV shows, social media, are the perfect example of how the content industry instills in us that our sole role is to

spend

show other people how we spend.

We’ve got a bunch of people consuming a bunch of content, which influences how they see the world. It is very much a live-vicariously-through-the-drama sort of model coupled with the whole vibe of excess - people have always admired the ~rich and famous~.

And now there are ample tools of consumption to play the game alongside them - a lot of which hinges on the dynamic of just-in-time inventory.

Just-in-Time Inventory

Taiichi Ohno, an engineer at Toyota, came up with the concept of just-in-time in the 1950s in order to meet consumer demands and eliminate waste.

Just-in-time: Everything will be delivered just as you need it - so parts, goods, etc - the just-in-timeyness of it would increase profits, because things are more Efficient.

Just-in-time did a lot of things: put pressure on the infrastructure of the supply chain, forced companies to cut costs (usually wages) to compete with the quickness of other firms, and increased vulnerabilities to something breaking.

Too efficient? If you are always operating at breakneck speed, anything that goes haywire will derail everything (high energy costs, natural disasters, stucky bois in canals).

There is an inherent tradeoff between efficiency and dangling at the edge-of anything-might-go-wrong.

The Small Pieces

The edge-of anything-might-go-wrong is compounded by how many small pieces support the whole supply chain. It is composed of raw materials, work in progress things, and finished good things and all of those things have to be distributed all over the world, by boat, by plane, by truck - it’s honestly an incredible feat.

But if one thing goes wrong -

These problems are exacerbated… by the near-total evaporation of maritime shipping’s quickest alternative: stowing shipments of goods in the bellies of commercial passenger jets already flying between Asia and the United States, which have been making far fewer trips during the pandemic.

Everything goes wrong. There are a lot of moving parts to the process that we never see.

Turns out, the Consumer always wants More. Especially as the holidays roll around. We have consumers consuming, which is how the economy grows. But is that a good thing?

There are two different lens to consider here:

Amazonian Expectation and the Concept of Excess

Amazonian Expectation

Amazon has pavlov-dogged us.

Give Me the Thing Now: We have a culture that is on-demand. We just log into Amazon.com, throw things that we might want (and maybe need?) into our carts and expect it to be there with !Same Day Shipping!

Not having the Thing: We really don’t know what its like to not go roll up to the grocery store and purchase chicken, eggs, and apple cider donut Oreos.

So we don’t know what it feels like when we can’t get access to certain things that we want when we want them. And that’s mostly because supply chains have worked up until this point - and Amazonian Expectation has enforced the instant-gratification society that we operate in. They own the heart of consumers through three main ways:

Trust: 89% of Amazon shoppers are like “Yes, I trust Amazon to deliver products that we want, on time, in-tact, in those brown boxes”

The Everything Economy: Amazon is the one-stop shop for everything. Food, clothes, electronics - it has it all, because it can have it all. And we want it all.

Instantaneous: A lot of people shop with Amazon because it’s pretty cheap. And fast. And efficient. And we get a rush of joy when we hit that little buy button

One of my favorite artists, Mikey Mike, has a song detailing this ~feeling~ that Amazon evokes (“I fill the hole in my heart with Amazon Prime”).

Amazon has this excellent model - they have built 1) trust with a very large consumer base who desires 2) frivolous products and 3) instantaneous products!

wHAT MORE COULD YOU WANT

The only problem is that this model is extremely hard to maintain - mostly because of the rickety nature of supply chains and the forcing function of excess - you can only maintain for so long at full throttle before the machine gets exhausted.

The Concept of Excess and Fear of Shortages

Jay Forrester, a MIT engineer, developed something called the Beer Game back in the 1950s, where people take the roles of retailer, wholesaler, distributor, and brewer in a simulated supply chain - with the goal to minimize cost, meet demand - and people do REALLY bad. The process looks like this:

Some people order too much - causing supplier to temporarily run out of supply

Supplier orders some more, but buyers start to freak out and order MORE

Buyers stock up on goods, trust becomes scarce

!shortages!

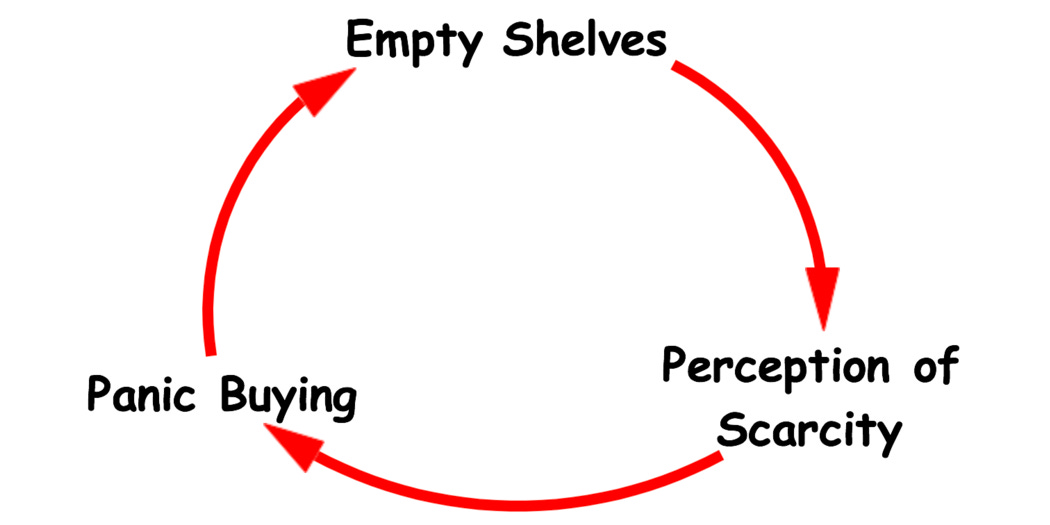

It’s very hard to get logistics right. And hoarding is a brain thing. We live in a world of:

“Scarcity, uncertainty, and resource competition. In such a world, hoarding can be adaptive. Brain imaging studies show that the impulse to hoard arises in our limbic system and amygdala, ancient structures that generate emotions, fight-or-flight, and other survival behaviors.”

It’s human to respond like this.

Our executive decision making brain eventually tells us to chill, but we still have this animal instinct to hoard - which is a bit different than pure consumption for consumption’s sake.

We hoard because we are afraid, and then when things normalize we say “oh wow wasn’t that wild that we had a toilet paper shortage!!!”, and then rinse and repeat the next time we get spooked.

So hoarding is a fear thing, but consumerism is flashy thing. It tends to be “yes I want shiny thing to be mine”, perpetuated by Amazon Prime and a culture that values excess and flexing.

Consumption in Crypto

On a large scale, you can see excess and flexing in the crypto economy with NFTs etc, but also with how money flows. There is productive nature to a LOT of it - but broadly speaking, it’s calibration. There are three basic levels to how crypto flows throughout the system (at a high level)

Flippers - A great model seems to be to get into an airdrop, sell the tokens on the secondary, rinse repeat. It’s about making gains - but that flipping compounds over time, as money finds a lot of different homes.

Yield farming: You lock up your crypto, they lend your crypto out to other people, and you get yield based on the fact that you are lending money out. In this model, money still flows throughout the crypto economy. It compounds even - and you get way more than 0.0001% like most tradfi banks.

HODL - as in hold your money, don’t let that circulate.

But crypto consumption doesn’t impact society in the same way that consumerism does - it’s a derivative of it, sure - a lot of the consumption patterns in crypto center around gathering NFTs and tokens that usually represent

Access to an ingroup (DAOs, NFTs etc)

Status (flex goods)

Same exact model (unsurprisingly) exists in the “regular” world. We consume products that make us feel that we 1) belong or are 2) rich. On aggregate.

It’s flexation theory.

Clout is currency: Sometimes, people operate with one goal in mind and that is to flex on their friends as hard as they can, especially in younger generations.

Flexation: inflation but for flexing - think of how we operate with flex dollars as currency - youre going to need to flex bigger and harder in order to match that next level flex.

With clout as currency and flexation as the backdrop, it makes sense that we have NFT projects moon - you have to show that you are doing the thing harder + better than everyone else

Crypto as a Sink

Then the question becomes: how does excess escape in an economic structure? I think crypto actually serves a really important role here in this consumer-oriented society. Lots of people making the jump into web3, buying their first NFTs, joining DAOs. But as broad economic structure in this Consumerism On-Demand world, crypto is interesting.

I think crypto is a gold sink for the broad market economy.

Sinks reduce inflation: In video games, there are different sinks that exist in order to take currency out. This reduces inflation so the ~in-game economy~ can stabilize. Few examples:

Fees - paying a certain amount of in-game currency to access part of world. Money gets taken out of circulation, funneled into fees.

In crypto - Gas fees: This is how much you have to pay to execute something on the blockchain

High priced items - Pay money into rare collectibles.

In crypto - NFTs: ah, the non-fungible tokens. The rare collectibles.

Crypto is acting as somewhat of a sink in the real economy, unintentionally and very broadly speaking. Obviously, crypto people still consume by owning homes and eating food etc, but a lot of their wealth is tied up in these real-life gold sinks. From a high level, both gas fees and NFTs (among other things in the crypto ecosystem) take money out of the economy and put it into more static systems.

So crypto has the functionality of a sink for excess currency - it’s deflationary.

Wait wut: Imagine if all the crypto $$ was flowing into the broad economy - it would be the more dollars fighting for the same amount of goods, and that would create an element of inflationary pressure.

So crypto consumption is a way for the broad market economy to leak some excess. And please note - crypto is more than just a gold sink in a video game, but it’s interesting to think of its role as both 1) the Future of the Internet and 2) a Monetary Policy tool.

Stagflation and Monetary Policy

So crypto is a sink, but that doesn’t mean the rest of the broad economy is immune to inflation. Right now the Fed is talking about tapering (raising rates, scaling back on asset purchases) because the economy is growing too fast (!!inflation!!).

But Stagflation is a concept that keeps floating up - it’s a function of:

Rising prices (high inflation)

High unemployment

Flat economic growth

So think of the worst possible combination, and that would be stagflation. There are murmurs that we are entering into that world again, mostly because of the strain of the supply chain and the “Great Resignation” (labor shortage.) The idea is that things are getting so tense that it will be tough to grow the economy - it’s stagnant.

How do you fix that?

Ideally through policy, especially monetary policy!! Wow! But monetary policy probably doesn’t have all the answers.

The Fed is whispering sweet things of tapering - that yes, they will hike rates, yes they will pull back on asset purchases, and wow if it won’t be the most BEAUTIFUL economic contraction that you’ve ever seen - inflation will STOP.

But will it?

If we have the workforce quitting in droves, if we have boats that are stuck in ports, if we have an energy crisis - how will hiking rates solve any of that?

One could argue that higher rates would make everyone chill tf out - stop spending your money on apple cider oreos, stop all the frivolousness, and just get sh!t done.

But there is no promise of that.

Right now we need innovation, both in terms of how we consume products and how we produce them

Raising rates isn’t going to be a magical antidote. It might prevent the next on-demand grocery service from getting millions in funding, but what good does it do for the bottom-of-the-hierarchy consumer? And that’s who we have to worry about, because they are ultimately the underbelly of the economy.

The Desire for Analog

The funniest thing about all of this is that it’s on a precipice. People are tired of the model of 9-to-5, which makes sense, which is why stagflation might happen.

The Upside is Gone: The feeling of upside optionality in the day-to-day has fallen (on average) - it’s incrementally more difficult to achieve the same things that our parents did - house, retirement, savings, etc etc.

This dissatisfaction is bred by technology (and the system, but a lot of it is technology), something that could enhance our lives significantly (and does, still) has probably turned into a net negative to the average American - because they spend so much of their day scrolling social media, and comparing their lives to the outside world.

Consumption and Production: As a participant in the digital world, you both make and take content. You are a consumer: you consume your favorite websites (read Twitter) & you are a producer: you post on those favorite websites (post on Twitter)

This is an unavoidable byproduct of a consumption-focused society. We are taught to put our lives online, to celebrate in the flashiness, to be a part of the ~goldenness~ of the online world. There is a certain level of exhaustion that comes with being that online, both from a consumer and producer perspective.

A lot of people talk about futurism and the completely digital world, but we are still communal creatures that have a biological need to be around others. So we end up bandaging this loneliness with buying stuff online. The excess is just a patch.

Final Thoughts

We tend to operate in this short-term mindset, where we consume quickly - take in fast fashion, keep up with the trends, follow the viral meme format - everything moves so much quicker because we are online.

And so when we think about instant gratification, it’s largely a byproduct of the instantenous nature of our online existence. Amazon helped to confirm that, the Kardashians et al amplify it - and we get stuck in this cycle of “NEED THIS NOW or else I’ll miss out!!”

Instead of GDP, the economy could be best measured by FOMO metrics, a component of flexation (inflation of flex culture, or how it becomes more expensive to flex over time):

Economic Growth = Flexation + FOMO + Instant Feedback + Desire for Community

So we do have a society that is Consumer on Demand - and I think the supply chains and the stuck boats are a great example of how this only *works* to a certain extent, and how there is ample room to rethink the structure of consumption - and I don’t know what that looks like. But there is room to retool fast fashion, malls as focal points of cities, the constant advertising we are subject too. It works until it doesn’t, and that inflection point is rapidly approaching.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

Could you add a segment at the end of your posts: "What I'm reading now.' or "What you could read that would help an understanding of... ." Iw would be helpful for those not classically trained in finance/econ/stucky bois that want to consume more acedemic - ish style content. thanks you are still the best in the game.