The Distortion and Disruption of Narratives

Everything remains the same until it doesn't

Some thoughts on narrative flips (through the lens of safe haven investments and reserve currencies), narrative distortion (capital as a signal and indicators), narrative disruption (leaders saying things and changing world order)

If you’re already subscribed, thank you! If you’d like to subscribe, please do so here:

YouTube and podcast up later today!

Outline:

Narratives

‘Beyond the age of information is the age of choices’ - Charles Eames

Our lives are mostly a result of the content that we interact with. We are (sort of) an average of the five people that we spend the most time with. The things that we read and watch and the people we talk to end up shaping our world.

And that is compounded by !algorithms! that *also* determine how we see the world. We end up tying ourselves into our online worlds because that is where we exist for most of the day. Like sure, we might have a running group or in-person work environment, but most of us are inherently online beings right now.

So what does that mean for how we develop a sense of self?

The Self

“Algorithmic identity—an identity formation that works through mathematical algorithms to infer categories of identity on otherwise anonymous beings”

We spend a lot of time with ourselves - especially in the Online Age - connection through Internet connection. Lieberman and Schroeder have a good paper on this - the “Two social lives” - the online and the offline - and bring up a couple of important questions:

How do our online interactions lead to misunderstanding and dehumanization?

How does globalized communication change universal norms?

How do online interactions “encourage the commodification or objectification of interaction partners”?

How can online interaction resemble in-person interaction?

All of these questions are important - how do we build a concept of self? Why is the mask of the Internet so powerful for trolls? Why is there so much anger Online? And what are both the consequences and rewards of building an online and offline self?

And what do we become when the algorithm rewards behavior that is ultimately asking us to take all that we are and package it into pieces of “Self-Branding?”

In a really grossly simplified way, who are we, if not defined by our algorithmic interests?

And what happens when we think consulting firms????? are the answer to comedy?

Charles Eames has another really good quote on this -

"Recent years have shown a growing preoccupation with the circumstances surrounding the creative act and a search for the ingredients that promote creativity. This preoccupation in itself suggests that we are in a special kind of trouble — and indeed we are."

I think all of this boils down into a creativity crisis, an identity crisis, the divergence from the digital and the physical reality. It’s why we see anger and intense dehumanization online, and so much more.

And our brains in general are kind of breaking? When we have to par the reality of the nondigital world to the digital - one of which we can scroll away from, the other of which we are stuck in - we have trouble.

For example, TikTok - “If kids’ brains become accustomed to constant changes, the brain finds it difficult to adapt to a nondigital activity where things don’t move quite as fast” as Michael Manos, the clinical director of the Center for Attention and Learning at Cleveland Children’s Clinic says.

Bhandari and Bimo have a really wonderful reserach paper on how TikTok shapes us - stating “TikTok users occupy the precarious position of dually engaging with an external and internal entity; they engage with versions of themselves, as mediated through the algorithm”

So then the question becomes - who is the truest version of ourself?

And so you’re probably like - why am I reading about this in a market newsletter?

It’s mostly because one of the root aspects of economics is HUMANS - economics is essentially monetized philosophy.

Our algorithmic selves are also how we consume content, and thus how we interpret the world around us - which is important in context of understanding the narrative of the broader economic system, and the role that we play in it.

I *think* that the more that we can understand humans, the more that we can understand the world around us (to an extent)

Because everything are these Big Narratives - and how we see the world (through our own algorithmic lens) often times impacts how we see these things.

Narrative Flip

Things are no longer what they seem.

Safe Havens

The Yen, a Safe Haven (?) Commodity

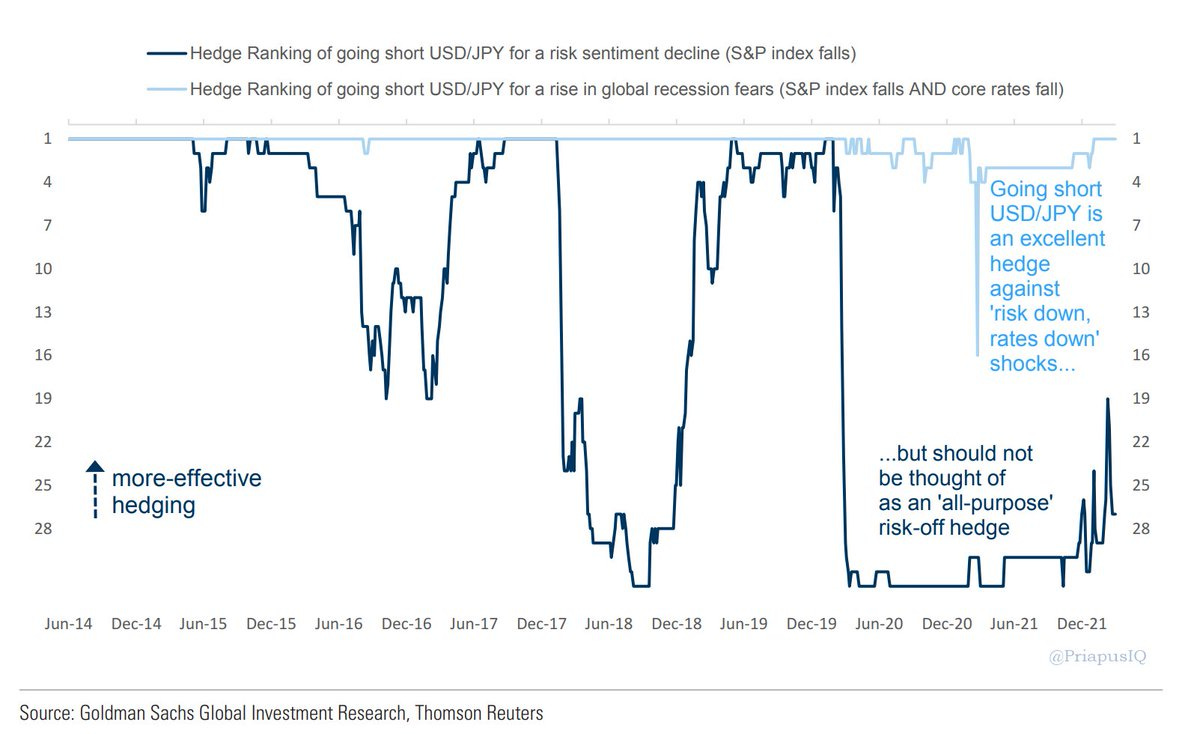

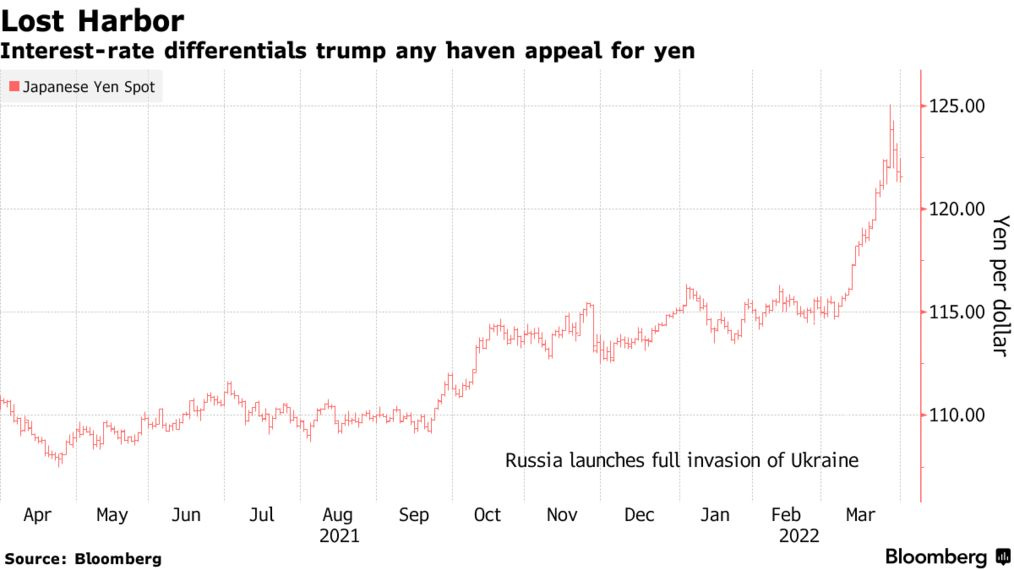

Not… really anymore? As shown below, the yen is not an “all-purpose risk-off hedge”. It used to be the safest place to go - the yen was *the* safe haven. It appreciated when people are like “wtf is going on”, when people are risk averse, and trying to find stability.

So it’s the yen’s time to shine right? We have great uncertainty right now with the Ukraine War - but the yen isn't really responding the way it usually would. This is mostly because of policy divergence and very weak Japanese economic data.

Ultra loose monetary policy: The Bank of Japan is like “we must have easy monetary policy and keep rates at zero!” when the rest of the world is in an inflationary crisis.

So now they are maintaining low rates through yield curve control to try and get their economy off the ground - which is like '“oh no, how many bonds are they going to end up buying”

So that divergence makes market participants go “hm ok wtf” - especially when you have the market pricing in 2-3 50 bp hikes from the Federal Reserve.

It’s just a huge dichotomy - easy monetary policy in Japan versus hawkishness from the rest of the world. Not great. So everyone is like “eh, maybe the yen isn’t the best thing anymore”. The BOJ Governor isn’t super worried about a weak yen - but a weaker yen makes inputs more expensive, especially as we see upticks in commodity prices as Bloomberg points out. And how long can a central bank buy unlimited bonds for?

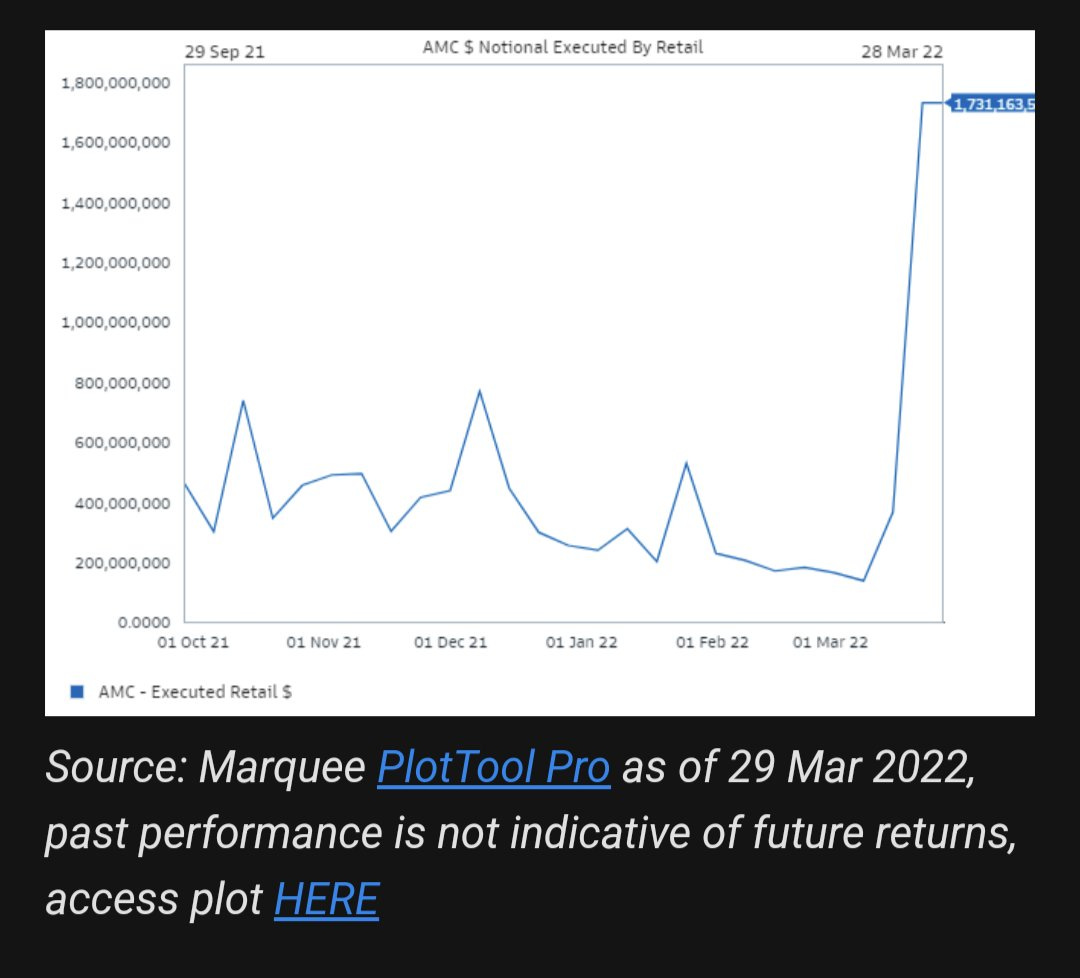

So investors are seeking alternative safe havens… like memes.

Memes as a Safe Haven Commodity?

Edwin Dorsey said “AMC is trying to become the Berkshire Hathaway for meme stocks” and that is HUGE.

AMC is buying up a gold miner, GameStop is doing a stock split - and it works?

And it will continue to work (until it doesn’t, of course) because retail is like “YES - I believe in the stock - not the company - the STOCK.”

this is important, it’s *really* not the company, it’s the stock

And it just doesn’t make sense. And that’s why it makes sense.

Reserve Currency

The Dollar → Lots of Other Currencies

Is the dollar facing its downfall? Kind of?

“The shift out of dollars, in fact, is not overwhelmingly a shift into the renminbi. The shift out of dollars is more substantially a shift into the currencies of smaller economies that, historically, had less of the scale and liquidity needed to constitute an attractive form of international reserves.” - IMF

Everyone likes to say that the Dollar’s reign is going to end soon, and the IMF addressed that in their paper, “The Stealth Erosion of Dollar Dominance: Active Diversifiers and the Rise of Nontraditional Reserve Currencies”.

The main takeaway was basically “like yes, the dollar is declining as a share of international reserves, but there isn’t another currency stepping up? it’s mostly moves into smaller currencies”.

And this makes sense right? This ties into the broader theme of domestic protectionism and onshoring and deglobalization - everyone is going to try and protect their own space. As the IMF writes:

The most notable trend in recent decades has been the rise of nontraditional reserve currencies—the currencies of countries without the economic scale and volume of cross-border transactions that distinguished traditional reserve-currency issuers… If dollar dominance comes to an end (a scenario, not a prediction), then the greenback could be felled not by the dollar’s main rivals but by a broad group of alternative currencies

So it’s sort of like - the dollar will remain the Dollar until money fragments into many other currencies - but there isn’t another currency (including the renminbi) that is going to take its place.

But there are some rumblings of potential change - the world order is shifting a bit.

As Adam Tooze wrote (mostly in response to Zoltan’s note on Merhling’s Money Framework, but it works well here)

If Russia-China is to form anything like and an equivalent to the global dollar system it has a very long way to go... There is a huge asymmetry in the world right now between the financial system that remains spectacularly euro-dollar centered and the new multipolarity of power, trade and economic activity… The world is multipolar and so is global trade. Western policy must adjust to that.

So will Bitcoin become a reserve currency too?

Narrative Distortion

Things are confusing.

Capital as a Signal

The Axie Hack and web3 VC

So this was bad. Ronin, which is an Ethereum sidechain and hosts the play-to-earn game Axie Infinity was hacked for > $600m. Basically, there are 9 validator nodes - the hacker got ahold of 5, and thus, the attackers were able to rock and roll.

It’s one of the biggest hacks in the crypto universe. And no one noticed for like 6 days? And then they tried to move money into FTX? It underscores a few things -

Cybersecurity is going to be a very Big Theme over the next many years

Crypto is pretty scam inelastic - it doesn’t matter how many rug pulls or hacks there are - you can still raise ~$200m again, as Wormhole proved. Which is good- Wormhole can rebuild etc, but *so* many scams are getting money

And all of this is calibration, so it makes sense, but also like “oh no, web3 VCs STOP investing in everything that has web3 in its name”

Building to build - I think that this is sort of a problem across the board. It’s really a top of funnel problem - there are so many people that *want* to be VCs (how many people have a fund/trying to join one deserves its own piece, so I am not going to expand on that too much) but there is a focus on “Have Mediocre Idea for Thing, Get Money”. And the mediocre things are often puzzle pieces that don’t really fit in anywhere, because no one really wanted the puzzle in the first place.

As Yoni highlights above - people are building the Thing without the Things that Thing needs to succeed. It’s a platform with no games, a marketplace with no users, an B2B SaaS company with no real use case, etc

As Ho Nam said, “Easy money (which does have strings attached) is going to cause harm… if you don't know where the boundaries lie, is there really a competence?”

Ah, competence.

Yield Curve Indicator

The yield curve is sort of fuzzied out by easy money too - as the Fed themselves write:

It is not valid to interpret inverted term spreads as independent measures of impending recession. They largely reflect the expectations of market participants.

Which like sure - but expectations manifest a thread of reality.

I’m taking some liberties with their paper (they argue that we should focus on the near-term forward spread). But authors explain that we tend to focus on nominal interest rates, when we *really* should be looking at real rates (inflation adjusted). When 10Y yield > 2Y yield, that means that growth is expected to “accelerate” as the St. Louis Fed highlights. When the 2Y > 10Y, that means that things just aren’t looking that hot.

Basically, the yield curve measures economic vibes. When it inverts, vibes are off. When it’s upward sloping, vibes are good. But sometimes, the vibes are confusing.

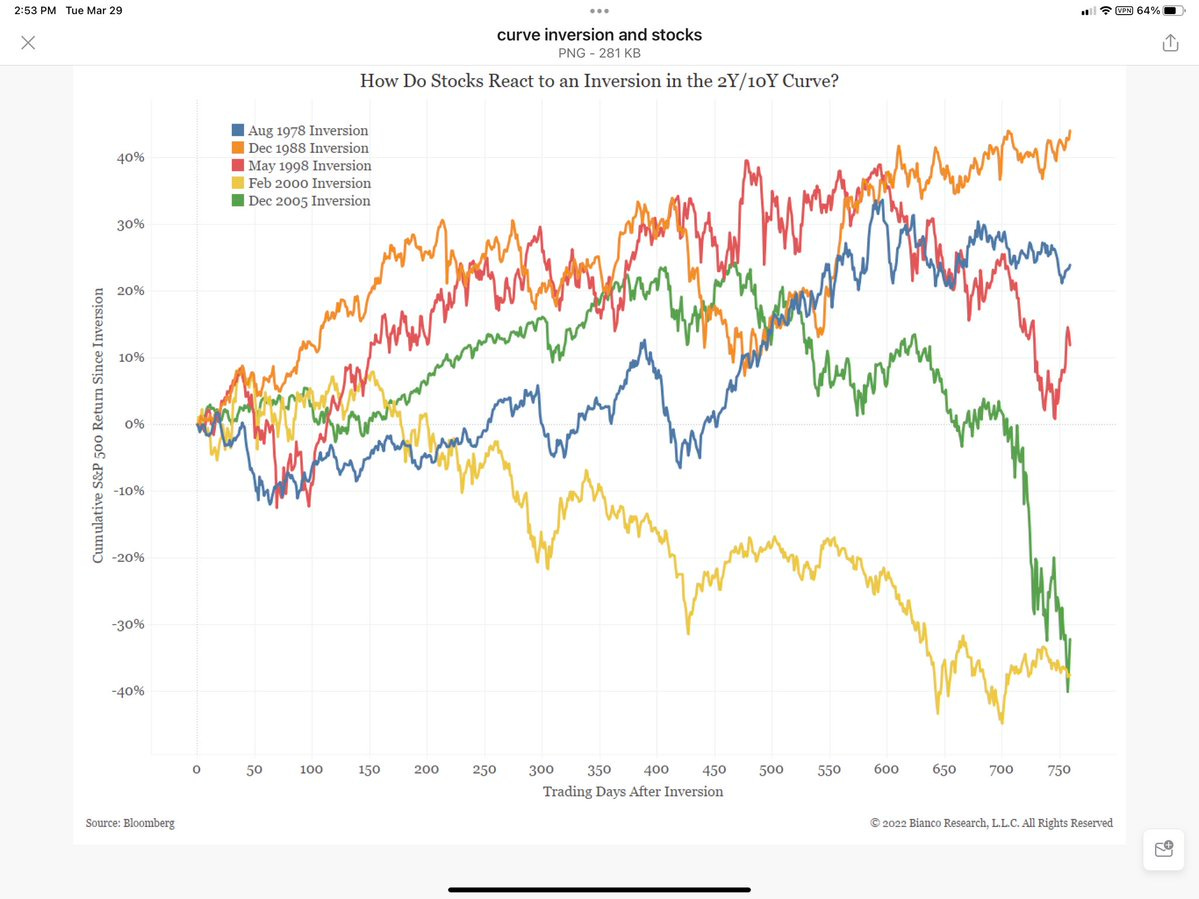

The yield curve inverting DOES NOT mean that a Recession will follow. In the most simplified version - it just means that things are not looking hot.

And stocks just sort of do whatever after the yield curve inverts. Things just keep going.

But as Joey writes in his excellent piece on the yield curve:

Still, the yield curve isn’t useless: knowing that investors likely expect nominal interest rates to decrease sometime in the future is important to assessing the economic outlook… However, it is always necessary to put bond market movements in context with other economic data points.

So the yield curve matters because it matters in context, and it matters as a signal. We must understand why thing go up, because that will tell us why other thing go down.

Narrative Disruption

The shareholder letters are out

Leaders Saying Things

Larry Fink wrote a very strongly worded letter about the future of globalization which basically boiled down to “ah yes, the beginning of the end.” (Jamie Dimon also discussing how chaos will reign if America doesn’t get it together) To Larry Fink:

The Russian invasion of Ukraine has put an end to the globalization we have experienced over the last three decades. We had already seen connectivity between nations, companies and even people strained by two years of the pandemic. It has left many communities and people feeling isolated and looking inward. I believe this has exacerbated the polarization and extremist behavior we are seeing across society.

Remember One BlackRock is in everything. So when Larry says “hey, things are pretty not good” we should probably listen. And, as Adam Tooze and the Unhedged team highlight, Fink’s views are mostly a function of:

Geopolitics: As many have written, other countries are not going to vibe with the concept of sanctions and are going to do what they can to protect themselves against that.

Energy: As Russia has repeatedly proven, if you provide someone with natural gas, they will be a certain type of indebted to you. If you demand that they pay you roubles, they will strongly consider it - even if it ends up making sanctions pretty much inert.

Energy is a huge part of this globalization/deglobalization narrative - energy is the common denominator of everything.

Domestically, oil makes politics successful or not. Politicians are incentivized to make people feel somewhat okay about the pump prices so they don’t get voted out of office.

So they say “hey, here is some gas money :) don’t spend it all in one place.” But then there is a lot of skew on the price because all of the sudden people get an influx of cash - gas demand goes up, supply is the same, so prices naturally increase.

Or you can release oil from the Strategic Petroleum Reserve, which also sort of kind of works sometimes

Political instability: Mostly, if you don’t have stable energy sources, you likely will not have a stable political system, and governments are *very* aware of that

Demographic changes - people are getting older. Developed nations have exported a lot of their production to developing nations, but as those nations age, yikes! No more underpaid labor.

So everyone is like “wow the world order is changing! Things are different!” But no one is doing much about it? As the FT highlights:

It is a weird form of cognitive dissonance: to talk as though you recognise the headwinds and not price them in. Hoping, perhaps, that they will not, after all, materialise… Something similar holds for globalisation more generally. There is a lot of talk about reshoring and rebuilding supply chains, but far less action on the substance. Apple actually increased its reliance on China last year.

So things are not thinging the way we thought they would always thing, but they are still basically thinging the way that they have before.

Will ESG save us?

One thing that Fink is well known for is ESG - the ESGification of everything - “how can this fossil fuel producer become green? by buying carbon credits 😎” Rinse, repeat. But the transition to ESG, which both Tooze and Fink highlight in their pieces is going to be long - and it’s going to require “underlying commodities” and as Chartbook highlights from Isobel Schnabel of the ECB, “most green technologies require significant amounts of metals and minerals, such as copper, lithium and cobalt, especially during the transition period”

For example, these are the materials needed to build a wind turbine:

335 tons of steel

4.7 tons of copper

1,200 tons of concrete

3 tons of aluminium

2 tons of rare earth elements

The UK plans to build 7,000 of these! Which is awesome! We need that! But also this is a chart of the cost of some of these inputs:

And lithium is a huge component of electric vehicles. Copper is a huge component of everything. So it’s not like we can just say “ah yeah, green energy will save us, all good, everyone just buy a Tesla, handshake, high five” - there is going to be a transition - and it relies on raw materials and underlying commodities.

ESG gets in its own way - its an annoying compliance checkmark that ends up causing more harm than good because we simply don’t have funds that matches the mandates. To play the broken record again, “we can’t have green energy policy without green energy investment.”

I don’t know.

Russia and Ukraine

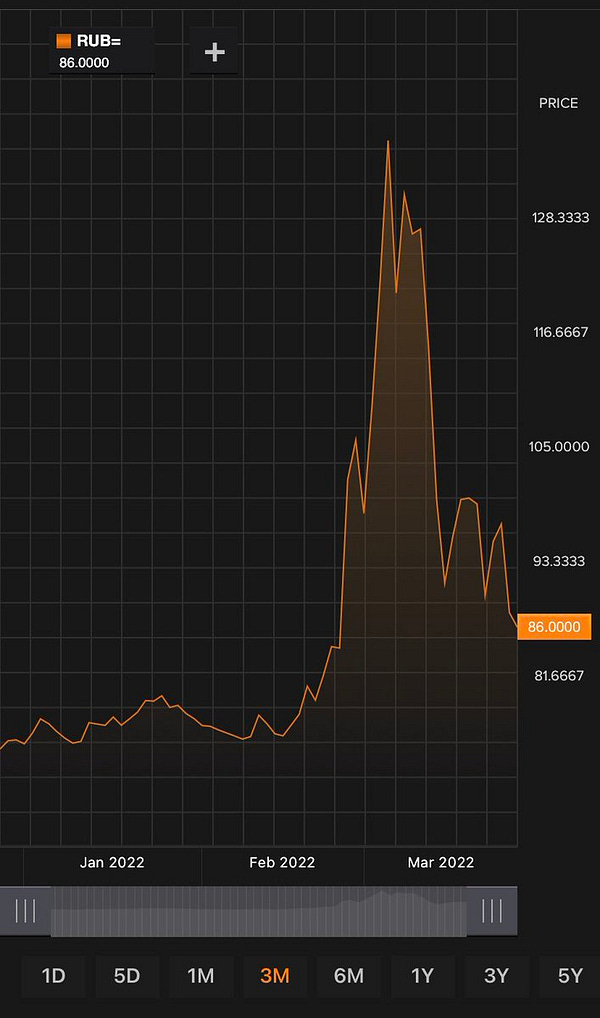

Russia is committing more than war crimes in Ukraine, and the sanctions are effective - but they are likely not going to be enough to deter Russia from this horrific path.

The ruble is strengthening (mostly because people can’t get rid of them) - so it will be likely more sanctions (maybe freezing Russian imports of energy eventually).

More must be done.

Final Thoughts

That was a lot. There is a lot happening. I don’t really have any final words other than a closing thought from Erich Fromm:

“Love of others and love of ourselves are not alternatives. On the contrary, an attitude of love towards themselves will be found in all those who are capable of loving others. Love, in principle, is indivisible as far as the connection between objects and one’s own self are concerned.”

And some final words from Morgan

Some Good Links

Theme: Crypto

Theme: The Ukraine War

Theme: Globalized Finance

Theme: Consumer Spending

Theme: Things

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

Kyla, great writing as always!

The observing mind can see how the pendulum swings and when narratives shift.

Thank you for highlighting what we “feel” is going on but may not always put into words.

Thanks, Kyla! This is now Econ 101

"So things are not thinging the way we thought they would always thing, but they are still basically thinging the way that they have before."