Dichotomy in the Golden Age of Fraud

The Fed, capital discipline, artificial scarcity, and the Gilded Age

hello here are my notes for this week

If you’re already subscribed, thank you! If you’d like to subscribe, please do so here:

YouTube up this weekend and podcast up later!

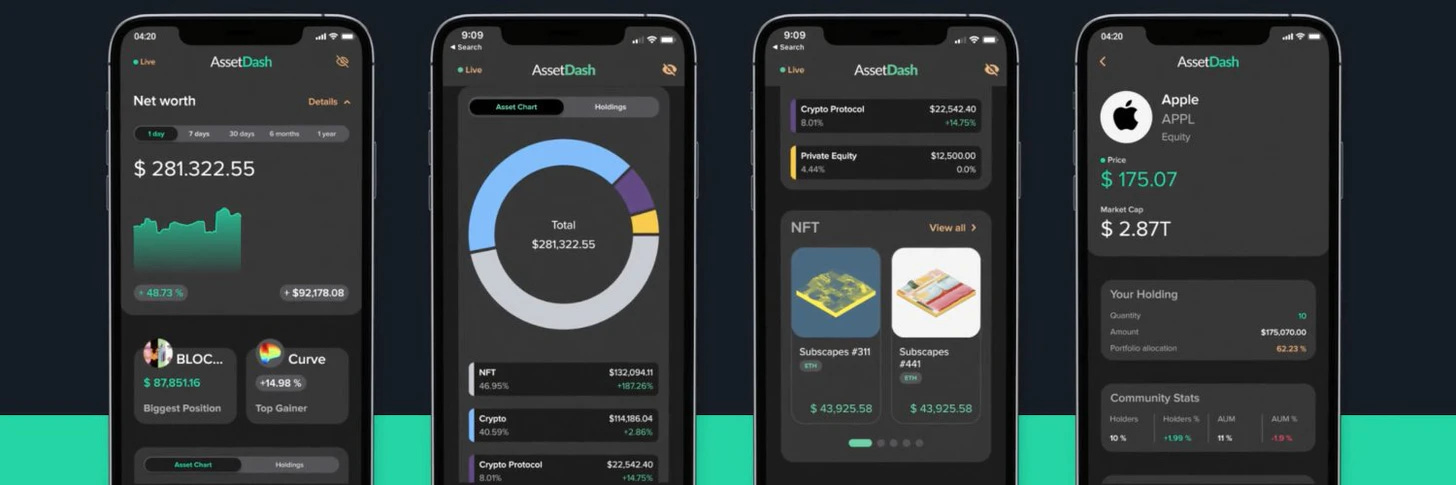

Brought to you by AssetDash

Stop checking multiple investment accounts and crypto wallets, and track everything in one place with AssetDash. They support everything from NFTs to DeFi to stocks, and every major crypto exchange, brokerage, blockchain, and crypto wallet. You can receive notifications and insights about your investments and more. It was voted #1 Product on Product Hunt.

Check out the app here: https://linktr.ee/assetdash

*This is not investment advice.

Big Market Moves

The market is gyrating ? for lack of a better word (maybe a blowup yesterday?). layoffs are happening. funding is drying up. bitcoin is down. It’s really brutal - not just the selloff but the volatility in the selloff.

With the market, it sometimes is like that limbo game where it’s like “how low can you go without breaking your knees”

The market was happy after the Fed meeting because “no 75 bps!! (even though the market is pricing that in?) so money flowed in!

But yesterday, the market realized that 50bps is still a lot (especially the pace of which the Fed seems to be planning to raise) so, a lot of digestion.

Selloffs are normal, they happen, theoretically, they are good for the market because they do represent buying opportunities. But, there is a bad feeling about seeing red.

This market is very reactionary and nervous.

Powell pointed a lot of this out in his speech, but things are WEIRD. War, pandemic, political stagnation, food shortages, an energy crisis, etc etc.

So the market is going to be kind of weird too

But it’s also good to zoom out.

There are some themes I want to discuss with the goal to underscore dichotomy.

The Federal Reserve

Capital discipline

Artifical Scarcity

The Gilded Age

The Federal Reserve

It’s a changing of market regimes - no longer is money free-flowing and life-is-a-easy, but rather the Fed is like “wow the labor market is WAY too hot (go to work!! so this wage inflation chills out!!) and also inflation is WAY too high (stop demanding things!)

They have the responsibility to fix this imbalance between supply and demand, but their toolkit (rates + balance sheet) only really works on the demand side.

They can’t make ships go any faster or produce oil - the goal is to have consumers chill out so hopefully supply can normalize

Raise rates: make it more expensive to borrow, less loans, less demand.

Shrink balance sheet: less support for market, no Fed backstop.

So that’s what they are going to do! The plan is to ramp up balance sheet rolloff and probably do 50 bps of rate hikes at the next few meetings. I made this Fed explainer video that dives into the specifics of what all that means:

The Fed is doing the best they can with the tools that they have. The market has been sort of frothy, right? Imagine making policy in this sort of environment.

More IPOs with negative earnings today than Tech Bubble

Ark Innovation quadrupled in value in one year

Diesel prices rocketing

Fertilizer prices up 70% from last year

Things have to revert to some semblance of reality eventually. Once the wind starts blowing, the house of cards is going to have to sort of tumble. And it’s scary! And the Fed shoulders some of the blame for that but also -

An INTERESTING thing about the delay in monetary policy (at least in terms of getting inflation under control) is that they couldn’t respond because they didn’t know who would be in CHARGE.

So the Fed had to wait on decision-making because of the uncertainty of their own future - which feels sort of meta?

They are deciding the economic future, but couldn’t, because they didn’t even know their own path forward.

Which is arguably why they (and we) are behind the curve now.

And of course, there are many, many, many questions left. Just because the Fed knows their path forward (raising rates by 50bps! shrinking the balance sheet!) doesn’t mean the path forward is certain. The Fed is kinda feeling things out.

If I had to reenact the Fed meeting from Wednesday:

Powell: Hello, yes, inflation is indeed super high and we know that and we are going to deal with that with our tools and the economy is strong also have you all noticed that bad things keep happening

Nick from WSJ: Hey man, a recession? We seem to be barreling towards that?

Powell: no!! 3.6% unemployment rate (even though the participation rate dropped a few bps recently) ha please go back to work! Supply and demand is a MESS. We have to get wages down to get inflation down to ~decelerate~ (not slow!!!!!) the economy. Everyone is doing somewhat okay it seems! Right?

Steve from CNBC: 75 bps? What? When is that coming? Why 50bps?

Powell: 75bps is far too much! Inflation is going to flatten out soon hopefully and we are waiting for evidence for that. Supply chains. China needs to open up omg though ha. And listen! We aren’t going to STOP! We will just go to 25bps.

Colby from FT: Neutral rate?

Powell: Right, that’s when the economy is just straight up vibing, economic activity is not going higher or lower. Idk where that is? It’s pretty much based on vibes. Somewhere between 2-3% but we are so far from that lol. Financial conditions and the economy will tell us what is going down with all that.

Steve from Bloomberg: Recession?

Powell: omfg LISTEN. We could have to induce a Recession! But we will need to see. I love Volcker because he was like “Get Rekt” and I understand that! We need price stability. Things are crazy rn you get it. If appropriate, yeah. Recession. But we are monitoring the vibes, don’t worry!

His whole thing was that the (1) economy is strong (even though GDP was negative) and that (2) the labor market is very tight (3.6% unemployment is good but wow!), so things are okay if they slow demand a little bit. The economy can handle it! And like maybe! The stock market can be a bit of a whiny crybaby, but time will tell how both the economy and financial conditions respond to the Fed’s moves.

Monetary policy really is vibes.

Okay so market cycles are normal, Fed is tightening, etc etc but also -

Are… humans doing okay?

Like?

Capital Discipline: OPEC vs VCs

Oil: OPEC+ has been underproducing for a while, which leads to shortages in oil supply (also there have been freezes in North Dakota, political turmoil in Libya, etc, all of which has exacerbated problems).

OPEC+ announced at the end of their most recent 13-minute meeting (amazing) that they would increase oil production, and that the oil market is “balanced”. Both of those are probably lies!

U.S. shale producers underproduce because of “capital discipline”.

Investors are very mad at them for burning cash during 2014 shale boom era, so they say “hey you better pay us FIRST ignore the global energy crisis!”. And that’s that.

It’s one of those things where it’s like “okay I get it but ??”

Venture Capital: The venture space is going through a bit of a contraction (kind of?) right now. There’s a lot of talk, but the main thing is “wow investing in companies with no real product model was probably a bad idea”.

It’s sort of a lack of capital discipline.

And it’s really sad. Amazing people are losing their jobs because companies 1) overhired or 2) need to get towards profitability.

I think the thing that bothers me most about this is the VC funding path is - the companies that get funding and what they do with it. We live in a world that operates in the tail ends of the extremes, so we need to have companies that are building in the tail ends.

Lux Capital does an incredible job investing in this space but most VCs don’t invest in some of these companies (think like future of healthcare, biotech etc) because multiples aren’t high enough, exit returns, etc etc etc.

And VC investments drive the future of the world! Like! Come on.

Artificial Scarcity: Bored Apes vs Home Desirers

Bored Apes Land Sale: Okay, so Yuga Labs, the parent company of Bored Ape Yacht Club had a big metaverse land sale event for Otherdeeds (oversimplifying). This is the pinnacle of artificial scarcity - which is fine! But there is a limited amount of thing to buy, which pushes the price up because of the mechanics of (artificial) supply and (real) demand.

And it was a big deal! Lots of ETH was burned as people tried to get some metaverse ape land (that’s why you use L2s!) And some people won and some people lost. And that was that.

Housing crisis: BAYC is in SUCH stark contrast to the actual housing crisis which is a function of real demand and real scarcity.

Mortgage rates are above 5.5% which makes it increasingly difficult to own a home (if you can even find one!) because of real scarcity

Home supply on the market is at all time lows, and so it’s just brutal for a anyone who is like '“I want to have equity and ownership” and then someone else comes in and bids $600k over asking price

The American Dream of 2.5 kids, a house, and a 9-to-5 that can finance *all that* feels increasingly out of reach for many. And in the same universe, people are buying $40k metaverse land plots (which is fine for them!) but it’s just so… stark.

The Gilded Age: The Met Gala vs Roe v Wade

Warning: This is political. I am a 24-year old woman, so I care about this, and am worried about the broader implications for what this means (beyond abortions). I really liked Leila Cohen’s take on the situation:

“If it was about babies, we’d have excellent and free universal maternal care. You wouldn’t be charged a cent to give birth, no matter how complicated your delivery was. If it was about babies, we’d have months and months of parental leave, for everyone.”

So, that’s my opinion. And I respect your right to have an opinion on this subject too!

So, the Gilded Age -

So the Met Gala (for some reason) chose the theme ‘Gilded Age’ for their big party of celebrities. It is from a Mark Twain novel - a satirical take on the supposed post-Civil War golden era:

“An era of serious social problems masked by a thin gold gilding of economic expansion… and a time of materialistic excesses combined with extreme poverty and political corruption”

Like oh no that’s WAY too close to home right know

Naturally, the Met Gala happened at the same time as the Roe v Wade Supreme Court leak. So if you were on Twitter, the dichotomy of the tweets was strange.

A very odd thing to experience. And it was almost too ironic - like if you were watching a sitcom, and everyone was at a fancy ball and someone came on the loudspeaker and was like “hey the U.S. is even more politically divided than ever!!! isn’t that super neat and awesome” it would make sense! Because it’s absurd!

The deep sense of irony that permeates recent events is really bizarre. It’s like living in two worlds at once. Presumably, reality converges eventually, but I am not sure what that looks like.

Final Thoughts

We live in an ecosystem, as much as we like to ignore it. And not to get all kumbaya around the fire, but we need each other. Just like the flower needs the wind, the fruit needs the flower, the animal needs the fruit - we have a responsibility to each other (which has been trucked over since the beginning of time, but it is still there).

The flower is profoundly alive, and because the flower is so brilliantly and wonderfully here, WE are here.

Bloom — is Result — to meet a Flower

And casually glance

Would cause one scarcely to suspect

The minor Circumstance

Assisting in the Bright Affair

So intricately done

Then offered as a Butterfly

To the Meridian —

To pack the Bud — oppose the Worm —

Obtain its right of Dew —

Adjust the Heat — elude the Wind —

Escape the prowling Bee

Great Nature not to disappoint

Awaiting Her that Day —

To be a Flower, is profound

Responsibility —

Links

This Is How America’s Culture War Death Spirals (The Atlantic)

FTX sponsored fortune cookies

Cunningham’s Law: “The best way to get the right answer on the Internet is not to ask a question; it’s to post the wrong answer.”

How Elon Musk's Twitter Activity Moves Cryptocurrency Markets

A comic I made about billionaires that I don’t have words for yet

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

Feedback: Keep doing what you’re doing Kyla. You’re only getting better !

Thank you.