This is a weekly market update (I post daily to TikTok). I publish these once a week (beta phase), as well as single stock pieces (1-3x a month) and macro deep-dives. I also publish on TikTok, Youtube, and Twitter!

YouTube here

Dollar General's CEO:

"We do very good in good times, and fabulous in bad times."

Yes. Yes, they do.

This is a quick piece about the power of Dollar stores - the hold that they have on rural communities, how they use consumer psychology to sell products for “one dollar”, and the bull and bear case for them moving forward.

The History of the Grocery Store

Grocery stores have evolved over time, from first delivering non-perishables such as spices and teas to becoming digitally integrated supercenters that offer everything from tires to papayas. The Piggly Wiggly was the first self-service grocery store, established in 1916. Since then, the entire industry has seen rapid growth, encompassing everything from home delivery services to online grocery shopping.

However, there is a polarization among the evolution of grocery stores, a process that has been occurring since the early 2000’s. There is a fork in the road in how the industry will continue to progress:

We are already seeing alternative grocers taking major lead, with the bifurcation of natural/gourmet supermarkets and dollar stores becoming increasingly apparent.

But the big question is WHY - why are dollar stores taking so much market share? that’s what I am going to talk about ~today~

The Dollar Stores: The Tree and the General

Dollar stores are taking over America, and for several reasons.

Monopoly? There’s two of them: DLTR and DG. Family Dollar was acquired for Dollar Tree back in 2014 for $9.2bn.

To give you an idea of how bad this is - Dollar Tree actually gotten in trouble with the FTC for some ~monopoly practices~ and had to divest 300 stores to Sycamore Partners to skirt around the monopoly worries

Low Prices? They offer their products for 20-40% less than drug and grocery stores (sticker price, at least - their products are still technically more expensive).

Margins: The stores operate on thin margins (relatively), which enables them to provide discounted goods.

Private Label: They also often offer their own brand (private-label goods) that allow for higher margins than national brands.

Lean: They also keep their stores pretty lean - keeping the minimal amount of employees working at any given time

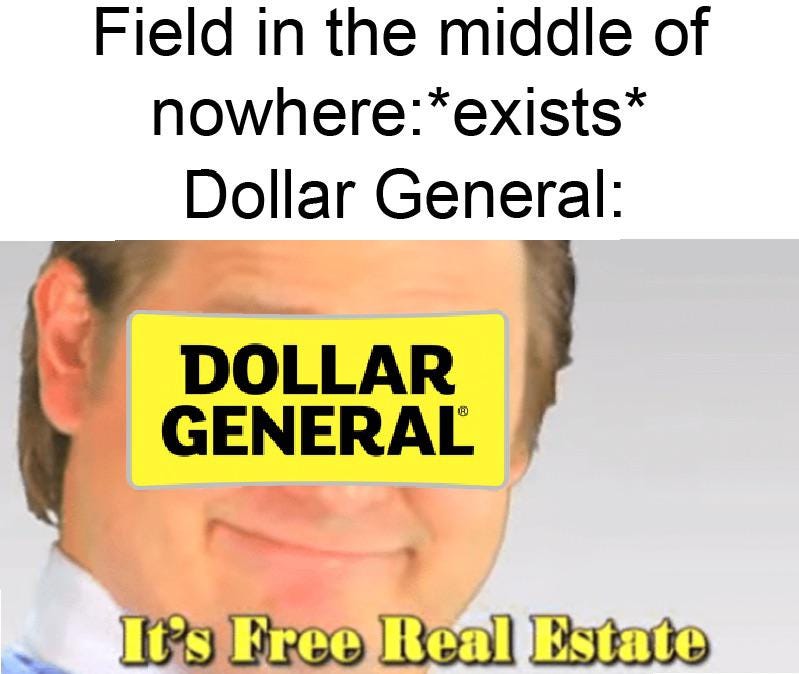

Scary Plans? They target rural communities who often do not have a grocery store in their town, which gives the dollar stores a monopoly on those communities.

They mostly operate in very intensely rural areas - think of the most small-town esque area that you can imagine (2 lane road, gas station, maybe a church across the street).

They purposefully plan to be in areas with limited shopping options - they search for food deserts (serving a purpose there) and target households with incomes of < $40k.

In fact, when Dollar Stores enter an area, the sales at a grocery store in the same area decline by 30% on average.

Supply Chain Genius? They keep SKUs low - so each store has between 10-12k products, whereas a store like Walmart has ~60k

They have a private truck fleet which enables them to circumnavigate the messiness of the supply chain

What’s the Difference?

Dollar Tree: Literally only offers products that are $1 - larger, with a focus on seasonal items and less on grocery items

Dollar General: Operates more as a discount retailer - smaller, with a focus on the necessities.

They plan to add over 1,000 new stores this year, and double their store base from 17k to 34k.

They also don’t OWN THEIR STORES - they lease them, which keeps costs down.

They also have the grossest design possible - “metal shelves, strip lighting, and low cost signage”. The average shopping trip is < 10 mins.

Nearly 1 in 3 new stores opening in the US is a Dollar General. That’s terrifying.

Dollar General is one of the most profitable stores in the rural US. Sometimes, it’s the only store in the town that offers grocery products. In fact, there are more Dollar Generals than there are McDonalds, which highlights the sheer ubiquity of the company. The Dollar Stores are in places where Walmart won’t go, and that gives them strength, and a grip-hold on communities.

With estimates that 75% of the population lives within 5 miles of one of their stores, Dollar Stores have the reach necessary to be successful. Walmart, the dollar store’s biggest competitor in terms of price point, has locations that only reach 37% of the population within that same 5 mile radius.

The Psychology of George Washington

Dollar General plays right into psychology and uses framing bias - often times, their products aren’t cheaper.

They trick people into paying less, but paying more per-ounce because the quantities offered are smaller.

People think that they are paying less for the product that they purchasing, but really they are paying more down the line. Paying $1 for 12 oz now at the dollar store, sounds a lot better than paying $1.5 for 24 oz at the supermarket, but that 0.50 cent difference coupled with the smaller quantity adds up over time.

Just because it’s cheaper doesn’t mean it’s ~cheaper~

Dollar stores aren’t meant to be real grocery stores full of fresh food (despite many people using them as such, out of necessity) They’re designed for fill-in trips, to grab a quick microwave dinner in the middle of the week. Most of them don’t carry perishable goods which enables them to keep their margins up.

The dollar stores, with their smaller scale and selection, don’t need to pay as many workers as grocery stores, and they can focus on the high-margin packaged products, which happen to be the unhealthy ones.

The Income Gap: The Importance of Just One Dollar

As the Dollar General CEO once said, “The economy is continuing to create more of our core customer“. The shrinking middle class plays right into their target market.

Dollar General's might not be a net positive on society - they tend to cannibalize and prey on other stores.

“There’s growing evidence that these stores are not merely a byproduct of economic distress. They’re a cause of it. In small towns and urban neighborhoods alike, dollar stores are leading full-service grocery stores to close. And their strategy of saturating communities with multiple outlets is making it impossible for new businesses to take root and grow.”

But on the flipside, they offer rural communities access to food - and that is very important.

Whole Foods operates on the other end of this spectrum. As stated by Dennis Berman, “Amazon did not just buy Whole Foods grocery stores. It bought upper-income, prime-location distribution nodes for everything it does”

They are expanding into healthcare - their items are cheaper than drugstores (~40% so). It’s good that they are going into this much needed space (and there is a plan to use them for vaccinations too)

The Path Paved with Gold

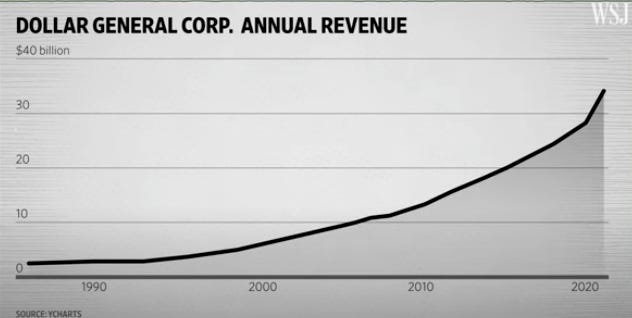

All of this adds up into a pretty strong profile for the Dollar stores.

What’s the bull case?

They are insulated from the necessity of innovation, because their core customer does not require a showroom experience or an online platform.

Dollar stores operate lean, and that allows them to avoid the ongoing supermarket transformation, and protect them from some of the issues plaguing the industry.

They have an incredible operating style, which is hard to replicate.

They have low labor costs, small and simplistic stores, a limited number of products, and an efficient supply chain.

Their sales and growth numbers are unparalleled.

The bear case is Amazon.

The income gap will continue to widen - so I don’t think that the dollar stores core customer is going to go away.

But if Amazon chooses to go into this market - I truly don’t think that anyone will be able to beat them - including dollar stores.

Overall, the dollar stores should continue to take share in grocery, especially if pressure on the economy increases. Its niche in its offerings, has a captured target market, and has a monopoly on several rural communities.

As the world of retail evolves, Dollar General especially has a business plan that appears to be bulletproof, and will continue to be profitable - for better or worse.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

There's actually a new gRoWtH sToCK dollar store called Five Below ($FIVE). I actually love the place. If anyone can dethrone the king it's those guys.