This is a macro market update for my Let’s Appreciate Podcast (I post daily to TikTok). I publish these once a week (beta phase), as well as single stock pieces (1-3x a month) and macro deep-dives. I also publish on TikTok, Youtube, and Twitter!

Youtube linked here :) This a podcast, which is why the below might be a bit rambly.

AMC Clearly Now

I really don't even know where to begin. When all this started happening back in January, I actually made a PowerPoint about the whole debacle - because it still doesn't make perfect sense to me (I don't think anyone *really* understands).

Let’s get into it.

QUICK NOTE: This is a generalization. I know that there are people who do believe in AMC and GME. I am not diminishing that. This is just an analysis of the narrative behind it, and my take on what I think might be happening.

Wait, AMC?

Back in January, a short squeeze happened - on GME and AMC, two stocks that are heavily shorted by hedge funds. The squeeze primarily came from Reddit - with the goal to squeeze out the hedge funds by collectively buying shares of stock.

When hedge funds are short, they are borrowing shares to bet on the price of a company going down.

They eventually need to buy those shares back to cover their negative position.

But if the actual shareholders (here the Redditors) don’t sell, and subsequently there aren't enough people to sell shares back to the short sellers -

The price can run upwards out of control - like it did with GME.

Short Selling:

Reddit wants to push the price up to squeeze out the hedge funds so that the price that these people borrowed the shares at is going to be lower than any price that they can buy them back at - so the hedge funds ultimately lose money. In that process, a few different squeezes happen:

The short squeeze - where the hedge funds get stuck short, get margin called, and have to buy back their stock at a higher price. Those buybacks trigger more demand for the stock. Then, with momentum as a tailwind, the stock keeps on going up and up.

The gamma squeeze - the stock price gets close to the option strike, dealers have to hedge and buy a lot of stock, which will result in the stock price going even higher.

So both squeezes result in a stock price spiraling upwards, essentially “squeezing” out the hedge funds. It's a 2-for-1 - and people join in because:

Profit: They can make money on a rapidly increasing stock

Destroy: Squeeze out the hedge funds

With AMC in particular, Adam Aron, their CEO spoke out against the short selling attacks back in November of 2019, far before any of this happened. When COVID shutdowns hit, AMC was in a lot of trouble because no one could go to the movies. They were potentially going to have to declare bankruptcy in January 2021 - which conveniently was when the first mini squeeze happened.

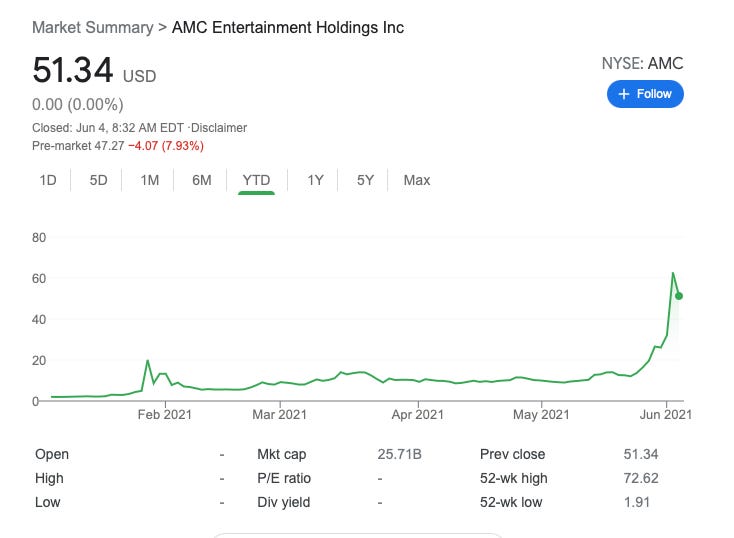

The stock price jumped 310% overnight - from $4 to $20.

Collective Belief

But the really interesting part of all of this is not what is happening with AMC (although they are fine financially now and can give away popcorn for free to their shareholders) - it’s about the community.

It’s about r/wallstreetbets, r/superstonks, and everyone else who has invested in these stocks.

Because AMC is really two main things:

Reopening trade - people are gonna want to go back to the movies. That drives value.

Meme stonk - People believe in it. That drives value.

AMC is up over 2,500% this year. Reopening demand might be strong, but its not THAT strong. Most of its value comes from it being a meme stonk.

Leonard Kostovetsky wrote a paper about how, in order for AMC to be “correctly valued” (whatever that means) either:

Future revenues would have to increase by 4x what they were pre-pandemic

Share price would have to drop by 75%.

But the thing is, valuation (at least in this scenario) is not real. It does not matter.

Here, valuation is driven by community. Somebody from Reddit put together this Google doc that is talking about AMC’s path - the educational timeline - and it has six main goals:

This document is talking about the path forward for AMC with the goal to encourage people to hold. And if people aren’t already invested, giving them the confidence to do so. It’s about building community. Underneath the Gorilla Grodd, of course.

It is this collective belief driving the value of an asset. But that collective belief is driven by a few different things.

Community: We just don't have the community that we used to. So people look for stuff online. And you become very attached to your online groups and your online friendships

Excess Liquidity: Financial engineering and dollars trying to find a home

The Future: What do shareholders of the future actually do? How do you break down the gates of the market?

The State of Affairs

Where's the money going? AMC.

But if you draw the curtain back - the whole situation is really about liquidity. The Fed’s QE and the amount of cash in the market does play a role here.

Because what happens when you bail out companies with printed money?

“You know what happens when you continuously bail out companies with printed money? Passive investment grows larger and larger and corners the tradable float of these meme stocks. Remaining retail investors sniff out these shareholder imbalances and create a casino of capital misallocation. If no one knows what the price of money actually is, the only thing that matters is investing in the future and avoiding companies that are too leveraged and too old to capture revenue in the 21st century... Throw valuation out the window and just concentrate on whether the business model will capture the revenues of the future.”

The revenues of the future.

There are a couple of different futures that we can have:

Tech Works With Us - we really lean into technology and we figure things out. We figure out healthcare, the labor market, all of it. We utilize digital technology to its fullest potential (instead of it using us)

Tech Works Against Us - we have too much technology, we have too much information and everything is just overflowing. And all the digital apps in the world can not be built to save us from ourselves

I would like to think that we are moving towards the “Tech Works With Us” space, but I also think that there is an increasing element of this extremist mindset where you have to go all in. You have workaholic culture, political extremism, religious extremism, etc - everyone operates at these barbell extremes.

Now, we're operating at these financial extremes where people treat the stock market like the casino, going all in. It’s a total psychology shift from how we used to think about investing - holding onto the same 60/40 portfolio, collecting dividends, shifting from growth to value as we age.

Now, none of that matters.

The way that investing has changed is reflected in how lives have changed too. Previously, people could spend 40 years at a corporation, get a home, have a family, do that 9-to-5, be fine, and retire safely and comfortably.

Now, none of that is the case. There's just so much resentment bubbling underneath the surface. You have people who are just so mad at the system and so angry - and none of that is really about AMC.

Yes, AMC is the main character in this story. You can go and get your free popcorn, the CEO will take full advantage of the situation, and it is at the receiving end of Redditor love - but it isn’t about AMC. They are the main character in the sense that Jay Gatsby is the main character in the Great Gatsby - the story is about him, but its really always been about Daisy.

Community drives AMC. The power of Reddit to provide a platform to drive the collective belief behind the value of an asset, as well as give an outlet for the underlying resentment at a system that people feel like has wronged them or will wrong them.

One way to destroy a system that you don't believe in is to bet against it. And now, people are treating the stock market like a casino - throwing money at AMC and GME from the fuel of FOMO and the desire to get rich quick.

The Market Mechanics

But there is always somebody on the other side of your trade.

Is the “get rich quick” aspect of AMC a bad thing? Especially considering the underlying desire to squeeze out hedge funds (considered to be net negative on society)?

Tracy Alloway had a good piece on how people should allocate money to companies that they care about.

Just because it's AMC (a movie theater that almost failed) doesn't mean it's a bad thing.

So much has operated behind closed doors for so long. There are so many barriers to entry in the markets. AMC, GME, meme stonks, crypto are potentially one way to break down the gates that the industry keeps on putting them up.

There are institutions like Mudrick coming out, flipping shares, and verbally stating “We think this is overvalued”.

And on the complete other side, the Redditors are going to hang on to it (for a while), stay with it, keep moving with it, there are the Reddit investors who are “diamond hands, strong apes, smooth brain”, etc. etc.

That is why you have to throw valuation out the window and just concentrate on whether the business model will “capture the revenues of the future.”

Then the question becomes - where are the regulators?

Where's the SEC, where's Gary? They just kind of missed the boat on all this stuff. They're just two steps behind - same with crypto. They definitely see crypto as a threat. They're always just two steps behind. They're saying “investor protection, we've got to step in.” But what does “investor protection” really mean if the stock market is a casino?

You have all these people who are able to “drive the price of a stock upwards”. What does that mean for how we think about building portfolios? So what does that mean when thinking about portfolio strategy?

Should everybody have exposure to meme stonks?

I think one very weird thing about our society is that we memefy everything. Because memes creative narrative - and that is what drives value. It doesn't have to be a narrative about how the company is going to produce a certain amount of free cash flow. It is literally just the power of narratives, the power of people saying things, the power of everybody deciding what's going to happen.

The collective belief behind the value of an asset.

For example, GameStop is the highest valued company in the Russell. Because after all, it’s a value stock, right!? Meme is value - the rotation trade is the meme trade.

The meme stonks were more than 25% of the volume traded on Wednesday. AMC’s market cap of $33 billion is 70x larger than where we started the year. And now it’s larger than almost half the companies in the S&P 500.

Institutions are definitely involved. Because the whole narrative is - “we need to get away from the institutions. we need to squeeze the hedge funds” - but you're making money for people on the other side.

But institutions will always be the winners, because they have the capital. So in the meantime, maybe just giving shareholders popcorn is the answer. Maybe this is a new model of shareholder ownership - community through shared ownership and collective belief.

The C in AMC stands for Community <3 [maybe]

Final thoughts:

People are using the stock market as a way to find community. People are using it as a tool to connect with other people. That’s why you see the proliferation of social investing apps - because investing is scary and overwhelming. The stock market is weird. It doesn’t make sense.

AMC is driven by narratives. AMC is driven by collective belief behind the value of an asset. AMC exists because we crave community.

So no, free cash flow will not be replaced by collective belief. But for the short term, community is driving the multiple here.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

Amazing article. All your content is the perfect blend of insightful analysis, hilariousness (it’s a word why not).

Great article.