Solutions are the Problem

Ponzis, elon, and web4

If you’re already subscribed, thank you! If you’d like to subscribe, please do so here:

😎YouTube up soon and podcast up today!

💛Also I was on Odd Lots to discuss Memes and More! Big thanks to Joe and Tracy, and huge shoutout to Lily who is just so brilliant. Was a lot of fun!

haha hello things sure are thinging

So some things I am thinking -

Social media makes us feel better because we can shout into the void and the echo makes us feel like we're being heard

There is a very thin line between greed and governance

Luxury can overwhelm necessity

The global consciousness is not beautiful, but it is human

web4 is probably going to be commodities

Okay - so ponzinomics, telonwitter, and the macroeconomy:

Ponzinomics

SBF of FTX went on Odd Lots last week and basically described yield farming as a ponzi scheme (game) - in his words -

It's called ‘Protocol X,’ it's a box… And then this protocol issues a token, we'll call it whatever, ‘X token.’

X tokens [are] being given out each day, all these like sophisticated firms are like, huh, that's interesting.

We'll put a little bit more in, right? And maybe that happens until there are $200 million dollars in the box. So, you know, sophisticated traders and/or people on Crypto Twitter, or other sort of similar parties, go and put $200 million in the box collectively and they start getting these X tokens for it… And so then, you know, X token price goes way up.

So they go and pour another $300 million in the box and you get a psych and then it goes to infinity.

And then everyone makes money.

This was surprising! As Matt Levine described it:

I think of myself as like a fairly cynical person. And that was so much more cynical than how I would've described farming. You're just like, well, I'm in the Ponzi business and it's pretty good.

SBF also described VC as a bit of a ponzi game, highlighting the difference between building and burning and it really is best to do both rather than just the latter.

How do VCs find the next anything that they're gonna invest in, right? Like how do they find the next company they're gonna invest in?… Well, they like see what all their friends are chattering about. And their friends keep talking about this company or this token or something, and they start FOMOing… And all the while you're like, how do we justify? Is this a good investment? Like all the models are made up, right?… You're valuing them off of a model built by a person who owns the thing that's being sold… It's bizarre processes like that ultimately that are like shaping VC's investments in both traditional equities and in cryptocurrencies.

But I think all of this makes sense. VCs have money that they have to allocate, and so they kind of treat companies as absorption tools most of the time. It’s mostly spaghetti at the wall. Which is not bad, it’s just a thing.

yeah

Back to ponzis -

That was (no offense) but the entire thesis of Olympus, Beanstalk, etc - the more people put in money, more thing go up. And to caveat all of this - it’s not a bad thing. And stocks are like kind of similar right - Tesla (for a random example) goes up because fundamentals sure, but also because people are like “haha daddy elon”.

Archegos

And oddly enough, that’s sort of what Bill Hwang got arrested for (sort of)!! He bought so much of some stocks (on massive leverage) that the SEC was like “well Bill, you’ve bought a lot of this through total return swaps and lied to people which allowed you to influence price, therefore, you’re going to jail for market manipulation!”

"We allege that Hwang and Archegos propped up a $36 billion house of cards by engaging in a constant cycle of manipulative trading, lying to banks to obtain additional capacity, and then using that capacity to engage in still more manipulative trading.”

More money, more thing go up.

I guess the takeaway is you either live long enough to see the Bored Apes get hacked yet again, or for the pyramid to invert.

It works until it doesn’t

Kristen Stone said it really well -

Humans are naturally little raccoons!

We love to gobble up money, and when given a scenario where we can *make a lot of money* we are going to take full advantage of that.

And this isn’t a bad thing either - people hold onto things if they are good to hold onto - value accrual wise.

And honestly, greed probably drives a lot of innovation that we see, so it’s weird debate on what Value Ethically Means (is your token ESG, ser) and that is a windy rabbithole -

I liked Barry’s take in Purposeless Capital: “Without a purpose, money is merely an entry in an accounting ledger. But capital tied to a useful purpose has magical powers.”

But thing can only go up as long as more money comes, but what happens when money goes away?

Is the US Dollar a Ponzi?

Haha no but seriously what is going on with the U.S. dollar? Why is it rocketing up?

The Fed, of course: It’s mostly on the move because of expected rate hikes and the shrinking of the balance sheet, and the subsequent move in Treasuries.

But also: The rest of the world is kind of confusing right now (China shutdowns, Japan easing their economy into oblivion) so everyone is like “yep I want to be in dollar-denominated assets” creating more demand and more upward pressure.

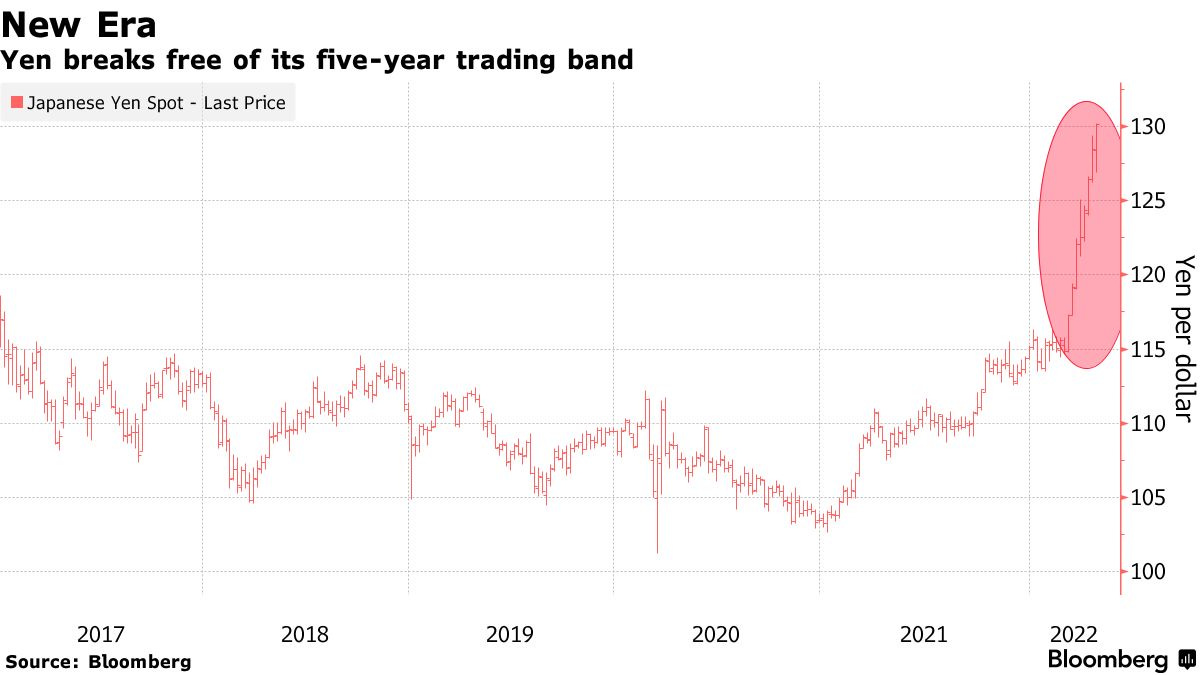

The yen has fallen more than “10% against the dollar in seven weeks” which is making people question if the yen is still a safe haven to be in during times of uncertainty. And the BoJ is coming in with an entire battalion of unlimited bond buying. It’s not just level (yen at 130) but the rate of change - the yen is on a tear.

I think that investors are quickly running out of alternatives, and the dollar is the Land of Last Resort.

But of course

life is weird

and the ruble is a top performer

The GDP Print

And then there is this.

GDP growth unexpectedly declined at -1.4% growth for Q1 2022 so - yikes. But it is +3.6% y/y. The recent GDP print wasn’t good - but it wasn’t bad. A very simplified explanation -

GDP = Consumption + Investment + Government Spending + [Exports - Imports]

Where Investment = Fixed investment + Residential Investment + change in Inventory

Why did it decline?

Fall in inventory add - businesses added a lot more inventory in Q4 2021 ($250b) versus Q1 2022 ($152b) so there was a decline in growth, naturally

Net exports: We are importing a lot of things!!! So if we are importing more than we are exporting, the [Exports - Imports] number is going to drag on growth too. A trade deficit at a record is going to weigh on GDP numbers.

This ties into the stronger dollar - imports are cheaper but US exports suffer because it makes American-made goods more expensive.

BUT demand is still ripping -

Consumption was at +2.7% (up from 2.5% in Q4)

Business fixed investment: +9.2% (up from 2.9% in Q4)

Residential investment: +2.1%

The main takeaway is that the economy is still growing at 3.6% y/y - so this isn’t recession time, despite what people are saying on Twitter.

Things are okay, but there’s a lot to pay attention to. Job growth is strong, investments are happening, corporations are sort of okay, etc. (also is GDP even a good measure of consumer welfare or economic strength? maybe?)

Now the question will be - can the consumer hang on?

The Fed seems to be intent on their path forward, and because this report was relatively strong on the demand side, things should be okay.

It’s still worrying.

Telonwitter

Elon Musk is buying Twitter! At least for right now! He did indeed f*ck around and find out. There are a lot of questions around the mechanics of the deal (what happens if Tesla’s price continues to fall? Why did literally ALL THE BANKS choose to help him finance this deal?) But I think one of the biggest questions will be…

What *happens* to Twitter?

You’ve got governments, brands, financial institutions, and a lot of people discussing and doing things on this app. And tweets get circulated outside the ecosystem - one could argue that Instagram is merely ScreenshotTwitter (no offense Zuck).

But I think there will be a few interesting questions around this deal -

Can he finance it? I mean sure, as long as Tesla’s stock doesn’t drop to $740 he should be fine, but is it worth it?

Source: Matt Levine But also how much would you spend on marketing? It kind of makes sense to spend $44b on your own marketing arm, which is what Elon seems to be doing! That’s not too bad if spread out over several years.

Also think about all the press this has given him so far!! Really incredible stuff!! Lots of marketing, and if he chooses to nix the deal he paid $1b for an absurd amount of attention

But free speech

There is a line between harassment (which is harmful! and no one wants to experience that! trust me!) and speaking Truth.

I liked You’s take here -

Okay, so China?

As Reuters wrote -

Tesla produces half of its vehicles there, as well as a quarter of its revenue. But Twitter is no friend to the People's Republic, most recently for defying Beijing in its handling of content related to Hong Kong protests. China could easily hold Tesla to ransom if a Musk-owned Twitter didn’t play ball. That’s uncomfortable for a self-professed “free speech absolutist.”"

I don’t know. That feels inflammatory and like its pointing fingers but maybe?

This is basically just a cornerstone in this weird culture war I think. Antiwokism, antigovernment, anticensorship, whatever. But it’s also interesting because all the billionaires are piling onto this and decrying the government! It’s just sort of interesting to watch them say “The Man is Bad And We Must Topple The Institutions” and it’s like… aren’t you… Exactly That?

It’s a strange cognitive dissonance - I know that we know that you are this, but do you realize you are the thing you are lobbying against?

Finally - what is Elon thinking? I really liked Kara Swisher’s take on him because it captures his zeitgeist well I think. He is a really, really, really powerful man that happens to shitpost - but the power comes before the shit.

Source: NY Mag I really liked Andy’s take on this

And Midtown East highlighted the paradox of tolerance by Karl Popper and I think that applies here too.

Where you can’t have unlimited tolerance (you can’t have unlimited anything) because the intolerant take over the tolerant - so “defending tolerance requires to not tolerate the intolerant” as Popper said.

web4 is going to be commodities

Remember nickel?? That was only two months ago??

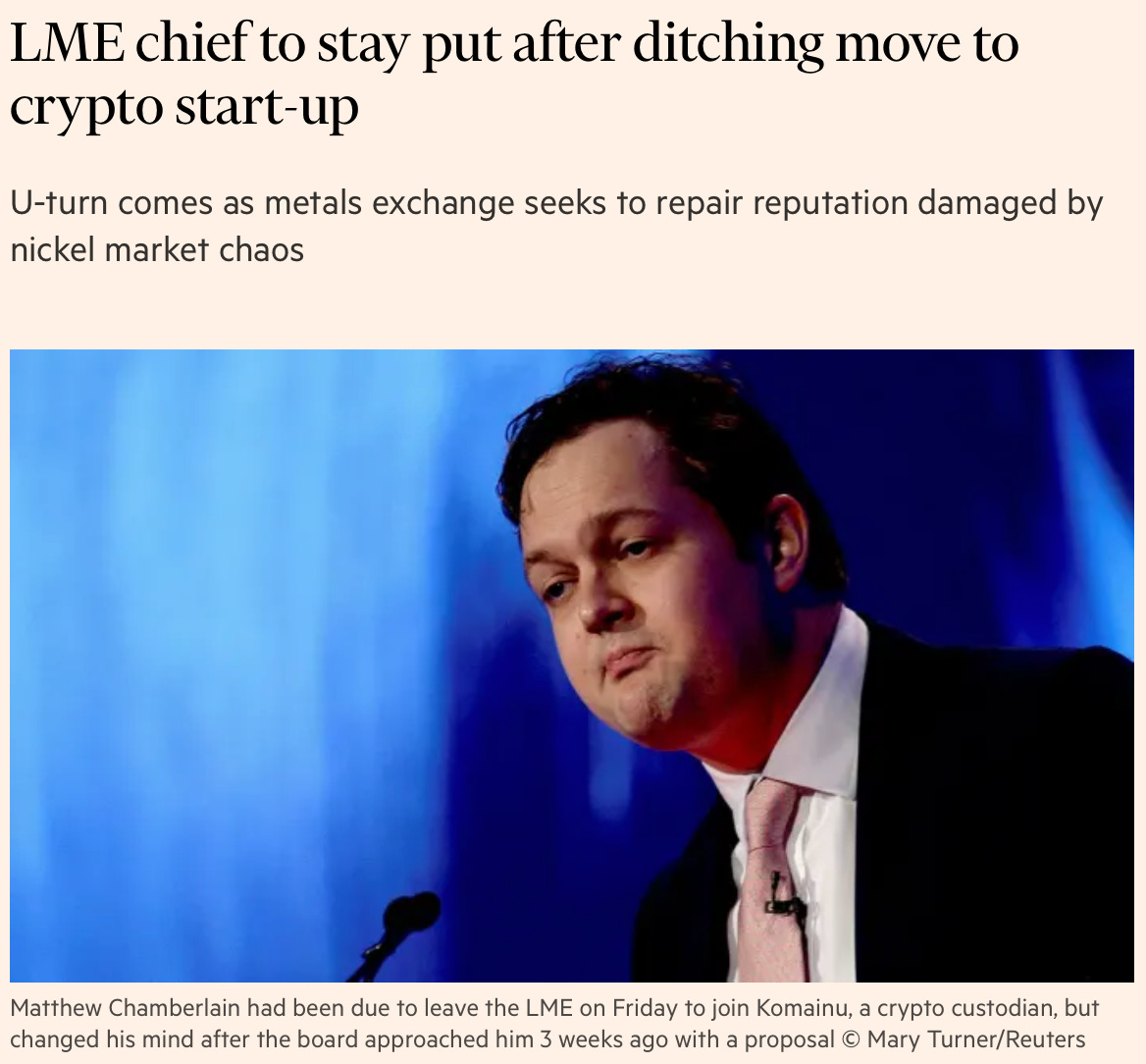

Well the head of the London Metal Exchange was like “okay I am leaving this crazy show for crypto, a much less crazy show” and then he changed his mind! And was like “actually I will stay in the commoditiy industry because it is even more crazy than crypto” Which is bonkers!

“I want to continue to work with the team on supporting the long-term health and efficiency of the market and drive forward the sustainable development of our industry” - Matthew Chamberlain

Crypto is still pretty wild (remember I am bullish! but still!)

People are 1) taking out their mortgages in crypto 2) and a company is like “let’s package these crypto mortgages” and 3) securitize them. Surely nothing bad has ever happened when we’ve done something like that! As Mark Gongloff wrote

If you entered a contest to see who could design a financial instrument to lose the most money the fastest, you would struggle to come up with a better idea than taking home mortgages backed by crypto, slicing them into mortgage-backed securities and selling them at the moment the global financial system is being bludgeoned by pandemic, war and Jerome Powell.

I think that we are going to see some sort of reckoning where it’s like oh DANG we were really betting the literal house on vapor! And there are very very good projects in crypto, and I am bullish on the space in general - but I do think there is something to be said around this broad weirdness.

Zoltan’s thesis around commodities - that countries are all going to be stockpiling commodities and domestic protectionism will result in more reshoring etc - applies to the consumer too.

I think we could see people begin to rotate towards some concept of hard assets (I don’t know if it’s gold, real estate, etc) but I do think there will be a reckoning of “I want physical wealth, not paper wealth”.

That’s pretty oversimplified, but considering the raw material shortages and the continued energy crisis, it will be interesting to see how individual digital wealth evolves.

Final Thoughts

ARK’s ship seems to be sinking, which is sort of a flashing red bell for a lot of things.

But things are okay, mostly.

But things are mostly very Silly.

And most of our solutions are simply problems.

Links

Retail Trading in Options and the Rise of the Big Three Wholesalers (SSRN)

A “proliferation of administrators”: faculty reflect on two decades of rapid expansion (Yale News)

$100 Million to Cut the Time Tax (The Atlantic)

"90% of VC-backed companies could disappear and there would be no impact on the world" (Video, Delian)

Child-Care Workers Are Quitting the Industry for Good in the U.S. (BBG)

Taking Watsuji online: betweenness and expression in online spaces (SpringerLink)

They Flooded Their Own Village, and Kept the Russians at Bay (NYT)

Tim Mak’s threads on Ukraine

Multiple Ivy League universities, KKR back Dragonfly's new $650 million fund (The Block)

Statistical release: BIS international banking statistics and global liquidity indicators at end-December 2021

Investing in Innovation (Sparkline Capital)

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

extremely great, per usual. good luck to us retail investors.

"Are we not Meme? We are DeFi!"

("Devo" was a band that said stuff like this, made weird videos)

Great stuff Klya, thanks!

Maybe just a suggestion: if you'd send two mails instead of one, they would not break in gmail.