Last week I wrote about the debt ceiling, inflation expectations, the power and energy crunch, and crypto. Today I wanted to talk about reconciliation and try to draw a line between the supply chain crisis, the energy crunch, and also talk about ~what it all means~.

YouTube will be posted here soon

I enabled paid subscriptions- but my work will remain free and accessible to everyone, forever. My goal is financial education, always - and this model is one way to help me achieve that. So sub if you’d like, and thanks for coming on this journey with me :)

PARTNERSHIP!!! This piece is written with my friend Gannon - I offer my thoughts as an outsider, he offers his thoughts as an actual person who lives on a ship. He is absolutely brilliant, and does incredible equity analysis and thought pieces. Subscribe to his newsletter here!

The Crisis

So, there is a combo energy crisis, supply chain crisis, and everything feels bad.

Why?

I have a few theories here.

Supply and Demand Mismatch

The general theory of not-enougness: We have skewed demand and not enough supply. When thinking about supply, you have to think about the inputs. For example, think about what it takes to buy an apple at the grocery store:

Apple seed goes to farm, farmer farms apple tree, apple gets picked from tree, apple gets loaded into truck, truck drives to warehouse, warehouse drives to grocery store, apple gets unloaded, you pick up apple, you walk to cash register, you buy apple, you drive home.

That’s a LOT.

Imagine that apple process x n^100000 and that’s what supply chains are like. There are so many opportunities for things to go wrong, and thus, they often do (especially when you have exogenous shocks like a global pandemic).

If all the sudden the trucks stop delivering to the stores, you can no longer purchase your apple. Bad! And that’s kind of what’s going on right now:

The thing theory: People are demanding things but there aren’t enough things to produce the things (labor, machinery, trucks etc). And that compounds as people demand MORE things.

This works until it doesn’t

The Reliance on Comparative Advantage

A key concept in economics is comparative advantage.

You do things better than me, so you should do that thing

I will buy that thing from you because you can produce it at a cheaper cost than me

This is good for the both of us because you do it SO WELL.

This can come across a few different ways - people, capital, export goods, etc.

This is what happened with China and production. China has a comparative advantage at producing things. So we rely on China for a lot of the stuff that we consume. But there is a lot working against them at the moment.

Pandemic shutdowns: factories off, no production, still playing catch up

Skewed demand: There is outsized demand in the United States for different products and services (but not so much in Asian countries, which I will touch on later)

A theory here is because of the amount of stimulus the U.S. received, which is a contrast to the demand situation abroad.

The Demand Skew

Comparative advantage is great until the country that has the advantage stops working towards it. Which is essentially what China has done - they’ve stopped growing the way they ~used to~.

The theory of debt-fueled growth: China has always been the place to grow. They’ve actively taken out a ton of debt (a la Evergrande) in order to actually “grow”. But this is a different type of growth versus true, organic growth.

Tomato hacking: Think about it this way - say you want to grow some vegetables. You could throw a bunch of tomatoes into the ground and pound them with fertilizer and growth hormones, or you could let them grow ~naturally~.

Gross tomatoes: The tomatoes with growth hormones are going to be massive, but they are also going to be really gross - the organic tomatoes might not be as big - but they will probably be better.

China is a bunch a giant, GMO tomatoes that are about to explode because they’ve gotten so big.

No more tomato: And the Chinese Government knows that - so President Xi Jinping is rolling out several pledges to try and change how things operate - such as Common Prosperity, the carbon emissions cut, “2021-2022 Autumn and Winter Action Plan for Air Pollution Management", etc

But the problem HERE is if you change your economic model from massive tomatoes to organic tomatoes, you’re not going to produce as many tomatoes!

So you get a tomato squeeze - aka supply chain and energy crisis

Most importantly, the structural issues in the supply chain are going to keep reverberating because of underinvestment and structural changes and the RELIANCE on China to always be a big tomato.

For example, as Mike highlights in his thread -

“In stainless steel drinkware, 93% of the world's production happens in one province in China. Of that production, about half happens from now until Chinese New Year. What that means is that almost 20% of the world's production isn't going to get built this year!”

!!!!!!

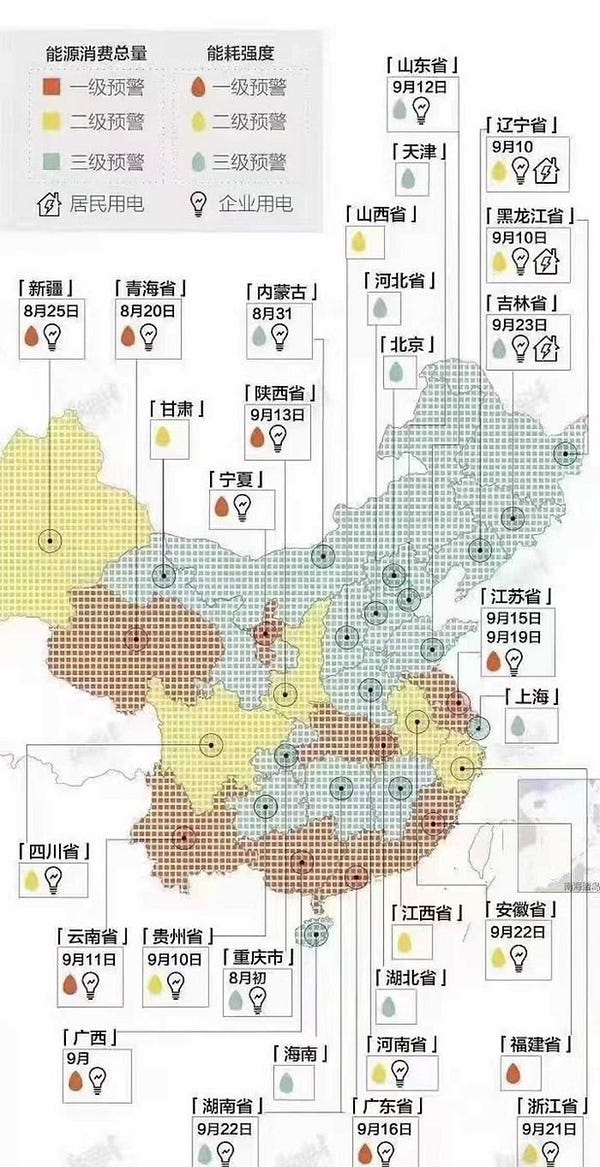

So the supply chain is getting squeezed, but ALSO electricity prices are increasing because China is going the ~green energy~ path (as they should). But now the cost of coal has increased and thus the cost of production has increased. Coal is also >70% of electricity in China.

Domestic coal production has reduced (specifically, “reduced availability of hydroelectric power in much of southern China, as well as limited supplies of coal due to the ongoing China/Australia trade dispute” according to Fortis Analysis). Imported coal costs increased

It’s got too expensive for smaller players to produce, so they stopped.

A combination of

Factory shutdowns, port congestion, rising freight costs, and low investment because change in energy strategies

The supply chain and the energy crisis are one and the same. China is no longer the big tomato of growth. We are having supply chain issues because we are having energy issues - and it’s squeezing top down and bottom up.

Supply and Demand

So in the game of supply and demand, who wins? Trinh (a terrific follow in Twitter) ran a test and found that Asian CPI (so inflation) is much more impacted by *demand* shocks versus supply shocks.

So CPI or consumer inflation doesn’t bounce that much - but manufacturing costs DO which stream up the supply chain and bleed into higher prices everywhere - manufacturers are feeling the burn.

So we have high CPI here in the U.S. - inflationary pressure because we are DEMANDING a lot of things. But in Asia it’s a bit different.

This is a bit counterintuitive - but it turns out that demand in Asia has fallen for a few different reasons, including Evergrande spooking everyone and power cuts leaking down to businesses (how do we exist without power?!)

So you have outsized demand in the States, weakened demand in Asia, and rickety supply chains and a power crisis - things are just getting really *tense* out there.

Facebook Shuts Down

Facebook is actually a really interesting example of the supply chain in action

It shutdown because it was basically too reliant on its own internal servers. They booted themselves off their own system.

The collorary to supply chains is that there has been a reliance on just a few key chains, just a few key energy inputs - and so when the whole thing implodes, that reverbates through the entire system. As Krebson Security writes in their analysis:

“This disruption to network traffic had a cascading effect on the way our data centers communicate, bringing our services to a halt.”

Just one little thing can disrupt the entire system.

What’s it really like out there?

Here are some thoughts from Gannon, who actually lives on a ship!! on the situation:

I am fortunate (or unfortunate) enough to see some of the transportation supply chains in action with my own two eyes. This may come as a surprise to some, but along with making finance and tech newsletters I am currently a licensed unlimited tonnage third mate who is able to navigate any size ship in the world and have been aboard thousand-foot long container ships/roll on roll off carriers in the past.

A memory that stands out to me was in Oakland, California during cargo ops. Containers were flying on and off the ship while trucks pull up to a marked spot for the gantry cranes to pick up the containers off the truck beds and place them in the ship bays. There is a giant conga line of trucks bringing the containers to the cranes. I will never forget when one particular truck pulled up to the spot and stopped abruptly. A heated argument between the truck driver and some of the longshoremen standing by. The driver got so frustrated that he got out of the truck and walked off effectively quitting the job right then and there with the keys still in the ignition!

You’re probably wondering “Okay so what? Move the truck”. That was the day I truly witnessed union politics firsthand.

Nobody moved the truck for over 3 hours and all cargo halted which caused a delay on our departure to Alaska - which in turn pushed other things back. This was because no truck driver wanted to drive a truck that wasn’t theirs since it wasn’t their contract, no longshoreman would dare step in a truck in the first place, and therefore the port and all unions involved had to have a meeting to figure out what to do. This was just one example - silly stuff like this happens all. the. time.

With shipping you have:

A shipping company (owner of the ship), the ship’s agent, the crew of the ship

Unions who crew the ship

Unionized Pilots who park the ship

Tugboat companies (owners of the tugboats) and the tugboat unions who crew the tugboats along with the tugboat crew

Longshoreman unions (workers who take off/on the container lashings)

The port authority/ops

The truck driving company, trucking unions, and drivers themselves.

If I missed someone I apologize. As you can imagine, even slight miscommunication, stubbornness, or business politics between any of these parties can cause a massive delay at all stages of the supply chain. What’s crazy is that is just the supply chain at the port! We haven’t gotten to even the supply chain with the warehouses, railroads, and the dozens of other hands that cargo touches.

Let’s go back…

The shipping industry and trucking industry were already in a hanging balance before COVID. Trucking companies were starving for more drivers. On the flip side, many could argue that rampant complainants of unsafe work conditions or just simply bad bosses have been caused the shortage of truckers – we won’t get into semantics all that matters is there aren’t enough drivers then, and there aren’t enough now. On top of this, there was a global shortage of containers themselves. Containers get banged up more than you imagine - they break and sometimes just get lost!

COVID threw a massive wrench into this supply chain and arguably, what added the fuel to the fire, was the fact that the world trade green light was switched back on too fast with no revving of the engines.

Let me explain: When COVID broke out all manufacturers slowed down their purchase orders. Shipping companies and all unions involved reacted to the lower demand by tying vessels up, slowing down operations, or operating at a lower capacity. When global demand rocketed back (Amazon never sleeps or had COVID) all those manufacturers went back to full speed but the ports simply weren’t ready. You still had longshoreman unions battling COVID cases in their teams alongside truck drivers (which there was already a shortage of). Along with this, the warehouses faced the same issues and every step of the transportation supply chain were understaffed or operating at not high enough capacity. As you can imagine costs to ship anything and the time to deliver skyrocketed as you see below.

These were just some of the MANY replies I had about my post about the insane costs to ship right now.

So what’s going on now?

Ships are stacking up in harbors around the U.S. because there simply is a giant backlog. Below is a photo from Marine Traffic yesterday of all the ships at anchor off of Long Beach harbor. Every green circle is an anchored ship.

Ask anyone in the sailing industry and they will tell you this picture above is insanely abnormal. If you don’t believe me I will let J.P. Morgan show you in the graphs below.

What does this mean?

The ripple effect of this is almost unimaginable and truly impossible to quantify. An impact you will see is goods at retail stores start to dwindle and shelves of all types are not being stocked. iPhones, clothes, chairs, pencils, literally everything in your house, and more comes from the sea by ship and then by truck. Even grocery is being affected by the trucking issues. It truly is a wild time and I don’t know the solution.

TL, DR: Start shopping for Christmas now.

Kyla’s Final Thoughts

Things are flying in the online world. But the physical world is showing increasing signs of strain.

We are at an inflection point. I have the incredible opportunity to go on podcasts, and I recently sat down with Annie Zhang on the Hello Metaverse podcast. We talked about if web3/metaverse/crypto could replace the current government structures that we have.

No, at least the way that it is designed right now.

The winners here (if stuff gets worse) will be the big boys like Apple and Facebook (if they can keep themselves online). Companies that own their supply chains will win. Amazon has a chokehold on suppliers. They will win. They know how to play the game.

But broadly speaking, we have to find other ways to work on energy, to sustain demand, and to solve the theory of not-enoughness (perhaps not overconsume???).

I have the same conclusion as my piece from last week: it’s very easy to ignore the world around us when the world on the Internet is so enticing. But it will become increasingly important as we lean into decentralized governance, to understand how the physical plays into our “real” world.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.