Taking Some Sense to Make a Nickel

Nickel, agriculture, oil, commodities, and common denominators

Some thoughts around recent movement in commodities, in the light of war and volatility.

If you’re already subscribed, thank you! If you’d like to subscribe, please do so here:

YouTube up Sunday, podcast up later today!

What’s Going On

In this piece - Exploring the movements in commodities over the past week, specifically agriculture, oil, natural gas, and of course, nickel. Then some thoughts around China.

Brought to you by Kalshi

The commodities and derivatives market has had a long history - commoditizing everything from grain to credit risk. Event contracts are the next step in this evolution -after decades of trials from large Wall Street firms, Kalshi is the first financial exchange to get federal approval to allow people to trade on event contracts, a long-awaited instrument that commoditizes events.

You can now buy Yes or No shares on events like whether the Fed will hike interest rates next week or if oil will hit $150 this month. Check out Kalshi.com/oil

*This is not investment advice.

So Everything is Spicy

Inflation. The CPI came in at 7.9% yesterday, which is broadly in line with what economists, etc, expected - so that’s good. It’s high, but expectedly high, which sort of negates some of the highness (kind of)

Inflation definitely seems like it’s going to be sticking around for a while. Everyone likes to say “haha guess this wasn’t transitory” but yeah, of course it’s not. The concerning part is that war is not at all *reflected* in the February print (despite the White House saying so?) - so the March print (which will come in April) could be a doozy, especially considering all that’s unfolded over the past week.

As Gregory Daco pointed out - “Assuming oil prices average $120 per barrel through the rest of the month, we would expect gasoline prices to rise about 19-20% in March. This alone would add 0.7% to headline CPI inflation.” For context and sizing, the Fed’s target inflation is ~2%.

So. Small businesses are hiking prices to try and mitigate rising input costs, but wages are pretty much stagnant. And everything is getting more expensive.

Agriculture

There are basically two common denominators to most people on Earth - they need 1) food and 2) they need energy (electricity, heating, etc). These two things are intertwined throughout the broad global ecosystem - agriculture is an input to most processes, and energy is a facilitator to most processes.

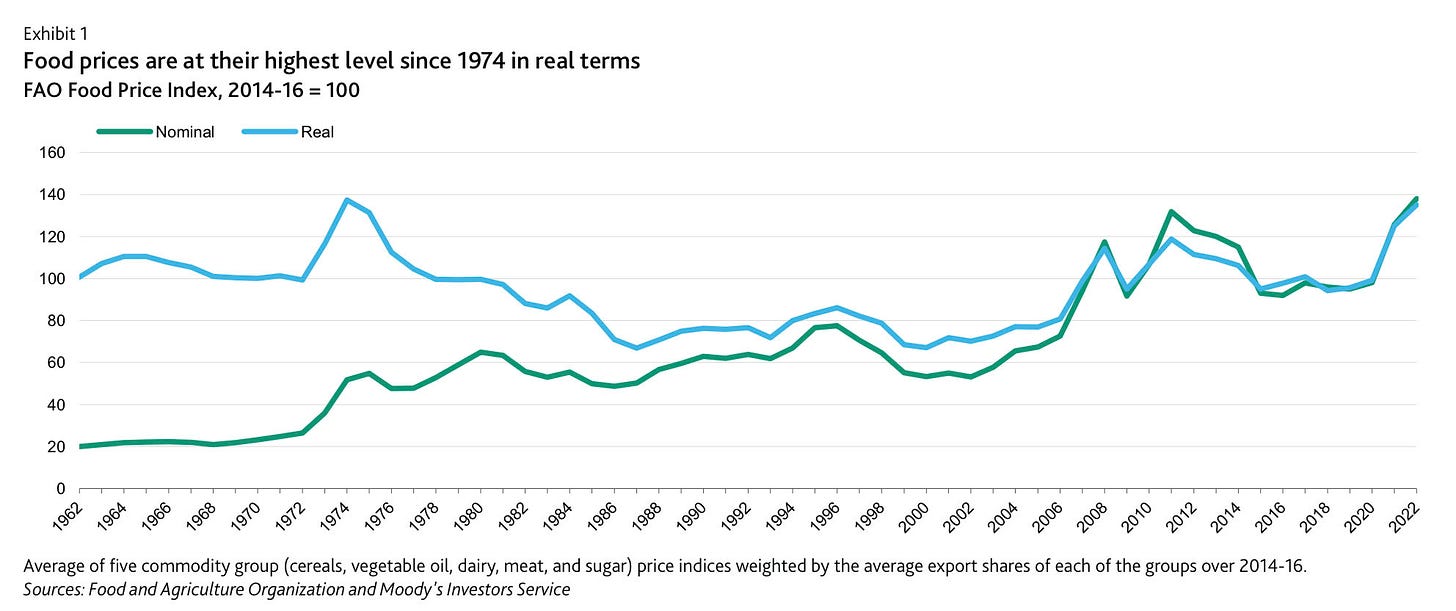

Food is expensive: Wheat is still near all-time highs. Russia and Ukraine are two of the world’s top-5 wheat exporters, so that’s a massive amount of pressure for production levels. Not to mention grain, barley, corn, soybeans, !!!!burlap!!! etc.

And the crop calendar is coming under pressure, with a potential loss of planting season, which will have cascading effects.

This is a domino tipping - Grain is the #1 cost of feeding cattle, so when grain prices increase, the cost of cattle is going to have to increase too.

Everything is a giant interconnected web - and when the gravity of higher prices rips a web thread, the whole thing becomes that much more delicate

Political stability: And of course, food is largely a function of political stability. Arab Spring partially happened because of shortages, and if all the sudden people can’t access food - they are going to be very, very unhappy.

Food protectionism: We are starting to see countries like Hungary block grain exports, egypt blocked all exports, and Ukraine will be limiting exports, and many more - all to secure a stockpile of goods in the face of immense uncertainty.

And food prices are very high. And could surge another 22% - regardless, it’s concerning.

Fertilizer

Then there is the common denominator to *food* - fertilizer.

As Bloomberg wrote, “Natural gas is the feedstock of nitrogen fertilizers, usually accounting for 80% of a manufacturer’s cost” and of course, Russia produces a large amount of ammonium nitrate (roughly 2/3rds of all production) which is a key input into fertilizers according to S&P Global. European facilities are only at ~45% capacity right now because of these constraints.

This makes the cost of running a farm go up - or shut down.

Russia just suspended fertilizer exports. It’s reverse sanctioning on the U.S. - “ah you stop importing our oil, have fun growing crops”.

Global food prices are already at all time highs - and they will definitely go higher if a key input gets sucked out of the process.

Natural Gas

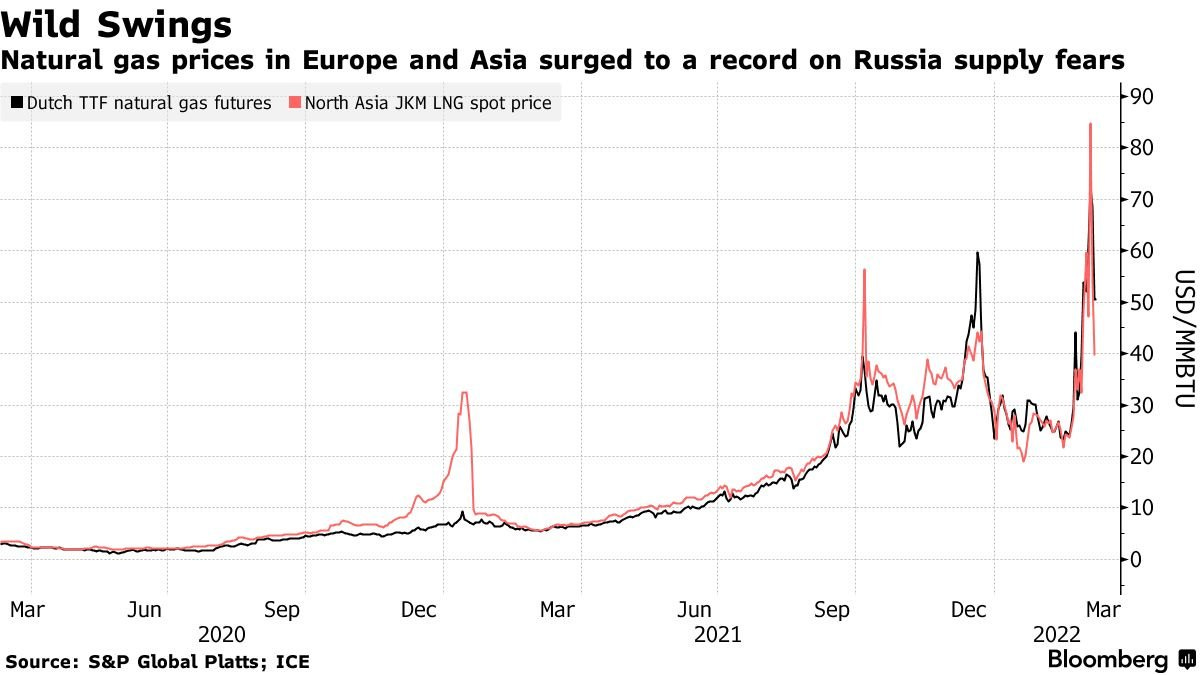

European natural gas futures have been all over the place all week, and at one point were equivalent to $600 for a barrel of oil. Russia is a huge supplier of EU gas - but now, the U.S. is actually exporting a lot of LNG (liquified natural gas) to Europe.

But unfortunately, the game of resource allocation is pretty much zero sum. Europe and Asia are likely going to end up in a price battle for gas.

This leaves countries that can’t pay with the short end of the stick. It’s already sort of happening - Pakistan did not get their deliveries, forcing them to purchase from the spot market.

Europe’s energy demands are going to take LNG from the emerging world.

Energy is super important. And when more countries are bidding for a smaller pool of it (now that Russia’s contribution is diminished), prices will go up. And the EU wants to boost imports by 37 million tons and there just literally is not enough supply for that, so prices will go up even more.

So once again, we find ourselves back at the intersection of supply and demand.

Oil is a Meme Stonk

Tto give you an idea of how this is looking - despite all the efforts of renewables, [oil, natural gas, and coal] are ~75% of the world’s energy consumption. And to caveat - yes renewables are the future one day, but they simply are not the solution right now. We have to invest for the !!long run!! but the short run is going to be a lot of mitigation. Some of these mitigation options:

Sanction lifting? The U.S. is trying to get Venezuela and Iran to ship some of their oil **if the US*** lifts sanctions on both countries.

OPEC steps up? The UAE agreed to press OPEC to produce more and Iraq acknowledged and were like “yeah we can probs produce more” but the key will be getting Saudi Arabia on board with that.

OPEC+ is producing more - but still not even at output targets, so this could be a really delicate balance

And even then, if sanctions are lifted:

And of course, all of this requires global coordination, which is easier said than done.

Iran: The Iran nuclear talks were suspended - so those sanctions might not be lifted anytime soon. No one knows quite why it was suspended (due to “external factors”) but Russia is involved in these talks, and seemingly made it all about them stating that Russia’s sanctions should be lifted too? - making the talks stop entirely. As Hamid Hosseini said, “Putin sent the nuclear accord into a coma.”

Saudi Arabia: They are not happy with the United States right now - they refused to take a phone call from Biden (and instead spoke to Putin). The two countries have a very strained relationship from the horrific murder of journalist Jamal Khashoggi, which was reportedly approved by Saudi Crown Prince MBS, according to U.S. intelligence.

JUST IN - Saudi Arabia and the UAE declined to speak with Biden about countering Russia and containing a surge in oil prices, WSJ reports.

JUST IN - Saudi Arabia and the UAE declined to speak with Biden about countering Russia and containing a surge in oil prices, WSJ reports.This is really a lot of unfortunate political web weaving - Biden and MBS do not get along, with Biden speaking only to MBS’s dad, and MBS and Donald Trump are pretty tight, so it’s a messy relationship.

But now the U.S. needs their oil. And Boris Johnson might step in, so we can “deliver more flows of oil and gas from Saudi Arabia (to) shut down Putin’s war machine sooner” which feels ironic but it isn’t.

As Albert Marrin wrote in Black Gold, “oil has often mixed with politics, religion, and blood.” Indeed it does.

So for right now the market is just like “hmm where is the oil going to come from lol” and because of that uncertainty, it’s VERY volatile, and very expensive.

From a consumer perspective, people don’t spend that much on gasoline as a % of total budget, but oil goes into EVERYTHING - so it’s not like “ah yea, this SPR release will solve all our problems”.

We have unfortunately found ourselves in a very toxic relationship with oil, and the breakup is going very badly.

And the volatility hurts lower income consumers the most here in the U.S.

On a positive note, the world is more efficient than it used to be - it can produce 2x as many goods now than it could in 1973, for every barrel of oil - but it’s still not a great spot to be in. And the outgoing general secretary of OPEC was like “don’t worry, there’s plenty of oil to go around” but is there?

For Russia in particular, Europe and China buy ~85% of their crude, and Europe (oh Europe) and the U.S. take ~75% of their refined product export.

So even if there is plenty to go around, access is a whole different story.

The U.S. and the U.K. both stopped importing Russian oil this week (U.K. is still importing gas) but Russian oil has already sort of sanctioned itself as I wrote about last week

Even with the self-sanctioning, Russia is just bathing in oil money right now because even though they are selling their oil at a discount - the rise in prices has made “the net effect trivial”. However, the EU did say that they would wean themselves off Russian gas by the end of the year - but with Putin pulling the plug? who knows what the rest of the year even looks like.

With that being said, it is highly unlikely that Russia would make it until December 31 with their current trajectory. They are losing a massive amount of soldiers, and seem to have largely underestimated the West at every turn. Negotiations seem to be going better? but still have a long path until agreement.

Why doesn’t the U.S. just produce more oil?

So this was my research question for the week, mostly because everyone was like “Keystone Pipeline blocky” which is, you know, fair I guess. But it’s actually a bit more interesting than that, at least from the shale perspective.

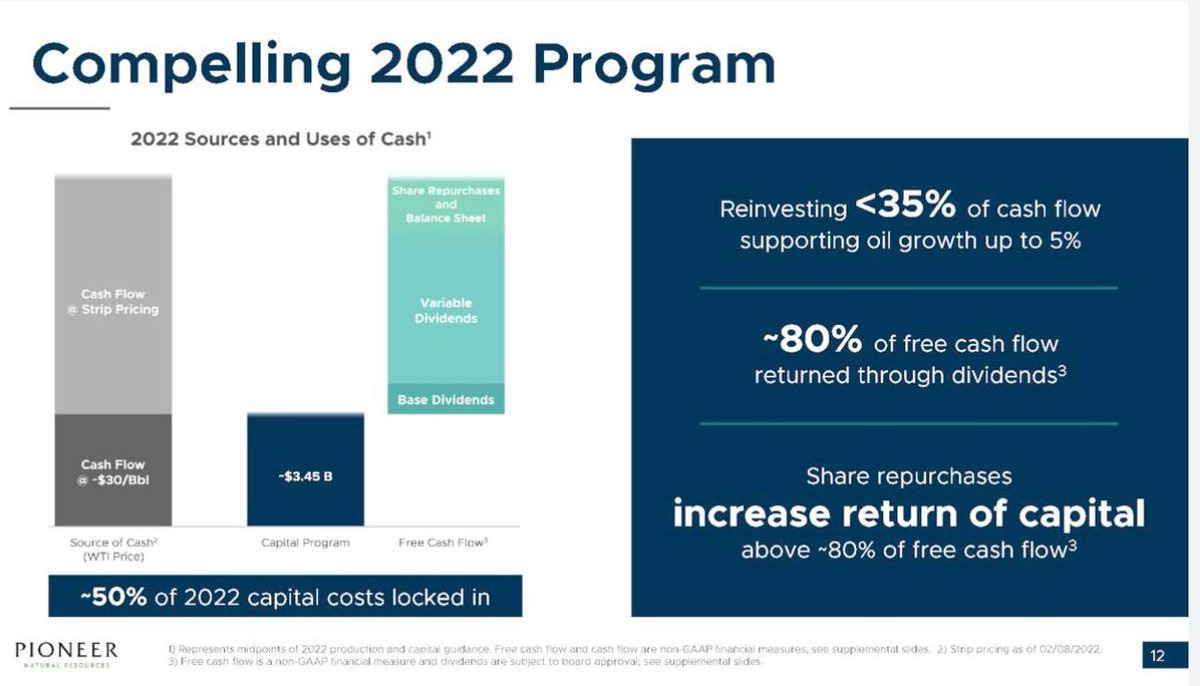

The shale industry lit their investor’s money on fire a few times over the past several years, and now the Investors are Not Happy with shale. They say,

“Shale, please focus on giving us money!! Thanks! No more expansion, no more rapid growth, just free cash flow and dividend yields, and that’s all.”

So the shale people are like “ah ok no problem sugar dad - i mean shale daddy” and they retain focus on getting investors some returns. It’s a bit bizarre honestly - fracking companies haven’t drilled as prices have risen because of the fear of their Investors.

They’ve also pointed out shortages of “labor, sand, and equipment” and have acknowledged that the shale industry can’t just go from 0 to 60 - they are going to need ~18 months to ramp it up.

And Biden is not happy about that - telling them to do “whatever it takes” but shale is like “noo we can’t just drill, we have to Explore & Produce first” so yeah.

This is just an example from Pioneer Natural Resources, but it just shows you how much they CARE about ~giving cash back to investors~ versus producing which like I personally am just ?? about.

I know investors want to make money (as an investor, I relate) but also I feel like when there is a global energy crisis, everyone’s priorities might shift? Maybe?

And yeah. I know.

Electric Vehicles?

So everyone is like aha what if we just drove electric vehicles, that will show Big Oil! And it would, but also the raw materials and metals needed to produce EVs and their batteries are all increasing in cost too (and there is just not enough manufacturing capacity). Like this White House tweet just isn’t true.

So let’s discuss nickel.

NICKEL

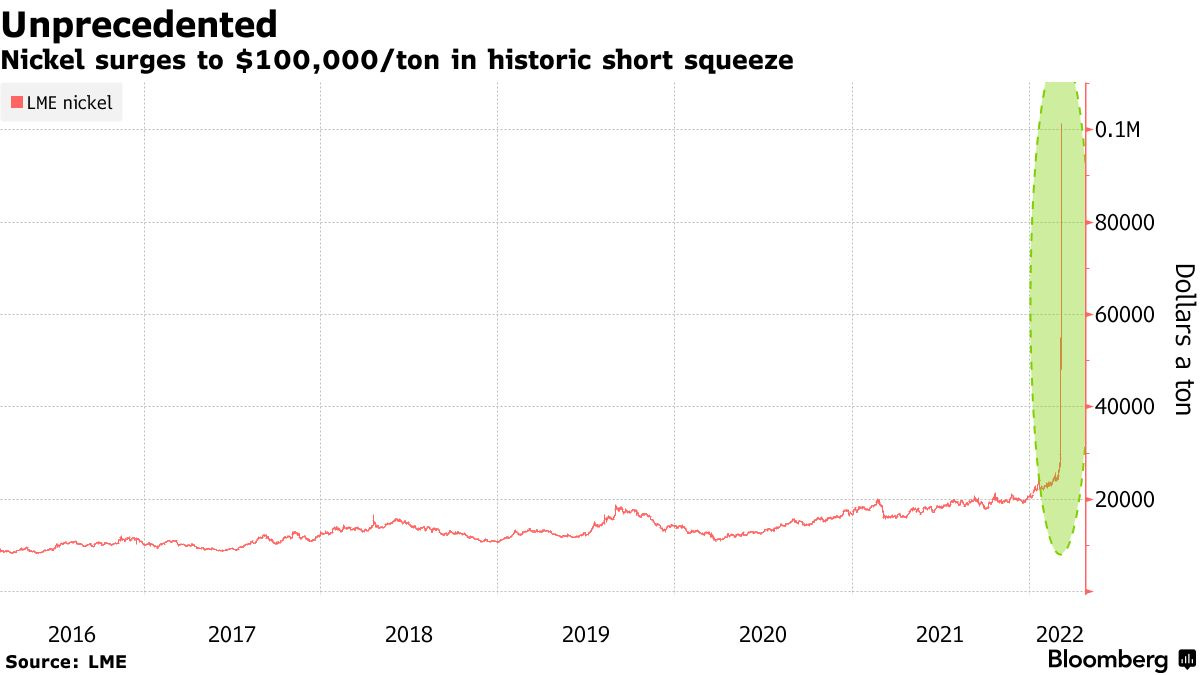

Going to lead with this - this blip barely covers how wild this news is.

This was more of a market mechanics thing but nickel just went asbolutely wacky this week. 250% increase in prices! And Russia produces about 16% of all nickel, which is definitely it’s 5 cents, but this was pure market.

What happened was a short squeeze - something that was ABSURD when it happened to GME and AMC, but now it’s just like “oh yeah, that Anomaly is Happening Now Too” so. A lot of traders are short nickel to hedge against their physical positions - and one Chinese tycoon named Xiang Guangda was ~ridiculously~ short.

This guy has been lowkey manipulating the market for a while. But the price of nickel rose on Russia uncertainty, and then it rose more as people covered their shorts, more and more collateral to pay margin calls, boom, the price of nickel exploded upwards.

Guangda has BILLIONS in losses, but the London Metal Exchange was like “ok wow things are getting reckless out here” and they shut down trading -

This represented about 9,000 trades worth ~$4bn according to fnlondon. So all the people like Guangda that have losses (and all the people that were trading the gains on this) had their trades cancelled.

Which is highly questionable, right?

As the WSJ wrote:

This is… a trend that is undermining free markets and creating all the wrong incentives: A growing reluctance by the authorities to let financial groups go bust, even when they aren’t too big to fail… the danger to free markets is that governments, regulators and, in the case of nickel, the exchange itself are setting the bar for bail-outs lower in every crisis.

And Guangda is going back for MORE. Because why wouldn’t he? If you could lose $8b, get saved by the exchange, you’re essentially trading risk free.

But both China and the LME are asking Tsingshan, Guangda’s company, to cover some of the losses. The funny thing about this is that Tsingshan produces nickel pig iron, which is like the low budget version of nickel - and when they started producing this, the nickel market freaked out then too. It’s just kind of wild that this guy was able to amass such a large position - and has been doing this for *years*. As Mark Thompson, wrote:

Allowing a market counterparty to build a 190,000 short position in the most volatile and one of the least liquid metals without anticipating the risk to market orderliness was a dereliction of responsibility.

And it is! How are you going to let someone come in that big? Especially when the war rolled out - anyone short would have gotten squeezed just given the volatility and uncertainty.

It sort of circles back into the “weaponization of the dollar” question - what does it mean when an exchange (who is literally mostly just supposed to be a facilitator of trades) actually steps in and cancels… those trades?

If you just delete the dollars from Russia’s reserves, what does that mean for the credibility of the dollar?

If you just delete trades, what does that mean for the credibility of LME?

The market is still not open.

So that’s nickel. Little squeeze on the LME. Ah commodities. This of course, also happened back in 1985 with the Tin Crisis. And oil went negative back in 2020. And we can’t forget about Silver Thursday, when the Hunt brothers tried to corner the… silver market. History doesn’t rhyme, but it does re-peat.

And nickel doesn’t exist in its own piggy bank!! This could bleed out to the rest of the commodity markets - hedging, margin calls, liquidations, etc.

China Tech Selloff

I’ve written about this before, but it’s happening again because of course it is. Chinese tech stocks are spiraling ($2T in losses). The Golden Dragon China Index which tracks U.S.-traded stocks is down almost 70%, which is near what it hit in 2008, to give an idea of how BIG the move is.

It’s mostly an “ahh” fueled sell off, a combination of China having a very confusing (and ever-changing) stance on Russia, Chinese companies not complying with auditing rules (including YUM China, which might result in delisting), and of course, Beijing cracking down on everything (randomly) again.

Reminbi reserve currency?

What’s interesting relative to this is people thinking that the renminbi might take over as reserve currency, which is interesting, especially in the backdrop of all the volatility in their markets.

The reminbi overtook the yen in SWIFT (which could be because everyone is like ?lets get away from the dollar? and could be looking to use Cips, China’s alternative to SWIFT, as CBN points out).

“Every time the US and its allies make access to the dollar a weapon, it creates an additional incentive for the Chinese to take advantage at some point. It’s not a case of the Chinese wolf at the door [of US dollar hegemony], it’s more a case of termites in the woodwork

I don’t know. China seems to mostly care about China - they refused to supply Russian airlines with aircraft parts (which I am sure Putin loved). But they are also looking to buy some stakes in Russian energy companies and assets?

But broadly it’s just unlikely that China would take over as reserve currency, as George Magnus points out. You have to have a bit more transparency, allowance, and system access.

However!!! This is a rather anti-Zoltan view - who wrote

If we are right, and if this is a “crisis of commodities” – a 2008 of sorts thematically, if not in terms of size or severity – who will provide the backstop? We see but only one entity: the People’s Bank of China! … when this crisis (and war) is over, the U.S. dollar should be much weaker and, on the flipside, the renminbi much stronger, backed by a basket of commodities...and Bitcoin (if it still exists then) will probably benefit from all this.

So he is calling for China to sort of take over. Which is is/isn’t a wild take.

Commodity vs Reserves: Main point is that international banks are going to rotate away from reserves in USD because of dollar weaponization, which is a similar point that Matt Klein made.

As Matt wrote, “'‘Safe’ financial assets now look much less appealing to any government that thinks it could ever get cut off from the allies currently mobilizing against Russia”

Savings are domestic industrial capacity, not financial assets - people are going to want to produce their own things and not be reliant on the USD

And a commodity driven world might not be a USD driven world.

But China as commodity king? China also imports a lot of commodities (hence their concern around food inflation) so the point about them swooping in to provide a backstop to Russian commodities (because Western Banks can’t due to sanctions) is a bit interesting. Basically, the PBOC clears new money commodities, which like maybe? Will Russian commodities even be around?

Military money: But then this gets into most of the value of the USD. China is building out their military, but U.S. is probably #1 player in this game. Dollar weaponization comes with actual weapons.

Who knows. But Matt Klein is right - we likely will see people rotate to commodities, domestic production, and away from USD - and the implications of that could be interesting. This could be a weird geopolitical era - individualism, but for a reason. We already see it with food protectionism, and I’d imagine we will see even more of it soon.

Bitcoin Fixes This

Zoltan’s …if it still exists… around crypto seems unlikely because the U.S. finally got closer to passing meaningful regulation around crypto with Biden’s executive order.

It highlights the power of digital assets (and the need for the U.S. to get it together with CBDCs) and underscores that the industry should not be destroyed, but incorporated into existing economic frameworks better.

Which is really good! And it brings crypto into the conversation in a really powerful way. Everyday a new web3 fund pops up, so it’s probably good for those dollars to have guardrails. Finally, crypto has been a really powerful donation tool during the war - and it kinda deserves to have fair regulation that reflects that.

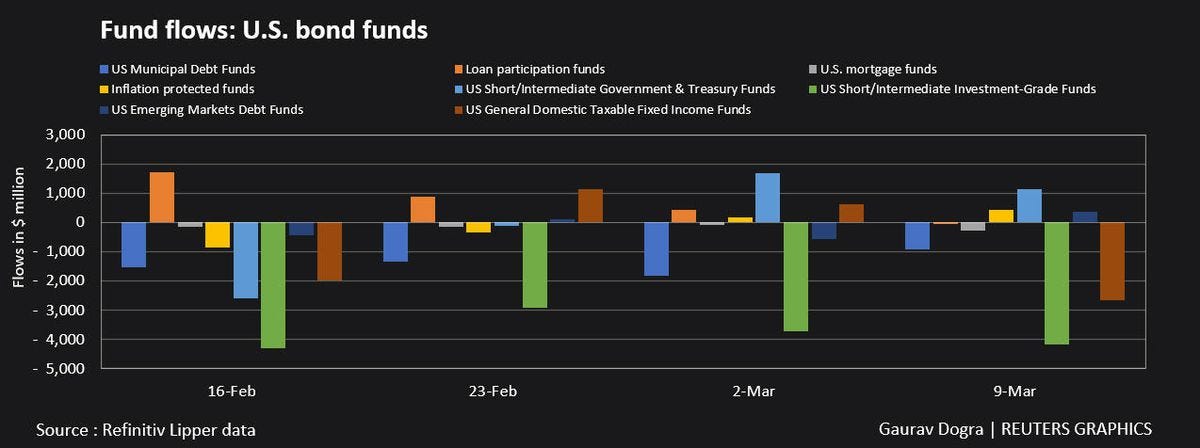

But crypto as an industry trades like tech because of the sheer amount of institutional dollars that have flowed recently - and as people move into inflation protected funds and out of growth funds, that could put a bit of price pressure on the space.

Final Thoughts

This war is still raging, and the Ukrainian people are still fighting for their people and their country. Putin is increasingly acting like a cat backed into a corner, and the recent development of taking on soldiers from the Middle East is concerning.

India accidentally fired a missile into Pakistan, which Pakistan was like “this will definitely lead to unpleasant consequences for you” so things are just tense, to use a far from descriptive and all-encompassing word. Goldman is saying there is a 35% chance of a recession, which makes sense - considering the strain on resources, the broader uncertainty, it will be difficult to avoid some sort of slowdown.

And Russia might default, which could be a whole cascading wave of financial impacts. Blackrock has already lost $17bn, DB is stuck there (apparently), and it will just reveal any sort of contagion shock that exists in the dominos of sanctions. Credit markets are already showing signs of strain, so a lot might be yet to unfold.

As a final point, humans are always innovative.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

I cant help but think, in the long term, isn't this all where we are heading towards, an actual relationship to,our resources? I mean isn't this the change that endures, not being able to mindlessly produce and waste?

Great analysis Kyla. An ominous footnote: you indicate it would be good if oil producers stepped up because it is a war and kind of the right thing to do. I think a lot of people underestimate the frustration in the oil business, the common take that You guys are all dinosaurs with stranded assets and btw you are killing the planet. But now come save us, SHORT TERM, and then we will resume trying to wipe you off the map.

Oil Atlas may be Shrugging