Some brief thoughts on credit markets - and thank you thank you thank you for all the very kind words on my last piece!

If you’re already subscribed, thank you! If you’d like to subscribe, please do so here:

In this piece I want to talk about credit markets, the elements of bonds, components of risk, and why things are okay (in general).

YouTube here

What’s going on in credit markets?

Okay so credit markets - the canary in the coal mine, the flashing red signs at railroad crossings, the “beep beep” that a car does when you get close to backing into another car. Credit markets are powerful - often telling a narrative that the stock market doesn’t fully reflect yet. Because of that, we can examine them when we want to figure out what’s going on (like right now).

But first, for a brief explanation -

Stocks represent ownership in a company, and investors make money here when the stock price increases or dividends are issued, etc.

Stocks are considered ~risky~ because of relatively uncertain income, and are usually issued by corporations - but are pretty easy for investors to access through different exchanges.

Bonds, on the other hand, represent the debt of a company, and investors make money through interest payments here

Risk is lower due to that of defined income, and *lots* of different types of organizations issue them - governments, corporations, financial institutions etc.

Basically, bonds are certain (most of the time) and equities are not.

With bonds, there is usually an issuer/borrower - the corporation, government, agency etc that borrows money and issues debt. For example, the State of Kentucky (hello) might want to build up its highways so people can get around - they could issue bonds to help finance that. They would normally enlist a broker/dealer to help them get a deal together, who then sells said bonds to to investors like mutual funds.

Bonds are a great tool for investors to own because of:

Diversification - Owning stocks and bonds can reduce the ~risk~ of the overall portfolio because they end up balancing each other out.

Capital preservation - The optionality of different types of fixed income instruments will give avenues to protect money across different market environments

Defined income - Dependable income in the form of interest payments!

There are a lot of different types of bonds - Treasury securities, mortgage backed securities, corporate bonds, Federal Agency Securities, Asset backed securities, money markets, and municipal securities. I am going to focus mostly on corporate bonds throughout this piece, but note - the world of bonds is vast and large. All of those asset classes are important - but corporate bonds are important from a whole “light in a dark tunnel vibe”.

Corporate Bond Structure

Interest rates and prices: There is an inverse relationship between interest rates and prices for bonds - when interest rates go up, prices go down and vice versa.

Prices normally go up when people *want the bonds* (supply and demand!) so rates fall. Prices go down when people *don’t want bonds* so rates rise.

Corporate bond ratings: Corporations are (very very very simplified version here) rated on their ability to pay interest payments to investors *based* on the profitability and stability of different projects that they are working on.

There are different levels to the game - AAA bonds have the highest vibe, are “investment grade” - reflect best quality and lowest risk to investors.

Investors normally want these high quality companies (like Apple) but also! Risk return!

High yield companies (those rated BB and below) are riskier, but they also pay higher rates of return because of that risk (usually).

Okay so that’s a pretty brief academic overview of what’s going on out there - but what’s *really* going on out there?

Bond Risk

First off, why are things so “bad”?

Supply and demand

Tight labor markets

Housing market (and now the average for a 30Y loan is ticking up to 4%)

Fed policy error - are they moving too slow? What happens if they move too fast?

Bonds reflect these concerns, and are broadly a function of several different types of risk, as described by Finra:

Interest rate risk: As mentioned earlier, when interest rates fall, bond prices rise, and vice versa. So there is some risk baked in there - if rates go up, prices go down. The longer that you hold a bond the more risk that you’re exposed to here - because the higher the probability that rates go up over a longer time frame.

When rates rise, the value of bonds fall, which isn’t great - and can lead to ~bad performance~ so investors have to be compensated for this

Inflation risk is tied into this - there is a risk that a 5% coupon bond won’t keep up with inflation (especially with inflation at 7.5%!!!)

Call Risk: An issuer can call back bonds when rates drop because they will want to sell new bonds with lower interest rates - save that money.

But the investor is left high and dry - they get the principal paid back early, but now they have to go find a new investment (and are left without payments and lost income for the previous bond)

Duration Risk: Duration is measured in years but it signals how much the price of a bond investment will move when interest rates move - so higher duration, more sensitive a bond will be to interest rate changes

Default risk: U.S. Treasuries are considered to be “risk free” (if the U.S. defaults on it’s debt, we’ve got some big problems). But for companies - there is a chance that investors might not get repaid if the company ends up defaulting, so they want to be compensated for that

And there are a few ways to measure this risk - for purposes of this piece, we will focus on credit spreads and duration.

Credit spreads are broadly a measure of credit risk

Duration is a measure of a bond price sensitivity to changes in interest rate

This is important! Bonds can respond to the general idea of credit risk (as outlined above, this corporation is FAILING??) but bonds can also respond to changes in interest rates, which we have seen a lot of recently. The 2Y was it’s own superbowl this past week - and that’s going to put pressure on the entire credit market.

In general right now, we see a lot of movement because people believe that the Fed is going to do that whole ~raising rates~ thing. So bonds can move around - but it doesn’t mean that things have gotten “riskier” per say. Things aren’t a perfect loop in credit markets.

Credit Spreads

So bonds do their thing, but the most important thing about bonds is how they do their thing - relative to other things (usually U.S. Treasury securities). How they do their thing relative to other things is a great indicator of how the market is feeling.

This is measured through a credit spread - this is the price of corporate risk, relative to the “risk free” U.S. Treasury security (the U.S. would ~never~ default on its debt). Corporate bonds have risk because they could go out of business, and thus not pay back their debts. People are going to need to be compensated more for holding the corporate risk - no free lunches!! So the difference between corporate bonds and Treasuries of the same maturity is the credit spread.

So the 10Y U.S. Treasury is right around 2% right now, and a 10-year corporate bond *might* be trading with a yield of 3% - the spread between those two is 100 basis points.

This is the compensation relative to U.S. interest rates - gotta get paid for taking on that corporate risk.

Companies with higher credit ratings [companies that have a high ability to repay the loan, usually a function of stability and growth] are going to have a tighter spread than companies with lower credit ratings

In general, the tighter that spread is across the board, the better the bond market is feeling (usually). If all the sudden spreads blow out - that’s not good because people see a lot of risk in the markets. They say “well why on EARTH would I buy a corporate bond if corporations can FAIL??” - lenders begin to demand higher rates because of general worries and shaky confidence around the future. And of course, if rates are higher, prices are down - and that creates a lot of problems in credit markets.

High Yield vs Investment Grade

Things haven’t been going so well for corporate bonds.

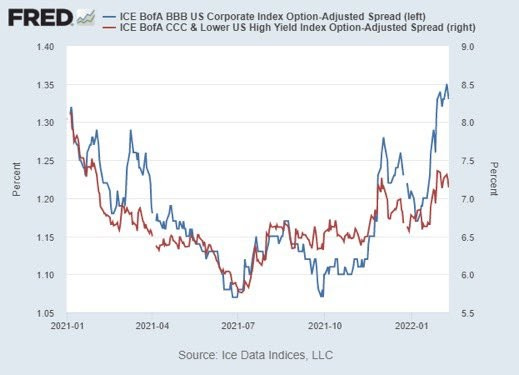

And this is important because spreads have moved. But this can be boiled down a few different ways. Going back to investment grade versus high yield bonds -

High Yield

We can look at ETFs as a proxy for credit performance: SPDR Bloomberg Barclays High Yield Bond ETF (JNK) and the iShares iBoxx $ High Yield Corporate Bond ETF (HYG) give a general idea of how high yield debt is trading. Effective duration for HYG is 4.1 years, meaning that for every ~1% change in interest rates, the bond price changes by 4.1%. That means that a lot of the bond movement is focused on credit risk because of the shorter duration -

Duration: The duration of JNK and HYG is short (meaning that they hold shorter duration bonds that mature sooner, between one and fifteen years) and is ultimately more impacted by big moves on the short end of the curve (like we’ve seen recently).

So what’s going on? High yield bonds don’t do great in times of balance sheet contraction as Fed members have been hinting at - there is more financing risk, more concerns for these companies. But things are still relatively okay right now.

We can look at the difference between HYG and HYGH to parse out the relationship a bit more - HYG has credit risk and interest rate risk and HYGH has only credit risk (Jack Farley has a great thread on this and special thanks to him for sharing the below charts with me)

HYG (purple line) is down 5.08% and HYGH (purple line) is down 2.64%. HYGH is credit risk - that’s all it really represents, and so HYGH - HYG = interest rate risk or ~2.44%

There is more movement from duration/interest rate risk, not credit stress.

However, there is a lot of movement in general - the yield on junk bonds has risen every week this year, meaning junk companies are facing increasingly higher borrowing costs.

Corporate credit risk is likely beginning to tick up. We are seeing some flashes of panic in the market - and it will be important to keep an eye on that.

Investment Grade

We can look at LQD ETF for IG credit - and it has NOT been doing okay. This is because LQD has a effective duration of 9.29 years, with a huge exposure to 20+ years, as shown below. That means for every 1% move in interest rates, LQD moves by 9.3%ish - which is a lot.

Higher duration, so it has a higher sensitivity to rate increases and volatility in general, with lower credit exposure relative to high yield ETFs

We can do a similar analysis deal with LQD and LQDH - a lot of the fall that LQD has experienced over the last few is from interest rate risk NOT credit risk.

Brandywine put together a great sensitivity analysis of the IG index of the 10Y yield and IG OAS that shows some different scenarios relative to spread widening. A lot of the movement is going to be dominated by duration moves, not necessarily credit risk

So this relationship between duration and credit risk is why we’ve see IG spreads widening, especially relative to HY spreads. IG has more duration risk because they have longer dated bonds.

They are also pricing in the Fed moving on interest rates - LQD has a significant amount of duration, and is very sensitive to any movement in interest rates

The most important point of all of this is that bonds are falling because of duration and interest rate risk, and not because of credit quality. You can see in the graph below that investment grade has taken a beating relative to high yield. If we were really seeing a credit quality crisis, high yield bonds would be the ones hurting. This is duration, not credit quality.

HOWEVER

All of this could change! The yield curve is flirting with inversion, and it’s a bit tough for the Fed to accomplish what they want to do without inverting the curve. The curve is already not happy. But in order for the yield curve inversion to be a true recessionary indicator (according to Campbell Harvey himself):

The 3m / 10Y would need to invert and the inversion would need to last for 90 days - so it’s not really about momentary inversions or flips on the other parts of the curve. And we aren’t there yet.

So what’s going on right now?

Well, everything. Geopolitical tension, inflation of 7.5%, a stock market that can’t decide what’s going on, investors that also can’t decide what’s going on - people are like “where do we find yield” and also “is the economy going to be okay or”. Treasury yields have skyrocketed because of worries, and that puts pressure on all bonds.

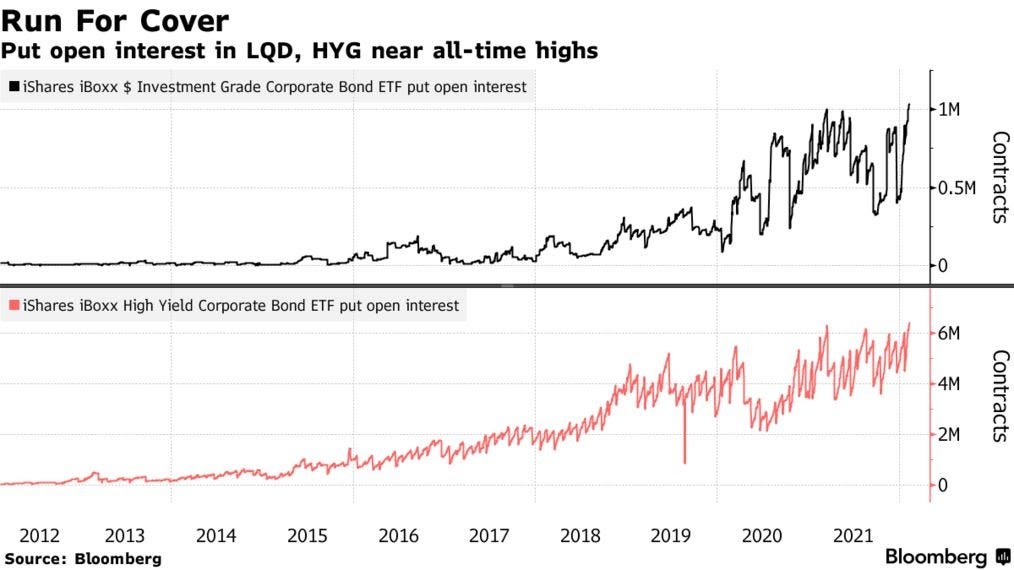

People are fleeing corporate bonds - because worry. How can you even begin to think about credit hedging, especially considering low absolute yields and increasing levels of corporate credit risk?

We’ve started to see people begin to buy protection in credit markets, with worries that the Fed could make a policy mistake (tighten us right into a Recession, forgoing economic growth in favor for getting policy “right”).

We are starting to see some of the free flowing money that became a staple of the past few years begin to trickle away. Central banks are !!!tightening!!! and investors and issuers are very aware of that, and the impact it could have on credit conditions. Companies are beginning to pull deals, as they are paying more interest than they thought they would be. People are getting nervous - companies are guiding lower, it’s getting more expensive to get financing, and economic growth is ???.

But not that nervous - yet. As Joseph Wang highlights - the Fed has been buying a lot of bonds, which messes with the signal-to-noise ratio. It’s a bit difficult to tell what’s going on if you have a perpetual buyer - very similar to passive flows in equities. However, the bond market might wake up soon. We face a tunnel of economic growth concerns and higher inflation (the dreaded stagflation combination) - and there is a lot more to go.

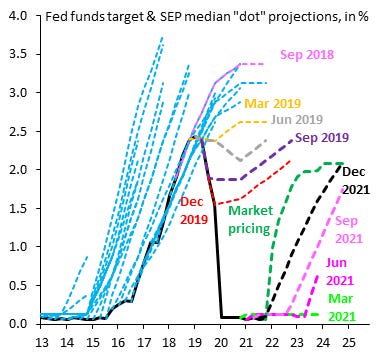

What’s really interesting about all of this is the Fedspeak (verb: fed members talking in order to gas up the markets).

Bullard (a voting member!) has done a very good job at this. He has advocated for 100bps by July, and has also questioned the Fed’s credibility - suggesting that the Central Bank frontloads the removal of accommodation. He has singlehandely spooked the markets out, and the markets have said “yes Bullard, we HEAR you”

The only problem with the market hearing Bullard is that they have basically frontloaded hikes (with the terminal rate still relatively low and below the Fed’s estimate (meaning market doesn’t really believe the Fed can go all the way)). The Fed thinks the terminal rate is ~2.5% but the market is pricing it close to 2%.

It’s clear that the market doesn’t think that the Fed is going to manage this well

What is a solution?

BROUGHT TO YOU BY:

How do you retain protection in a market environment that is so wacky? Simplify has several strategies that help investors hedge against credit risk. In an environment characterized by low absolute yields and high levels of corporate credit risk, efficient credit hedging becomes much more critical in portfolio construction. The strategies are designed to provide a a combination of positive carry with negative correlation to credit, creating the potential for improved returns at lower risk.

Simplify Asset Management was founded in 2020 to help advisors tackle the most pressing portfolio challenges with an innovative set of options-based strategies. By accounting for real-world investor needs and market behavior, along with the non-linear power of options, their strategies allow for the tailored portfolio outcomes clients are looking for.

*This is not investment advice. See https://www.simplify.us

Final Thoughts

Credit conditions are actually decent - the Fed needs to do their monetary policy job and start to tighten (and they will hopefully) but in general, spreads have been pretty tight, and the credit market has been okay. We might see some widening but that isn’t because bOnD marKet eXplOde. Things might hurt for a while - mostly because if the economy slows down, everything hurts. Geopolitical risk compounds that - and that situation is looking worse and worse.

Zoltan is suggesting that the Fed *literally* crash the entire market - which is like bad right? The idea would be to get people back to work but ? surely, that is not the best path. Bullard is out there talking his talk - it’s a delicate balance.

“if the young feeling Bitcoin -rich are less inclined to work and the old feeling mass affluent are eager to retire early, labor force participation drops to the detriment of real growth prospects.”

However it’s important to have solutions - the world is increasingly uncertain, and no one really knows what’s going to happen. Prepping your toolkit is the *best* thing to do.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

Well done. Your ability to switch from in depth and cerebral to TikTok stardom is something to behold. Energy is my world but I appreciate the current take you have on the bigger picture.