The Traffic Light

signaling and finance as culture

This is a macro piece. I publish these once a week (beta phase), as well as single stock pieces (1-3x a month) and weekly market updates. I also publish on TikTok, Youtube, and Twitter!

YouTube up soon (please subscribe for updates heh)

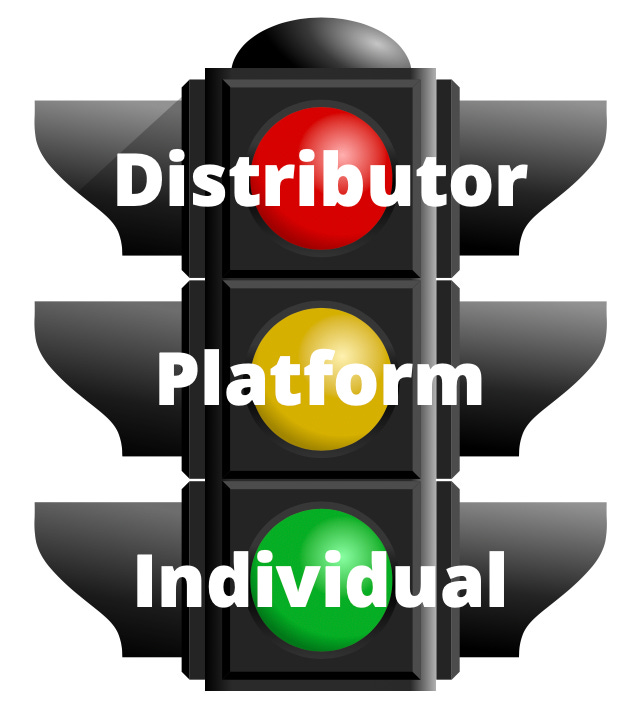

This is a Traffic Light

Last week I slugged through what was happening (mostly in crypto) - and now I want to explore ~why~ things happen.

Through three levels:

Distributors: SPACs and Amazon

Platforms: OnlyFans

Individual: You and I :)

Distributors

SPAC (Special Purpose Acquisition Trust)

I wrote a bit about SPACs back in January - they are “memes as investable narratives”.

The important thing to remember is that SPACs are tools. They are financially engineered products. They can be multipurposed – sometimes they are an investment opportunity, but sometimes, they can be used to simply shift risk

SPACs are shells. They raise money with the intention to buy a company - whether that be a good or bad company is uncertain. Investors are truly investing on hope, in a way that transcends the usual pre-revenue tech investment.

SPACs sell because they have a story. They have narrative.

Memes are visual narratives. SPACs are investable memes

Mudrick backed out of taking Topps public after Topps lost their (70-year long) contract to make cards for the MLB.

The SPACs just SPAC whatever into existence, doing little to no due diligence (or so it seems). It seemingly just boils down into a get rich quick scheme for the hedge funds (and others) during the redemption phase. They just are not *good* distribution tools, because of the below variables:

Hype Cycle: The SEC had to step in and warn against joining a SPAC because so many celebrities were forming their own!!?

Risk Reallocation: Sometimes the SPACs can be used to pay down debt. That shifts the risk of a levered SPAC and the loan investor to the individual investor

Sponsor Incentives: SPACs are popular because it’s an easy way to get paid as a sponsor.

They earn about 20% of the equity independent on deal outcome (this is where things get DICEY) – and post-deal, the owners (i.e., individual investors) of the SPAC are left holding the bag

Supply and Demand: Supply of companies (there are only so many companies that are ready to SPAC) and Demand of SPACs (lack of choice can lead to bad decisions)

Bad Companies: Because of the combination of supply and demand misbalance, the incentives of sponsors, and the potential for SPACs to simply be a way to shoulder off risk, sometimes bad companies can get SPACed.

But SPACs are a signal to the broad market - they are a narrative, they are a way for companies to get access to $$, they are a way for the investors to make $$.

Then there is this. SPACs *seemed* like an awesome idea, but boiled down, its just a combination of FOMO, get-rich quick, and signaling propping up a product.

Amazon

Amazon (a good distribution tool) announced that they would be opening their own department stores. Everything seems to loop back to the same point in time eventually.

Is Amazon the next Sears?

Amazon has not created a new vehicle in retail sales, they have really only reinvented the wheel. And now they are returning to the roots of commerce by opening their own stores.

Sears had a really similar path. They began by selling watches (books) by mail order. Then they got that big catalog, and they sold to *everyone*. 1/3 of all US workers had a Sears credit card by the 1960s.

Shopping there was a signal - Sears was the American Dream.

Amazon is a signal of Web 2, Internet Dream.

But of course, Amazon is the backer of the entire cloud network with AWS, so these physical stores are just topping on the Amazon cake.

They are likely doing this for:

Distribution: more goods, more people, more money

Growth: see above

For fun: Because they destroyed the mall, they now must become the mall

People want to go hang out (because despite society becoming decentralized, we genuinely crave tangibility and accessibility to other humans).

That’s why Amazon is doing this. It’s a signal. They are signaling that they are a place for you to meet this ~communal~ need. Yes, you can still get same-day shipping, BUT ALSO, we have a *meeting place* for you.

Platforms: Only Fans

Just like SPACs, OnlyFans is also questioning its entire business model. OnlyFans is barring “sexually explicit videos” starting in October. This seems to be mostly because they are:

Having trouble raising money from investors

Investors are mostly due to worries of reputation and minor access

Card processing companies not vibing

SESTA/FOSTA laws are a big part of this

Moderation concerns, especially around underage users

The moderation concern needs to get figured out. No question about that.

However, the blanket ban creates a lot of problems, mostly for the creators, in the form of lost income. The whole thing felt very rushed, and there is still a lot of stigma around this ~sort of content~.

The thing is OnlyFans makes a LOT of money.

Their revenue was $375mn in 2020 and $2.5bn in 2022.

Free cash flow is strong, user base is sticky, growth is incredible

Any other business would be an overflowing cap table - but OF doesn’t have that.

They have to change their whole business model (essentially) to get $$.

Crypto has a role here. And there are a lot of crypto payment apps (like SpankPay)

But I think it’s more the reaction to the issue:

This is a society that is based on signaling and status.

Sex work, explicitity etc., is still meant to be kept under wraps (to a certain extent).

And it’s tough to parse through exactly what that means. There is a broader bubble in there around just that - the fine lines of signaling. It’s a very nuanced conversation.

~Markets are a reflection of behavior~. Clearly, OF has problems that it needs to work out (moderation, userbase) but a lot of the creators feel empowered by the platform.

Capital, money from investors, a strong backing is this key that unlocks a door of possibility. OF is doing this because of the problems with merchants, sure, but also because they want to have investors. They want $MONEY$ (as do the creators that they are harming with this decision, ironically enough)

But capital can be really picky. OF is the manifestation of the creator economy, and if it *wasn’t* OF and the OF business model, it would be as hot as Stripe.

Capital is a signaling tool.

Investors are signaling to OF that their business model isn’t investable

OF is signaling to their creators that their work isn’t acceptable

Similar to SPACs, it’s a signal to the broader market of what *works* versus what doesn’t.

Individuals

Humans seem to seek to signal the below three things:

Wealthy

Part of the in-group (community)

Someone that is Important (status)

We are increasingly melding into the Ownership Economy, which really a bunch of little economies strung together. And the key thing in an economy is who can flex the hardest.

Humans have been flexing since the beginning of time.

Packy of course wrote an excellent piece on the narratives that we tell ourselves. Of course, as humans we have relied on stories to carry our culture into perpetuity - but the question now becomes - what do we *do* with our communities in a decentralized world (which Howard Lindzon dives into here) and signal in a decentralized world?

What are the fundamentals of communal structure?

What does it really *mean* to be a part of the “in-group”?

How do you signal this and all of the above to others?

We operate asynchronously - so our internal pricing structures have to reflect that element.

okay???? and?

Basically:

We are communal, so we rely on stories to tell our ~story~

We are increasingly decentralized, so we rely on the Internet to distribute our story

We then rely on tokenization (a fancy way to say *officializing*) to enhance “belonging, signaling, and collective decision-making”

Then, there is this big FOMO. Justin wrote a piece here talking about how the roaring wave of success seems to touch everyone… except you.

With FOMO, the narrative that we tell ourselves is three parts:

Everyone is creating (except you)

Everyone is making money (except you)

Everyone has a community (except you)

2PM wrote about this here too - FOMO is manifested through social signaling, and the “key ingredient to any social club is FOMO”. It’s a digital country club - and you have to signal to show that you are in.

Basically, if you want to flex, you should have a Penguin as your pfp on Twitter. You have to have a way to signal to everyone else that they should have FOMO about what you’re doing - and flex goods accomplish this.

These “flex goods”, as Arthur Hayes highlights, are a perfect combination of:

Scarcity

Community signaling

Seemingly worthless (or could be replaced by something much cheaper)

Flexing is integral to the human experience. We don’t question the value of physical meatspace items used to project social standing. We understand and value fashion, paintings, jewelry etc. We all don costumes at work that illustrate which professional community we belong to. What is an investment banker without his Hermes tie or her pair of red-soled Louboutins? The costume is part of the self-worth.

You want people to know that you are *THAT PERSON*.

How do you flex in the virtual world? How do you signal that you are rich and fun and cool? That is what we are all trying to figure out right now.

Okay, But What?

Okay so a lot of random ideas to tie a thread through lol.

We want to signal that we are a part of something bigger. That bleeds up into Amazon, SPACs, and OF, where all want to signal those three variables that I outlined:

Wealthy

Part of the in-group (community)

Someone that is Important (status)

So it becomes:

Wealth

Amazon: They are just flexing on us, they don’t need investor money

SPACs and OF: they warp their narrative to meet investor demands

Individuals: Accumulate virtual goods

In-Group

Amazon: Can now be reached beyond the confines of the web

SPACs: ~designed~ for the everyday investor but benefit only the insiders (in-group to be the first to get in on one of those deals $$)

OF: Created insider access for their creators, and they are now revoking that -

Showing that they want insider access to investor $$ (insider desire)

Their creators are still on the “fringes of acceptability” (becoming outsiders)

Individual: Using goods as a way to signal community

Important

Amazon: We can destroy you and then become you.

SPACs: We can make lots of money (but only if you’re first)

OF: We will change our business model to fit in.

Individual: I can flex pretty hard.

So essentially -

There are these key tickers of FOMO and signaling and status. That’s what Amazon, SPACs, OF etc all represent.

And the key thing from an investable perspective is remaining true to your own vision. The products that we build, the things we invest in will always have a signaling aspect. Finance *is* increasingly becoming a culture and this ties into the ownership economy.

I really wanted a penguin. Because I wanted to *Signal* that I was ~in~ crypto. But I can’t do that - it was way outside what I can afford - but I was getting lost in what owning a penguin *meant*. I just wanted to show everyone that I was a cool person.

There is always a psychological game. And it’s important to parse through that -

Can OF have a user base if it doesn’t have a business model? No

Will Amazon succeed at physical stores? Probably

Are SPACs good? Most are not.

Do I *really* need a penguin that costs 4x my rent? Not right now

So its important to just watch these traffic lights that pop up around us and drive and direct our behavior - sometimes, the green light doesn’t always mean go.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

Oofff this some real deep stuff

Am I the only one laughing at "user base is sticky" for OnlyFans?