This is a macro market update (I post daily to TikTok). I publish these once a week (beta phase), as well as single stock pieces (1-3x a month) and macro deep-dives. I also publish on TikTok, Youtube, and Twitter!

Check out the YouTube for this piece here!

Also, this is a longer piece, so it might be cut off if you’re reading from your inbox!

Long Ago in a Far-away Monetary Land

“Money has always been a meme from Day 1. What seems whacky and modern is a return to the traditions of the ancients" - Sid Verma (I think)

The market is a narrative. There are earnings, cash flows, term structures, valuation models, etc - but a lot of short-term movement is driven by what people are saying. Reflexivity - perceptions impact fundamentals.

So you say, “Kyla, of course the market is backed by storytelling - tell us something new!”

But the important question here is what percentage is swayed by fundamentals versus storytelling - and it seems that most of the market is moving on the qualitative vs the quantitative.

The Elon and Bitcoin narrative is a great example of this -

Elon tweeted that Tesla would no longer accept Bitcoin as a form of payment, and Bitcoin tanked.

He then kept tweeting -

That he was working with doge developers (more on that later)

That there should be a carbon tax

Responding with “indeed” when someone said that Tesla should dump all their Bitcoin

Then clarifying that Tesla has not sold their Bitcoin (yet).

But it’s not just Bitcoin that responds to sentiment - the pumpcoins are driven entirely by social narrative.

Pumpcoin price is almost directly tied to perception because there is no fundamental value to these coins - only what people are posting about it.

And the narrative moves quickly, even outside of the crypto space.

Oil is sort of a meme at this point, along with the other commodities

Last year, the price of oil went negative (something that literally is not supposed to happen)

This year, people were going to gas stations with plastic bags because of the Colonial hack and supply fears.

Narrative evolves within the span of a few days or months, with markets (and market participants) shifting from one extreme to another with surprising fluidity. This is not a novel concept - no one really knows what is going to happen at any point, and narrative is the only supporting evidence we can give to any theory that we develop - reflexivity is well known.

The Inflation Narrative

Ah, inflation - the two-sided story.

You have the Fed assuring people that there is no inflation, that things are transient, that this too shall pass

On the other side, in an almost comically reverse fashion, you have very clear evidence that the market does not see this as transitory - or even if it is transitory, the transient will send permanent shockwaves through the system.

There is a chip shortage that requires a summit.

There is a chicken shortage.

We all know about lumber, copper, and corn.

Chick-fil-a is running out of sauce.

People are worried. The narrative is a circle. That’s because people seek out things that they fear. It’s apart of our narrative as a species - we find the things that scare us, and try to tackle them. We go on Google, and we search “inflation” - and we worry. And that worry perpetuates more worry, so on and so forth. The doom loop.

Inflation expectations have continued to rise, to the highest levels since 2008, nearing 15-year highs - all the “extremes” that you can imagine, inflation expectations are close to them. But why?

Supply and Demand: A lot of the inflation expectations are driven by shortages in the supply chains (+reopening demand), not enough materials, precious metals skyrocketing in price.

The Spoken Word: Companies will mention it in earnings reports, people search for it online, and people talk about it - “the cost of a cup of coffee is $7 now, talk to ME about inflation - the narrative itself perpetuates the inflation.

The market gets spooked about valuations getting depressed because of inflationary worries. Yields pop because of inflation expectations, which spooks the market even more. The market is jumpy to news (but only to the CPI funnily enough - things hardly budged when the PPI came in hot).

This is the inflation perpetuation cycle.

The market is reactive to the fears.

But the Fed won’t raise rates until inflation > 2%. They want maximum employment. Then, they will adjust. The Fed could take its target inflation rate higher - they could go after 3%, giving themselves room to tighten on the way down. Let things run hot.

But of course, the opposite narrative of inflation always exists too - deflation:

We have deflationary pressures such as automation, globalization, alternative sources of energy, demographics, remote work, and much more.

And some people, like Cathie Wood sees deflation as our future.

The Narrative of Money Flow

Cathie Wood has created her funds by telling stories.

ARK itself benefits from narrative:

Low rates

Tech focused

Tied into Tesla and Bitcoin

Cathie has created funds around the innovation economy. Her valuation models rely a lot on narrative - that companies will ~do things one day~. People believe in her - she is a good storyteller and paints a picture of a tech-driven, innovation focused future.

Her thesis is driven by more qualitative assumptions about the future versus quantitative (although they do have several models, I think they end up telling a story based on goals and hope a lot of the time).

Her funds have had an incredible amount of inflow this year - with roughly ~$1.1bn of fund inflows coming from retail from the $28bn of total inflows. So mostly institutional. But now, the institutions are turning against her.

"The put premium traded in ARKK constituents has also exceeded the call premium for the first time ever, which suggests that institutional investors are trying to crush extremely overvalued stocks," Vanda Research said.

Cathie’s thesis doesn’t fit into the narrative of inflation. Her tech stocks are overvalued - they don’t meet the market narrative of fair valuation (whatever that means anymore). So institutions are crushing her.

The Narrative of Institutions

Institutions always find their way into places. We told this narrative with GME, AMC, etc, all the meme stonks - that retail investors were driving the markets, when in reality, institutions have a very big piece of the pie.

The narrative of retail vs the institution is very prevalent in crypto too.

Institutions are stepping in and demanding that crypto moves according to their will - the institutions will go after governance tokens, try to command the market, and, in general, takeover. They do this with most things. The concept of decentralization is powerful - but money is the most powerful.

Money follows the narrative.

The fund inflows allowed Cathie to tell her tech-focused, innovative story.

Money allowed the GME, AMC pump to manifest, after the narrative appeared on Reddit.

The crypto narrative is appealing to institutions - so they are now coming at it with all of their money in an attempt to make it their own.

The Narrative of Debt

Money is awash in the bond market too.

As The Market Dog said on Twitter - “If I oversimplify everything & take one billion shortcuts, what the FED is pumping since March is simply going back to the FED. Closed Loop.”

The Fed bought a ton of bonds at the beginning of the pandemic to keep the market afloat with QE.

QE = buying bonds from banks, crediting them with reserves

RRP allows institutions to park cash at the Fed, reducing the amount of reserves in the system, which allows the Fed to do QE.

The RRP is a drain so the Fed can keep doing what it wants to do - which is ~$120bn asset repurchases every month through QE.

The narrative of QE is perpetuated by paper being pushed around. It allows the Fed to tell their story of keeping the market up, of keeping companies alive.

It bleeds into how other people see the U.S. bond market too. Foreign buyers are active - but not necessarily in treasuries. They are purchasing corporate debt - because they see treasuries and corporate debt as one and the same. Both backstopped by the Fed. As BofAs Hans Mikkelsen said, “The US imports electronics and exports BBB credit.”

The narrative has shifted. People are searching for yield in everything - with CCC yields pushed to all-time lows:

Investors are willing to take on significant balance sheet risk in order to scrape off a few percentage points of return.

This is completely acceptable in today’s market environment - the HY default forecast has fallen to 2% for 2021. So scraping for yield is pretty much riskless.

"Enhanced liquidity and low near-term maturities due to favorable capital market access and government stimulus lowers the default risk for many companies that experienced sharply reduced cash flows during the pandemic” - Eric Rosenthal

I would argue that Eric’s quote also applies to crypto - enhanced liquidity that has flowed into the crypto market has created a powerful narrative.

The Narrative of Crypto

Epsilon Theory has a great piece here about the narrative between Wall Street and Bitcoin. In their eyes - '“Bitcoin has been an authentic expression of identity, a positive identity of autonomy, entrepreneurialism, and resistance to the Nudging State and the Nudging Oligarchy.”

I think that crypto serves as a call to action away from everything that I wrote about above - the Fed, the institutional power, the interference - but I do think that there is a bit of a narrative problem in crypto at the moment.

People want crypto. That’s pretty clear.

Retail brokerage volume is slowing in the equity markets. After wacky options volume and the meme stonks (event though AMC is being squeezed again), it seems that a lot of the “newer” retail investors are moving to crypto.

These investors are drawn in by narrative - how quickly can you make money, what are the crypto projects about, and what is the best coin to invest in (out of the many hundreds). And of course, the pump and dump.

There is bias creep here - investors can get swayed by the expensive price tag of some stuff (even though you can fractionalize it) just like how people get swayed by the expensive price tag of $AMZN. This bias allows for narrative alteration - like what happened with $YFI and $WOOFY.

The narrative of unit bias

$YFI is a governance token for the digital-asset management platform, Yearn.finance. It’s pretty expensive (~$80k) because there are only 36k coins in circulation. So someone created $WOOFY, which is a bidirectional peg to $YFI.

This accomplished two things:

Fed into the dog coin narrative - (Shib coin, dogecoin, etc)

This is a “unit-bias a/b test” - people will buy $WOOFY because of the meme narrative it has - and it’s cheap

$YFI is a real protocol that issued a dog meme coin at a millionth price denomination so people could play the game. People will buy a coin named $WOOFY that trades < $1. That bolsters $YFI.

But the $WOOFY works because people are so accustomed to the memefication of these coins. They are looking for things like $SHIB and $DOGE because those are the ~dog tokens~ those are the things that are going to do well because someone is pumping it on the other end.

People seek the pump. And sometimes, that pumper is Elon Musk.

The Narrative of Elon

Elon Musk is very good at what he does. He tweets things that probably should get him investigated by the SEC - that his own company is overvalued, things about the company that are material information, and basically just trolls online.

Elon sent the market into a tailspin with the below tweet.

And he just kept on tweeting. The funny thing was, most of Tesla’s profit was from their Bitcoin holdings this most recent quarter (and regulatory credits).

Then, Elon changed his mind. Maybe it was ESG pressure from somewhere. But regardless, he hit *send tweet* and Bitcoin went spiraling - and then he tweets about doge (which is basically eloncoin).

Elon moved the Bitcoin market, just like he has done so many times with doge. One man, one tweet, moved the market. And that is the power of narrative, that is the way that things are divorced itself from fundamentals, that is the general skittishness of the the market.

It’s not just crypto. Janet Yellen merely mentioning higher rates spooked the market into a tailspin. The moves are steep and dramatic. It’s the power of storytelling.

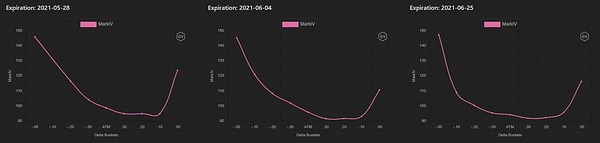

And I acknowledge that there are market variables - futures and options do move the market - both in crypto and the stock market.

But sometimes, it is a story.

Conclusion: It’s Always Narrative

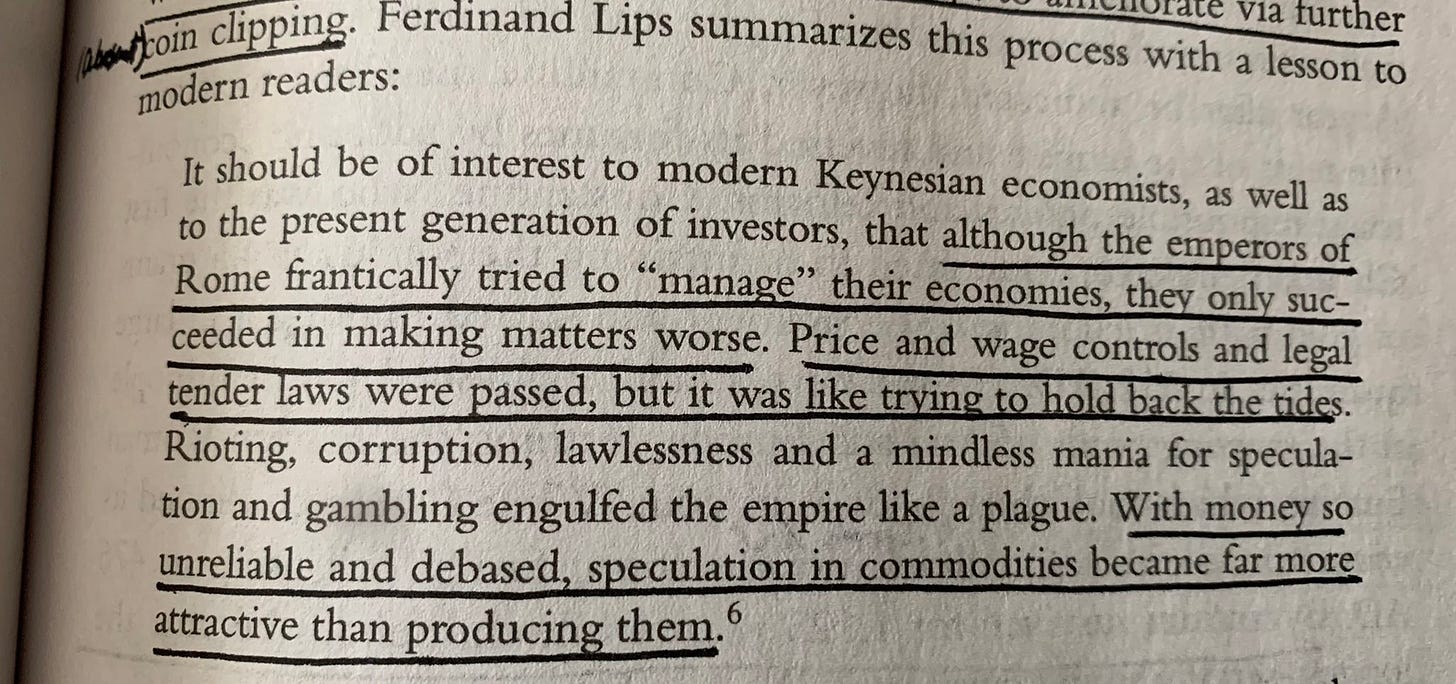

We have been here before.

Speculation more attractive than production. Managed economies getting worse with more and more management. The qualitative outweighs the quantitative. The fundamentals fall wayside to the story.

Rome went through it. History doesn’t repeat itself, but it sure does rhyme.

As Alex Good said, “Price determines outcome. Outcome does not determine price”.

This whole piece describes reflexivity - how we have a meme war in GME and AMC and the pumpcoins, a supply chain crisis that will ultimately result in *too much supply* as we shift from spending on goods to spending on services, and the constant narrative of inflation as the backdrop to it all.

The market is driven by storytelling more than anything right now - and those that hold the pen, like Elon and Yellen are able to shake the markets. And as storytellers, they get to decide when the “The End” comes up in the story.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

Thanks