The F*ck Around and Find Out Quadrant

Elon Musk, Netflix, the yen, and economic fragmentation

Analyzing things. I am doing the asterisk in the word but we all know what word it is.

If you’re already subscribed, thank you! If you’d like to subscribe, please do so here:

😎YouTube and podcast up tomorrow!

⭐️A quick housekeeping item - if your company would like to partner on a project with me, please fill out this partnership form!

This is a scientific quadrant that was created by Venkatesh Rao. I said “well, that seems like a thing that could apply to many other things in this economy so let’s analyze”.

So here is the f*ck around and find out quadrant (these are my own definitions).

F*ck around and Find Out: In my opinion, this implies big change. People are making big decisions, and they are making those decisions with goals in mind.

F*ck around and Don’t Find Out: This has an element of being resistant to change - because you never find out. You’re just goofing off or trying to prevent something from happening

Don’t F*ck around and Find Out: This is “reasonable” change in my opinion (whatever reasonable even means) because you’re still finding stuff out, but in a more orderly format

Don’t F*ck around and Don’t Find Out: Stuff stays the same basically here

Part One: Elon Musk and Twitter

So the richest man in the world is trying to buy the bird app, in case you hadn’t heard about that. I wrote about it in detail last week if you want a recap.

The quadrant:

F*ck around and Find Out: Tender Offer

Tendies: This is what Elon seems to have in mind for his Twitter takeover based on his more recent tweet (and news).

There are a lot of different ways that he could go about this but the main goal is for him to go to Twitter shareholders and say “hey there Twitter Shareholders, I will buy your Twitter shares for more than or equal to $54.20, let’s get me to 51% of Twitter Ownership, so I can Take Over This Company aha”.

Money: Shareholders seem to support that idea (at least the vocal ones) but the mechanics of it are something else entirely. However, as Matt Levine has highlighted (as of today) Elon now has the money! This story just keeps evolving.

He has more money because Tesla had such a banging quarter

He has letter from his banks and has agreed to put up $21 billion of his own money! So he is definitely going to get the cash from somewhere, probably it seems - and is potentially willing to pay more

Is this a good thing? It could still happen and it probably will happen but there’s a whole other side to the “Elon Musk taking over Twitter” thing -

Reddit alternative Voat is sort of what Elon and everyone else who thinks they are being censored seem to be envisioning. Voat just shut down. So the grass is always greener, but that doesn’t mean it’s going to get watered.

F*ck around and Don’t Find Out: Poison Pill

No thanks: Twitter’s board does not like this Tender Offer idea, so they’ve set up a poison pill. Basically if anyone (here Elon) buys up more than x% of their shares Twitter will allow other shareholders to buy more shares.

Specifically if someone (here Elon) gets to more than 15% ownership, other Twitter shareholders can pay $210 to get $420 worth of stock at the current share price, completely diluting Elon’s ownership! Ha! Got em.

Don’t F*ck around and Find Out: Negotiate

Probably not: The most reasonable option here is negotiation but we all know reason is simply a silly thing that doesn’t exist anymore.

The Board of Directors does have a duty to their shareholders, and they *can* rationally reject Elon’s $54.20 offer, considering where Twitter has been.

Elon could (and he might) come back and say “okay I will pay more” and then they could accept that offer.

But they also have other offers coming through. Apollo was like “hey sure, social media sounds fun to own” and if Apollo offers more than Elon they kind of have to consider that.

Don’t F*ck around and Don’t Find Out: Goodbye

This is the one where everyone walks away.

Maybe Elon tweets out “just kidding everyone, I am going to focus on the 57 other companies I run” or maybe he starts his own social media company or maybe he goes to Mars and develops a dogecoin-based economy there.

I think that Elon prefers to play in the f*ck around part of the quadrant, so - more to come from this wonderful saga. I don’t know.

Netflix: The Downfall of the FAANG Regime

Netflix. Tesla? Companies passing costs off to consumers? Everything becomes a subscription model in the end (ad supported?).

Netflix was a darling of the tech world! The growth would never end! More subscribers, more amazing content, more GROWTH. But Netflix experienced a weird kiss of death - a combination of several factors -

Growth pulled forward from the pandemic: A lot more people watched a lot more TV in the past two years because we were locked inside for several months. So a lot of people consumed a lot more Netflix, and that was very good when it was happening, but not so good when the well of content began to dry up.

There is also saturation - they have 220 million subscribers + ~100mn sharing passwords, so they have to figure out a way to break out from that

Streaming wars (and the premium of consumer attention): Getting people to pay attention to anything is difficult. Netflix is competing with Disney+, Hulu, HBO, ESPN, TikTok, Instagram, YouTube (especially), Twitter - basically anything that takes consumer eyeballs can be seen as a competitor.

The decentralization of content: As we saw from the toppling of CNN+, people are only going to want to subscribe to so many things. It’s pretty tiring to pay for 15 different subscriptions to news outlets, streaming channels, fitness apps, whatever - there is an element of subscription fatigue that is potentially beginning to bubble underneath the surface

Good content is hard: Good TV shows are kind of hard to make! And I think that Netflix spends enough money that they should be more of a content machine, but also it’s difficult to make good things sometimes. They could be doing a lot more to make their path easier, but TV shows are art! Art is kinda hard!

Macro regime: Netflix is discretionary spend. People don’t really need them. When faced with 8%+ inflation, you’re going to start cutting back on some subscriptions. Inflationary pressures might place increasing pressure on Netflix - and the “first subscriber loss in a decade” could become a pattern vs an anomaly.

The quadrant:

F*ck around and Find Out: Advertising

Sure. As Ben Thompson wrote in his piece “Why Netflix Should Sell Ads”, Netflix should consider… selling ads. He points out that ads would expand their subscriber base by providing a cheaper alternative for those that don’t really care if they watch ads and also help Netflix acquire more content.

As Ben writes, “Netflix demands scarce attention because of its investment in unique content. That attention can be sold, and should be, particularly as it increases Netflix’s ability to invest in more unique content, and/or charge higher prices to its user base.”

The market has really beat them up. So they kind of need to f*ck around here.

F*ck around and Don’t Find Out: Password Crackdowns

This will probably make consumers the most angry at them (risk losing more subscribers). If they start implementing measures to make sure that your aunt in Nebraska isn’t sharing an account with you, it could leave a bitter taste.

Don’t F*ck around and Find Out: Gaming Focus

This is something that Reed Hastings has highlighted as a focus for the company, and it makes sense. He said in an interview with Insider - “People want to lean back and be told good stories; that's Netflix. And the other part is interactive play, which grows into video gaming.”

This was meant to be their saving grace - a new way to monetize and get subscribers - but it’s not what they are known for. It’s a step outside of their competency, a potential money pit of spend, and also a highly competitive space.

Don’t F*ck around and Don’t Find Out: Throw Money into Content

They could just keep doing what they are doing. They lost many subscribers because of the war in Ukraine, so they could nod and say “well we weighed all our options, and its best to focus on better programs and new shows”. Wall Street probably won’t be too impressed with that, but it would be a way that they can stick to their 24-year company ethos of not having advertisements.

The meta question

But Netflix is doubly interesting because there is double impact from them. Sure, they are the leader in streaming services, but they are also FAANG. They are THE MIGHTY TECH INDUSTRY, and with them taking a tumble, so does the rest of tech.

And then that gets into the big question of consumer spending - if people are beginning to cutback on spending, what does that mean for GDP growth? Is NFLX the flashing red bell for the entire tech sector? There’s a lot that could play out from this.

The Yen and Global Consequences

this next part is pretty much a 180 degree shift in tone, sorry about that

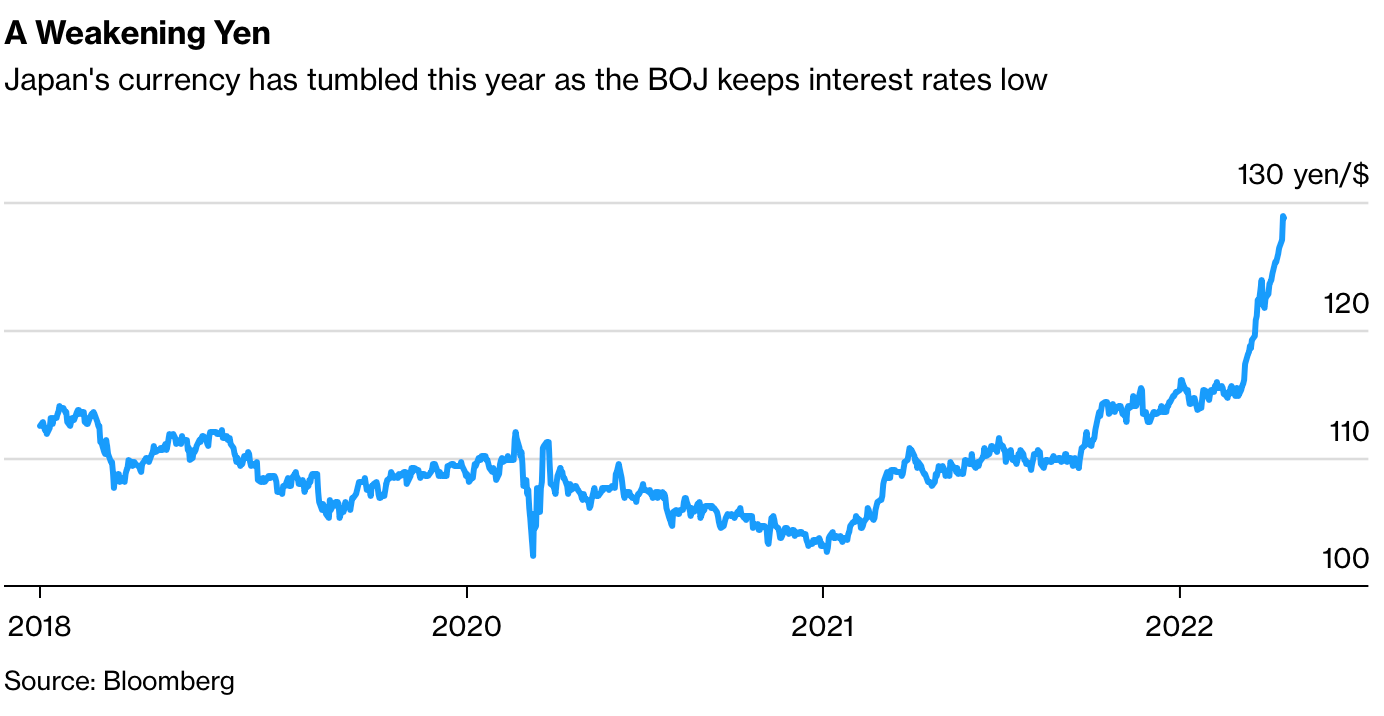

The yen is weakening through a combination of monetary policy divergence and Japan’s trade deficit (their imports jumped 31%). The Bank of Japan is trying their absolute best to make things okay (by offering to “buy unlimited amounts of Japanese government bonds”), but the market is not super happy about that - the U.S. is in a tightening regime, and Japan is in quite the opposite.

And what’s the problem with that? As Adam Tooze highlights in his Chartbook, there are a lot of problems with this.

The relationship between the yen and the dollar matters: Japan is a huge buyer of US treasuries, and if all the sudden Japanese investors have to pay a premium because of yen movement, it’s no longer as “attractive for Japanese investors to buy US Treasuries even if the US bonds promise a premium in terms of yield.”

Who buys Treasuries then?? If all the sudden, that demand flow from Japanese investors slows to a trickle, that would be a very bad thing. Compound that by the Fed purchasing less Treasuries as they shrink down the balance sheet and things can become messy for the U.S. debt market.

Is *this* the end of the dollar? Tooze highlights that this divergence in monetary policy could be more impactful to the dollar system than Zoltan’s weaponization of the dollar thesis. In his own words, “the uncoordinated response of central banks to that pressures will prove to be a more significant test of the dollar-system than the fumbling efforts by Russia and its trading partners to find alternatives to the dollar.”

Also - a weaker yen is damaging Japan’s economy, creating “imported inflationary pressures” and hurting both firms and consumers.

There is only one option here I think (unless the Fed completely pivots) - f*ck around and find out.

The quadrant:

This is once again domestic protectionism coming front and center, as Matthew Klein wrote about. Central banks are making decisions relative to their internal economies, but those results play out on the global stage.

Zooming out more, we are starting to see the consequences of debt-fueled growth playing out. 65% of emerging market government-to-government lending is owed to China - and a lot of developing nations simply cannot afford their debt burdens anymore. As Nicholas Mulder said in his excellent interview discussing the inflationary energy environment with Alex Yablon and Javier Blas in Phenomenal World, “the central issue is burden-sharing.”

That isn’t happening - rather it’s the opposite.

Economic Fragmentation

The IMF managing director came out the other day and said -

“The war (in Ukraine) has also increased the risk of a more permanent fragmentation of the world economy into geopolitical blocks ... It also represents a major challenge to the rules-based framework that has governed international and economic relations for the last 70 years.”

She also highlighted that we are facing" “a crisis on top of a crisis” - a pandemic, a war, economic turmoil, food shortages, an energy crisis, and a boatload of debt.

There is fragmentation at the individual level too - whether that be from the increasingly concerning culture war (I don’t know what to call it) that is bubbling or anti-patriotic tendencies combining with nihilism - there is a lot going on.

Martin Gurri, the author of The Revolt of the Public and a former CIA analyst said in an interview with Vox (he was also highlighted in Why the Past 10 Years of American Life Have Been Uniquely Stupid)

The digital revolution has shattered that mirror, and now the public inhabits those broken pieces of glass. So the public isn’t one thing; it’s highly fragmented, and it’s basically mutually hostile. It’s mostly people yelling at each other and living in bubbles of one sort or another… The public only really unifies around what it rejects. This has profound political consequences. People can’t organize around a common idea or worldview, but they all seem to agree that they’re pissed off and they’re against ... the system.

And he spoke at length about the elites (and how out of touch they are) - and how there is probably going to be a shift where we have to have a different model of democracy.

A lot of people want change. But they don’t know what they want the change to be. All we know is that we no longer trust our social networks, our stories, or our institutions. But we don’t really know where to go or what to focus on.

There is a feeling of losing the narrative because we have existed in the extreme end of the distribution for almost 3 years now - there is a profound sense of hopelessness because we’ve watched our systems erode in real time.

Whether that be from the unresponsiveness to (1) energy policy (“they don’t care about our future”) or from feeling financially barred from (2) home ownership (“I will never achieve the American Dream”) or (3) frustration at the system - it’s a loss. As Martin says “we have a system built on the control of information that has increasingly lost its ability to control information”

(1) Energy Policy

We can’t have green energy policy without green energy investment. That’s been a core component of the Kyla newsletter for a long time. It’s a fragmented and sad.

The green energy transition is not quite happening. Reclaim Finance recently published a scorecard ranking these asset managers on their commitment to green energy policy, and it sucks. As Bloomberg wrote:

Coal financing: 23 / 30 firms allow investments in companies that are starting new coal projects and hold “$82 billion in companies developing new coal projects.”

New oil and gas: 0 completely restrict holding companies involved in new oil and gas projects and 0 are calling for companies to “immediately and progressively decrease” their overall fossil-fuel production.

Passive in both investing and opinion: 0 apply their existing fossil-fuel restrictions to their index-tracking assets, which is particularly concerning given that “passive” investments keep growing

ahhhhHHHhhhhhh

I get it! You get it! We can’t just stop using oil all the sudden, coal is coming back into fashion because even oil supply can be tenuous at time (North Dakota just got shut down by a blizzard, Libya is in a political crisis, and OPEC has underinvested and is subsequently underproducing). We are going to have to deal with coal, gas, or nuclear, and as Frustrated Realist highlights in their thread - nuclear is one of the better options that we have.

There is also individual responsibility here too - but corporate responsibility also has to really keep an energy transition in mind. You can’t not give oil companies money right now, but to be like “hehe just keep doing what you’re doing” is not great. There has to be a level of responsibility.

So it’s tricky. Of course. Incredibly tricky. But something has to change.

(2) Home Ownership

You have firms like Blackstone buying up student housing because it’s an inflation hedge for them because they can charge students more in rent. And like sure maybe they can make student housing and build to rent homes better and build more and things will be great - but there are second order effects to that.

Stability is feeling increasingly out of reach for the average person.

People are backing away from purchasing homes because mortgage rates have skyrocketed - but even if they wanted a house, there is a huge gap between housing starts and finished homes - a combination of policy, material and labor shortages, and more.

And to many, it feels like the American Dream™️ is Over.

(3) Frustration at the System

And this circles back to Gurri’s point.

Right now, we are in the barbells - Anger at the Man - and it’s playing out differently, but the underlying response is the same.

I wrote about this before in the Polarization of Crypto Narrative - where two groups actually have really similar goals but because they speak past each other, reconciliation is never an option. I wish I had some sort of solution for all of this. I really liked Jonathan Haidt’s ending to his piece where he wrote -

We cannot expect Congress and the tech companies to save us. We must change ourselves and our communities. What would it be like to live in Babel in the days after its destruction? We know. It is a time of confusion and loss. But it is also a time to reflect, listen, and build.

It’s a time to create new stories. Things have fundamentally changed - a pandemic, a war, crypto ownership, wealth distribution and concentration, etc etc etc and an era where what used to work no longer works anymore. Maybe it’s time to f*ck around and find out - whatever that means.

Links

Inflation is NOT transitory anymore - Liberty Street Economics: Inflation Persistence: How Much Is There and Where Is It Coming From?

Adam Tooze: Tension in the dollar-system. Could a plunging Japanese Yen upset the US Treasury market?

VoxEU: Discovering the ‘true’ Schumpeter: New insights on the finance and growth nexus

Jonathan Haidt: Why the Past 10 Years of American Life Have Been Uniquely Stupid

An interesting thread on dynamics in China

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

Can you give some definitions of "fucking around/not fucking around" and "find out/don't find out" please. What is that supposed to mean?