This is a weekly market update (I post daily to TikTok). I publish these once a week (beta phase), as well as single stock pieces (1-3x a month) and macro deep-dives. I also publish on TikTok, Youtube, and Twitter!

What do Janet Yellen and dogecoin have in common?

Both are rallying cries against the system.

Youtube version here

We have the paradox of surplus and shortages right now.

Surpluses?

We have loose monetary policy - and a Fed that has little to no interest in raising rates. Yellen made her opposing opinion on this clear yesterday - before quickly backtracking and saying that a rate hike was “unnecessary”

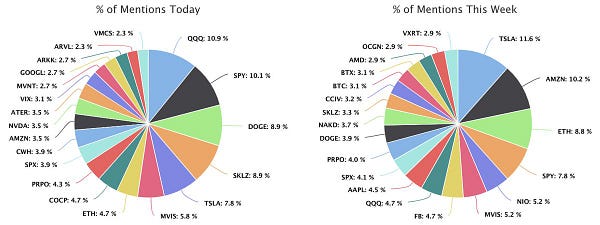

Loose monetary policy = loose money flows - This results in lot of money going towards different things - notably into Doge, meme stonks, etc

Shortages?

We currently have a physical commodity shortage - the economy is going hard in consumption right now, and that’s resulting in “not-enoughness” in a lot of things

Producers don’t want to expand because this demand could be temporary (ah yes, transient re-opening demand) and the current strain on the market should even out when things “normalize”. But that doesn’t mean that there won’t be short-term pain (and “transitory” inflation).

This creates a supply chain effect -

The Fed needs to keep rates low. When they keep rates low, that creates easy money, it’s easier to get a loan, things are more free flowing. That creates easier access to dollars.

People need to acquire dollars. When they acquire dollars, the dollars need to find a home. When they have a surplus of dollars (or when their sentiment shifts) their dollars goes toward different things (like Doge).

But people also want more goods - so they demand more, putting pressure on companies to produce more. Companies acquire more raw materials, more inputs - sometimes financed by the easy dollars of the Fed.

An endless loop.

Please note, I think that Doge, reopening demand, etc is driven by a lot more than just low rates - this is one symptom in a whole list.

What did Yellen do?

Where does Janet Yellen come in?

Yellen broke the fourth wall of the above easy money supply chain.

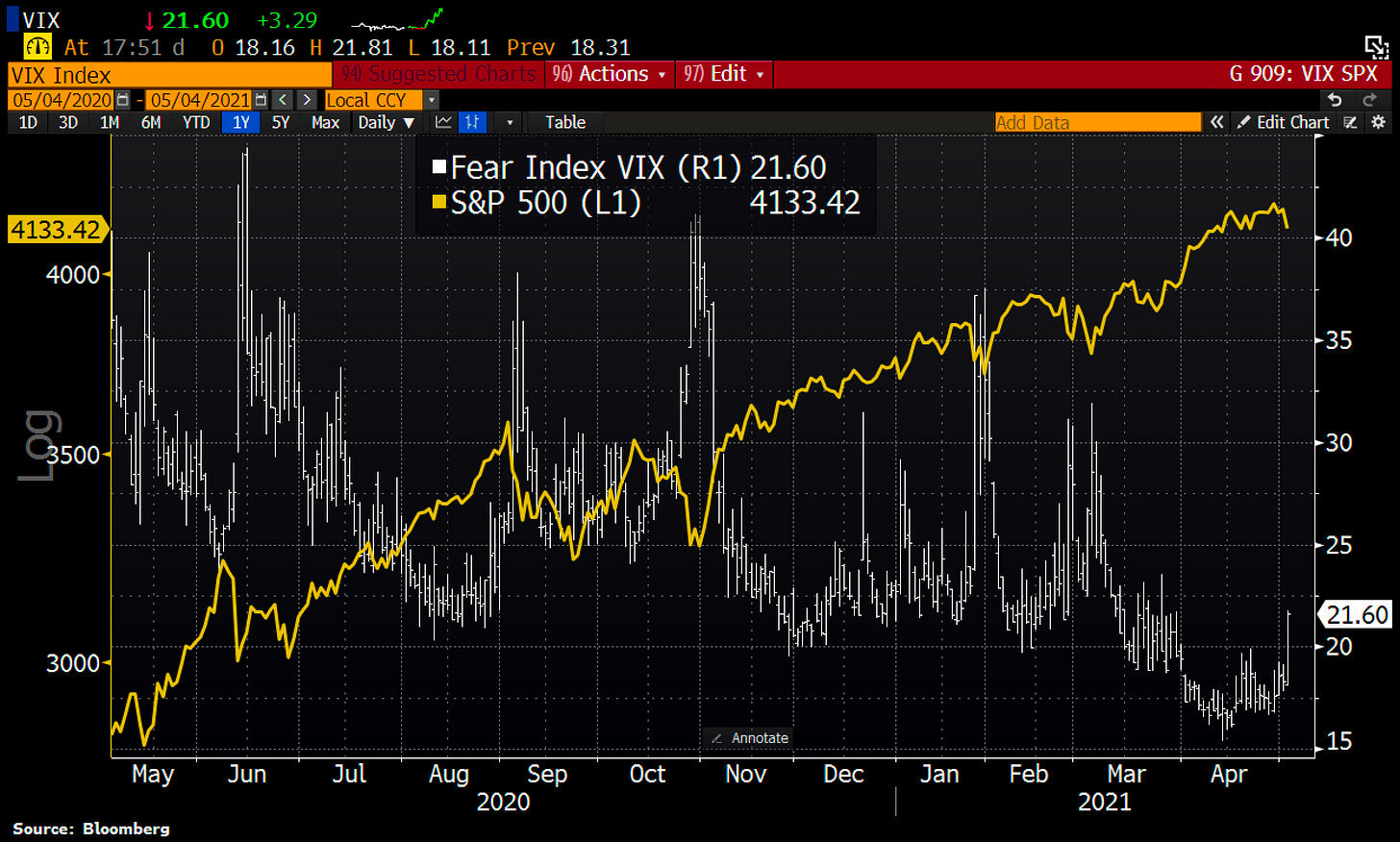

Janet Yellen spoke out for raising rates, noting an overheating economy (something Jerome Powell has adamantly spoken out AGAINST) and sent the market into a frenzy yesterday. The VIX jumped (a measure of volatility/fear/uncertainty) and the indexes experienced a lot of intraday movement.

But the thing is, Yellen wasn’t wrong. The economy might be overheating - the Fed might need to seriously consider raising rates (before the market forces their hand).

Here’s what she said -

“...interest rates (may) have to rise to make sure economy doesn’t overheat...(even if) additional spending relatively small relative to economy, it could cause some very modest increases in interest rates."

Yellen crossed the invisible line between fiscal and monetary policy - she wasn’t supposed to say what she said. And that is why she backtracked.

The backtracking was odd - because she was factually correct in what she said.

It was all a show - “don’t worry market, everything will be fine!”

In reality, the intraday movement and the pop in the VIX just shows how little the market even WANTS talk of raising rates. Spinning out like that on Yellen merely *suggesting* a rate increase shows how reliant the market is on words - taper, higher rates, inflation, stimulus, taxes - all of those are buzzwords for the very sensitive market.

It’s all based on sentiment - on words and communication.

That’s why people read into what Jerome Powell says - not always what he does.

It’s all about the words.

Doge is a Signal

Most of Doge’s value comes from words - and memes.

(They do have a core developer team, but the rapid rise has mostly been from words and memes, perhaps not as much the development)

Doge as Memecoin Leader: Doge is like Layer 2 of GME and the meme stocks. Speculation in crypto is high - a lot of the meme coins (scamcoin, asscoin, etc) are surfacing and Doge feels like the ringleader of all of them.

But value is supply and demand - so the value in the meme coins is “real” because it’s generated by supply and demand.

You could (very theoretically) argue that it is the same with USD - supply and demand. Foreign governments, citizens, U.S. government all use USD as a point of transaction - there is someone demanding USD in payment for goods, and someone else willing to exchange USD for goods.

With doge - someone is willing to convert their fiat to Doge, and vice versa. It’s a market.

So then the question is -

Do memes (what drives value of Doge) = the full faith and power of the U.S. government (what drives value of USD)?

Is money just a consensus choice? If more people end up using Doge versus the USD, what would make the USD anymore powerful than Doge?

Can people theoretically let Doge become the reserve currency if

Enough people “consent”

Supply and demand allow for it?

Of course, these are all hyptotheical questions. You can’t pay your taxes in Doge. If the U.S. government switches to a CBDC, these questions might become more pertinent. And there are developers on Doge (in case the U.S. government wants to build their CBDC on the back of Doge).

But the question remains - what do Yellen and Doge have in common?

The Intersection of Doge and Yellen

Doge is an iteration Janet Yellen, but in coin form.

Both (inadvertently or not) are calling out flaws in the system.

Doge is a sign that the current system doesn’t make sense - that things don’t need to be “fairly valued” in order to gain traction. Doge trades at an infinite P/E ratio and a zero P/E ratio - the whole project is determined by buyers and sellers (there are developers too!). If you want to buy Doge, someone will sell it to you - supply and demand.

Yellen’s backtrack shows that what she said was CORRECT - they wouldn’t have made her retract if they agreed with it. But she spoke out - said yes, maybe money is too easy right now, maybe things are too hot - and then had to quickly run in the opposite direction - she was moving against the system.

Doge responds to words too - just like the market did when Yellen spoke.

But instead of Yellen and Powell, Doge has Elon Musk, Mark Cuban, most recently the Winklevoss twins - people who are rich in fiat-dollars. I don’t know how they all personally feel about Doge, but whenever they mention it, sentiment for Doge turns positive. These people are respected, cultural icons. Their opinions matter. So their words are enough to provide value to something.

Same with Yellen and Powell. Yellen and Powell speak, the market moves.

Musk and Cuban speak, the Doge moves.

That’s just how the system works. Things move so quickly - tweets drive market prices, assumptions drive multiples, and Hopium and FUD drive the rest.

Nothing is real anymore.

There are a few things to consider here -

The Cons of Doge:

Would the money in DOGE be better spent in other crypto projects?

What happens when (if?) Doge crashes? Will retail exit the space?

The Pros of Doge:

Do meme coins drive more interest in crypto over all? Does a fractional interest in DOGE translate to something much more better and important in the crypto space?

Are memes themselves valuable? Does doges power translate to crypto power?

What does the Doge community mean? Does this say something about the collaborative power of human nature?

And most importantly, does attention command some sort of premium? The fact that people are talking about it - is that enough of a driver?

Is collective belief in an asset enough to give it value?

The Physical alongside the Computational

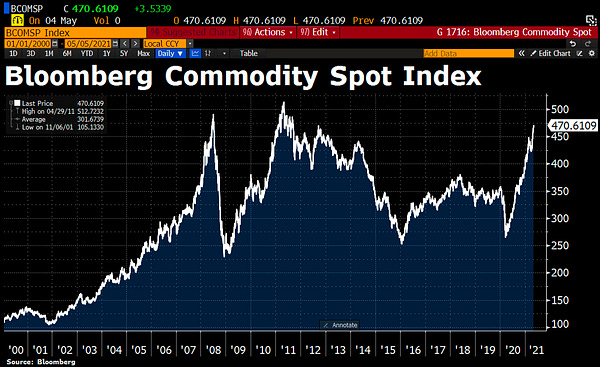

But alongside all these meta thoughts, you have physical commodities, constrained by physical supply. Lumber is hitting all-time highs everyday, there is a squeeze across most commodities - everything is topping.

Dogecoin can’t create more lumber. And that’s the inherent shortfall with both Doge and the USD and monetary and fiscal policy - it can create incentives, but there is still the physical that cannot be generated from computing or interest rate discussions.

This is one of my favorite takes from BDRY, the Dry Bulk Shipping ETF:

Trade impacts behavior, which impacts prices.

Sentiment. Communication. Reactions.

The physical does drive our consumption too. And in the debate between why Doge has value versus fiat, the supply chain woes serve as an interesting backdrop.

It’s multiple disruptions bubbling into one - driven by supply and demand (lumber with homes, copper with green energy) and disturbance from major shocks (the pandemic being probably the biggest one). With some words mixed in.

But still -

There definitely are physical shortages too.

Final Words

If you boil it all down - it’s all words.

As Byrne Hobart writes here - it’s the bullwhip effect.

Supply chains are everywhere, which means bullwhip effects are everywhere, too. If you have perfect information, you can react sensibly to changes in the real world. But if your information consists of other people’s reactions, it’s worth asking: will everyone misread things in the same direction?

The Doge supply chain, the Fed supply chain, the commodity supply chain - it’s all based on reaction and interpretation.

And that is why Doge has value. And that is why what Yellen says matters. And (stretching the example thin here, and recognize that there are many other factors) that’s why there are product disruptions.

Because everything is a supply chain - driven mostly by words and sentiment. Only differences are inputs and outputs.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

Also, if you would like to apply to On Deck Investing, please apply here!

The more I contemplate Doge, the less egregious it seems. I mean, I would never, ever, buy it, BUT, that Tyler Winklevoss tweet has a point. Doge is disinflationary, eventually it will have a lower stock-to-flow than gold. What are the arguments against it? Sure, DH5yaieqoZN36fDVciNyRueRGvGLR3mr7L is concerning, but ultimately we're trusting that Satoshi won't ever move the ~1M BTC he is believed to hold. I was concerned about BCH or BSV trading for 3 figures long before I got worried when Doge broke a dime. I mean, Doge is basically LTC with a dog logo. I'm not a BTC maximalist but from my perspective, unit bias has long been the cause of money flowing into dubious projects - XRP was the #3 coin for years because it seems "cheaper" than BTC.