Some thoughts around commodities again, and the Fed, of course.

If you’re already subscribed, thank you! If you’d like to subscribe, please do so here:

YouTube up Sunday, podcast up later today!

Also Joey (a brilliant blogger and aspiring economist, in his own words) and I are doing a Q&A newsletter together, so if you have some questions, feel free to ask them here!

What’s going on

Oil, gasoline, geopolitics, China and Russia, and the Federal Reserve

Omg OIL

So wow what a week for oil! What a rollercoaster - from negative in March 2020 to wildly swinging between < $100 barrel to $120+ in mere days. Because of geopolitics, because of supply and demand, but mostly because of… fear.

Odd Lots interviewed Pierre Andurand (who thinks that oil will get up to $200 a barrel by the end of the year and has indeed been right about this stuff before) and he said that there’s basically a few things going on:

Russia was a decent chunk of the market: And that Russian oil is lost - and that is going to have to be reflected in prices

Underinvestment and underproduction: Shale producers and OPEC have underinvested for many years, and it will be difficult for them to ramp back up

The river ends eventually: He also points out that a lot of U.S. oil has been drilled, and there is some supply sure, but it’s not a golden river of oil - meaning it’s important to invest in alternatives *now*

Shale moneybags: The Shale Shareholders Want Money - the companies are going to listen to them because they did burn $600bn of their money last time - and have to keep the financial liquidity spigot open

Basically investors are saying “MAKE US MONEY, BUT DON’T MAKE OIL” - which is makes sense but also?

To give you an a little bit more insight into the oil industry - because prices are so high, oil execs are like “I think prices are gonna stay high” and are removing some hedges to essentially take advantage of that. So basically, guard down, hopes up, that oil is going to stay high.

Long term: But this isn’t great from a long term perspective because it can result in “less liquidity and fewer checks, leading to more volatility and potentially bigger rallies” according to Bloomberg

OPEC already missed their target by over 1 million barrels per day!! so things could get even more expensive on that.

So it’s kinda making big bets now at the expense of stability down the road (you would have thought they would have learned by now)

So shale is not really producing, we are still trying to find alternatives, and oil is expensive! That gets into demand destruction - where it’s just incredibly costly to get oil, so people are like “eh maybe not” - demand lessens, which does help to soothe price fluctuations. Demand lessening could *potentially* be helpful from a calibration perspective as the markets readjust to the lack of Russian supply.

Rory Johnston does really really good work on this space (a great newsletter)

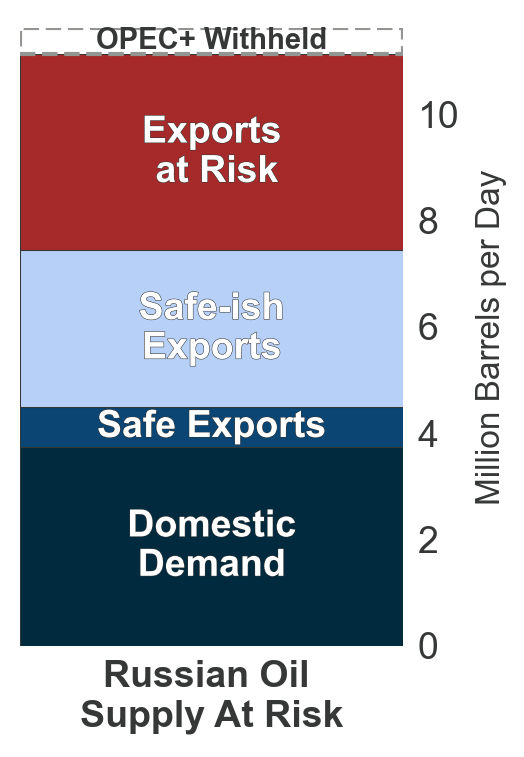

He outlined how a break out of Russian oil looks - and it shows 2 things

What does the loss of Russian oil looks like? [exports at risk]

Pierre estimated that Russia’s sanctions removed 4m barrels a day from the markets - the world consumes ~100m barrels per day, so this loss is rather significant

But - how much money they are still able to make? [safe exports]

A lot of Asian countries are still buying Russian oil (discussed later) and of course, Europe is pretty energy dependent on Russia still - so some money flows for sure

Oil is complicated. There are different grades, production ramp up, the whole supply chain from refineries to processing etc - it isn’t as easy as just pressing a button and more oil comes out (one day, no more oil hopefully) - which gets into gas prices.

Gasoline Prices

So as everyone has noticed (unfortunately) oil has been swinging around lately. When oil prices increase, gas prices increase too - but when oil decrease, gas prices… don’t.

There’s a really good research paper Do Gasoline Prices Respond Asymmetrically to Crude Oil Price Changes? and a key point in the paper is

If a consumer uses ten gallons of gasoline per week, a 5c per gallon increase in crude oil prices (~$2.10 increase per barrel) costs the consumer $1.30 more over her life than a 5c gallon decrease saves her. This asymmetry implies that variability in crude oil prices, even if there no systematic increase or decrease in price, is costly to consumers

VARIABILITY is bad. And that’s what we have had a LOT of recently. There are several other research papers that make this same point - “thing go up fast, but it come down really slow”. Matthew Chesnes writes:

On average, retail prices rise three to four times as fast as they fall. Branded gasoline features significantly more asymmetry compared with unbranded gasoline in response to changes in the rack price

So pricing is just kind of a weird thing - it’s a combination of

Market power from gas stations (after all, gasoline is an inelastic good)

Fear of variability (if prices go up again, they don’t want to be caught on the wrong side of that)

Feather and rocket - gravity works in reverse for the gasoline industry (and across all prices, really).

So what’s going on here? Clearly, Biden has not read the peer reviewed studies right???

Well yeah kind of. Garrett Golding, a Dallas Fed energy economist, had a great breakdown of what happened to gasoline prices and oil upon invasion, highlighting:

Invasion Day, Feb 24

Oil prices: $92

Average gas price = $3.57

March 15 (when oil went back down after rocketing up)

Oil Prices: $96

Average gas price = $4.31

What the heck right? Why is gas still so expensive? Why is there a gap? Why is crude going back down but gas prices aren’t?

So it’s… complicated.

Refiners acquire crude and turn it into fuel, and then its sent to service stations and distribution facilities, etc - that costs $$ - it’s not a 1:1 gasoline to crude

As Garrett highlights, when oil first shot up, it took about two weeks for that to be reflected in gas prices - but now, crude has dropped and they haven’t - things take time to adjust

And to the previous variability point - they don’t want to drop prices because oil could jump again. Much easier to keep prices high to hedge against that.

Another interesting thing with oil is that markets are kind of drying up - as Javier Blas wrote, “the commodity market continues to trade largely on value-at-risk and margin (initiation and variation) rather than supply and demand”. So it’s the market making moves, not really moves making the market - and things are kinda messy because of that.

And it gets worse.

The European Federation of Energy Traders is now asking for emergency liquidity because yikes! these “high and volatile wholesale energy prices are leading to intolerable cash liquidity pressure for energy market participants” and “liquidity support should be provided”

The commodities are asking to be backstopped!

And that’s a whole conversation to be had! What does it mean if the Central Bank has to intervene in commodity markets? How did these markets get so fragile (how could anyone let a tycoon accumulate such a massive short, is the immediate answer)? The Central Bank’s role could become even more outsized.

Which is sort of ironic?

Sarah Bloom Raskin lost her Fed opportunity because some politicians were mostly like “she cares a little too much about making sure the Earth is livable in 20 years” (gets into the whole green energy policy without green energy investment idea)

She was overstepping what they thought the Fed was in charge of

So squaring that - where does the Fed’s (really, all central banks) power line end and begin? I think that question is going to become increasingly prominent soon

The Geopolitical Hot Potato

Let’s zoom out to a global view.

India is buying Russian oil. India also relies on Russia for ~60% of their military equipment. They are trading buddies. They are planning to create a rupee-rouble trading mechanism! Their former ambassador to Russia said “this is not a fight we have created”, showing his frustration with Russia’s invasion.

Russian exports to India have 4x’ed in the past month - BUT the purchases don’t violate sanctions.

This is mostly because Russian oil is on A Big Discount, and India consumes a lot of energy.

Oil is important. Lots of “friendships” forged from it.

China imports 25% of their oil from Saudi Arabia, and the two are now like “what if we priced this oil in yuan”, which gets into the whole “what’s going to happen to the U.S. dollar?” China has been hardcore courting Saudi Arabia, helping them build different things, investing in a city that MBS is building, and more. It would make sense for them to price in yuan, but it’s not !!! global superpower crumbles !!!

Dollar as Reserve Currency

Everyone is on this whole !!dollar won’t be reserve currency anymore!! which is definitely a thing to discuss - countries are watching Russia get slammed with sanctions (because you know, they invaded their neighbor) and are like “hmm how do I avoid all that?” And the easiest answer would be to simply rotate away from USD as a large portion of reserves, try to conduct less global trade in USD, etc.

But 80% of all oil sales are in USD, according to the WSJ. And the yuan is not the perfect currency because China is an autocracy, and they sort of do whatever they want. So there’s really three things here:

It could happen: China’s oil sources (Russia, Iraq, Angola) might want a yuan-denominated trade system so they can get away from the weaponization of the USD. That could put pressure on the power of the dollar.

But the yuan is the yuan: China’s currency is not the most stable and reliable.

China still needs USD: But China can’t go messing up their relationship with the West (at least right now) and they know that:

Western capital and technology are essential to China, despite recent efforts to make the country more self-sufficient. Foreign direct investment topped 1 trillion yuan last year, with about a third going into high-tech sector.

Ian Bremmer summarized it well too:

China will continue to sit on the fence, maintaining normal trade relations with Russia where sanctions allow it while refusing to directly come to Putin’s aid to avoid decisive breaks with the West.

David Fickling had a good thread on the yuan replacing the dollar (really the eurodollar) highlighting a few key things - mostly that the yuan isn’t really used that much (and you can’t really be an effective currency if you’re not used that much)

The Swiss Franc and Canadian and Australian dollars are used in more FX transactions than the Chinese yuan

Cross-border claims in China are mostly denominated in dollars (~86%)

And it’s mostly the eurodollar that matters here - it’s the instrument that facilitates trade, and as David highlights “the closest thing the world has to unregulated global finance”.

So okay, what’s going on with the ruble?

Russia

So everybody was like?? Will Russia default on their debt! And no, they didn’t. Russia paid their coupons on their bonds! to JP Morgan. They are also now looking to issue “digital financial assets” which sure is something!

The U.S. is discussing banning Russian imports of uranium into the U.S. which is just another tool in the Russia Economic Sanction Toolkit - but one that is interesting because Russian uranium makes up 16% of U.S. purchases - most of which go to nuclear reactors. And this gets into the broader Are Sanctions Working? question

There are three main points:

We need that Uranium: This is just the broader scope of sanction effectiveness - how bad does all of this hurt Russia? And how much does Putin actually care about the Russian economy?

We need to wean off Russia in general: Like we probably shouldn’t be using Russian energy supplies, especially considering their desire to Invade. So it makes sense to sanction them as a way to expedite that, sort of.

Domestic production: This is going to be a big theme over the next few years I think, where we see a lot of reshoring of production. Countries are going to focus on having their own physical stockpiles and access

That will make things more expensive. We have gotten very used to the cushiness of globalization.

But are the sanctions working? I mean, they are developing digital assets so like?

Iran apparently built out an entire system to evade sanctions. So sanctions might not be the thing to end all things -

Iran’s sanctions are different than Russia’s, but things get sneaked around (especially when energy markets are in the picture). As the WSJ wrote:

The system provides Iran the revenues and imports it needs to keep its economy and country running. It moderates the pressure on the country’s currency by giving the Iranian economy access to the dollars, euros and other reserve currencies in which world trade is denominated

And the Russian sanctions are kind of… confusing?

So they are working (the ruble shows that) but Russia is still operating, just with one hand tied behind their back with a rather loose rope, it seems. And their BFF China has been a bit confusing too.

China

So China. China has been a really interesting piece in this whole geopolitical chess puzzle for a few reasons -

They don’t want to ‘pick a side’ - They are seemingly trying to maintain a relationship with both Russia and the U.S., a task that will likely become increasingly impossible as time moves forward

XI TELLS BIDEN CHINA, U.S. MUST SHOULDER DUE INTERNATIONAL RESPONSIBILITIES, MAKE EFFORTS FOR WORLD PEACE - CHINESE STATE MEDIA

XI TELLS BIDEN CHINA, U.S. MUST SHOULDER DUE INTERNATIONAL RESPONSIBILITIES, MAKE EFFORTS FOR WORLD PEACE - CHINESE STATE MEDIAThey need energy - China uses a lot of coal. And oil. And natural gas. And they are going to find sources for those things, no matter what

They had an uptick in COVID - This caused a shutdown of cities, supply chains, etc, and then a pretty quick reopening of some things. But that puts pressure on supply chains everywhere

Regulation?? - The Chinese Internet sector got clobbered (AGAIN) because:

US Regulation - The U.S. is like “hey if you’re going to be listed on exchanges, you have to comply with regulations, which includes us auditing you” and China is like “hmmm not right now but maybe later” - which puts them at risk of being delisted from the exchanges

China Regulation - China has cracked down on the tech sector, and everytime they do it again, everyone seems surprised again? There are worries that they are going to nationalize more industries, which would be quite bad for U.S. shareholders (regulation took $660 billion off $BABA)

China has stated that they would make regulation more “transparent”, reduce the economic impact of Covid-zero, and support the market with all their might. So their market rallied big, because, of course.

And then China is a huge portion of $EEM which is how a lot of investors get exposure to emerging markets, and that has gone rather… poorly.

So everyone for a few days everyone was like !China is uninvestable! but all China had to do was say “okay we will fix this” and then all the sudden the stocks became “ridiculously cheap”. This feels like playing poker with your cards turned backwards - you might think that you are making great plays, but everyone can see your whole hand.

Remember Evergrande? There’s more of that too. More than half of debt from developers is trading below 50 cents on the dollar.

Their real estate market is a mess - as Adam Tooze wrote, “the overwhelming majority of China’s household wealth is in real estate and those markets are not looking good”

Let’s discuss the Fed.

Fed Inflation Policy

THEY DID IT! Hawks at last. Fed raised rates by 25bps, and we will hear more about the balance sheet in May, most likely. They are expecting to raise rates at every meeting this year which is a lot. I think it’s helpful to bucket this into short and long term:

Short term (2022)

Raise rates 7x this year, likely shrink balance sheet (~1 rate hike)

The Fed made it super clear that their whole thing was going to be Fighting Inflation and Price Stability is the root solution to everything, including the labor market

The yield curve inverted because it was like ??? you really think that you can raise rates this much and not have things melt in some corners of the economy?

Long term (2023-2024)

This is their Summary of Economic Projections and basically they see GDP growth slowing a bit into 2024 (1.8%) with the unemployment rate staying steadyish around 3.5-3.6%, but !inflation! is expected to be 2.3% into 2024 (this is a weirdish combo of numbers)

End of 2023: They are expecting the Fed Funds rate to be above their neutral rate (at 2.8% when neutral rate is like 1.8 - 2.5%ish which is where monetary policy is chill, it’s not contractionary or expansionary)

Meaning that they are thinking that things are going to need to be restrictive - and that being restrictive will be ok for economy

And then of course their average inflation targeting goal is 2% - so the fact that they don’t think they can get there (2024 inflation is 2.3%) with arguably restrictive monetary policy is kind of wild

So the market is worried that this normalization could create quite the problem for the economy because somehow the Fed thinks that we can have tight monetary policy and not overly impact the economy

I really liked how Adam Cochran phrased it - “this is somehow both hawkish and yet still too optimistic.” Like yay the Fed is doing something, but it seems completely disconnected from the reality of what could happen. And the yield curve quickly informed the market of their opinion - flirting with inversion (which implies recession).

Matt Klein of course had an interesting note about it -

Policymakers can choose whether or not temporary disruptions in production and consumption have to lead to downturns. The question comes down to how much inflation people are willing to tolerate—and how long excessive inflation can persist before people start to adjust their behaviors to hedge against the risk of future price increases.

So maybe the Fed can manage inflation while still encouraging growth and spending? The economy might revert to the mean? No Volcker moment?

I’m not sure.

This was a title of a Bloomberg article and I thought it was kind of funny. Like of course they are guessing haha. Monetary policy is mostly slam poetry with a bit of bank nudge nudge mixed in. It’s like touching the stove to see if it’s hot - you just sort of turn the notch, you can kinda feel the heat, but if you have to temperature check it to see if its working (and yes, you can get burnt).

Rick Rieder, the global fixed income CIO at BlackRock said ‘high prices tend to be the cure for high prices’ and I think that is what the Fed is relying on too. Their whole meeting was really interesting because it was kind of like “everything is gonna be ok, even though we are raising rates 7x this year :-)”. They expect GDP growth and unemployment to remain relatively steady which would be great, but probably not probable.

Powell also said the labor market was unhealthy because its so strong: I really liked Dr. Coronado’s views on the labor market - “give me a labor market where I have to fight to keep my employees--pay them, train them, treat them as human beings.”

And I think that’s a really important point - it’s really easy to say “ah ya wage growth?? too fast, inflationary, bad stuff” but also it’s important that employees are valued.

Employer-employee: We still carry a bit of the Industrial Revolution grindset where the employer-employee relationship is one of dominance - but if you give employees a high quality of life, one would imagine that productivity and output would be that much higher too.

Wage spiral: But also it’s important to point out that a wage growth spiral is not a good thing - that makes cost increase across the board - people get paid more, employers charge more, people pay more for things, repeat.

Tim Duy said something interesting - “I think if the Fed continues to anchor the long end with its guidance on the neutral policy rate, it is almost certain that the curve will invert.” And this is an important point because inversion usually leads to Recession, which would make the Fed’s job that much harder.

But perhaps they can bring inflation down, keep growth high, amid a backdrop of geopolitical and resource uncertainty. I hope so!

U.S. mortgage rates are back up above 4%. So. They’re managing something, at least.

Final Thoughts

Putin is a desperate man who is increasingly feeling backed into a corner. Although the market keeps going up, this is not over.

Some other things:

One constant in life is companies buying back their shares!!!!!!!

Hide not Slide wrote a really good article on the nickel debacle

A good article on how carbon markets are pretty much fake (and more needs to be done to improve them)

I was reading about Jevon’s paradox this week, and I think it encapsulates a lot of the weirdness with oil, as Brent points out in his tweet. We have all this renewable energy, all these electric vehicles just buzzing around, but we are still so reliant on… oil?

Jevons paradox: When technological progress increases the efficiency with which a resource is used (reducing the amount necessary for any one use), but the rate of consumption of that resource rises due to demand.

If our cars are more ~fuel efficient~ we are going to use them more

This is an interesting juxtaposition to that - the energy efficiency & performance level of of transportation - oil tankers do really well, cars do poorly. Tradeoffs are kind of weird!

I think this is pretty cool from the Kyiv School of Economics. They reopened their bachelor program, have a variety of public lectures, are launching aid projects, have their own NFT campaign for Ukraine, and are basically continuing forward in the face of uncertainty.

Never doubt human persistence and innovation.

and yeah idk

And finally, a quote from Erich Fromm on resilience and change:

Only through full awareness of the danger to life can this potential be mobilized for action capable of bringing about drastic changes in our way of organizing society

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

Thanks, Love the content! Please keep doing this.

glad someone else thought the SEP numbers were odd