Financial Warfare: Russia-Ukraine

Fortress Russia, sanctions, energy, agriculture, and the strength of Ukrainians

An updated synthesis on the Russia-Ukraine war

If you’re already subscribed, thank you! If you’d like to subscribe, please do so here:

YouTube up tomorrow, podcast up now!

What’s Going On

Usual disclaimer that everything is synthesis and amalgamation of other people’s work. Hopefully it is a helpful summary of everything that has happened.

Please donate if you can - here are some links if you’re looking

In this piece - The concept of financial warfare, especially in light of dollar dominance. Some brief history on “Fortress Russia”, updated sanctions, energy markets, agriculture (and subsequent inflationary pressure). Then Russian monetary policy and central bank response - both from a money market funding and a reserves scope - and then a more focused view on companies and people. Finally!! Will get into crypto, the US market response (including JPow).

In partnership with the FRDM index

There is power in being in position to direct assets, and we can use that power for good, especially in emerging markets. Perth Tolle and the FRDM index work to solve the problem of autocracy concentration in market capitalization weighted emerging markets indexes by using a 100% freedom-weighted approach, for investors who want to support freedom in their EM allocations.

The FRDM index is a freedom-weighted EM equity strategy that uses personal and economic freedom metrics as primary factors in the investment selection process.

*This is not investment advice. See https://www.lifeandlibertyindexes.com

The Pillars of Financial Warfare

Before getting into this, I want to highlight that the most important part of all of this is that the Ukrainian people are still fighting for their lives and their country, Russians are still on the streets protesting. Putin has threatened nuclear warfare - and shelled near a nuclear plant on Thursday night (and there’s never been a military attack on an operating nuclear plant). So things are escalating, quickly.

Another part of this is that warfare exists on different fronts - psychological, cyber, chemical, economic, and more.

Economic warfare has been the primary tool that the West has wielded during this fight - the “weaponization of finance” as it’s been called. The dollar (and access to it) has become its own military tank.

However, in a globalized economy: Impacts of globalization (both the efficiencies and the effects) are felt when the broader supply chain falls apart, as we saw during the pandemic and as we are seeing again now.

When one country invades another, you *can’t and shouldn’t* really do business with them anymore. But when we have a just-in-time-everything-interconnected economy, that makes things a bit difficult from a functionality perspective - if all the sudden one of the biggest trading partners gets booted from the system, that’s not super great from a “oh yeah my fertilizer that I use to grow all my crops and feed the country” view. It’s just a byproduct of geopolitical relations.

And so the West has been sort of dancing around sanctions with Russia - sort of choking them out of access to the outside economy (important to note that not all countries are sanctioning). However, they recently came out swinging by (1) removing Russia from SWIFT and (2) sanctioning the Russian central bank, (3) direct sanctions on Putin and the Oligarchs *BUT* (4) still allowing energy payments to come through, because the consequences of the loss of oil and gas.

But this is a two-player game - Russia vs the world (mostly). Right now, the world (including China) is making it economically clear that Russia is not welcome.

Fortress Russia

An interesting thing is that financial distress is what got Putin into office in the first place - he was the dude who was gonna make all the economic pain from the 1990s go away. Fast forward a decade or so, and that’s no longer the case.

They’ve Been Sanctioned Before

Russia came under sanctions in 2014 after they invaded Crimea. Since then, they’ve been prepped for round 2 of sanctions - exporting more than they imported, reducing their debt levels, de-dollarizing, etc. Also oil money is a really helpful tool to pay down creditors ahead of schedule.

Things were going okay! As the OECD’s December report highlighted, Russia was grooving - with expected 2021 GDP growth at ~4.3%.

But Never Like This

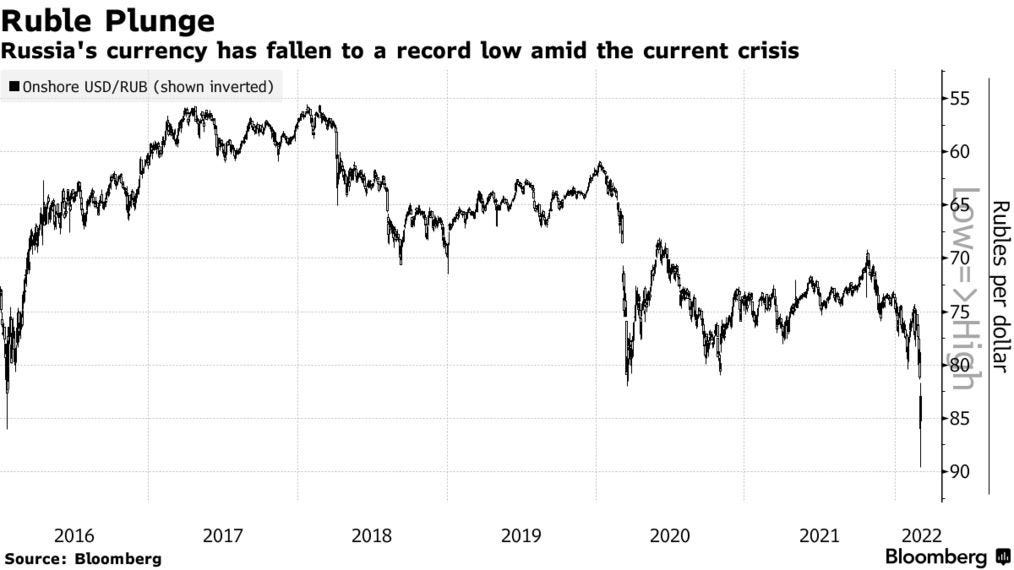

But now, not so much. They were prepped for 2014 sanctions this time around, but these 2022 sanctions greatly exceeded those, as Janis Kluge said. Russia is now struggling by the West’s design, with the “ruble turning to rubble” and their financial pearly gates are crumbling. The UN finally got it together to tell them to stop (good on them), but these sanctions are what’s really going to (hopefully maybe) get them to stop. The West keeps rolling out new ones (like the expanded oligarch list from Thursday):

Updated Sanctions

Sanctions on their central bank and increased sanctions on all banks (Sberbank’s London listing fell 74% next day and the ruble cratered)

Goal: Their financial system cannot finance war

Being removed from SWIFT - This prevents them from using SWIFT for cross-border messaging with other finanical institutions, which is shuts them out of the broader financial system (more or less). Their alternative, SPFS, is eh.

Goal: They can’t really communicate with the outside financial system

Direct sanctions on Putin and The Oligarchs: Take their yachts, seize their assets

Goal: Make the oligarchs mad at Putin so they hopefully boot him

All of this makes for a pretty brutal hit to the Russian Economy. The main goals are to (1) freeze out the very rich to make them mad at Putin and (2) make it harder for Russia to finance their war efforts - BUT these sanctions exclude the backbone of Russia’s economy.

Sanctions ex Oil and Gas

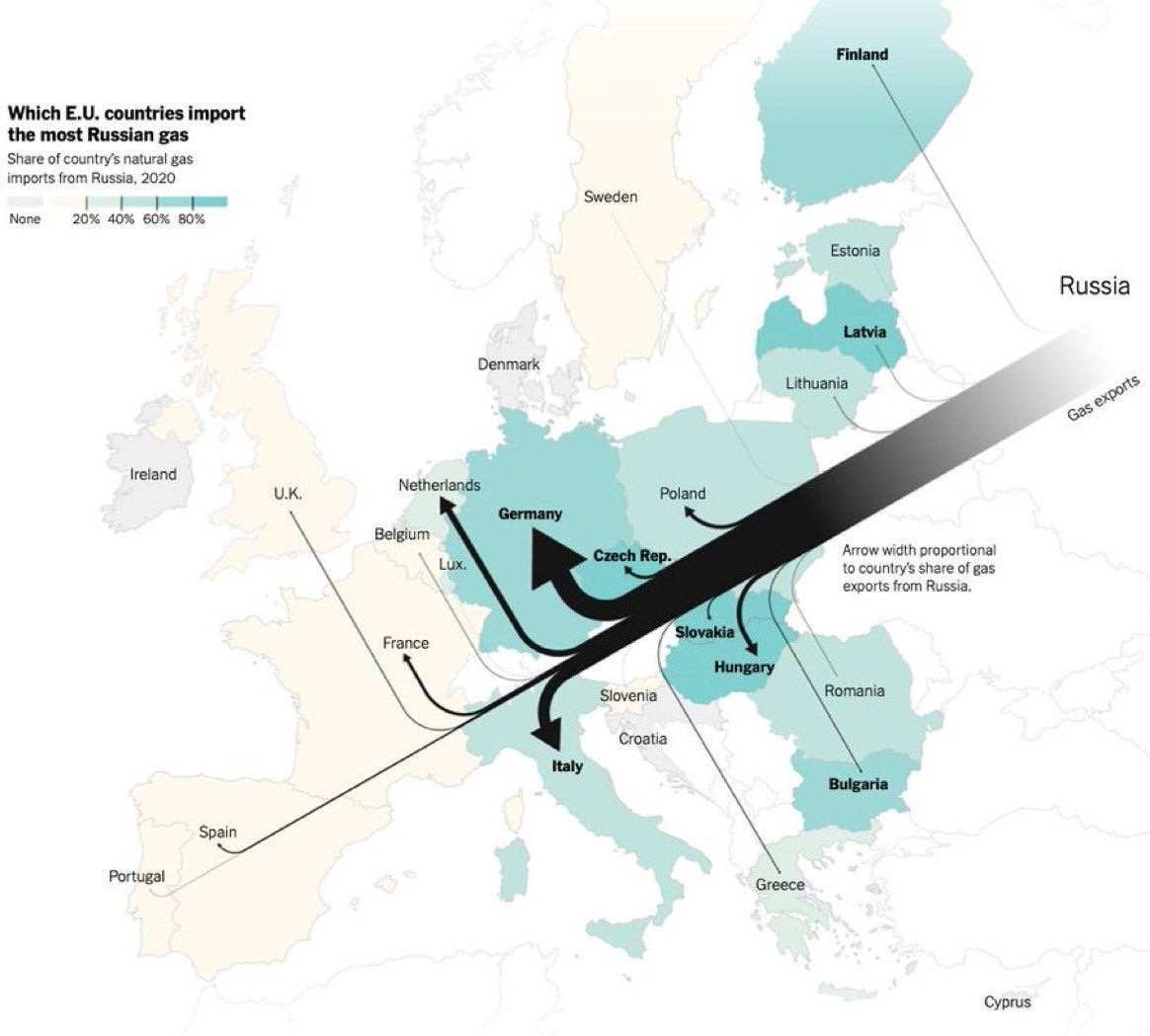

They are still getting ~$1bn+ a day in oil and gas payments! Which is a lot of money. The oil and gas payments really are effectively fueling the war - but it’s a painfully delicate balance for the very energy-dependent West. As the German Economy minister says:

“I wouldn’t support an embargo on imports of fossil fuels from Russia. I would even speak out against it, because we would threaten the social peace in the republic”

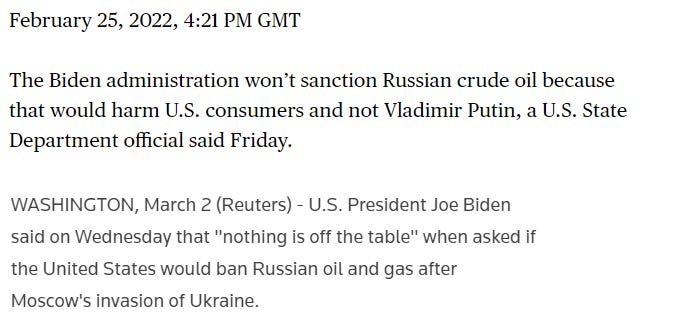

A thinly veiled suggestion that if they sanction Russian oil and gas, all would be *not* peaceful on the western front. But everything is subject to change. It was once relatively unthinkable that Russia would be SWIFTed, and that ended up happening. The picture below shows the difference between February 25 to March 2nd with regards to energy.

Energy Markets

However, even though energy isn’t sanctioned directly, it’s still kind of sanctioned. Russian exports are down 2.5 million barrels per day. Oil moved ~20% over the past two days, natural gas is essentially vertical.

Nobody want to even look at Russian oil because of the fear of being hit by sanctions. No one wants to finance it. No one wants to refine it. No tank wants to carry it (and it costs $3.5m to hire one, +300% since the invasion). So even though it’s not sanctioned, it kinda is.

And that’s not good from a pricing pressure perspective because all of the sudden, things get super expensive and oil is in everything - skis, glasses, lipstick, cabinets. And that’s why there is likely going to be inflationary pressure from rising oil costs - even if the West doesn’t sanction Russian oil, Russian oil is sanctioning itself.

There is a lot of pressure on energy markets right now. There’s a really good paper from The Oxford Institute that dives into the oil markets more, with the main focus being on the uncertainty of flows and broader supply disruptions.

Agriculture and Commodities

So things are very expensive here - the inflation pressure and the broader market risk is more than just pure energy.

As the OEC’s very good website highlights - the loss of these two breadbasket countries from the global food production process will not be good.

Russia and Ukraine are both huge producers of agriculture goods (and the things that make agriculture goods, like fertilizer). We’ve seen huge spikes in wheat, soybeans, corn, and more because all of this is at risk now. There have been just massive moves in commodities - from milling wheat spiking 10% to cotton spiking 2%.

Both Russia and Ukraine are commodity lush - and there is also a concern of broader food stability, especially with the loss of fertilizer. I think the base case assumption is that things are going to be expensive for a while longer. And I am going to talk about this a bit later, but this inflation certainly cannot really be fixed by Fed hiking.

Russian Central Bank

But first, the Russian Central Bank. So first off, sanctioning a central bank is a pretty big deal, and this is probably the biggest deal of all the sanctions. And that’s what the West did - the EU announced that they would "paralyze the assets of Russia’s central bank" & "freeze its transactions.” - which worked - “Putin’s war chest was effectively cut in half overnight.” This is important because:

Most of Russia’s reserves are held outside the country: ~78% of their total $630b in reserves are held in “China, France, Japan, Germany, the U.S., the U.K. and elsewhere” according to Bloomberg.

For a quick note on China (~14% of Russia’s reserves) is a confusing part of all of this - they have a nuclear pact with Ukraine! and their broader temperament has shifted from “this is the fault of the U.S.” to “Russia and Ukraine seriously need to have some dialogue”. So they might not be swooping in to save Russia anytime soon.

So this sanctioning immobilized half of their reserves. That’s really the broad goal - make it so the central bank can’t really come in and provide support to their economy and market.

BUT energy payments are still coming through, allowing an element of central bank support.

And if you’re like “buy why energy” this is why:

Global Financial System

But you can’t just remove a piece from the global Jenga tower that is the globalized financial system and not expect some the tower to at least wobble a little bit.

Money Markets

There is worry that pushing Russia out of the global financial system will create some downstream consequences. Zoltan Pozsar has been banging the warning drum around Russian funding in money markets for a while, and recently did a great Odd Lots episode which basically boils down into “Um yeah, so Russia is actually a leg of the broader financial architecture, so yikes”. As ridl.io highlights:

At the end of 2021, Russian trade with countries outside the former USSR and China amounted to $ 556 billion, and Western investments in Russia exceed $ 500 billion

The risks of the Jenga Tower: As Tracy Alloway writes, “many of Russia’s foreign currency reserves (are) held in euros at national central banks and now effectively locked up and off-limits for lending out into the wider market.” Which essentially boils down into [liquidity worries, collateral problems, missed payments] and broader stress on the banking system

Basically, the wheels on the bus of the financial system could get some flat tires - and that could prevent the whole thing from moving forward like it’s supposed to. As Matt Klein highlights, “Banks in the allied countries could therefore be facing more than $100 billion of losses now that sanctions have largely cut off the Russian financial system from access”

So there is just a lot of plumbing, and a lot of interconnectivity, and with MSCI removing Russian stocks, those trying to buy the dip on the RSX or holding Russian debt might be rekt, to use the scientific term.

Reserves

The central bank might be rekt too - this is a big deal. Paul McNamara wrote this about international capital markets and Russia: “It has allowed the country to import a degree of institutional certainty — vast foreign reserves in reserve currencies and the use of western courts for dispute resolution.” Even though Russia was prepped, they weren’t insulated. There are two important points to reserves

Reserves ≠ Stability - from Nick Trickett

“Asserting that holding massive reserves reflects Russia’s economic stability is akin to seeing an expensive health insurance policy as a sign of good health. The stiff premiums may ensure you can afford surgery or palliative care, but don’t address your lack of exercise, smoking habit, drinking to excess, or pre-existing conditions.

Reserves ≠ Money Money - from Matt Levine:

But “foreign currency reserves” are not an objective fact; they are mostly a series of entries on lists maintained by foreign-currency issuers and intermediaries (central banks, correspondent banks, sovereign bond issuers, brokerages). If those people cross you off the list, or put an asterisk next to your entry freezing your funds, then you can’t use those funds anymore

Adam Tooze had a good analysis on it, pointing out there are a few ways to see reserves:

Russia’s reserves are a “national strategic buffer” This helps to prop up the value of the ruble and slow the process of devaluation.

The problem with that is if the reserves are in dollars and euros (which a large portion of them are) those can only work “by selling them in western financial markets” which they can’t do because, you know, sanctions.

Reserves are “surplus of unspent revenue squeezed out of the Russian economy”

“Reserves are accumulated by exporters depositing their foreign currency earnings (so) Moscow depends on trade surpluses…If the state refuses to borrow and spend, then it forces the private sector to do so on worse terms with greater demand uncertainty.”

So basically, all of this puts massive pressure on Russian *people*

Reserves are petrodollars - This is a sort of concerning part. As Adam highlights, petrodollars are “recycled” meaning that basically the money that Russia accumulated is part of a much broader financial ecosystem.

Basically, these petrodollars are circulating in European banks as IOUs. As Adam writes, “the Russian funds in European central banks are not simply pools of money sitting idly. They are part of complex chains of transactions that may now be put in jeopardy by the sanctions.” And that impacts everyone - not just Russia.

Michael Pettis has a good analysis here, ultimately boiling down to the difficulty that comes with trying to offload these imbalances - and how there really *isn’t* a “good answer” for Russia here (which is of course, by design). But there is some contagion risk that comes from this, which will need to be monitored.

What is the Central Bank doing

So yikes right! The Russian government has been doing a lot to try and stabilize their economy, but it isnt as easy as 2014 where they simply could swoop in.

Spending $1T rubles ($9b USD) to buy shares of sanctioned companies

Banning “foreign investors from exiting local assets”, not paying coupons on local government bonds, and not allowing Russians to send money abroad

This puts their ~$480bn in debt at risk - because if you can’t send money out of the country, you surely can’t pay lenders. Default risk.

Making companies sell 80% of their foreign currency gains

The Central Bank doubling the interest rate to 20% and selling $26 billion at limitless one-day repo auction

Suspended trading on the Moscow Exchange and bought gold

The thing is that Russia still has energy payments coming through, which amount to $1b or so a day - giving the central bank a little bit of leverage in managing the economic downfall. In fact, with oil near $120 now - they are going to bring in maybe $110b in extra revenue this year.

But things are not looking good. As Julia Friedlander said, “you impoverish Russia through sanctions, but they destroy Ukraine in the process, and no one gets anything.”

Currency

Ruble

As many have pointed out this week, the ruble has become rubble. Harel Jacobson has a good thread on the RUB FX market and how wacky things are - with the worry of just sheer lack of liquidity in RUB markets and just a large amount of risk coming from the uncertainty of what is going to happen to the ruble.

And of course, if your currency becomes unusable, well you’re in a world of pain. And the central bank might return to the gold standard (considering the massive amounts of gold they have) but it’s largely uncertain

Dollar

A lot of people have questioned the dollar’s role during all of this too, as its essentially become a weapon in its own right. One must imagine that China is watching this and thinking “oooookay time to rotate away from USD” (Powell confirmed his concerns around that at a Senate hearing on Thursday)

Zoltan has pointed out that other countries are going to follow suit - if you wield the dollar as a punishment, people are going to try avoid being punished. As Jon Sindreu wrote, “barring gold, these assets (money) are someone else’s liability—someone who can just decide they are worth nothing.”

The idea is that dollar has sort of lost the notion of “store of value” because all of the sudden, the spigot was turned off. Lots of countries are likely going to get spooked by that and reduce dollar dominance.

For example, Iran is charging in euros versus dollars for new contracts. But dollars are still in demand as a safe haven. So like sure people can transact in euros, whatnot but USD is still that girl.

And I think Alan Cole has a good take here (h/t to Matt Levine)

Financial commentators love talking about the dollar losing its status as reserve currency, because it gives them a permission structure to wildly speculate. But there is little constituency for a Russia-friendly financial system among the world’s largest economies. And for countries seeking a relatively neutral and rules-based system free of geopolitics, China isn’t a very good alternative anyway. (It has a variety of idiosyncratic foreign policy demands of its own, and regularly uses economic might to help reinforce them.)

Companies

Companies are also exiting and refusing to do business within or with Russia, with Shell announcing that they would exit from their equity partnerships with Gazprom, Apple refusing to sell their products there, and banks halting operations entirely (except of course, Deutsche Bank, because of course not). There seems to be a “get tf out of here” to all companies - and a lot of them are following that moral imperative.

EA is simply deleting Russia. And all of this makes sense because if you mess with sanctions, YOU get in trouble. Companies are going to try to avoid that.

People

The Russian People

The Russian people are experiencing the consequences of Putin’s decisions. They are facing high inflation, crumbling businesses, and isolation from the West. Their standard of living is likely going to decline. The whole point of these sanctions are to try and get Putin to stop and say “well I just wrecked my economy and now my people hate me so maybe I should stop.”

Another one of the many sad parts of all of this is that most Russians did not support a war - “Fewer than one in ten Russians supported war against Ukraine — and that was before the bombs started falling” as Christoper Mims highlights.

People started panic buying luxury goods as an atempt to salvage value, there have been multiple runs on ATMs, and a Russian stock market expert is going back to being Santa Claus.

However, Putin likely does not care about his people (and some people do support him) - so the focus is really on getting the oligarchs around him to pause and say “hey buddy I just had my yacht seized in Germany. You need to leave.”

Farida’s article on the *real feelings* of Russian officials and deputies highlights:

"Nobody rejoices, many understand that this is a mistake, but on duty they come up with some explanations for themselves to somehow put it in their heads…

And one Russian official quit, and several have been like “hm yeah this isn’t the coolest thing ever” but there is going to need to be more noise.

Putin

But that requires an element of rationality, which Putin just doesn’t seem to have. He invaded the *largest* country in Europe, on the basis of “actually this is mine”. He is frustrated, and a frustrated person never makes great decisions.

Fiona Hill had a great interview with Maura Reynolds, and I think it’s the best explanation of Putin that you could get

“Every time you think, ‘No, he wouldn’t, would he?’ Well, yes, he would. And he wants us to know that, of course.”

Russia is likely going into martial law this week, and Putin seems to have his finger dangerously close to the nuclear button. But other foreign leaders are turning against him! So maybe he will get the hint. However, as Michael Horowitz wrote in his 2018 research paper Studying Leaders and Military Conflict:

“This institutional and personal context may make Putin more risk-acceptant — that is, more willing to gamble on dangerous nuclear threats to save his regime — than other leaders. It also likely makes him more paranoid. These tendencies again reinforce the escalatory dangers stemming from Putin’s recent decision.”

So like - as many have said before, Putin is irrational, and treating him as if he is rational is likely flawed.

Broad Connection of People

The Ukrainian people are bravely fighting for their lives and their country - and over 1 million people have fled to the EU, with estimates that over 4 million people will seek refuge there. Ukraine applied for EU membership. And so have Georgia and Moldova.

Crypto

Crypto has gotten a lot of attention because of the invasion, from two angles:

Russia will use crypto as a tool to evade sanctions: NO, but the people might

The Russian people do seem to be buying little bits of crypto to try and seek stability as they face mega-inflation but nothing massive

Source: Tracy Alloway The Russian government can and will not use crypto - Jake wrote a really good thread debunking this, but the main idea is that the blockchain is literally a public ledger, so everyone would be able to see what’s going down if Russia tries to move money via crypto.

Also Putin is clearly a control freak so idk if decentralization is his vibe

Ukraine accepts crypto donations: YES, but no airdrop

This is really good! They’ve raised probably north of $40m from crypto alone, which is really awesome.

However, the Ukrainian government was like “ok so we are going to airdrop a token to everyone who donated” and that *really* got the donations rolling in.

But of course, the government then was like “okay maybe not right now, considering War” and the crypto community immediately was like “rug pull”? Which like sure, having a token is great and all, but come on. It’s a donation, not a promise of wealth.

Also Russia is working on a digital “ONE WORLD ONE CURRENCY” so

I am very interested to see how crypto regulation triangulates around all of this. Will it become the tool for the future, or will governments squash it because of the broader risk? Russia is being squeezed across every single currency - and Peter Zeihan has been right about a lot of things - will he be right about this too? (hopefully not)

Market Response

The Moscow Exchange is seemingly never going to open again ? which makes it difficult to determine what exactly is going to happen to those companies. But things are bad - their stock market has effectively tanked - everywhere.

U.S. Markets

The Fed is hiking: Jerome Powell testified in front of Congress a few days ago and was like “yep we are gonna raise by 25 bps in March considering all this Inflation” and the market was like “that’s right buddy, sounds good”.

He highlighted the geopolitical risk, but made it pretty clear that the Fed was going to hike this mountain in March, and it was going to take something pretty big to stop them.

Biden made a funnyish comment during his State of the Union when discussuing inflation - telling companies to simply “cut costs” to manage it, which doesn’t really work? Considering that everything is expensive?? And wages are not growing??

So the Fed is going to try and play catch up as we entire arguably one of the most uncertain times in recent history. So. That should be an interesting experiment. Powell says that the economy isn’t that intertwined with Russia but we all know that globalization and comparative advantages are a little pillar holding up the Big Economy.

The ECB will likely be moving in a different direction, mostly because of their energy exposure (also because their market is deep red because of inflation risks), but things are looking a little bleak. Everyone is facing pretty high commodity costs, which could play right into STAGFLATION, which is never a great thing.

The general idea seems to be that we will enter a Recession, but maybe a baby one, a short lived growth slowdown just as a little treat coupled with outrageous prices. Things will recover relatively quickly, and then its back on all cylinders, somehow. But as John Kemp highlighted, all the warning bells are flashing, saying that the 2Y is trading less than 30 bps below the 10Y, which, historically speaking, “whenever the spread has narrowed this much it has heralded either a significant mid-cycle business slowdown or an end-of-cycle recession”

An interesting thing about this is that its probably going to change *how* our economy grows. Germany is going to spend much more on defense spending, Europe is trying to classify weapons as ESG, and I think a lot of people are going to demand that some manufacturing become domestic again. So this could be an era of hopefully really solid geopolitical relations, but one that sees countries becoming more independent.

The Stock Market

The broad stock market is trying to calibrate around what is going on. Pension funds and endowments are exiting Russia, Blackrock is removing all Russian stocks from their ETF baskets, but some people are buying? the RSX on the dip? which just? I wrote about this last week that markets are not moral, but just because something is falling doesn’t mean it’s not going to break?

A lot of investors are really used to buying and holding and thing go up. That’s been the environment in the stock market and crypto for the past several years - but that doesn’t always work. Just look at Credit Suisse. They were like “lets securitize some yachts” because things always go up, right? And now those yachts are being seized. And they are asking investors to destroy papers. So.

Final Thoughts

And this is a pretty common talking point, but no one really wants this war except for Putin. Russian soldiers appeared to have been caught blindsided by the invasion, stating that they didn’t expect this to happen, etc. But still. It’s happening.

A final quote from Zelensky:

“When I planned to become a president, I said that each of us is the president. Because we are all responsible for our state, for our beautiful Ukraine. Now it has happened that each of us is a warrior... And I am confident that each of us will win.”

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

Thank you, ms. Scanlon. I am grateful for your timely and comprehensive analysis. Good luck to us humans.

Thanks to your writing i have been able to break free of Twitter. It’s all here. And entertaining! Thank you