The Divergence Between Expectations and Reality

Rivian, inflation, gm, governance, and eternal optimism

Last time, a high-level overview of the digital infrastructure ecosystem and why it’s important for a web3 world. Today, the divergence between expectations and reality.

If you’re already subscribed, thank you! If you’d like to subscribe, please do so here:

YouTube/podcast up soon

A lot happened this week. A company that has sold 156 cars is worth $100 billion dollars, inflation came in really hot - Federal Reserve wya???, oil is moving, Evergrande did *not* default, Bitcoin was an inflation hedge then wasn’t, and the market still kind of… goes up.

$gm flipping GM

There is a coin called $gm (roughly ~$500m market cap) that has the goal to flip General Motors in market cap ($80b market cap).

gm is a greeting in crypto - good morning! On its Twitter page, the coin compares itself to other meme coins - $SHIB, $FLOKI, etc. And with $100mn in trading volume yesterday, it probably deserve to stand in those ranks. The marketing plan makes sense - meme yourself into existence.

This is not a bad plan, because, as Keynes wrote of the beauty contest:

We have reached the third degree where we devote our intelligences to anticipating what average opinion expects the average opinion to be. And there are some, I believe, who practice the fourth, fifth and higher degrees.”

We do not operate on the basis of fundamentals (conflated with facts).

But rather, much of the markets (crypto and equities) are interpreting the expectations and opinions of others

Confidence and enthusiasm abound because things *are* booming.

We become very assured in the idea that we are Very Good At This - until liquidity drains, and all of the sudden… the game changes (more on this later).

The CPI Print

Inflation came in super spicy this month (I have a full length video here) - 0.9% vs 0.6% expected, and beef was up 3.1% month over month, oil is up ~50% on the year. So now the pressure is on the Fed to move - to do something!

But policy is not perfect - policy is a patch.

Our labor market is funky -" “a combination of pandemic-affected, low pay/high turnover, non-market/bureaucratic issues” as Conor highlights. The Fed can’t *really* move on rates (make economic conditions even tighter) because they have a dual mandate - price stability and maximum employment.

And the labor market is really quite floofy.

Higher rates *could* result in labor getting even worse - the exact opposite of what they want to achieve.

The markets are funny, right? Its all nudgy nudge. As GC Selden wrote in the ever-salient Psychology of the Stock Market (published in 1912, absolutely excellent):

“Every human mind has its own peculiarities, so presumably yours has, though you can't see them plainly; but the stock market is the meeting of many minds, having every imaginable peculiarity.”

We are all just playing the game together, and minds drive the underlying fundamentals of everything - we are all pricing out our own peculiarities.

Imagine trying to make policy around that.

The Scapegoats of a Revolution

This is why new worlds are so exciting - the policy cracks haven’t begun to show yet.

We all know that Zuck is trying to build the Metaverse. And arguably, Facebook - the company that he built previously - sucks. It has done bad things. But the thing about bad things is that they have to exist so we can have a foil for good things (which is an unfortunate truth).

Zuck produced something that spreads misinformation and fear, but he also built something that connected people all over the world.

With big movements, there is always some sort of reverberation in the world

There has to be a “scapegoat” for volatility that a seismic shift in society creates.

Zuck was arguably that for social media.

Will he be that for web3? As crypto builds out governmental entities, what will be that scapegoat? What will be the thing that brings net-net bad, but also planted seeds of growth along the way?

Just as a quick aside - even with a “decentralized future” we have to have distribution tools. What happened with Curve Finance is interesting - (very high level overview) the team had to step in and essentially nuke Mochi, which was a good move because Mochi was trying to moochy. But a lot of community members got mad (even though the move was likely net good) because it was a centralized move through an Emergency DAO.

Governance and government diverge.

Sometimes people have to make fast decisions, as Michael highlighted. All policy and power distribution narrows during times of war.

Rivian IPO and the Narrative

And new worlds rely on speculation, as well as scapegoats.

So yeah, of course Rivian happened. Of course a company that has only sold 156 cars but is backed by Amazon is going to somehow reach a $100b valuation.

The funny thing around the Rivian saga is the narrative (after all, narrative is the only thing that matters when you’ve only sold 156 cars and have less than $1mn in revenue). “Oh they have big plans, just you see” - ????

It’s the function of a very hot private market. Lots of venture capital firms are beginning to sniff around early-stage companies - and putting hefty valuations on them.

Spicy Venture Capital

Rivian is a great example of valuation divergence.

Just as an example, the “best” seed-stage startups (very young companies) are now worth ~$15m more than the very worst seed-stage startups. Huge divergence!!

Exit demand (IPO or acquisition goal) is driving VC valuation growth.

This is SUPER important. There is an inherent craving for return - people are seeking out these 100x baggers (VCs and regulars alike) - with the expectation that its completely reasonable for 100x baggers to continue to exist.

But as we saw with inflation numbers - it’s very hard to price in expectations.

And obviously, venture capitalists know WAYY more than I do. But there is just continued divergence across the board - Tiger Global is eating everyone’s lunch here because they execute (Sar has a great thread on why) and they throw spaghetti at the wall. This is because they

have the capital in order to do so

are an absolute machine.

They are pricing people out of the market - you can’t play the game if you can’t pay for the ticket.

But this sort of Silicon Valley (in the cloud?) mindset (where huge venture scale returns are a norm on *any* investment) has leaked down into the language of a lot of everyday investors - because you see Tiger pressing valuations up to the stratosphere (compounded by others trying to keep up), and that warps our sense of reality.

There is a continued divergence between expectations and reality. It’s really easy to expect 100x returns when that’s what the market has done - but how long can it sustain? (the eternal old man yells at cloud question ugh)

Divergence of Expectations

Arlan asked a great question -

“Would you take $10M today or $100M in 5 years if you knew either was guaranteed, but you could only do one?”

Most people voted for the $10m (the “correct economic answer” is $100m bleh), but several said that they could turn that $10m into $100m over the 5Y time frame - which require a ~60%/yr return.

Which is… high.

Like sure you can take out a loan and leverage that loan, buy real estate, (buy sh!tcoins) and do all these money hacks - so it’s probably possible. And I’m rooting for you!!!

But the main issue is this continued divergence between expectations and reality. See below - what investors expect and what advisors think are realistic. People expect 17.5% annual returns - for context, the S&P 500 returns ~10% per year (and even that is probably unsustainable).

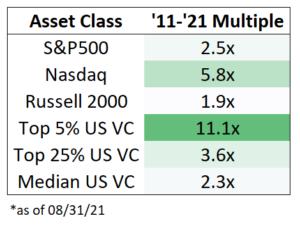

We have it in our heads that this market environment is normal. But its not normal, it’s not normal for anyone really. This is from NextView ventures and its a look at the “top 5% of '11 vintage US VC funds”. It’s “only” 11.1x returns - still solid, but not 100x!

We have it in our heads (because of memecoins etc) that this sort of return profile is normal - across both public and private markets.

All of this “normalness” predicates liquidity and flows.

The reason that stocks go up is because money goes into them - because people speculate on call options, market dynamics force the price up, etc.

The reason crypto goes up is because money goes in (and some of the projects have complete merit, this just an objective mechanics point)

Keynes beauty contest - “i think other people think this will go up”

Money go in, price go up

Once money stops going in (i.e., when the Fed begins to taper, when it becomes apparent that there is no more fiscal stimulus coming, when credit conditions tighten) all of that will *could* put downward pressure on prices because there isn’t the same element of inflows. And I’m simplifying things quite a bit, but the underlying dynamics shift is still the same - less money, less go up.

GC Selden’s 1912 (nineteen-twelve, more than 100 years ago) book reminds us:

It is generally more difficult to distinguish the end of a stock market boom than to decide when a panic is definitely over. The principle of the thing is simple enough, however. It was an oversupply of liquid capital that started the market upward after the panic was over. Similarly it is exhaution of liquid capital which brings the bull movement to an end.

What ends a bull market?

GC asked two key questions in his book:

What effect do varying mental attitudes of the public have on the course of prices? How is the character of the market influenced by psychological conditions?

How does the mental attitude of the individual trader affect his chances of success? To what extent, and how, can he overcome the obstacles placed in his pathway by his own hopes and fears, his timidities and obstinacies?

There was an excellent Odd Lots podcast on the grain markets with Angie Setzer - one of the most beautiful things that Angie said was

“The farmer is an eternal optimist.”

Because farmers have to be. They have to keep the cattle, they have to keep growing the food, they have to keep the course because a huge big world is relying on them - and that requires an element of faith.

People play a funny role in this broader world ecosystem. We are little builders and doers, we are the conduits of economic growth - and because of that, the conduits of economic destruction.

The mental attitude of the public is shifting - no longer is it desirable to sit behind a desk when you could make 400x on $SHIB coin. Is there a world where memelord is a viable career path, and what does that mean for productivity/GDP growth/a sustainable economy? What does that mean for what we produce, for intellecutal capital?

How do our incentives change? How does government/governance change? How does policy change?

Will the money that is generated by the meme cycle result in innovations that we never could have dreamed of? Or will there be a total collapse in faith because of the huge misalignment between expectations and calculated reality?

“Life is full of strange absurdities, which, strangely enough, do not even need to appear plausible, since they are true.” ― Luigi Pirandello

For as long as this absurdness can persist, I suppose. And perhaps none of it really needs to make sense at all.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

You have really great articles. Glad I found out about you. Unrelated to your articles, have you read "globalism and its discontents" by Joseph Stiglitz? He's the former chief economist of the world bank and criticizes lots of their policy as well as IMF policy I think youd like it

10/10 writing and insight