This is a macro piece. I publish these once a week (beta phase), as well as single stock pieces (1-3x a month) and weekly market updates. I also publish on TikTok, Youtube, and Twitter!

YouTube here

“MSCI is not an investor, or an asset manager, or an investment adviser,” Henry Fernandez, CEO of MSCI, told CNBC’s Becky Quick Friday at the Baron Investment Conference in New York. “We are an intermediary. We are an agent helping our investors figure out how to invest around the world in a good way ... We cannot tell clients what decisions to make.”

The China crackdown.

Before I get into the piece I want to preface it with the fact that this is meant to be as objective as possible. I am mainly focusing on fund mechanics, which has resulted in overexposure to China. I will be discussing:

The Role of Tech in Investing

Cathie Contrarian

The Index-Fund-Manager Relationship

How did it happen?

What’s happening now?

The Role of Tech in Investing

China cracked down on the edtech sector.

China has been cracking down on various things over the past several months - with the intent of making it very clear that the Chinese government has the final say on what business succeeds - and they will destroy companies to make a point. Some examples:

The cancelled Ant Financial IPO

Jack Ma’s disappearance (and the subsequent antitrust fine against Alibaba, his company)

The penalties against Didi

More antitrust measures against Tencent and Baidu

The Tencent case and spiritual opium

No one really knows what they are going to go after next.

It's similar to the Federal Reserve, funnily enough. They can take an “outcomes based approach” - enforcing regulation when there is a threat (inflation for the Fed, companies falling out of the chosen State narrative in China).

But as Noah points out in his piece -

“It's not technology that China is smashing - its consumer-facing internet software companies that americans tend to label “tech””

China has created an internal mandate that tech = hard tech (semiconductors)

In the United States, tech = consumer/social tech (Facebook, Google etc)

That's why almost every person appears to be building a consumer social app in the US - because we conflate this type of tech with all types of tech. And US investors carry their notion of consumer/social tech into investing in China as according to the FT-

Global holdings of Chinese stocks and bonds have surged about 40% to more than $800bn over the past year as investors bought assets at a record pace in spite of souring relations between Beijing and the international community. Offshore investors have bought a net $35.3bn of Chinese stocks YTD… 49% higher compared with a year earlier.

Much of it due to index inclusion. Index inclusion has driven a lot of flows to China and away from EM, resulting in the overexposure of China in the major indexes.

Cathie Contrarian

Chinese tech and education stocks have lost more than $1T in market cap since February. The wild thing is that Cathie sold - she sold before a lot of fallout. And because of that she avoided the movement shown below.

Cathie sold based on valuations, stating that valuations were likely to compress and likely to remain compressed - and that is a pretty big signal for the broad market.

There is also the underlying concern of fund arbitrage - pump up the stocks enough to get them included in the index, then dump. GME, but bigger.

The Index-Fund-Manager Relationship

That’s an important point - while Cathie was selling, the indices were gathering. They were gathering for a few reasons - but China being more than 1/3 of most EM funds is an over-concentration.

So it ends up being this weird, convoluted cycle where the index ends up having heavy exposure to China - where its more than ⅓ of most EM funds! So then the fund issuers track that - and then the asset managers have to somewhat follow it so they can ~beat the benchmark~.

Funds are thinking about how to solve this - BlackRock is thinking about separating China out as a stand-alone market, not part of EM or DM. This will help with fund structure but it still doesn’t solve the overexposure issue.

This shows up in a few different ways:

General overexposure: EM funds have massive exposure to China, mostly due to market cap weighting. ~VWO has 40% to China alone.

Source: Vanguard Intensive overexposure: For example, broad EM funds, due to their sheer size, and their outsized over-concentration to China (up to 40%), are the biggest holders of $EDU. Not China funds, not thematic education funds. BROAD EM FUNDS

Source: CNN

You might say - oh, I can just invest in an ESG fund and avoid the overexposure right?

Nope.

It doesn’t get any better in the ESG world (does it ever?)

EM ESG funds have the same exposure because of tracking error— they cannot deviate from the parent (non-ESG) benchmark by more than 1%. So they end up with the same overexposure issue.

Zooming out here, this is a problem with fund structure-

Because the ESG funds cant deviate, they end up with not-very-ESG results.

And because the EM funds are overexposed via market cap weighting to China, everytime there is a downturn, they get dragged too.

And because managers have to track the index, they also have this ~overexposure~.

An endless loop of pointing fingers.

How Did It Happen?

The whole MSCI /China story and the global benchmarks inclusion is really interesting too. This partly happened because of pressure from Beijing - “heavy pressure from the Chinese government” - resulting in domestic Chinese stocks being added to the Emerging Markets index. When they were added -

Business has boomed in China for MSCI and large global asset managers who supported its move. Regulators last year approved nine Chinese exchange-traded funds designed to track the performance of MSCI indexes, when just one existed previously.

The SEC has a paper on it - “more than 150 China-based companies with a combined market value of $1.2T were listed on US stock exchanges at the end of 2019.” There are three different classes of shares: A Shares, B Shares, and H Shares.

A Shares are listed on either the Shanghai or Shenzhen stock exchanges and are traded in renminbi (CNY).

B Shares are listed on the Shanghai stock exchange and are traded in U.S. dollars (USD), or they are listed on the Shenzhen stock exchange and are traded in Hong Kong dollars (HKD)

H Shares are listed on the Hong Kong exchange and are traded in Hong Kong dollars (HKD)

A shares used to be *just* for mainland Chinese investors. But now all 3 major equity index providers - MSCI, FTSE, and S&P have A Shares in their EM indexes. This trickles down - mutual funds have exposures, foundations have exposure, the Federal Thrift Retirement Investment Board (FTRIB) that oversees retirement savings for U.S. government employees has exposure to China A Shares.

Why is this a big deal (according to SEC)?

Fraud: “limits on credible standards in corporate governance, the risk of insider dealings, market manipulation and other misconduct increases” - all the usual

Volatility: Mainland China is dominated by retail investors - they have shorter holding periods, basically it’s just a toned down version of January’s GME.

Corporate incentives: “In companies, Communist Party organizations shall...be set up to carry out activities of the Party.” The incentives are the companies are definitely not to “maximize shareholder returns”. State interests before shareholder interests.

Accounting practices: More than 80% of Chinese bond issuers are rated AA and above- which doesn’t *really* work. Not everyone can have that solid of a credit score. And that is often the problem - there are a lot of undisclosed risks.

Lack of hedging: there are not a lot of ways to protect your downside here - and China said that derivative products led to their 2015 market turmoil so :-/

National security risk: There are companies in the indexes that are considered “entities” by the US government so basically they are leaving the door open and complaining about the rain getting inside.

What’s Happening Now?

Now the Edtech sector might be turned into nonprofits. But as Dalio states: “in the case of the educational tutoring companies they want to reduce the educational inequality…they believe that these things are better for the country even if the shareholders don’t like it.” But it’s not ~good~ for investors.

And a lot of broad EM and thematic ETFs hold these companies - meaning that they are going to feel the pain if/when/how all of this comes to fruition.

Long term growth vs regulatory risk comes to a pin.

What’s a solution?

BROUGHT TO YOU BY:

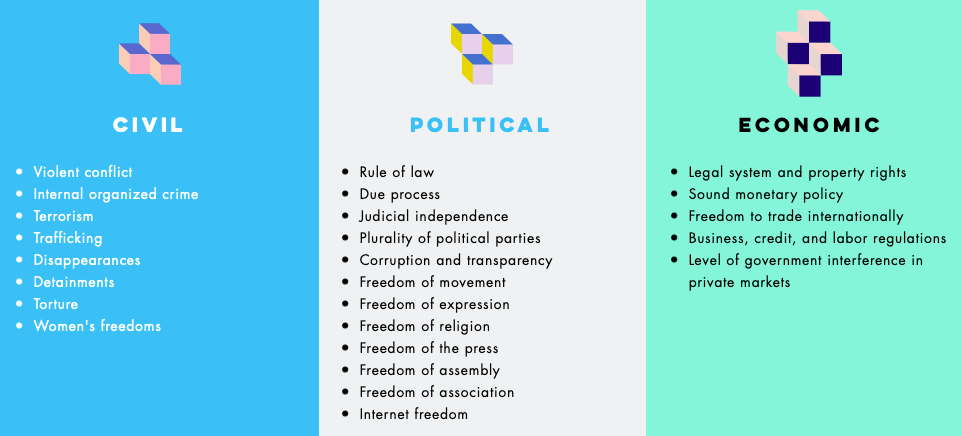

Freedom weighting. Perth Tolle and the FDRM index *literally* solve the above problem - by investing in countries that prioritize personal and economic freedom. You can free yourself from benchmarks with the autocracy drag and get rid of distorted concentration.

The Life + Liberty Freedom 100 Emerging Markets Index is a freedom-weighted EM equity strategy that uses personal and economic freedom metrics as primary factors in the investment selection process. $FRDM

*This is not investment advice. See https://www.lifeandlibertyindexes.com

Final Thoughts

So the deal is that there is an overexposure to Chinese companies in the EM indexes, then an increasing exposure to them due to market cap weighting, resulting in funds having overexposure, resulting in asset managers having overexposure :)

Noah again on why China has different priorities than the U.S.

But China never really shifted out of survival mode. Yes, China’s leaders embraced economic growth, but that growth has always been toward the telos of comprehensive national power. China’s young people may be increasingly ready to cash out and have some fun, but the leadership is just not there yet. They’ve got bigger fish to fry — they have to avenge the Century of Humiliation and claim China’s rightful place in the sun and blah blah.

And so China wants to invest in hard tech - and they are going to redesign their stock market to make that happen. There are a multitude of other reasons for all of this but the main thing

China does not see tech as the U.S. sees tech. However, U.S. tech investors invest in China tech the same way that they invest in U.S. tech.

There is/was an underpricing of risk of Chinese stocks - resulting in a feedback loop of indexes, funds, and asset managers all being overexposed

So when a downturn does happen (because China does not see tech the same way that the U.S. sees tech) the feedback loop gets smashed

And fund structure - endowments, pension plans, 401ks, the broad EM indices - are all apart of that. Overexposure to uncertain risk.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

love it but, I mean the Vanguard Developed market is 53% in Europe (okay not one country but it tries to be).

https://investor.vanguard.com/etf/profile/portfolio/vea