On narratives, the Federal Reserve and web3, and Market Go Down. I know there is a LOT around web3 - this is a broader piece that hopefully encompasses the macro narrative at large. As always, most of my knowledge is amalgamated from others - these are synthesized opinions.

If you’re already subscribed, thank you! If you’d like to subscribe, please do so here:

YouTube/Podcast up tomorrow!

Topics Covered This Week:

Interview with Michael Hilliard and Ben Wheeler on Kazakhstan

“The real problem of humanity is the following: We have Paleolithic emotions, medieval institutions and godlike technology. And it is terrifically dangerous, and it is now approaching a point of crisis overall.” - EO Wilson

In this piece I hope to discuss:

What the Federal Reserve does and why they do what they do

The goal of web3 (and how much has already been achieved)

The importance of energy markets

The intertwindedness of it all

The Federal Reserve and web3 are sort of doing the exact same thing. Of course, they are doing it differently, but the goal is somewhat the same. It’s narrative - convincing people of a Future Thing That Might Happen.

There are a lot of different narratives out there. Deflation vs inflation. Scaling vs security vs decentralization. Index investing vs stock picking. Optimism vs pessimism. Everything ultimately boils down to ~narrative~ to the raison d'être, the reason of being.

Narratives

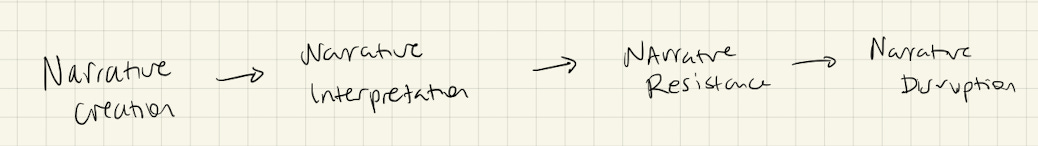

Narrative has a few main components:

Narrative creation

Narrative interpretation

Narrative resistance

Narrative disruption

Everything starts off in the creation phase - what does this thing mean, and why? It is then interpreted, then usually faces an element of resistance because that’s what humans do, then eventually it gets disrupted because it no longer really works.

Think about web2 (the predecessor to web3, Facebook, Wordpress, etc). The narrative evolved from something that was enabling the world to get connected (which it still definitely does) to something that is run by tech conglomerates that harvest our souls into data, sell us for advertisements, and generate billions of dollars - that we never see a penny of (unless of course, we own the stock).

Just like web2, both the Fed and web3 have their own respective narratives.

The Fed has an Important Narrative, as they have managed to make themselves *seemingly* indispensable to the broader narrative of Market Go Up.

web3 has a narrative that is meant to be an alternative to the very centralized business of the Central Banks, but from a flows perspective, the two are tightly knit (at least for right now).

So, here are their stories.

The Story of the Federal Reserve

The Fed has two main worries: price stability and maximum employment.

Managing inflation (a political hot potato)

Managing jobs (a lagging political hot potato).

The Fed manages this dual mandate through monetary policy - open market operations, the discount rate, etc - basically, in order to expand the economy, they say to banks, “hey, take some money lend it out” or in order to contract the economy, they say “hey chill out, no more”.

This works fine-ish and well-ish, but one of the problems that we have, is that we really have not had “normal” monetary policy since pre-Great Financial Crisis. The Fed tried to normalize during 2016 - 2019, raising rates, shrinking their balance sheet - but in September 2019, the repo market freaked out, so the Fed swooped in yet again, reversing some of the normalization progress.

Then of course, March of 2020 happened.

The Fed was the market floor during March of 2020. They recieve a lot of criticism for being *too* much of a floor, but they came in, guns ablazing, to provide support to the markets. Oil prices were negative - yikes. So they became heavily accommodative, as we descended into a global pandemic.

And now we are sort-of-in-a-pandemic, but the numbers that the Fed has to worry about (those of the narrative of price stability and maximum employment) are very hot.

Narrative Creation

The Fed is in-between a rock and a hard place. The metrics are pointing to them arriving very late to the party -

Price stability: We have inflation at ~7%

Maximum employment: Unemployment below 4% (labor market is weird though)

And all markets are incredibly spicy

So the auto-reponse that the Fed has to have to that is to tighten and taper - liftoff and runoff - raise rates, shrink the balance sheet. They have to do Quantitative Tightening.

Narrative Interpretation

Because if the Fed does not do Quantitative Tightening, what will the Fed do when we enter another Recession??

Inflation has become a political football - and the Fed has to answer to that. Because if they don’t… well, who knows what will happen?

Probably some sort of financial implosion of sorts, and with mid-terms on the way - well, that won’t be allowed at all.

But the Fed has to remain credible. People have to believe in the Fed.

That is the only way that their story works.

Based on the December FOMC minutes, the Fed is now saying “hey, we are gonna move faster, raise rates in March and shrink that balance sheet right down” - and the market said “oh wow, you’re serious about this?”

And to be fair - the Fed has decided to “normalize” pretty quickly - moving from not raising rates in 2022 according to their June meeting, to 3 rate hikes (now whispers of 4+), faster taper, and a shrinking balance sheet in 2022 based on December meeting.

Real rates have risen substantially, putting pressure on growth stocks and their (perhaps outlandish) valuations. It also puts pressure on cryptoassets, because institutions still price most cryptos as risk assets - basically, the narrative is higher rates, bad time to be a high-flyer.

A portion of this is the Fed signaling, enabling reputation protection. This isn’t 2019 anymore - the Fed set up a standing repo facility that should prevent the same blunder from occurring. So as long as the markets don’t collapse, they kinda “need” to do QT.

Narrative Resistance

The biggest question is - will it work?

What if the Fed raising rates DOESN’T fix inflation - Because this inflation is primarily from supply chains (compounded by shutdowns, labor problems, outsized consumer demand), and raising rates doesn’t clear ports.

What if we have deflation? We have an aging population (older people don’t need as many things, or so the theory goes), tech could make large portions of labor obsolete (one day) and maybe monetary policy would get us there faster than we think

What if this inflation is transitory? And we will enter a deflationary period because the Fed raised rates too soon?

What if the labor market isn’t really recovered, and the Fed pushes a bunch of people out of the jobs market?

What is the neutral rate is lower than expected? This is the point where monetary policy is neutral (expected to be 2.5%-2.75%), neither accommodative or restrictive - just maximum employment and price stability.

If the Fed hits this sooner than expected, then they wouldn’t have to hike as much - which would result in less hikes. So they move fast, but then they can slow down

There are countless other scenarios. What if we get an even-worse variant of Covid, what if vaccine mandates put pressure on supply chains, what if consumers BNPL into a credit crisis, what if oil stockpiles remain low and spare capacity isn’t expanded, what if the manufacturing sector doesn’t recover, and so much more.

Obviously there is so much nuance that goes into this narrative. The Fed has become inflation firefighters - not because they don’t care about maximum employment (which has seen improvements) but it isn’t as prevalent (in the current state) as the public slowly watching their food prices increase.

So the Fed must engage in Quantitative Tightening, because Inflation is Here. If inflation goes away, the Fed will throw that car into reverse. If the market loses its mind, the Fed might capitulate then too - but the politicalization of inflation might be too loud for them to avoid.

The markets are political. It’s a balancing of all the different narratives.

The Story of Web3

See, web3 is different than ~web3~. It’s different than the different NFT pump-and-dump projects that get paraded around - there are very smart people building very amazing things in the space.

Narrative Creation

There is the ethos of [protect, own, benefit] in web3 where those who have historically not been able to participate in the upside now have the chance - through tokenization, through new platforms, through new incentives.

It is permeated by collective effervescence (if you HODL, I will HODL). It allows those who create on platforms (those who make the platforms worthwhile) to benefit from the digital content that they create, and more - that’s just one example.

Like the Fed’s dual mandate, the mandate of web3 seems to be:

Protect data: control over access and usage

Own data: lack of a central authority, direct ownership

Benefit from data: make money on things

All of that is compounded by FOMO.

web3 = [Protect * Own * Benefit]^FOMO

So the narrative is being built - an element of this is yours, no one can take it, and you can make money with it, underscored with this space will leave you in the dust.

As Barney Frank once said, “Government is simply the name we give to the things we choose to do together” - and obviously, there is a LOT more nuance to that. But there is an idea stirring where web3 is the way that people are able to participate in the economics of the networks we belong to - where we benefit from doing things together, from the upside of things just as much as Big Corporations.

Narrative Interpretation

But of course, the problem is narrative interpretation. People see other people buying monkey pictures for millions of dollars - which doesn’t always feel great if you’re struggling to make rent every month. It’s flashy opulence in a world of increasing wealth inequality - in an industry that supposedly wants to democratize access.

So this narrative of what web3 could be - which would probably be net-beneficial for most people - gets skewed because the narrative gets skewed. It could be percieved as an equitable, cooperative, and accessible world, but it isn’t. From an outsider’s perspective, the narrative is not being translated in the right way. Most people still see crypto as an get-rich-schema-for-already-really-rich-people, and that is not… appealing.

It’s really two main threads:

Economic change: Crypto is going to change how the economy functions, digitize everything, make us own everything, and change how we work, play, etc

Ponzinomics: This is really just a promenade of wealth, and its a bunch of rich people getting richer and leaving everyone else behind.

And another tough (good?) part about crypto is that a lot of stuff is a literally a joke - which can hit different people different ways. Mike talked about that during his Odd Lots interview - they have a meme maker on staff. Memes are sort of an onboarding tool into the crypto universe - if you buy a non-fungible Olive Garden, that is Funny, ***BUT*** it is also a learning tool - because now you have a wallet, you know how to navigate the different tools (Uniswap, Trader Joes etc).

And of course, all markets calibrate. Shitcoins are calibration. Ponzi forks are calibration. One could even argue that SPACs and GME are calibration in TradFi. It’s a test of how much the market is willing to take, how much the market will (or won’t) learn.

Narrative Resistance

There are people like Jack Dorsey and Elon Musk who are Narrative Resistors - they vocally speak out against web3 and when narrative is kind of a core driver of your entire value (this is what we *could* be), then it gets a bit dicey.

Several people have written pieces on their experiences in web3 (or that which is web3) recently. Moxie Marlinspike, the founder of Signal, dove into web3, laid out that web3 is exciting, but still inherently centralized, consolidates around platforms, and other thoughts on the actual tech underlying the narrative.

Looking at it through the lens of these small projects, though, I can easily see why so many people find the web3 ecosystem so neat. I don’t think it’s on a trajectory to deliver us from centralized platforms, I don’t think it will fundamentally change our relationship to technology, and I think the privacy story is already below par for the internet… but I also understand why nerds like me are excited to build for it.

As Vitalik, the founder of Ethereum wrote in response:

Moxie's critiques in the second half of the post strike me as having a correct criticism of the current state of the ecosystem (where (1), (2), (7) and (8) are the only things that we have working code for), but they are missing where the blockchain ecosystem is going. There's already teams working on implementing (3), (4), (5), and active research on making (6) happen.

A lot of the narrative exists in some future point, a point being built towards. Hope, enforced by progress.

The Story of Society

An aside on society-with-a-capital-S.

I don’t think it’s fair to discuss anything without contextualizing why things might be the way that we are. In our Society, we have the assetification of absolutely everthing - there is a group suggesting that we tokenize litigation so people can bet on the upside of different court cases. This is probably not good. We do not need to bet on everything.

Basically, we play games all the time. We are speculative creatures, like to make bets, search for social cohesion and community. We also like cheat codes - and in a life where the world feels increasingly tilted towards “rich get richer”, you have to find other cheat codes in order to make the game work. And those cheat codes right now are $FAST MONEY$.

You have to make your own game. As Iain Banks wrote in The Player of Games:

"All reality is a game. Physics at its most fundamental, the very fabric of our universe, results directly from the interaction of certain fairly simple rules, and chance; the same description may be applied to the best, most elefant and both intellectually and aesthetically satisfying games.”

One of the reasons that the Stonks and Crypto Go Brrr narrative has stuck around for all this time (I think) is because people felt like they were playing a massive RPG. Gather your battalions, plan a bank run, maybe become millionaires, even billionaires. What the RPG fails to teach you is that there is no alpha in copy-paste, BUT you do get a little glimmer of hope.

“Maybe I can bet $20 on some call options, turn that into $20k, lever up into $100k, then turn that into $1m by flipping NFTs and shitcoins.”

A proper investment lifecycle.

Hope is ultimately a function of fear, what else is there besides choosing to believe in something better. Sometimes, shitcoins are the something better. Things become ultimately a function of emotion and narrative.

The Story of Energy

But the narrative is always disrupted by reality.

In the past few weeks, deadly protests erupted in Kazakhstan, sparked by a lift on LPG price controls. These protests were the result of much more (an authoritarian regime, inequality, oligarchs taking all the wealth).

But a small shift in energy access set it off. I don’t think it’s good to extrapolate from that, but we do have increasing signs of tenuous energy access.

Energy is EVERYTHING.

In crypto, the Proof-of-Work consensus method relies on access to cheap energy - which is why miners went to Kazakhstan after China cracked down. This resulted in Kazakhstan owning ~18% of the hashrate - and also put pressure on their already weak grid. When the Internet was shut down in Kazakhstan because of the protests, Bitcoin’s hashrate dropped ~12%.

You’re only as decentralized as your access to the energy source.

A lot of the inflation we’ve experienced over the past year has been because of energy prices - underinvestment and underproduction because of the pandemic. That bleeds up the supply chain - higher gas prices, higher production prices, higher prices for consumers.

Everything reverts back to energy. And this could easily be the disruptive variable for all the narratives aforementioned.

The Story of the Fed and web3

Both the Federal Reserve and web3 are trying to convince people of a future that might exist, so you should believe in it now, because it might exist, one day.

So the Fed has been accommodative over the past year(s) - which has enabled a lot of Market Go Up.

Once the Fed pulls back and engages in restrictive monetary policy, all those free flowing dollars will be freaked out - which will put pressure on risk assets like crypto and growth stocks.

Institutional investors see crypto as a risk asset, it hasn’t quite blossomed into a digital gold/innovation bet narrative yet.

When the market becomes risk averse, risk assets logically suffer - so it will be interesting to see if the crypto narrative evolves into a place to preserve wealth and decouples from equities.

The bond market is already responding to what it think could happen, the realization that the Fed is serious this time. This means that the stock market will begin to realize that the Fed is serious, and due to the nature of institutional dollars, so will crypto.

A dry-up of liquidity is hard for most things. Investors have started to somewhat de-risk, limit exposure, prepare for higher rates, rotate from growth to value, etc. It is uncertain if the market will *keep* responding like this - obviously higher rates bite into valuations, and perhaps the Lightning McTightening Fed will result in even more risk-off.

We will have to see.

Where Our Stories Meet

What I’ve described throughout the piece is, of course, an element of reflexivity - coined by George Soros, it describes how our perceptions impact fundamentals, how “distorted views can influence the situation to which they relate because false views lead to inappropriate actions.”

We live in a world where things like GME can go from bankrupt to the moon, where Bored Apes sell for millions. As Messari wrote of NFTs, “attention is finite, the internet is vast, we’re tribal creatures driven by mimetic desire”. On aggregate, we want the thing that everyone else wants - and we communicate that through stories.

As Morgan Housel wrote,

“The most important variable was the stories people told and the emotions they suddenly stumbled upon”

In bear markets, narratives get a bit blurry. Short term thinking (which is already pretty short term) gets even more short term. “Maybe one day” gets priced a bit lower, “actual cash flows” gets priced a bit higher. When money dries up, the vision needs to be crystal clear, memes can melt - in the excellent paper Manias and Mimesis by Tobias Huber and Byrne Hobart, they outlined how the meme (here a startup, but it applies broadly) dies:

The cycle of a startup might look like this:

Someone has an obviously insane idea, like selling Basic to computer hobbyists in 1975 or selling books on the Internet in 1994.

They wildly oversell this idea to investors and early employees—it’s quite common for startups produce sales projections in their early stages, but rare for them to hit their initial numbers.

The combination of investor money and talent makes the idea a little less crazy, albeit still ambitious.

On the basis of this track record, the founder raises more money and recruits more talent.

Over time, either reality converges on these wild expectations, as the expectations get toned down and reality catches up—or exaggeration becomes the only possible way to keep the company alive, and founders ratchet up self- and other-deception until it reaches the breaking point

Everything reaches a breaking point eventually. The Fed might be an accelerant to that, as they bring the reality to the narrative - stonks and coin go down. The Fed might skew the equilibrium, make it so prices have to show more of what is actually happening, which results in the feedback loop of fear, sell, sell more, fear more.

However, I think web3 is interesting because it’s based in hope. Back to Manias and Mimesis - is that enough to keep the “exaggeration” alive? There is a floor in crypto/web3 - the knowledge that the world can be better. Can you assign valuation metrics to people who truly believe in a better future, will innovation prevail? Or will it melt away into something else entirely?

“The only hope is in the creation of alternative values, alternative realities. The only hope is in daring to redream one's place in the world - a beautiful act of imagination, and a sustained act of self becoming. Which is to say that in some way or another we breach and confound the accepted frontiers of things." - Ben Okri

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

Really enjoy your socio-philosophical approach to economy and political context. A lot of interesting questions. I loved the drawings btw.

Interesting read! With all this being said, is your investment strategy to profit off of narrative or to avoid it?