The Stonk Market

How the Markets Became a Meme

The market is no longer driven by fundamentals. It’s driven by memes.

What is a meme? A meme is an idea, behavior, or style that becomes a fad, spreading by means of imitation from person to person within a culture. They drive how we interact and serve as visual news sources, and ultimately are tools of navigation. We use them as methods to process the massive amount of information thrown at us every single day.

This broader meme movement is reflected in something important -

The stonk market.

Check out the Youtube here

and subscribe below!

The Meme Market

The stock market is a reflection of memes, notably magnified through SPACs, NFTs and GME. The memefication has displaced reality from valuation, as fundamentals grow less and less useful as each new flying helicopter company hits the market.

It’s not a bad thing – it just reshapes how we think about investing and the decisions that we make around portfolios. This is a hype cycle in a bull market. It’s to be expected. The core drivers are some of the financial tools (SPACs), but it’s also the broader market environment – memes are no longer a metaphor, but a living structure, called the stonk market.

The perfect meme storm has been created through a combination of 4 factors:

Market enthusiasm: A function of lack of consumption opportunities during the Pandemic and information access via Reddit forums/Twitter etc

Risk-on sentiment: The “Pandemic YOLO” coupled being stuck at home

Liquidity: As ~40% of stimulus checks headed right to the stock market, it makes sense that excess will create exuberance.

Meme markets: SPACs, NFTs, and GME are all real products that can be traded, and have financial value, but at their core, they are memes.

The markets are currently driven by a core memetic thread resulting in the disconnect of reality from fundamentals. This can be looked at from a few different angles – SPACs, NFTs, r/wallstreetbets, and the general frothiness that information access creates. There are several people who have built incredible systems around this (most notably, Alex Good – linking his checklist here). As Alex states in one of his weekly recaps –

“Equity markets are becoming delegitimized by SPACs and meme stocks… the free markets themselves, are largely a meme.”

There are 6 parts to the memefication of the markets, fueled by the 4 factors above.

SPACs

The Tesla Effect and Elon Musk

ARK Invest

NFTs

GameStop

Retail Investors

SPACs: Memes as investable narratives

SPACs have gotten a lot of attention recently, with a lot of investors getting into the SPAC game. SPACs have an interesting structure, because they are basically a shell company with a dream. Investors invest with the SPAC with the hope that the SPAC will take a company public. SPACs have looser regulations relative to IPOs (the more traditional path to going public).

IPOs are normally conducted through a middleman, with underwriters interpreting the growth for investors. SPACs can circumnavigate that with softer regulatory constraints and tell the whole story (however outlandish that story ends up being).

Here’s how the structure works (at a very high level):

SPACs are fascinating because they are a mystery box IPO – it could be anything, ranging from EV, AI, Robots, terraforming, and vertical farming – and that’s new and exciting. And that excitement is reflected in the market movement.,

2019: 59 SPACs raised $13.6bn

2020: 248 SPACs raised $83bn

March of 2021: >260 SPACs raising ~$80bn

We are only 3.5 months into the year, and SPACs have already outpaced all of 2020 numbers. If we continue at this pace, we will see $275bn of SPAC flows, across more than 900 SPACs. Considering the structure of SPACs, this will make hedge funds and SPAC sponsors happy, but investors are likely getting the short end of the SPAC stick.

The important thing to remember is that SPACs are tools. They are financially engineered products. They can be multipurposed – sometimes they are an investment opportunity, but sometimes, they can be used to simply shift risk:

Hype Cycle: The SEC had to step in and warn against joining a SPAC because so many celebrities were forming their own – with the reminder that hype and performance are not positively correlated.

Risk Reallocation: Sometimes the SPACs can be used to pay down debt. That shifts the risk of a levered SPAC and the loan investor to the equity investor – allowing the company to have a more liquid balance sheet and eliminate high-yielding private debt

Sponsor Incentives: SPACs are popular because it’s an easy way to get paid as a sponsor. They earn about 20% of the equity independent on deal outcome – and post-deal, the owners of the SPAC are left holding the company.

Supply and Demand: There are about 400 SPACs on the hunt for target companies – which is a lot. There were 480 IPOs in 2020 (1.5x more than any other year). There are two headwinds here: supply of companies (there are only so many companies that are ready to SPAC) and demand of SPACs (lack of choice can lead to bad decisions)

Bad Companies: Because of the combination of supply and demand misbalance, the incentives of sponsors, and the potential for SPACs to simply be a way to shoulder off risk, sometimes bad companies can get SPACed.

SPACs are shells. They raise money with the intention to buy a company - whether that be a good or bad company is uncertain. Investors are truly investing on hope, in a way that transcends the usual pre-revenue tech investment.

SPACs sell because they have a story. They have narrative.

Memes are visual narratives. SPACs are investable memes.

Elon Musk + The Tesla Effect: The billion-dollar tweets

SPACs are connected into Elon Musk and Tesla. Most EV companies that are hitting the market are doing it through SPACs, and Tesla sets an interesting precedent for the EVs to match. This part of the meme market is compounded by two things:

The Tesla Effect: Tesla’s existence tacks additional multiple onto to any EV business, solely through association.

Elon Musk: Tesla is led by Meme King that creates billions of dollars in value simply by tweeting

Elon Musk

Some of the Tesla Effect (>50% most likely) comes from having Elon Musk as the CEO.

Elon is an embodiment of the meme market. He is remarkably successful at it – renaming himself Technoking of Tesla, his association with Doge, his $420 share price target for Tesla, randomly tweeting company names, his involvement with GameStop (Gamestonk) and so much more – he has created billions of dollars in value from tweets.

Knowing that you can tweet things to move markets is immensely powerful. He is very good at what he does, both in creating value for Tesla and pumping random cryptocurrencies. That power carries across the industry, fueling the Tesla Effect, and subsequently, the valuation of the EV SPACs.

The Tesla Effect

Tesla is a golden-child stock. It has defied expectations, achieved S&P 500 status, and got very close to a $1T market cap. Elon Musk created Tesla into what it is – and that success has manifested additional multiple onto any other EV company.

The EV companies are bold in their vision. There’s an article in the WSJ that discusses the big plans of the companies relative to Google. The fastest growing startup ever, Google took 8 years to reach $10b in sales.

5 Electric Vehicle companies think that they are going to beat that record (despite some having $0 sales at the moment). They’ve executed on deals with SPACs despite producing no revenue. Zero-revenue companies are not new, and lofty goals are always appreciated.

But these valuations are fueled by the coattails of Tesla, the general hype market, the froth of the SPAC environment, and the broader easy money atmosphere. This leads to mispricing.

There’s a research paper that analyzes the underperformance of the EV SPACs through the lens of the “Tesla Effect” (and subsequently, the Elon Effect). With the EV SPACs:

"Many mispriced SPACs in 2020 were linked to electric vehicle-related businesses (“Tesla effect”), raising concern whether investors understand what they are buying. On average, SPAC unit prices are higher after announcements of business combination, and more so for electric-vehicle SPACs… The coefficient on Thematic (cannabis and space) is indistinguishable from zero, suggesting that much of the mispricing may be limited to EV SPACs.”

EV SPACs are more mispriced relative to other SPACs.

Investors were associating these EV companies with Tesla and Elon, and assigning an arbitrary dollar sign to that, simply by association. A relative valuation, but a misplaced conclusion.

The Headwinds to the Tesla Effect

The EV industry has a significant amount to navigate over the next few years.

US legislative and regulatory efficiency

Limited availability of lithium

Issues with hydrogen fuel cells (notably with PLUG and FCEL).

Investors seem to be ignoring all that. There is a significant amount of money flowing towards EV companies. The thesis is not on fundamentals, but on hope and optimism yet again. Once again, not an inherently bad thing.

But memefication implies understanding. If we know enough to meme it, that means that we can distill it down and process it. But with SPACs, they aren’t understood – especially the dilution impact as illustrated by Nikola. Money flows are fine in a high growth environment, but as soon as the market pulls back, EV SPACs are going to be hit pretty hard. They are an incredibly elastic good in a competitive market fueled by association to one of the biggest companies in the world.

SPACs and Tesla are driven by meme markets. Tesla itself is fueled by Cathie Wood and ARK.

ARKK: Reversion to the meme

ARK owns a lot of Tesla. The funds have a ~10% exposure to Tesla. Tesla owns a lot of Bitcoin. And through Square and Grayscale, ARK has even more exposure to Bitcoin. So when Bitcoin’s price drops, there is this potentially ugly forced selling dynamic, which causes pain not only in Tesla, Bitcoin, and the ARK funds, but also in the Biotech stocks that ARK is a whale in.

ARK is then caught in a feedback loop with Bitcoin and Tesla. ARK also has a lot of inter-stock correlation too, with most of their top holdings (SQ, TLSA, TDOC, ROKU) mimicking each other’s performance.

ARK itself now owns > 10% of ~30 companies, according to Bloomberg. On top of that, there is an affiliate fund, Nikko Asset Management – and when combined, they control 20% or more of an additional 10 companies. The two own more than 25% of at least 3 businesses: Compugen Ltd., Organovo Holdings Inc. and Intellia Therapeutics Inc. Those are hefty positions in volatile companies.

This concentration works now because of the four market drivers: enthusiasm, risk-on, liquidity, and memes. But, as seen recently, moving yields will put pressure on tech valuations, which ARK has significant exposure to. These high-fliers that are based on cash flows 10-20 years in the future are vulnerable to rising rates – and if their valuations compress, that could be very bad for ARK.

With ARK, there is (broken out really well here):

Magnified illiquidity: ~20% of NAV is in illiquid biotech stocks that ARK is a whale in

Volatile Companies: More than half of the companies in ARK ETFs (85 out of 165 according to the WSJ) were unprofitable in the last year. Not being profitable is not a bad thing, but it can be a volatile thing, which could be painful if the rotation out of growth continues.

Inter-correlation: ~40% of the fund is dedicated to 7 companies that move together. TSLA, TDOC, SQ, ROKU, Z, BIDU, SHOP, and ZM perform similarly.

Concentration risk: TSLA is ~10% NAV across several funds. It would be more if it could be more.

ARK benefits from the concept of reflexivity too, as reflected by their inflows over the past year – rising prices attract more investors, and that’s a cycle within itself. Reflexivity, and investors chasing moving prices, shows up in another meme byproduct - NFTs.

NFTs: Perhaps a fart is art

NFTs are non-fungible tokens. With money, each dollar bill is the same, but with art, no painting is exactly like another – same with writing pieces, books etc. NFTs are meant to capture that uniqueness. They are digital assets, a cryptographic key to a particular address on the blockchain that points to the asset that you have NFTed.

The value to NFTs comes in three parts (highlighted in Santiago’s tweet thread):

Ownership and Authenticity: NFTs are a noun, not a verb – they point to the asset, they aren’t the asset themselves. It becomes property that you can buy or sell just like any other property (the legality of which still needs to be worked out). The inherent basis of supply and demand makes the market.

Abstraction: Money is just an abstraction of value. Art an abstraction of emotion. Digital assets an expression of code. NFTs are an abstraction of all three. Noelle Acheson describes it really well in her recent piece on emotions in the market – “If NFTs, in theory, give us price discovery on feelings such as “pride of ownership.”

Purpose: Its not about the merits of the medium, but rather the merits of talent. Just because it isn’t a painting doesn’t mean its not art

Broadly, it’s a mix of FOMO and memefication, with people NFTing ridiculous things (like a fart) but also beautiful works of art. That’s the hard part about memes – they are inherently clever and valuable in disseminating information to people, whatever we choose the information to be. Perhaps a fart is art.

There are worries of sustainability – proof of stake would be more efficient than proof of work. In order for this to scale, it does need to be contained. The current environmental concerns that crypto in general causes needs to be capped in order for them to be scaled.

If the environmental concerns do get worked out, it seems that NFTs will likely be around in some iteration as we rethink online property rights and move more into the digital age. But the current frothiness and heat in the NFT market is unsustainable – a situation that is also reflected in GME.

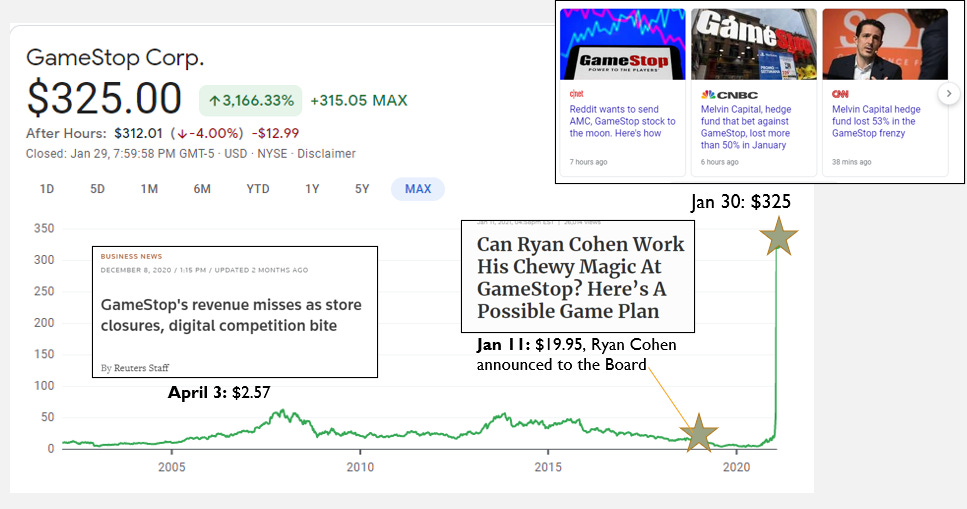

GME: The momentum of the collective meme

GameStop.

GameStop is the collective power of the meme market in its prime state. r/wallstreetbets has been around for a while, moving other companies before GME. When Hertz declared bankruptcy in May, 140k Robinhood traders added it to their portfolio, causing the share price to spike by > 1,000%. They did the same thing with Kodak.

GameStop was a combination of market forces. It was Hertz and Kodak but amplified.

There were 3 main drivers here:

Exogenous shock: The Pandemic created a lot of volatility and movement in the markets.

Stimulus package: This was a true liquidity inflow among a lack of consumption opportunities

Collective coordination: r/wallstreetbets is the prime example of the power that information access provides

Keynes said it best when he said “markets can remain irrational longer than you can stay solvent”. With GameStop, that’s the exact situation. It was 4 main players:

r/wallstreetsbets (within that was DFV)

Hedge funds: Melvin Capital and Citron Research

Brokerage firms: Interactive Brokers, WeBull, TD Ameritrade

Public figures: Michael Burry, Elon Musk, Chamath, AOC, Alexis Ohanian

The Set-up: DFV has been posting his GameStop trades for a while and has been bullish on the company back when it was ~$2/share. trades way way back, he’s been doing this forever. And Michael Burry of the Big Short announced he was long GameStop. And then in 2021, Ryan Cohen joined the board. r/wallstreetbets is a place for people to post memes and talk about trading. They keep a close eye on hedge funds – and they noticed that the hedge funds were short GameStop. And a perfect storm was created:

Hedge funds have a strategy of short selling – making a trade expecting the price of a company to go down. More specifically:

Short interest in GameStop was almost comically short - 140% of free float, meaning they were short more shares than were even available. r/wallstreetbets decided to take advantage of that, and engaged in a coordinated move to push the price higher.

Short Squeeze: Hedge funds were short GameStop, so r/wallstreetbets began to buy shares and options to put upward pressure on GME

The stock began to go up in price

This triggered margin calls, where the short sellers had to buy back a higher price

The buybacks triggered more demand for the stock and drove the price up

This short squeeze bled into a gamma squeeze, as dealers tried to hedge against the increase in the price of stock.

The stock began to go up in price (GME was just a giant momentum trade)

Option buying resulted in the price going even higher

The hedging of the stock resulted in the stock price going even higher

Rinse and repeat

Robinhood and the other brokerages halted trading. There were potential liquidity, solvency concerns. The brokerages had to protect their financial positions. The DTCC (Depository Trust & Clearing Corporation), the main clearinghouse for U.S. stock markets, demanded collateral from brokerages including Robinhood.

But people thought the brokers were shutting down to protect the shorts.

Some of the reasoning came from the brokerage revenue model: payment for order flow. Market makers, such as Citadel Securities or Virtu, pay Robinhood for the right to execute customer trades – so people thought trading was halted to help them, which only fueled the anti-establishment narrative even more.

Public figures (Elon, the Meme King) posted about GME. The rise of GameStop is the manifestation of the meme markets. It’s not going up on fundamentals – it’s going up because it can. Because bubbles can be created. Because the markets are abstract and divorced from reality.

GME was the peak of memefication. It was the memefying of the entire financial industry.

GameStop is still going up. The system hasn’t been debased entirely, but there are real structural cracks that bubbled to the surface. It’s uncertain of what the “final” outcome will be – and retail investors are still entering the market in droves.

Retail Investors: The Powers that Be

r/wallstreetbets is primarily retail investors. Retail investors are a big part of the memeficiation story. As a retail investor and a staunch advocate for investor education, I don’t think this is a bad thing. But I do think that some people are treating the market as a casino, not as a place for long-term wealth creation. And I can’t say I blame them.

Retail by the Numbers

Retail investors account for ~20-25% of all value traded in the market, up from 10-15% a year ago. GME put investors at the forefront of this conversation, giving them the power to actually move markets. Robinhood, a key part in providing access to investors, has added 6mn users over the past 2 months. Call option volume is at all-time highs. People are trying to figure out what money actually means. Several market factors gave investors the tools to start exploring trading:

Accessibility to margin debt and information access

Online brokers and low commissions

Stimulus checks and excess time in the Pandemic

Crypto was a leading indicator here, where retail has been more prominent and active relative to institutions. Even in the crypto space, investors are primarily concentrated in speculative assets. I am sure that a percentage of investors are bullish on the core part of these companies, but there is a lot of money chasing returns too – which is not inherently bad (money is money) but does underscore the continued move away from fundamentals.

Retail and Institutions

The Fed has a communication problem now, as do institutions. The Fed is ignoring the collective asset bubble in favor of transient inflation and easy policy, and institutions are moving far too slow in our hypergrowth world.

This gives retail investors a lot of power. From The Equity Market Implications of the Retail Investment Boom:

"Despite their negligible market share of 0.2%, we find that Robinhood traders account for over 10% of the cross-sectional variation in stock returns during the second quarter of 2020. The inelasticity of equity markets, which is potentially driven by investment mandates and the rise of passive investing... It is the inelastic demand response of institutional investors, that allows retail traders’ demand shocks to have sizeable price effects… Robinhood traders also boosted the recovery in Q2 by adding 1% to the aggregate stock market valuation."

We have so much information about so many things that the gatekeeping doesn’t make sense anymore. Institutions still have a lot of power – Bill Ackman’s CDS trade is a great example of the power of the institutional voice carries. But there is a change in tone. GME was more than just a meme of a stock or posting something in a Reddit forum – this was a collective knock on the door of the ivory institutional walls.

What’s Next?

What is beyond the meme markets? There are several things that I am keeping a close eye on (my attempt to integrate the fundamental into the meme!)

Earnings Numbers: There is a big gap between non-GAAP and GAAP (median difference between non-GAAP EPS and GAAP EPS was ~30% in Q42020) profits as the “adjusted for the pandemic numbers” begin to shake out. It will be important to discern what non-GAAP actually means, especially in context of memefluences.

Energy market: The five supermajors—ExxonMobil, Chevron BP, Total and Shell—generated $20.5 billion in free cash flow, defined as the amount earned from their core business operations minus capital expenditures. Meanwhile, they rewarded shareholders with $49.9 billion in dividends and share buybacks in 2020. This itself isn’t surprising – but industry shifts could make this unsustainable.

Oil is coming under pressure from a myriad of variables. Most of the pressure will end up constricting supply, which will give it structural upside and cause prices to spike.

It will be important to watch for the reflation trade, with the potential for banks and oil to catch a bid if people rotate out of tech

The Fed: Fed and Foreign buyers can keep long-end Treasury yields from moving too high (if yields keep moving, that could put a quick pin in the current asset bubble).

The Fed has been incredibly dovish despite the inflationary pressures that the market is expecting. Foreign buyers have been relatively quiet. As yields tick up, this will entice buyers to the market – but the Fed seems resistant to acknowledge the changing environment.

Treasury Movement: The Treasury is planning to reduce the very large balance of Treasury General Account (a liability for the Fed).Yellen recently laid out plans to reduce it from $1.6trillion to $800 billion by the end of March, and then further to $500 billion by June, which would be ~$1.1 trillion of liquidity hitting the system

The 10Y: We're in an interesting situation where markets are pricing much more rate hikes than the Fed's latest forecast. Powell has done his best to calm the markets, but the 10Y is still ticking up persistently. If it continues, that could put a lot of pressure on tech.

Inflation: Breakeven inflation expectations just broke through 2%. I am worried that there is a ton of liquidity about to hit the market, but I think that people are going to spend more on travel and going out as we reopen over the next several months.

What do the Meme Markets Represent?

SPACs, NFTs, and GameStop are all people testing the limits – memefying things in a way to reimagine how we make money. I am very bullish on the creator economy –giving people the tools to create their own future. People are increasingly wanting to work for themselves and “be their own boss”, and I think the market memefication is an iteration of that. The idea that the financial industry is the gatekeeper to the ivory tower of money isn’t as accurate as it used to be.

Memefication is a function of information access, and subsequently, the market is fueled by this meme access. This is a broader sociological phenomenon, but meme markets show the growing power of the retail investor, as well as the structural cracks in the current market.

Borrowing from Dawkins:

Socrates may or may not have a gene or two alive in the world today, as G.C. Williams has remarked, but who cares? The meme-complexes of Socrates, Leonardo, Copernicus and Marconi are still going strong.

The meme complexes of the financial system are going strong. The market is no longer driven by fundamentals - it’s driven by memes. No longer a metaphor, but a living structure – the stonk market.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

Great analysis beautifully written

Wonderful summary of what's going on!