This is a macro market update (I post daily to TikTok). I publish these once a week (beta phase), as well as single stock pieces (1-3x a month) and macro deep-dives. I also publish on TikTok, Youtube, and Twitter!

YouTube linked here :)

Thesis: Tesla is not a car company. They are an Elon Musk company. Elon attaches a premium to other EV SPACs, through conflated conclusions from the “Tesla and Elon Effect”.

What is Tesla?

Tesla is one of the most well-known companies in the world. Their notoriety comes from a few different places:

Their CEO, Elon Musk

Their lofty vision

Their affiliation with ARK Invest (+ ARK’s 2025 $3k price target on the company).

Tesla is a company that is tough to value, primarily because they have so many intangible inputs.

How do you value a Meme King for CEO?

How do you value an EV company that is actually a dozen tech start-ups in one?

Right now, Tesla is a ~$655bn company. I am going to piece out how much each of the parts of the business are adding to the overall market cap, and then how much I think Elon is adding to the market cap. I am not modeling out the share price!! Enough people have done that.

I am piecing together what the Elon premium is - and how that impacts the company at the present moment.

The Premium of the Qualitative

For April Fools, Volkswagen “changed” their name to “Voltswagen”. This joke was taken seriously by investors, and added ~5% to their market cap, showing how close investors are paying attention to communication and expectations versus true fundamentals (obviously, investors decided they weren’t vibing with the stock after the fact).

Same thing with Tesla.

Tesla is one of the most coveted companies in the world. Elon drives a lot of that.

So the share price might be “expensive” to underlying fundamentals, but what are the models not pricing in? According to a compilation of reports (mostly Morgan Stanely and Piper Sandler), Tesla is a few different companies rolled into one:

Automotive

Direct sales: customers buying Teslas

Leases: customers leasing Teslas

Regulatory credits: OEMs buy credits from Tesla to meet emissions targets

Vehicles: Model S, Model X, Model 3, Model Y, Cybertruck, Roadster, Semi

Energy

Energy storage systems: Powerwall, Powerpack, and Megapack

Solar system sales

Loans, leases, PPAs

Insurance:

Currently a nonfactor, but could be impactful moving forward. ARK has this at $60 per share by 2025 (bull case), with revenues at $23bn in their bear case.

Mobility/Robotaxi:

TSLA is making strides here, but not sure how much impact it has on the overall business

They estimate that the chance of fully autonomous driving is 50% by 2025 which would push their EBITDA up by $160bn

Network Services (Software)

Supercharger Access and connectivity packages

Software packages (autopilot and FSD)

After-sales vehicle service

Merchandise, etc

Bitcoin

This is confusing considering Elon’s stance - it could add value to the company over time, and will modify the Elon premium - if Elon doesn’t sabotage it again.

So when thinking about valuing Tesla, you have to take into account all of these different forces. I only included software, energy, robotaxi, auto, and insurance - but the Bitcoin Premium will definitely tack additional multiple onto Tesla over time (especially because Musk seems to have direct control over the price)

The Tesla Effect - Zooming Out

Tesla is a golden-child stock. It has defied expectations, achieved S&P 500 status, and got very close to a $1T market cap. Elon Musk created Tesla into what it is – and by proxy that success has manifested additional multiple onto any other EV company.

The EV companies are bold in their vision, because they have the room to be. They are SPACing into existence despite producing zero revenue. The valuations are fueled by Tesla association (coupled with the general hype market and the froth of the SPAC environment).

EV Valuation = Valuation x Tesla Premium x SPAC Froth

There’s a research paper - The Tesla Effect and the Mispricing of Special Purpose Acquisition Companies (SPACs) - that analyzes the underperformance of the EV SPACs through the lens of the “Tesla Effect” (and subsequently, the Elon Effect). With the EV SPACs:

"Many mispriced SPACs in 2020 were linked to electric vehicle-related businesses (“Tesla effect”), raising concern whether investors understand what they are buying. On average, SPAC unit prices are higher after announcements of business combination, and more so for electric-vehicle SPACs… The coefficient on Thematic (cannabis and space) is indistinguishable from zero, suggesting that much of the mispricing may be limited to EV SPACs.”

EV SPACs are more mispriced relative to other SPACs. Investors were associating these EV companies with Tesla and Elon, and assigning an arbitrary dollar sign to that, simply by closeness to Elon.

A relative valuation, but a conflated conclusion.

Some of this valuation comes from the Elon Effect - an addition to the Tesla effect. Elon is important to the brand of Tesla, for several reasons

Who is Elon Musk, the Meme King?

Some of the Tesla Effect comes from having Elon Musk as the CEO.

The King of Meme: Elon is an embodiment of the meme market – renaming himself Technoking of Tesla, his association with Doge, his $420 share price target for Tesla, randomly tweeting company names, his involvement with GameStop (Gamestonk) and so much more. He has created billions of dollars in value from tweets, and that translates into Tesla market cap over time.

Creating Value from Meme: Knowing that you can tweet things to move markets is immensely powerful. He is very good at what he does, both in creating value for Tesla and pumping random cryptocurrencies. That power carries across the industry, fueling the Tesla Effect, and subsequently, the valuation of the EV SPACs.

The Elon Effect: Elon offers a narrative around civilization and the prospect of unconstrained growth. He promises a lot, delivers on some of it - but people believe him.

“Eventually” is a keyword for him and the business - and the concept of eventually in a growth focused market goes pretty far.

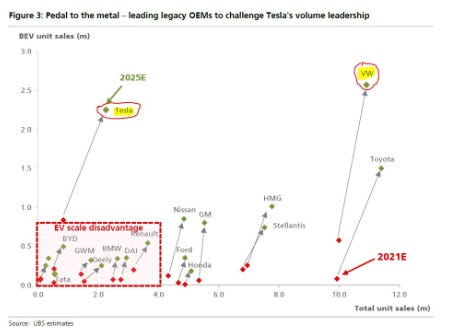

The Competition in the EV Space - Tesla’s Main Line of Business

The legacy automakers are catching up: Ford’s Mach-E sales are eating into Tesla’s EV sales. Tesla’s share of the EV market fell to ~70%, down 10% y-o-y. Volkswagen has already taken top spot in many European markets (Norway has the largest amount of drives in EVs at ~50% penetration). The Ford Mach-E accounted for nearly 100% of TSLA's market share loss. It will be interesting to see what happens as the legacies begin to catch up. TLSA’s market share is not protected in the EV space - so what will happen when the others start to encroach?

The SPACs are SPACing EVs into existence: As more EV companies SPAC into existence and the traditional automakers finally catch-up, Tesla’s EV market share will likely continue to contract.

But does the market support these EV SPACs: How many EV companies can trade at a $100b market cap? It’s a crowded trade with supply chain issues and high raw material costs.

FSD competition: How protected is FSD? Tesla can be first to market, but can the legacies just copy it?

There are tailwinds:

Subsidized by the competition: A VW JV (FAW-Volkswagen) in China is buying green car credits from Tesla to meet local environmental rules. This means that Volkswagen would be subsidizing Tesla - and with Tesla’s total revenue from selling credits at ~$1.6bn, it is material to their business. The offer was 3,000 yuan per credit.

Carrying the Legacy Automakers: Tesla and Toyota are considering a JV for SUV EVs. Tesla would provide electronic control platform and the tech, as Toyota looks to max out economies of scale (and are also partnering with Mazda and Suzuki)

Supported by the top company in the world: Apple purchased $50M worth of battery storage (consisting of 85 Tesla lithium-ion megapacks) which resulted in a $13B move in Tesla’s market cap. That’s a hefty multiple on news - every $50m worth of batteries resulting in a 260x move in value.

Pricing Power: They’ve increased the price of solar and hiked the price of the Model Y by ¥8,000 ($1,217) in late March but it didn't stop people from coming to place orders.

Government Partnership: Tesla has secured a new order for 10 Tesla electric Semi trucks and 2 Megachargers from Mobile Source Air Pollution Reduction Review Committee (MSRC) which has has awarded “MHX Leasing LLC (MHX), a California-based logistics company, $1.9 million for the deployment of 10 Tesla Semi class 8 semis”. That’s a big purchase.

The Backdrop of Bitcoin: Tesla will now accept Bitcoin to buy Tesla vehicles in the US. Wedbush expects “less than 5% of transactions to be through Bitcoin over the next 12 to 18 months.” Also Elon seems intent on destroying Bitcoin, so.

And there are significant headwinds

Semi shortage: Ford cut production due to semiconductor shortage - which is a massive problem. Semiconductors are a large part of any tech build - and demand is currently outstripping supply. Tesla’s first-quarter sales likely hampered by chip and parts shortages

Other input issues: Regulatory frameworks working against them (and for them), lithium access, hydrogen storage problems (FCEL and PLUG)

The ARK Risk Cluster

Tesla makes up a whopping 10% of ARKK. Tesla is also part of the SPX basket, making up ~2%.That’s why it’s important to look at companies from all angles, even if the direct metrics don’t necessarily support the full valuation.

Cathie Wood giving them a $3,000 price target drives market attention. That’s a premium there.

Valuation

What multiple does this afford the EV companies? How valuable is a Tesla coattail? How should we think of companies beyond cash flow?

With Tesla, it’s a mix of fundamentals and subjectivity.

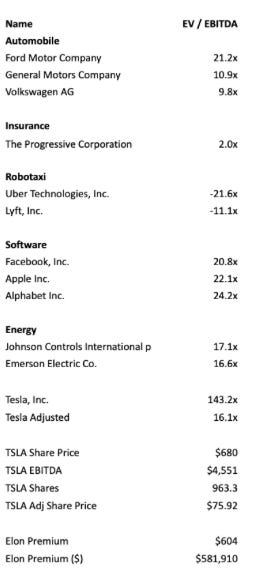

I did a pretty simple analysis here - comparing the EV/EBITDA of auto, insurance, robotaxi, software, and energy companies to that of Tesla. Tesla is trading at an EV / EBITDA of 143x - many times more than any of the comparison companies.

disclaimer: all of the below is very -ish

I removed the Robotaxi companies (counting Uber and Lyft as such) because they trade at negative multiples. But just taking a simple average of all the multiples of the other companies that Tesla *could* be trading at results in an adjusted Tesla share price of...

$75 per share. (here’s the rough math if you want to see it).

That means that Elon (generalizing here) tacks on an additional $604ISH in share price, or roughly (959m shares x $604) about $581bn in market value. That’s a lot of meme money.

Final Thoughts: It’s Elon

There are other forces that I didn’t calculate - ARK, Bitcoin, the Tesla fanclub - but Elon potentially does contribute > 70% of the value to Tesla. It’s important to parcel out what Tesla actually does - it helps contextualize why the company trades the way that it does, even if some of the valuation transcends fundamentals.

And they are a company, with risks and opportunities as outlined below.

Opportunities

Tesla has a lot of fans that will march to the beat of the Elon drum. Elon has good ideas. If they can execute, tremendous upside

Lots of new models in the pipeline

Potential for FSD

Potential for growth abroad

Risks

Continued growth of legacy automakers and EV SPACs

The utility monopolies on energy storage etc

EV SPACs taking over

Elon has moved billions of dollars worth of Doge, Etsy, Pinterest, etc. So half a trillion dollars worth of Tesla doesn’t really seem that far reaching. Will the market price him out eventually? Maybe. But for now, Tesla is moving on a lot of new things, and have generous headwinds. Are they expensive? Yes. But growth comes at a cost in today’s market structure - and so does the Elon Premium.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

Very entertaining read! Thanks Kyla!

SPACing this issue to the moon cuz this is soo good. Thanks for writing this Kyla