Roblox and the Creator Economy

Roblox is a call option not only on the metaverse, but the open-source economy.

Today’s piece takes a deep dive into the potential of Roblox ahead of their DPO!

The Open-Source, Creator Economy

Roblox is a call option not only on the metaverse, but the open-source economy. We are entering a world where people are building for themselves – and Roblox is an iteration on the path towards a creator-led decentralized future.

Roblox = Identity + Friends + Immersive + Anywhere

What is Roblox? Roblox is not just a game but rather a “human co-experience platform”. It is currently the most popular game in the world, specializing in UGC (user generated content). Founded by David Baszucki and Erik Cassel in 2004 (and launching in 2006), the game is a multiplayer platform that allows users to 1) build games and 2) play games (with potential and access to much more). Their mission is to “bring the world together through play”.

Roblox launched on PC in 2006, mobile in 2011, and Xbox in 2016. This multiplatform access led to its explosion in popularity. The company has remained focused on curating the in-game community. Roblox is still free-to-play, monetizing through Robux (an in-game virtual currency), in a series of microtransactions (that could evolve into a full economy (NFTs, creator stock market, etc)).

The game has always had creators at the core of its mission, focused on giving developers and creators the tools to build, rather than aesthetics and flash of the games, with the world remaining pretty blocky until 2015. Most people still view it as a game for kids, but they have a huge opportunity to age up their user base.

They also have the opportunity to break outside of just the game industry (which they have taken steps towards). Roblox wants to expand its platform to encompass all parts of virtual life - the avatars will be used across all facets of existence, from gaming to social media, to education, and to business.

Roblox is priming itself to become a place for work and play, allowing collaboration and socialization. Roblox combines everything in its ecosystem – providing fertile soil for creators to grow, while also providing infrastructure to facilitate broader social interaction.

There are 3 main growth opportunities for Roblox:

Curating Developers and Creators [The Creator Economy]

Expanding the Social Network [The Evolution of Social]

The Metaverse [Integration with the Blockchain]

I am incredibly bullish on the creator economy, the evolution of social, and the potential of blockchain integration in our daily lives. And I think Roblox is a steppingstone in this path.

Roblox Owns the Ecosystem

Creators + Social Network + Metaverse

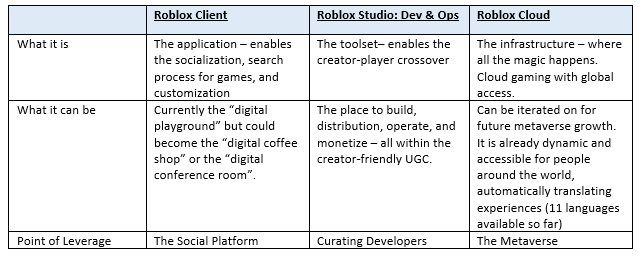

Roblox is a trio of products that interact to form an ecosystem: the Roblox client, Roblox Studio, and Roblox Cloud Services.

This all builds into the Roblox flywheel:

UGC Experiences: Content built by developers attracts more users, which in turn makes Roblox more attractive to developers as R$ flows - and then they build games that attract more users.

Social: Players play game with friends, who invite their friends, who then invite their friends

The Ultimate Flywheel: The more friends users have, the more valuable and engaging the platform becomes. Developers build more, bringing more users to the platform

The Four Roblox Differentiators

The In-house Flywheel: Roblox owns everything. The production of games, the distribution of games on the platform, and the eventual monetization. This gives them a lot of space to build out a strong ecosystem (outside of games and into the metaverse!)

The Future of Socialization: Roblox is a platform for socialization. Because of infinite builds, people can customize their corner of the platform, and share it with friends. It’s not just a game, it’s a place to create, host, play, and hang out (with safety protocols).

Decentralized Content: Roblox does not “create” content, which does give it a financial upside. It can pay creators post their game publishing, which negates any upfront costs and helps mitigate the usual boom-bust cycle of traditional game makers. But also it gives total creative freedom for developers to build whatever they want, and incentivizes Roblox to build the tools to make this creation possible.

Multi-functional, Accessible Ecosystem: Roblox is a place for gamers to become developers and for developers to curate their craft - the friction between the two roles is low. The game itself is simple enough but can be dynamic and powerful for those who dive deep. The YouTube-esque dynamic of creation and monetization gives Roblox a lot of potential. They give creators a place to create and grow, in a truly accessible format.

These are some of the main levers that I could see Roblox using:

AR/VR software platform: Mobile-based augmented reality or headset-based virtual reality could go far in the Roblox world. People could truly create their own space, and Roblox could be the first one to get this right. They already offer a lot in the platform – hosting games, storing data and content, and a pretty efficient conversion process.

Beyond Gaming: Tying back into the first point, if Roblox can leverage AR/VR in our increasingly online world, we could be having our work meetings in the Roblox universe. A game engine could become increasingly powerful as we lean into our virtual lives.

Interoperability: This is where I see some crossover with blockchain and crypto (which deserves its own piece) akin to what Sandbox has done. Roblox has already leveraged an internal network, an entire ecosystem on one platform. If Roblox can execute on the metaverse, this functionality will be very impactful to its future.

The Roblox Economy: The Dual-Sided Marketplace

Roblox exists in a fixed economy. They control the exchange rate of Robux to USD which they can use as a point of leverage. Controlling currency rates is a powerful tool.

The Roblox marketplace interfaces between players and developers. Players buy Robux (RS) with real money which can purchase in-game items. The exchange rate is roughly $1 USD = ~R$0.01, which are usually bought in bulk or through a monthly subscription (Roblox Premium). Developers get paid at a rate of R$1 = $0.0035.

Side 1: What do players do with their Robux?

Avatar Marketplace: purchase clothes, gestures, and emotes

In-game purchases: Buying in-game experiences

Accessing games: Buying into developer games and accessing special experiences

Side 2: How do developers and creators earn Robux?

Access: Sell game access and enhancements

Engagement: Get paid based on game engagement

Studio Marketplace: Sell content and tools to fellow developers

Avatar Marketplace: Sell items through the Avatar Marketplace

The Developer Moat: There are currently ~7mn developers across 170 countries. Almost 1mn developers have earned something on the platform, with earnings > $200mn for 2020. This is an army of developers already in the Roblox ecosystem, and brings a lot of value to the platform.

The Skew to the Top: However, Roblox is running into the usual platform problem where the top creators get most of the economics – clearly reflected in the skew of game play. Developers need to be enticed to stay on the platform. Roblox is going to build out several ways for games to be showcased, which should encourage developer stickiness.

The App Store Dynamics: This eats into the developer relationship in my opinion. Robux purchases can be made across any platform, but website tends to be “cheaper” than the in-app purchases due to the app-store cut. iOS and Android take their usual 30%, which bites into the revenue that Roblox generates from app sales of $R. ~48% of their revenue is under the Apple (30%) + Play Store (18%), and ~70% of engagement comes from those apps. Roblox has to pay ~30% of revenue to the apps. Assuming that was negotiated away (one can dream), Roblox could be much more profitable - but the power of the app store is unlikely to go away too soon. But the important people is that people are spending - in 2020, consumer spending in the mobile version was >$1 billion in revenue globally.

The most important thing to note is Robux is the “money”, but DAUs are the key to monetization.

“The more users on our platform, the higher the engagement and the more attractive Roblox becomes to developers and creators. With more users, more Robux are spent on our platform, incentivizing developers and creators to design increasingly engaging content and encouraging new developers and creators to start building on our platform. “

If Roblox can spin up their DAUs (primarily through aging up users and getting more developers on the platform) that is a huge lever for growth. There are a couple of ways that Roblox can continue to spin this faster, two main ones being 1) growth abroad and 2) actively shifting their demographics.

Growth Lever 1: Abroad

Right now, Roblox primarily generates revenue from the US/Canada and Europe (~90% of bookings) but almost 70% of the DAUs come from non-US/Canada. This is huge potential to monetize abroad – they already have the presence, just have to capture the dollars. There’s room for another Considering 30% of the base drives ~$2bn in bookings, there is easily another >$4bn to capture. There are more than 2.7bn gamers in the world – the biggest areas of growth are in Latin America and APAC, expected to grow by 10.3% and 9.9%

China: China depends on government approval. Roblox has a JV with Tencent - which means that Tencent wants to get this right. China is a very powerful market, and it’s good that Roblox is partnered with Tencent. Access to this market is an incredible growth opportunity.

Growth Lever 2: Demographics

As of 2020, about 40% of Roblox users are older than 13 years old – a demographic that they want to continue to age-up. A lot of this will surround getting developers into the platform to build “older people” experiences, which comes from two angles:

Curating the gamers that are already in ecosystem

Getting third party developers to the platform

Roblox has to age up users to avoid going the path of Wii and Guitar Hero. The network effects are powerful, but there is a lot that the company could do to make this execute faster.

Roblox is spending close to 20% of 2020 bookings on R&D to enhance features and create new functionality. This is pretty low relative to other developers - they have room to spend out here (perhaps in the AR/VR space to entice older users). Aging up users is an important step in monetization because older users can pay more - and their strategy has been working, as the 17-24 year old is the fastest growing category on the platform.

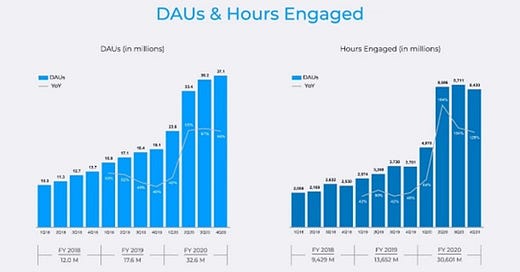

Roblox and COVID

COVID has definitely accelerated their growth, with easily 3-4 years growth in a 1 year time span. With 37.1mn DAUs now playing ~2.5 hours of content a day, the company has a solid base to work from. Roblox is guiding towards lower growth in 2021, but I still decent expansion in their user base over the next several years.

The Video Gaming Industry

The market is growing. The video game industry is now estimated to be worth $160bn in 2020, expecting to grow to $300bn by 2025, and the VR market is roughly ~S10b, with expected growth to ~$50b by 2027.

The Evolution into the Metaverse: Roblox doesn’t feat neatly into a single category. Because it’s a social network for Gen Alpha (capturing 70% of 9-12-year olds), it can be compared to Facebook and Snapchat. Because of the metaverse spin, it can also be compared to other platform games such as Activision and Epic. I think that Roblox is building itself its own media category – the first iteration of the broader metaverse.

The Power of the Toolbox: Roblox themselves are not a developer (like an Activision), rather a toolbox. It’s sort of like if you went to a infinite construction site – people can pick up the tools and use them, build, and also enjoy the already built content.

The Future of Social: It’s also a social construction site (bear with the metaphor here) where people can play and build together. This construction site also allows people to visit other games – letting the Roblox flywheel spin. This flexibility allows for increased game play, enabling growth in games such as with Adopt Me! And Piggy - two of the top games on the platform to reach > 10bn and > 6bn plays, respectively.

Key Competitors

Unity, Epic, and Microsoft are other players in the space. The industry has done well in the public market, with Unity IPOing at a $13.6bn valuation in September 2020, trading at all the way up to a $47.8bn market cap at its peak in December.

Epic: Epic is relentlessly going after the metaverse. They have the Unreal game engine, Fortnite, which commands the attention of ~350mn people, as well as a well-curated developer base. They’ve been hacking away at the metaverse, focusing on video chat, facial recognition, and Manticore. If they can continue building out their audience, they could be a force of reckoning for Roblox.

Unity: Unity is developer-focused, cheaper to use than Roblox, and primarily monetizes through ads. Unity spends 40% of revenue on R&D, spending twice as much as Roblox despite having a much smaller revenue metric.

Activision Blizzard: Activision Blizzard is a developer and publisher of entertainment software, including Call of Duty, World of Warcraft, and Candy Crush.

EA: EA is the second-largest gaming company in the U.S., in a similar space as Activision.

Roku and Spotify: I think that Roblox deserves to be compared to these platforms too. Roblox is a platform, not a developer like EA and Activision, or just a game engine like Unity. Roku is a powerful growth story, offering streaming media content from hardware devices. Spotify is a streaming music platform, also with mature margins and a solid growth story.

Minecraft: Parent company, Microsoft, is always a point of contention. Minecraft is personally one of my favorite games – and a lot of other peoples too, considering the ~125mn MAUs.

Comp Table:

**Comp Table (updated for new pricing)**

Quick Financials

Bookings: I think that Roblox can grow at a +25% CAGR into 2025. I am pricing in a lot of growth yet to be realized, but the opportunity of aging up DAUs and engaging their developer base gives them a lot of potential. Management was cautious towards 2021 numbers, highlighting COVID’s impact, but I still think they have room to the upside.

ABPDAU: Average bookings per DAU were ~$39.4 at the end of 2019 and is ~$57.8 in 2020. This is a significant increase and shows the power of monetization.

Free Cash Flow: They have incredible free cash flow generation, ~$292mn for the first 9 months of 2020 and ~$700mn in cash assets. They are well positioned to spend and allocate.

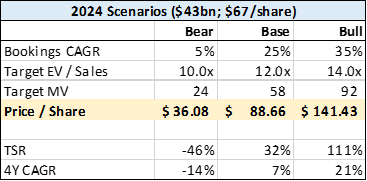

Returns

Below are some rough numbers. Their current valuation places them at a $29.5bn valuation or ~$45 /share. That is ~15x 2020 bookings and ~14x 2021 bookings. Using a ~25% revenue CAGR (roughly in line with Roku, Spotify, and Unity) and a 10x EV / Sales exit multiple based on a ~$29.5bn valuation, I can pencil in a 13% TSR CAGR into 2024.

**Returns Table (updated for new pricing)**

However, they are set to price north of $65/share most likely. Using $67 a share, this is ~22x 2020 bookings and ~20.5x 2021 bookings. Using a ~25% revenue CAGR (roughly in line with Roku, Spotify, and Unity) and a 10x EV / Sales exit multiple based on a ~$43bn valuation, I can pencil in a 7% TSR CAGR into 2024.

I want to revisit these numbers, but I think that there is upside to Roblox, especially if all of the above is realized. They are a mature company, with mature margins, and aren’t (too much) of a hyper-growth, flying taxi company.

Direct Public Offering

Roblox saw that the market was frothy with recent tech IPOs. It raised a Series H and has decided to go public via DPO. They are primarily going public to attract more talent (~80% of their workforce are engineers). They will list on March 10th.

Opportunities

The Metaverse: I think execution of the metaverse (and early execution) is a huge opportunity for Roblox. They are well positioned to take stage here.

Growth abroad (especially in China) is a great opportunity to grow. I love the value that international game play and social experiences will have too.

Creator economy: I think that Roblox is a great way to get exposure to the creator economy. People are going to increasingly want to control their own futures, and Roblox is giving people the tools to do that.

The Future of Social: This is the next iteration of social. They have the engagement and the metrics.

Risks

The gaming market requires innovation and is accelerating quickly – Roblox will have to be cognizant of R&D spend in the space

Losing their developer community – if another competitor comes along that promises more money and audience for developers, they could be enticed to leave

Failing to grow outside of their current userbase – 9 to 12 year are awesome, but they can’t pay as much as adults.

They will have to spend more on safety and infrastructure moving forward. This will put downward pressure on margins, but is absolutely necessary to the viability of the business.

Google and Apple take rate could put pressure on their margins too, especially if Apple decides to change things around.

Final Thoughts

I plan to update this as I learn more about Roblox and their future plans. I am really excited about the future of the creator economy, and I think Roblox is an iteration of that growth path. They need to pay close attention to their developers and creators (pay them!), and create a space for their players to truly socialize and grow together.

I am bullish on their goals. I want to revisit this post-DPO, but am excited about this mature, creator-focused, multi-functional platform. I am incredibly bullish on the creator economy, the evolution of social, and the potential of blockchain integration in our daily lives.

And I think Roblox is potentially one step in that direction.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

Want more market and macro thoughts? Subscribe below!

This is amazing! You have come a long wayyyyy and really proud of where you are headed! Keep it going!! Sheer brilliance!

Hiya, so late to reading that we have $86/share today after checking $100 and a bounce to $93. Blows the '24 estimate up! So what now? Too much cheap cash around, are we flat for the foreseeable future?