Quick note: I interviewed Cathie Wood and Clay Gardner about the new ARK Venture Fund. I will have some clips out over the weekend, but it was an interesting conversation about the fine line between reality and opportunity. If you’d like to watch the whole thing, you can here.

Dominos, Dominos Everywhere

I wanted to do a series of visuals for today’s newsletter because sometimes it’s nice to have pictures instead of a wall of text saying “hey you thought things were bad… welp, I am here to tell you it’s actually worse.”

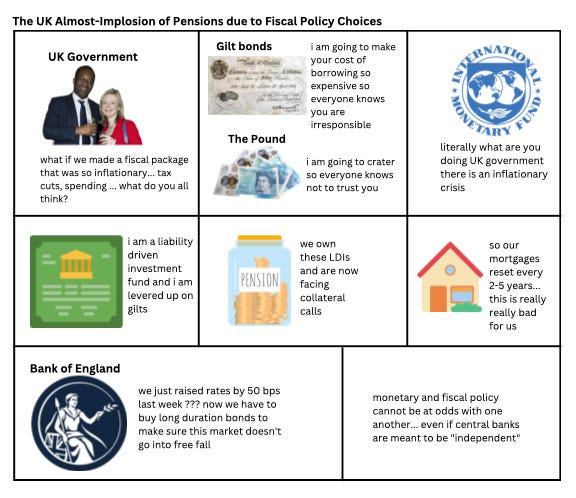

What happened in the UK?

I have a full video on YouTube about this, but essentially

An expansive mini-budget (tax cuts, spending, etc) by the U.K. government caused a big sell-off in gilts and the pound

This created a liquidity crisis for Liability Driven Investment funds, which are primarily owned by pensions

The Bank of England had to step in and buy long duration bonds to make sure things didn’t go into free fall.

This is not a great situation for the people in the U.K. Most have mortgages that reset every ~5 years or so - and raising rates will likely result in +$500 of monthly payments.

This highlights a very stark difference between how U.S. monetary policy impacts people (fixed 30-yr mortgages, great if you have one, sucks if you don’t) and U.K monetary policy impacts people (fixed mortgages for ~5 years, only great if you own your house outright)

The Bank of England’s pivot ended up sending a weird signal to markets that maybe… other central banks would pivot too? But the circumstances in the U.K. were *saving the market* not really pivoting. However, they did step in - which could make it more likely that the Fed steps in before things break here.

What happened in the labor market?

The Federal Reserve has made it really clear that they want to see a softer labor market to make sure their policies are working - a softer labor market would equate to softer demand, which would eventually result in lower inflation.

However, the labor market is still strong - evidenced by Dallas Fed Manufacturing data and lower jobless claims.

But it’s strong in certain parts - finance and tech companies are doing layoffs, but construction, utilities etc are all raising wages because they just don’t have enough people. Tech overhired, other industries did not - the latter cut too many jobs in 2020, and “you can’t lay off what you didn’t hire."

However, the Fed doesn’t really want to see wage gains (oversimplification, but they want a slow down) so they are going to keep raising rates *until a labor market slowdown happens* with the consequence being an absolute wrecking ball of a dollar, which puts pressure on everything else.

More on the Federal Reserve

The Fed is aware of the dollar entering into Super Mario turtle shell status. Lael Brainard spoke this week and she said

“In circumstances in which macroprudential policy cannot on its own eliminate the amplification of shocks through financial vulnerabilities, in a low-inflation environment, monetary policy has been relatively more accommodative than would be prescribed by a conventional monetary policy rule in order to reduce the likelihood of adverse output and employment outcomes. But in a high-inflation environment, monetary policy is restrictive to restore price stability and maintain anchored inflation expectations.”

She also highlighted financial stability risks that are happening around the world - debt sustainability, market volatility, reduced liquidity, etc. The main takeaway is that the Fed doesn’t want to let up on tightening yet (inflation is still here) - but they are (obviously!) aware of the impact that fighting U.S. inflation has on the world.

Japan had to do a yentervention as the BoJ and the Fed continue to diverge in policy path and China has intervened in their own FX markets

There is pressure on emerging markets, energy importers, etc through the stronger dollar - I’ve written about this

As the Fed fights inflation here, they create problems everywhere -

“The present danger…is not so much that current and planned moves will fail eventually to quell inflation… it is that they collectively go too far and drive the world economy into an unnecessarily harsh contraction.”

But there’s a flipside to this - Japan could begin selling Treasuries as they try to prop up the yen. The dominoes tip back the other way in the global economy.

Economic Data

PCE, what the Fed likes to look at for inflation, came in hot this week, which isn’t great - contrasted against weakening PMIs, it’s not a pretty picture. It underscores a wonky slowdown.

Disinflationary pressures: We are also seeing major disinflation red flags in companies like Micron, Carmax, and Nike who are like ?? inventory is up and there is “rapidly weakening consumer demand and significant customer inventory adjustments… an extremely aggressive pricing environment… supply constraints…” which points to slow downs. Auto inventories are piling up - all inventories are high relative to their 12m averages. There is a lot of stuff.

Consumers: people are spending a lot, and not saving very much. They are starting to search for “SNAP, food banks, and unemployment benefits” more.

The economy is starting to slow - but in a weird way. In a way that is worrying, not only for global stability, but domestically too. The Fed looks at lagging indicators, but the present situation is showing quite a bit of pressure. Lots of inventory + lower demand = huge price cuts coming soon. All of this highlights how difficult a job the Fed really has - they are doing what they can, but man.

Final Thoughts

There are global consequences to our actions.

I think this tweet encapsulates the stock market perfectly (hang with me, about to completely pivot from the topic of this article). Theoretically, money is finite right? And we see it being used on share buybacks in the market (great for shareholders, don’t get me wrong!) but maybe not being directed towards real innovation (not the concept of innovation, but actual real stuff). We fill party balloons, when we could have so much more.

And this stuff truthfully makes my brain itch because people are like “well what are your solutions, if Not This” and my goodness, I wish I had some. The point of this newsletter is to help people understand the world around them, to hopefully create signal amongst the noise, and to be reflective of *why* things happen.

Zooming back in, the finance industry is so jargony and opaque, and for what? This impacts everyone in the world! It shouldn’t be so secretive and so hard to understand. I went to the bike shop this week, and the amazing woman fixing my bike was like “well, I know nothing about finance” - and so many people feel that way. They feel defeated when the topic of money or the economy comes up, and feel like it’s their fault - but it isn’t - we just make it confusing and don’t give people the tools they need to process all this stuff.

Enrique Vila-Matas has a lovely collection of short stories and he writes -

“I remember always thinking that life itself doesn’t actually exist, because if no one tells it as a story or turns it into a narrative, life is merely something that happens, nothing more. To understand life, you have to tell it, even if only to yourself. This doesn’t mean that a story can make life comprehensible, because there are always gaps in any narrative, whatever sutures or remedies you might try to apply. That is why a narrative only restores life in fragmentary form.”

Thanks for reading.

Newsletter Subscriptions

The goal of my newsletter is for it to *always* be free - but there is work that goes into writing, of course! If you think the content is valuable or would like to buy me a coffee once a month :-) I would sincerely appreciate your support.

There are three options:

The annual subscription: $110 annually

The standard monthly subscription: $10 monthly

Founders club: $220 annually or any other amount

What do you get as a paid member?

Q&A drop box + links roundup - This will be sent out in a biweekly email (sent out next week) which will include a place to ask questions (which I will *search* for answers to!) as well as links of what I’ve been reading recently, ranging from Dostoevsky to Deese.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

Everything is finite, apparently! We just gotta deal, keep lurching forward, thinking madly, perhaps singing a song.

This book is worth your time: https://en.wikipedia.org/wiki/Finite_and_Infinite_Games

the general issue of financial ignorance, lack of confidence, is kind huge, imho. Would be great if more folks felt empowered to learn and/or had opportunities to experience the thrill of victory and the agony of defeat. It's a global issue of unequal opportunity to education flavored with misogyny and some racism.