A synthesis on the Russia-Ukraine situation

If you’re already subscribed, thank you! If you’d like to subscribe, please do so here:

YouTube/podcast up soon

I want to begin this piece by stating:

I am a synthesizer - the work is an amalgamation of opinions and analysis.

We are in information warfare - something I discussed in my piece pre-invasion on Tuesday and Ben and I have discussed in our videos for the past few months. So I am trying to help organize signal and noise.

Please be mindful of the information you consume and share. There are a lot of bots out there right now, meant to confuse and disorient.

I want to highlight journalists and researchers who are covering this (please defer to them). I’ve made a Twitter list here of people and highly recommend that you tune into their work (and support them, if you’re able).

I’ve been taking notes in my Notion doc so if you want timely information, it will be aggregated there

And some links to help Ukrainians (via Timothy Snyder’s list):

Libereco Partnership for Human Rights, evacuation and medical assistance

Caritas, humanitarian assistance

NGO that arranges life-saving equipment for Ukrainian soldiers

Hospitallers working at the frontline

NGO that assists internal refugees

NGO that aids traumatized children

Support The Kyiv Independent

An Update

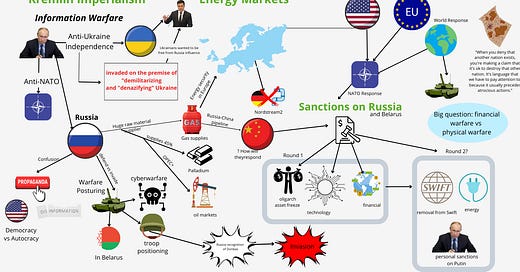

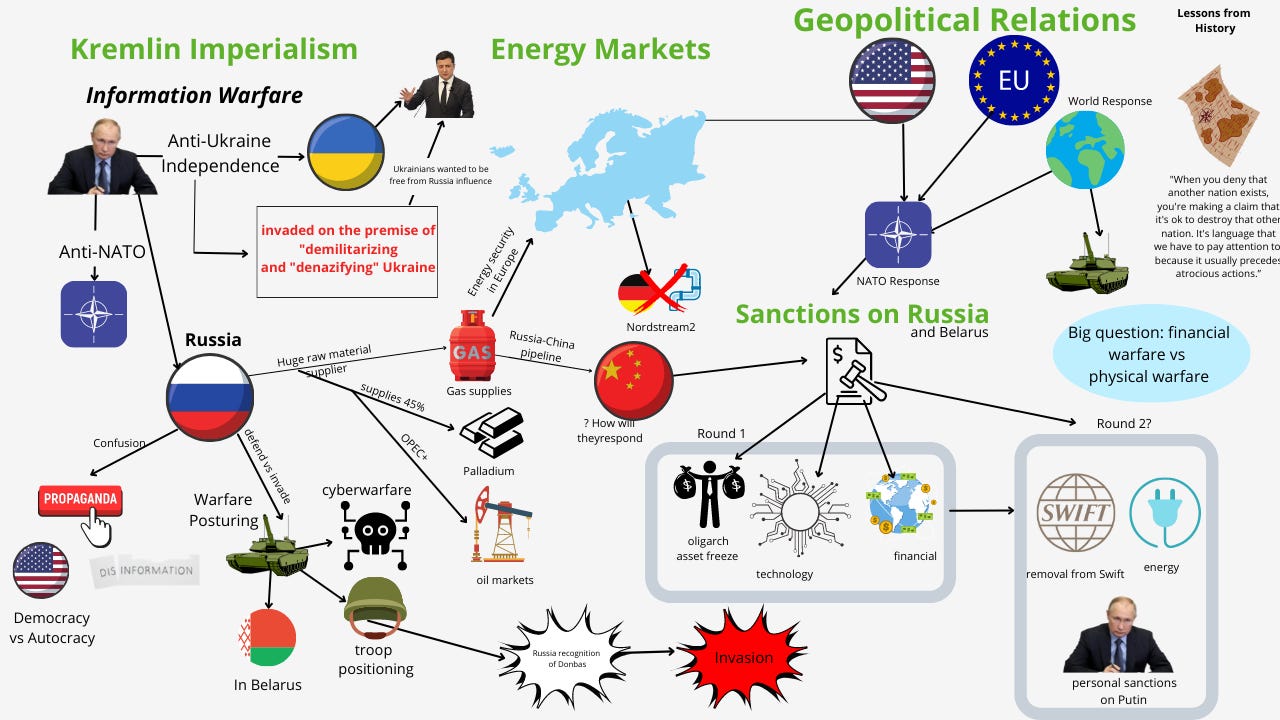

This is the flowchart I made on Tuesday. I’ve updated it since, and will focus on sanctions. I want to organize what has happened so far - specifically around

Why this is happening

Economic sanctions (including energy markets)

The broad market impact

Financial vs. physical warfare

The human impact

Why is this happening?

This is Putin’s first step in an attempt of Kremlin Imperialism. Putin invaded Ukraine on the premise of “demilitarization and de-Nazifaction” and “to protect Ukrainians”. Putin has assured everyone that he has no plans of going any further - but this likely is not true.

How did the invasion happen?

On Thursday morning in Moscow, Putin declared a “special military operation” stating that “we simply haven't been given another option to defend our people other than the one we are forced to use today”.

Then he said that anyone who would intervene would “lead to such consequences as you have never experienced in your history” which is considered to be a thinly veiled threat of nuclear war.

Putin’s main goal seems to be reinstating his view of the Russian Empire. To overthrow governments, install pro-Russian regimes, and prevent further Western assimilation (which he discussed extensively here: On The History of Russians and Ukrainians). So Putin invaded because he wants Ukraine “back” and there is no promise (and no sign) that he plans to stop there.

The United Nations Security Council Meeting

The United Nations Security Council found out about the invasion during their meeting to try and stop the invasion. Talks quickly shifted from “diplomacy is an option” to “we condemn these actions”. And in the most horrible irony possible, the Russian Federation is currently chair of the UNSC. The Ukranian ambassador had some choice words for him (after advocating that Russia be removed):

“There is no purgatory for war criminals, they go straight to hell, Ambassador."

The Rapidly Evolving Situation Now

Moscow has stated that they are willing to negotiate the surrender of Ukraine, which would essentially result in Ukraine losing sovereignty. Ukraine is open to the talks, but Moscow is alternating between engaging and being unresponsive. Moscow wants to meet in Minsk, Belarus which is *not* neutral and when Ukraine suggested Warsaw, Moscow was like nope, so.

However, broad Russian messaging on the situation is incredibly mixed. No one really seems to know what’s going on. As Max Seddon pointed out -

Dmity Peskov said that Ukraine’s “Ukraine's statement was "movement in a positive direction" and promised to "analyze" it.”

But then Sergei Lavrov said “Russia would only negotiate after it "restored order" in Ukraine and claimed Zelensky was "lying" about neutrality.”

No one knows what’s really going on, except for Putin (maybe). We’ve seen protests from people in Russia - antiwar protests, members of the military shocked that they were going into Ukraine to kill. A lot of this is about what *Putin* wants- and what he is willing to do to get it. As Lawerence Freedman wrote:

The decision to embark on this war rests on the shoulders of one man. As we saw earlier this week Putin has become obsessed with Ukraine, and prone to outrageous theories which appear as pretexts for war but which may also reflect his views. So many lives have already been lost because of the peculiar circumstances and character of this solitary individual, fearful of Covid and a Ukraine of his imagination.

So what’s everyone going to do about that?

We are a globalized economy, so when a country that produces 30-40% Europe’s gas supplies and ~1/3 of the world’s wheat (alongside the country that they invaded), things get unfortunately political around responses.

Right now, global leaders seem really focused on financial warfare in the form of sanctions - because as much as Europe needs Russia, Russia needs them too.

There are a few different levels to sanctions. SWIFT, direct sanctions on Putin, and energy market disruption would be the most punishing to Russia, but they would also be the most punishing to the West. Yesterday, Western allies announced a series of sanctions on Belarus and Russia.

Level 1 Sanctions

Here is a full list from Bloomberg, but here are some:

Freezing the financial assets of oligarchs

One of the weirdest thing is that they can transfer their assets into crypto which could mean that emergency crypto regulation could be implemented (which is a whole different can of worms).

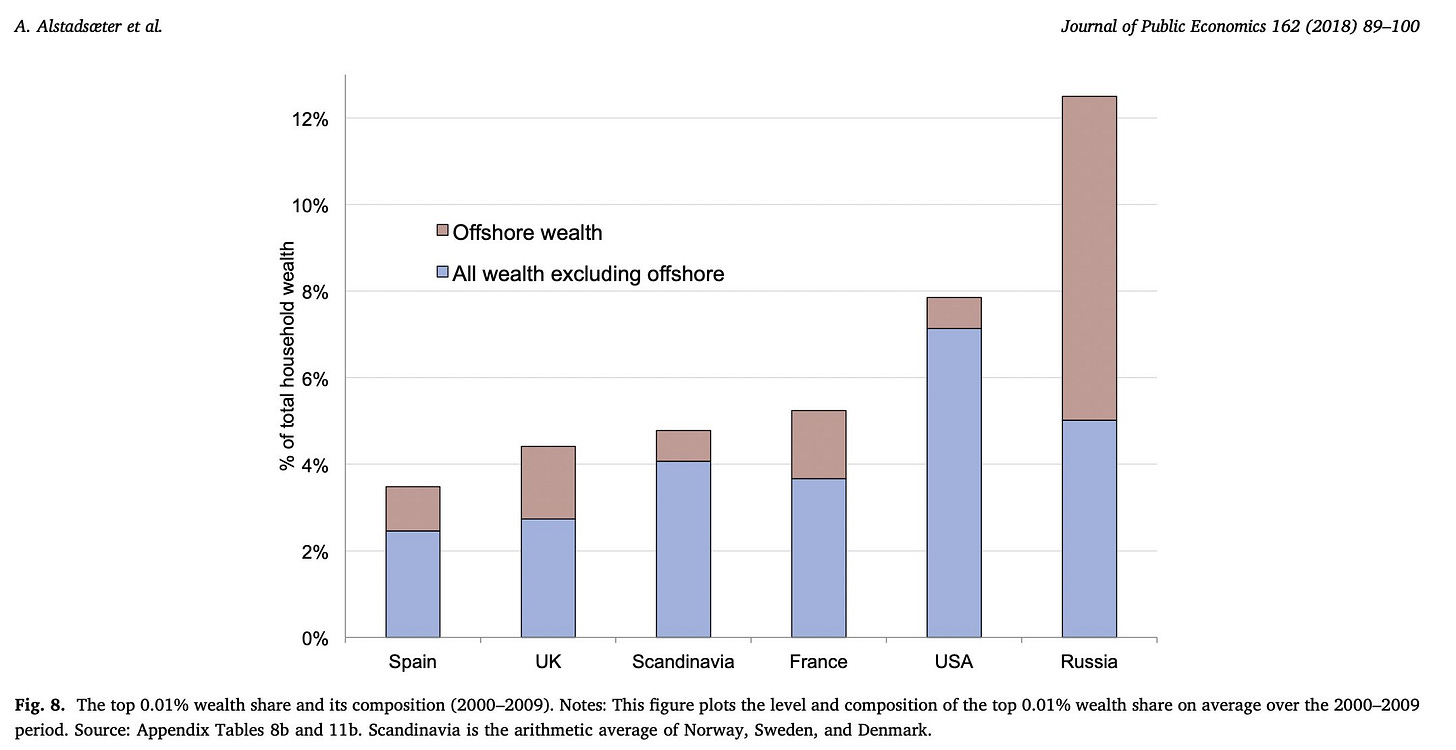

But this is meant to freeze about ~$1T in assets across these individuals, which is a big chunk of Russian offshore wealth.

Source: Gabriel Zucman

Freezing different banks (including Russia’s biggest lender) out of the system

Banking sanctions can lead to collapse and self-liquidation, but Russia has built up a lot of protection, so impact might be isolated.

Restrictive controls on countries that export technology to Russia

Singapore, Japan, and Taiwan are all on board with restrictive export controls - goal here is to choke out Russia’s technology including but not limited to “semiconductors, encryption security, lasers, sensors, navigation, avionics and maritime technologies.”

When asked if these sanctions were enough, Biden said “they are profound sanctions – let’s have a conversation in another month or so to see if they’re working.” (hm) Still left on the table (as of Friday mid-day):

Level 2 Sanctions

SWIFT: This is the Society for Worldwide Interbank Financial Telecommunications. This is basically how banks talk to each other (“communication infrastructure for cross-border money flows”)

This is essentially the biggest punishment a country can get.

Germany, Italy, Hungary, and Cyprus were like “why don’t we wait on this one” which means either

they think that things are going to worsen so are saving up some financial ammo

they really really really don’t want to do this - However!

Russia has been working on SPFS for the past few years, so this might not be the end-all option that everyone thinks it could be. As George points out, it would likely be more impactful to focus on “breadth and intensity of sanctions that block assets and halt payments”.

Energy Markets: If only we had green energy investment alongside green energy policy. The West is still buying oil and gas from Russia. Nord Stream 2, Germany’s pipeline with Russia has been essentially forgone, but everyone is tip-toeing around this. The US Treasury made it *very* clear that existing sanctions are meant to NOT focus on energy.

Direct sanctions on Putin: [these are now in place]

The thing is that Russia has been building up a financial fortress against this - rotating out of US Treasuries, getting a LOT of gold (more gold than USD), de-dollarizing (highlighted most notably by settling their pipeline with China in euros). Over ~30% of Russia’s trade is conducted in euros, and the dollar’s share of trade has fallen to 55% from 80%.

And Russia is going to do reverse sanctions on the U.S. primarily through “expanding trade and economic ties with Asia” which India seems to be taking part in by setting up rupee trade accounts with Russia.

China state banks have announced that they are going to “restrict financing for Russian commodities” and “yuan-denominated letters of credit are still available for some clients, subject to approvals from senior executives”.

China and Russia have a very close economic relationship (and a recent friendship to “broker international peace” so this shows the delicate balancing act once again that geopolitics and globalization play.

China hasn’t really taken a clear stance on anything, rather continuously highlights the importance of “comprehensive, cooperative, and sustainable security” and negotiations.

And the West is waffling on sanctions because ~the economy~. Italian prime minister Draghi carved out Italian luxury goods from the sanction package because of course, “selling Gucci loafers to oligarchs is more of a priority than hitting back at Putin.” Zelensky is not impressed - stating “next time I’ll try to move the war schedule to talk to Mario Draghi at a specific time”.

One can only imagine how history will see loafers as superseding sanctions.

Broad Market Response

Globalization creates a problem of financial contagion, which is what we are experiencing with sanctions around Russia and Belarus. “Russia’s central bank and private sector have almost $1 trillion of liquid wealth” which is a large amount of dollar-denominated assets, and could harm U.S. funding markets according to Zoltan Pozsar. Over $300b of that is short-term money market instruments, which could disrupt flows, Zoltan states.

So there is a broader risk of financial harm and disruption, an element of which is likely unavoidable. Bloomberg has a good table outlining the economic impact of different scenarios - the “best” situation is to keep oil and gas flowing, clearly, but that might not be an option.

And that’s why the West is unfortunately playing so carefully with sanctions - because they risk energy prices spiking, huge amounts of inflation, and probably a wide-reaching financial crisis. Biden, when discussing sanctions on Februrary 24th, stated that he “cared about gas prices” - so you know, it’s political too.

Energy markets

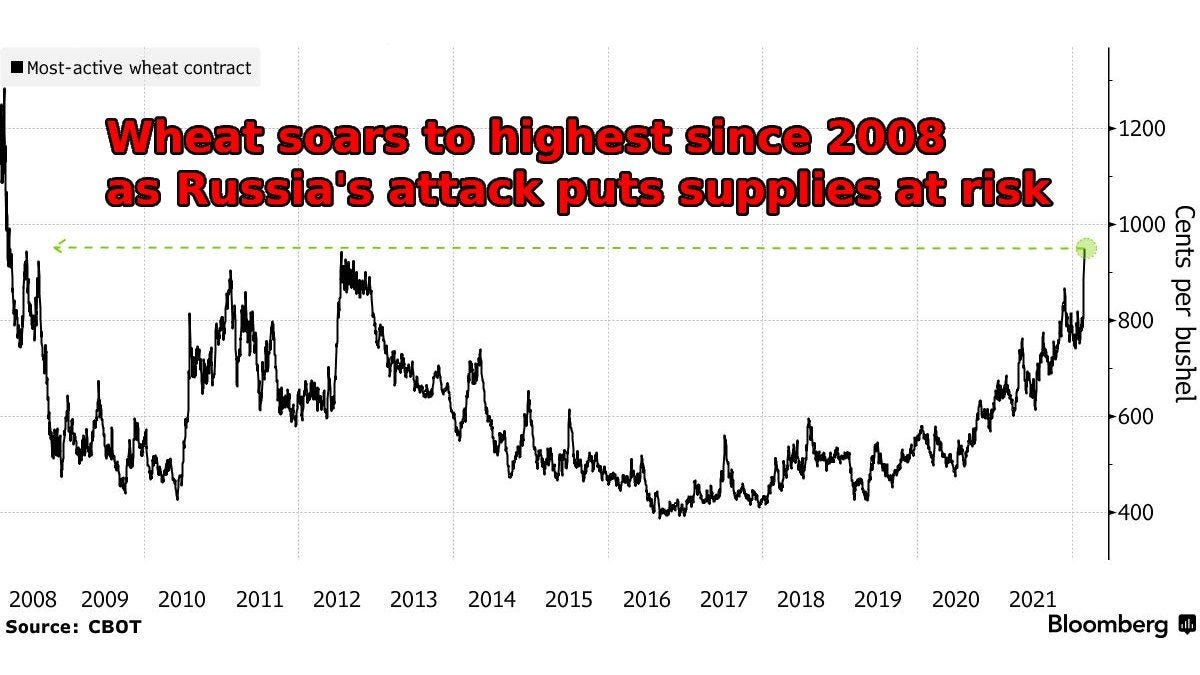

Energy markets freaked out at first, but have since calmed down since the weaker than expected sanctions package. European natural gas went up 50% in one day, and oil, wheat, aluminum, etc are all skyrocketing.

But this is why we are seeing a lot of caution - the U.S. and the EU are still really reliant on Russia for energy sources. As Daleep Singh, the Deputy NEC director said in a White House press briefing "Our sanctions are not designed to cause any disruption to the current flow of energy from Russia to the world.” So.

Russian stock market

The Russian stock market was on a rollercoaster ride straight to the bottom, but has since recovered a bit over weaker than expected sanctions. The ruble made it clear that people did not think highly of Putin’s invasion. But as discussed earlier, Russia has been financially preparing for this, as evidenced by the level of international reserves below.

Agriculture

This is highly concerning. Ukraine and Russia produce over 30% of the world’s wheat, and Ukraine is the #4 exporter of world.

Russia is a major exporter of fertilizer which is important for food production of *everything*. If fertilizer goes, then all food becomes more expensive. Energy is a common denominator in everything, and food is needed by everyone.

Source: Stephen Stapczynski

Russia and Ukraine both produce a lot of things, and alternatives might need to be found for all of them.

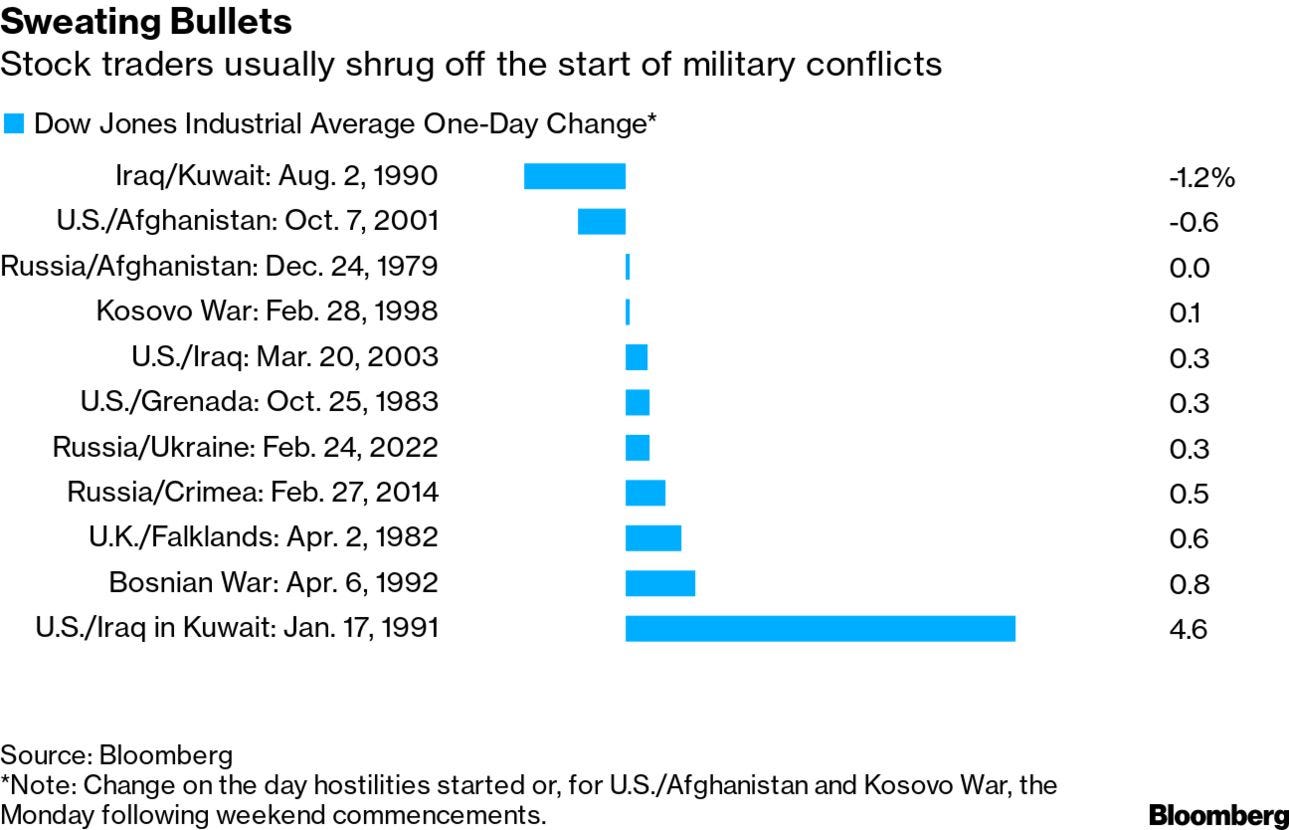

U.S. Stock Market+

So the market rallied on the back of expecting the Fed *to not hike*, which like I get because it’s a stock market. I used to think that the stock market was reflective of human behavior, but now, it’s reflective of the Federal Reserve and their various slam poetry sessions throughout the week.

And that’s just how it is, right? Green markets after the realization “oh things will have to remain easy for a while longer” (nevermind the fact that we are facing serious inflationary pressures from agriculture and energy import risk). But alas. As long as the Fed doesn’t tighten.

To quickly break the fourth wall: People are talking about war being a phenomenal buying opportunity and I know that the markets are not a moral compass.

I understand the tooling and why it works - companies are still going to exist (bar all things completely imploding), still produce cash flows, still need financing, but there is something horrific about discussing death and dividends in the same sentence.

Barry Ritholtz had a good take on why all of this might be -

The lesson here is to never bet against human ingenuity, creativity, or progress. In the face of horrific existential threats, while the headlines are terrible, gradual improvements are always taking place beneath the surface.

Remaining bullish on humanity is a good default strategy, for most things.

Financial Warfare vs Physical Warfare

Right now, things are not going as Russia expected. As Michael Kofman highlights “the Russian military clearly tried something. I think it at best yielded mixed results for them. They will adjust.”

Ukraine is winning. They are putting up an incredible fight against Russia, which Russia didn’t expect, considering how Crimea went. But this time it seems different.

However, Ukraine can’t do this alone. The West is going to have to stand for something, and it can’t be the luxury goods market. There has been a lot of focus on financially impacting Russia. Things are evolving towards physical readiness, which might be important in supporting Ukraine (even though they aren’t a member of NATO) and engaging across all fronts of warfare - economically, informationally, and kinetically.

Putin had a thinly veiled threat of nuclear war when he announced the “special military option” into Ukraine. Russia ended up taking Chernobyl, which has had a spike in radiation since being occupied. Zelensky has asked Russia to talk. Zelensky also called out Europe - stated that they needed them to disconnect Russia from SWIFT, isolate Russia, embargo oil, close the airspace, etc.

“Today everything should be on the table, because it’s about the threat to us, all of us, all of Europe”

Putin is likely not going to stop at Ukraine.

But Leonid makes a really good point here - “how does any of this make sense?” And it doesn’t. Putin is not rational - and as Alexander Stubb highlights, Russia’s economy is likely going to be irrevocably harmed, Ukraine is incensed against him, and the West is moving in unison. But Putin is on a mission - to win, at any cost, and it’s important to not underestimate that.

There is more that can be done.

Some final thoughts

The entire point of this article is to try and bring light to the situation, and to care for the people that are there. This matters. And we must advocate, and more, the best that we can.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

U rock

thank you for continuing to bring intelligent insight to this horrific situation. What I am doing (besides reading your excellent posts) is writing to my elected representatives. Good luck to us humans.