This is a macro market update (I post daily to TikTok). I publish these once a week (beta phase), as well as single stock pieces (1-3x a month) and macro deep-dives. I also publish on TikTok, Youtube, and Twitter!

Please note: I am no RRP expert. I have learned a lot from reading the brilliant threads from FedGuy, Magnus Macro, Analyst DC, Brian Chappatta and Rishi Mishra - and this is a very simplified explanation of their much more nuanced and insightful takes.

It is once again too long for your Inbox, but the images below are well worth it, imo.

Youtube linked here :)

Reverse Repo… EXTREME

The meat of it:

Yesterday, 59 counterparties (this is higher than the 40-50 that normally go to the Fed for collateral) took $502.9b (first time passing half a trilly) at the Fed’s fixed rate reverse repo. Today, it was 54 counterparties with $534 billion (see above).

RRP is important in keeping the market afloat.

But what… does it mean?

What is RRP? Why is it happening? What is going on here?

A few things…

What are reserves? Cash balances that banks hold to meet the Fed required reserves regulation. Banks get paid 10bps on these (IOR - interest on reserves rate)

How are reserves created? Two main ways -

Fed Asset Purchases: This is what the Fed excels at.

Why? They did it to keep the market alive during the pandemic, and now are doing QE to ~keep things easy~.

How? When the Fed buys treasuries for example (an asset), they swap reserves for the asset - the bank gets deposited the reserves, the Fed gets the asset.

Source: Magnus Macro TGA Drawdown: The Treasury General Account is owned by the US Treasury, but it sits on the Fed’s balance sheet as a liability.

The Treasury borrowed a lot of money to pay for fiscal support last year, which caused their TGA balance to pop.

Now, they want to readjust their debt to take advantage of the ultra low rates and well as cut down their cash balance (shown below) due to the impending debt ceiling.

When the TGA balance decreases (which is what it is doing right now), reserves will increase to balance it out - it’s a liability to the Fed - so a drop in TGA must come with a rise in bank reserves.

Source: FRED

Okay great. So reserves increase through the Fed conducting QE (asset purchases) and the TGA getting rid of cash. But what about rates? And what is QE?

How does the Fed set rates? They create a price corridor - with RRP as a floor and IOR (rate that Fed pays depository institutions like commercial banks) as a ceiling for people to transact in

But what is QE? This is when the Fed buys bonds from banks, credits them with reserves.

But banks want a higher yield - they don’t want to hold these measly reserves on their balance sheet.

Reserves basically help with regulatory requirements, and that’s it.

Nobody really wants reserves after a certain point. When this happens, it can push money market rates (short-term debt investments) down below zero - which is the exact opposite of what the Fed is trying to do here.

Enter the RRP: This is a facility (think of it like a parking garage or a drain) where people (mainly money market funds) can park their money overnight with the Fed at the RRP rate (a tantalizing 0%). This makes the RRP rate (and thus 0%) the floor for money market rates. RRP does three main things:

Keeps markets functioning: It helps to keep things afloat by giving access to non-negative yielding money market assets.

Manage rates: It keeps short-term rates down and prevents a lot of balance sheet pressure at the banks (banks unload into money market funds which then unload to RRP)

Reduces reserves: It allows the QE juices to keep flowing because it reduces the amount of reserves in the system.

And the Fed LOVES QE. They continue to create $30bn per week ($120bn/month) in additional reserves via (quantitative easing) QE purchases. On top of that, the Treasury General Account is running down and needs to get even lower so it doesn’t get squashed out by the debt ceiling.

So there is a lot of cash. The TGA is continuing to decrease, the Fed is continuing to do $120bn in QE, people have a lot of savings, and money market funds are AWASH with liquidity

Basically, the money needs a home. “QE created a lot of cash in the system that is looking for safe investments such as repo (secured lending against tsy).” Because of the demand for safe investments, repo rates were pushed really low, so “ as an alternative, investors may park cash at 0% in the Fed's RRP facility.” (Source: FedGuy)

The issue here is that if there is too much liquidity and not enough places for it to live, that is when negative yields become a real worry. That is why RRP is ~important~.

Will it get bigger?

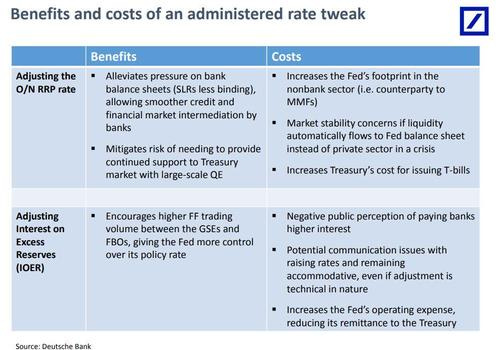

RRP is important and it might not be enough. MMFs are swamped with deposits - one way to alleviate that would be the Fed raising RRP rate

But there are of course consequences to that decision, mainly that it could potentially decrease market stability (everything does these days) and make things more expensive for the Treasury and the Fed.

They could also do “more bills issuance, SLR exemptions for banks, operation twist (“Fed uses the proceeds of its sales from short-term Treasury bills to buy long-term Treasury notes to put downward pressure on long term interest rates”, or end of QE”

But if we didn’t have RRP (at this point), the system would get flooded, and reserves would push yields well below 0

What does the Fed think about all of that?

As FedGuy said, “Post Basel III the banks just doesn't rely on money markets anymore, so there isn't any funding to lose.”

The Fed is simply unconcerned -

“The system is working exactly as designed. It’s working really well and the fact that funds are flowing between the banking system and our overnight reverse repos, this is kind of how we would expect that to happen given the level of money coursing through short-term markets.”

Basically, the system is working. It is draining liquidity and controlling rates. The question then becomes - can funds use RRP more? Because the Fed shows no signs of stopping and they definitely have more $$$ coming in

Source: Rishi Mishra And it seems that RRP can go upwards for a while. If the Fed increases their counterparty limit from $80bn, funds would funnel more money into the RRP, which would definitely get us well beyond that $1trn mark below.

Source: FedGuy

TL;DR?

Basically, the TGA wants to pay down, the Fed wants to keep on doing $120bn of QE per month, and definitely keep rates from going negative. RRP is a tool to do that. They are going to keep using it as a drain for reserves because MMFs have to park this cash somewhere. This is not an inherently bad thing- but it does mean that there is a lot of money in the system. Worse case scenario is that “rates go negative and funds close to new investors” - but the Fed will raise rates before then. There is a risk of too much “liquidity”, which the Fed needs to be cautious about.

The funny thing is that two months ago, there was no volume in the RRP. But now it is $500bn. It will likely be $1 trillion this summer.

The Fed has created quite the spot for itself in the stock market.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.