This is a weekly market update (I post daily to TikTok). I publish these once a week (beta phase), as well as single stock pieces (1-3x a month) and macro deep-dives. I also publish on TikTok, Youtube, and Twitter!

Also very excited to be partnering with Morning Brew on a Markets 101 Series!

Youtube linked here :)

What Happened in the Stock Market this week?

Quick thought -

If we do enter a hyper inflationary environment, maybe points based systems will be the best hedge - could be an interesting application for in-game currency and other rewards programs.

The Stock Market

What a week.

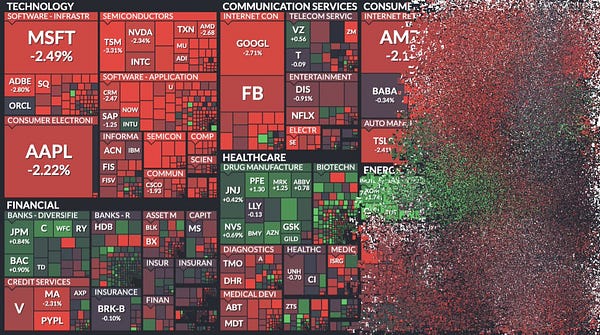

Still seeing a bit of a value rotation - energy and financials experiencing a pop, but tech did have quite the rebound after the beginning of the week sell-off. Tech ended the week strong after getting spooked by the CPI print.

VIX: The volatility of volatility was even volatile.

The shorts were out: The put-to-call ratio reached the highest this year - with lots of short bets against SPY and QQQ. People are worried about inflation, monetary tightening, etc - and the market reaction to all of the above.

Economic Data

Retail sales cratered - but don’t worry, “spending on services will be more than enough to compensate for it”.

We need people to spend but people are worried about spending because inflation, but partly the inflationary pressures are from people spending because of reopening demand and businesses spending because people want to spend - the spending cycle that keeps the economy alive.

Businesses are also getting crunched on the supply chain end, with the labor shortage in manufacturing and at ports putting more pressure on prices.

The Labor Market

Initial jobless claims came in lower than expected which is a good datapoint in the employment recovery path

But the job market is kind of weird right now. Part of the problem here is the shortage in manufacturing labor- which is huge problem for the way that we currently consume goods + measure economic productivity.

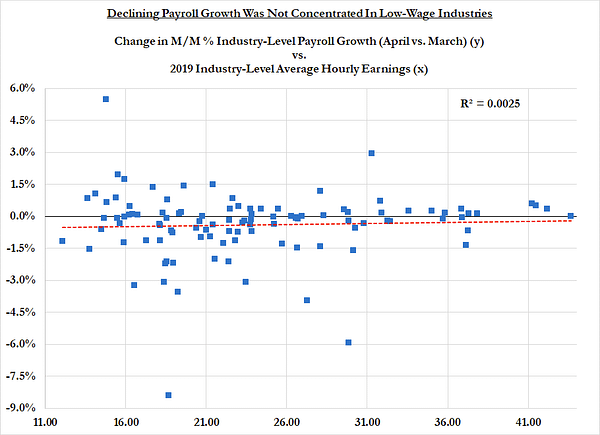

There are a lot of job openings - and a lot of people *not* applying, with some coming to the conclusion that benefits were too high (or wages too low) - but it turns out there are a few datapoints that highlight that a lot of mid- and high-wage jobs account for the hiring slowdown.

The entire U.S. market is built on cheap and efficient labor. People have been underpaid for a long time, and many have gotten accustomed to the cheapness that inexpensive labor allows (just look at recent Uber prices to see the impact that a labor force can have). This current labor shortage will bleed upwards - and put pressure on a lot of different things, prices, expectations around childcare, etc.

Inflation

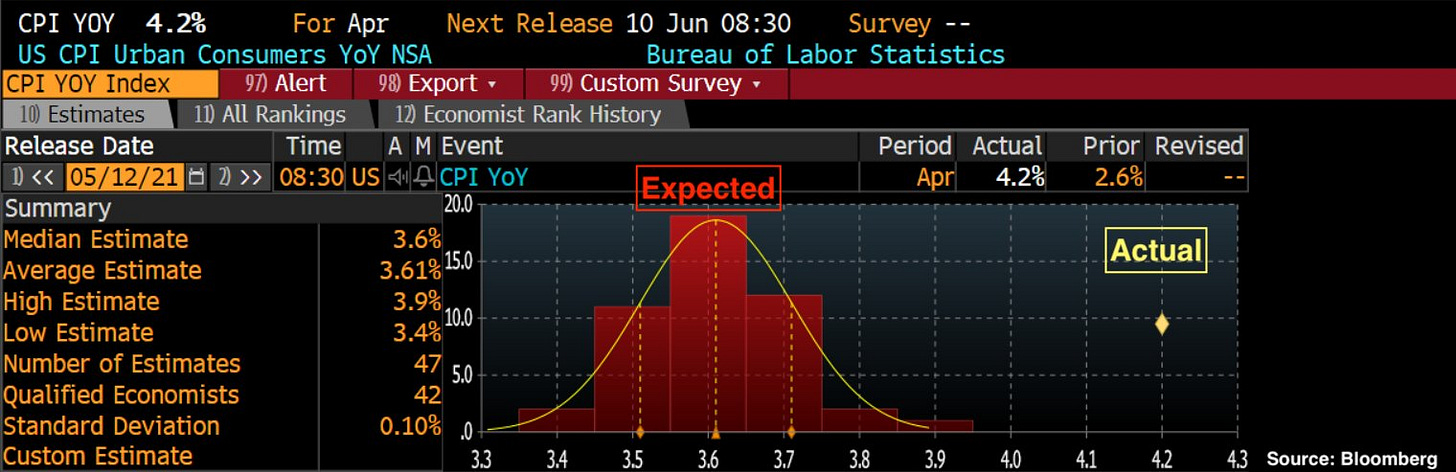

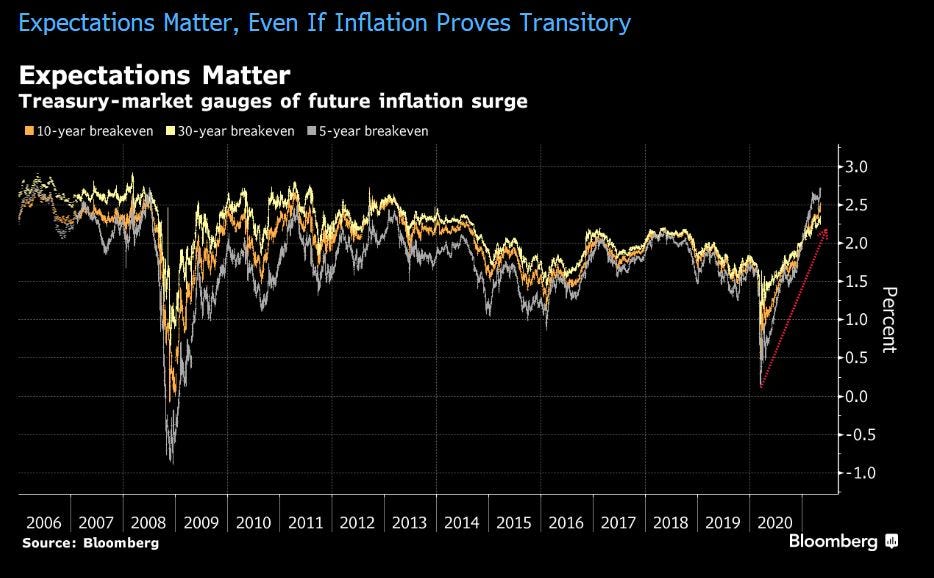

Core inflation came in higher than expected, rising 4.2% y/y vs 3.6% expected. Market didn’t like that. Expectations matter in this cat-and-mouse game, and right now, everyone is chasing the idea of inflation - and unfortunately, fear of inflation can make manifest it if people take action to move against it (like filling up plastic bags with gasoline)

Source: Jack Farley Most of the move in the core CPI index were hotels, autos, used-cars, etc. All of the reopening demand items - things we *expected* to move.

Consumer confidence cratered due to higher than expected inflation - “This combination of persistent demand in the face of rising prices creates the potential for an inflationary psychology, fostering buy-in-advance rationales and cost-of-living increases in wages.” —> inflationary psychology drives inflation.

In the same turn, PPI came in hot too - +6.2% y/y versus 5.8% expected. Market didn’t care at all.

UMich 5-10 year inflation expectations are at 3.1%, the highest since 2011. These are long-term expectations, meaning that people are paying attention - and that they are worried about inflation. The Fed keeps repeating that it is transitory - meaning that it will end “soon” if it does happen - but people simply do not believe them.

The issue is that the Fed can’t back it up (no matter how thicc their balance sheet gets)

The Fed is still deep in QE- they don’t need to raise rates because they haven’t met their goal of full employment. But as Will Slaughter said, “There is overwhelming evidence not that the Fed should put on the brakes, but that they should take their foot off the accelerator.”

The Fed should pull back on asset purchases - they aren’t necessary in the backdrop of reopening demand and an economy that is expected to easily surpass > 5-7% GDP growth.

But the Fed can’t pull back - the Fed can’t move their hand. If they pull back on anything, the market will lose its mind.

So the Fed finds itself in an infitnite loop. It can’t move. It also has to reverse some of the actions it took - which is what we are seeing in the RRP market. The Fed is creating a circle - reverse repo-ing all of the the assets sent out in March.

A snake eating it’s tail - that’s monetary policy for ya.

Source: The Market Dog

So things seem weird and bad. What’s the flipside of the narrative?

The U.S. is very entrenched and can move a couple of st devs in either direction before things get “very bad”. But things are definitely going to be weird - but that doesn’t necessarily mean that the entire foundation of the United States would crumble because of all the key advantages the country has (read Michael’s thread linked below for more).

Policy

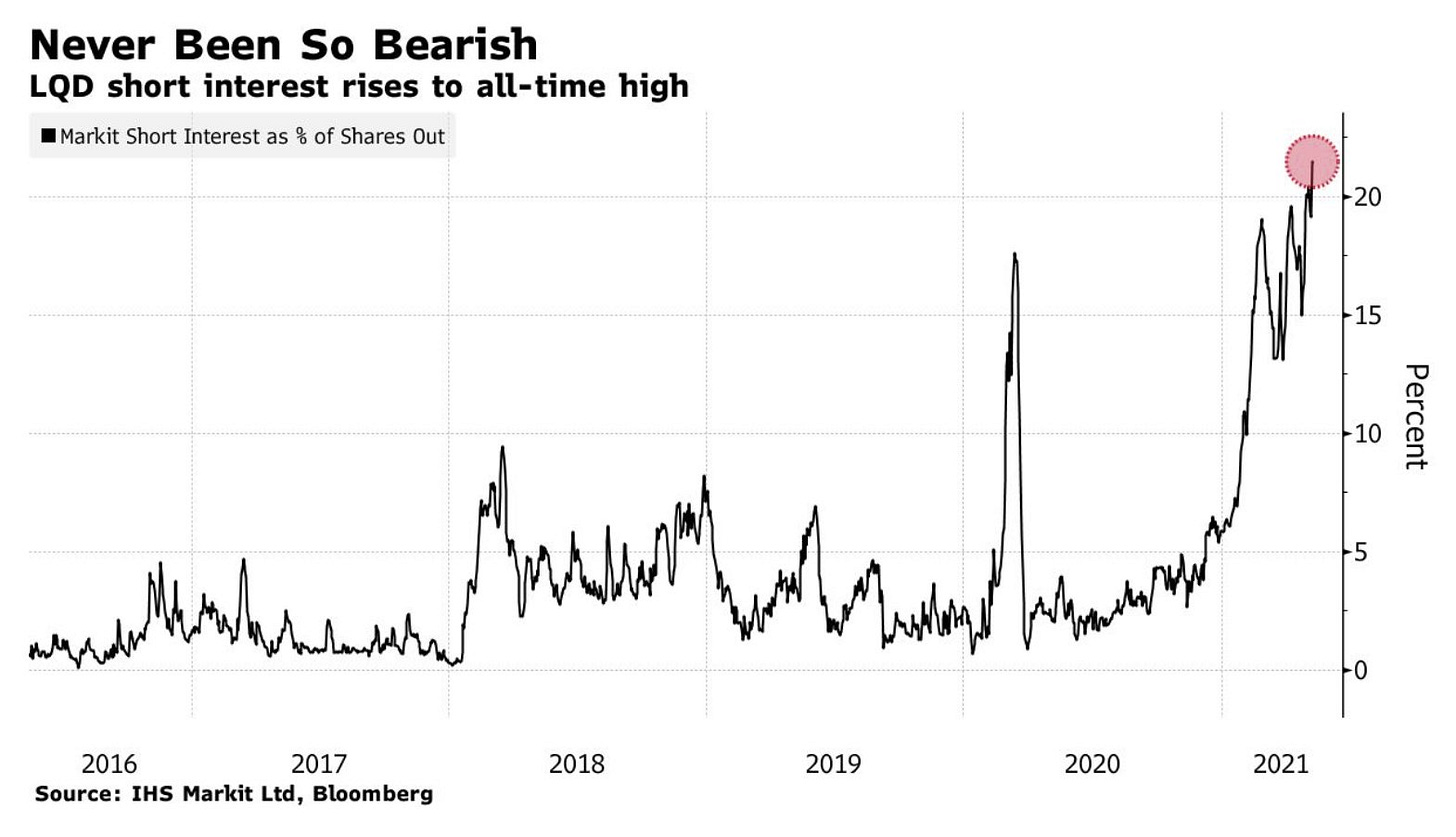

Lots of short pressure on corporate credit. With treasury yields poised to steepen, that could put pressure on LQD, because of it’s duration - it’s very sensitive to higher interest rates.

There are better places to find value than in investment grade credit - investors are likely rotating into HY and Emerging Market to find value.

Interestingy, total fixed income assets sold to the world continues to grow. People see treasuries and BBB credit as essentially the same thing - and with the level of Fed intervention, that conclusion isn’t wrong.

Commodities

Gold is a hedge against real rates, not inflation. That’s why we haven’t seen gold move that much, even though inflation has popped.

Lumber had a bit of a breather this week :)

Corn farmers are planting again - which should ease price pressures in the long run.

Still long term worries about supply chain issues - especially in semiconductors.

Crypto

There is a lot of noise in crypto. The SEC called it “a highly speculative investment” and warned of general lack of regulation in the market. It is unlikely that there will be a Bitcoin ETF approval considering this backdrop - and Gary from the SEC, who is looking to make a name for himself, said that the crypto industry could benefit “from greater investor protection”.

Binance is underinvestigation by both the DOJ and the IRS - so they could be the example case of how policy is enacted (resulting in a potentially bullish situation for Coinbase)

Crypto moved a lot this week (an ~understatement~). Elon sent things into a tailspin, the poopcoins created their own blackhole of volatility, and Vitalik’s selling of > $1mn of the dog tokens all resulted in a lot of market movement

Then Elon propped Doge back up by saying that Tesla was going to work with developers to execute on it.

Dogecoin is the perfect example of narrative become reality - people united behind this crypto because Elon supported it - and now, it essentially has become Eloncoin.

It’s a lot easier for Elon to piggyback on something like Doge versus developing his own currency - and he was able to pump the market cap up to a point where it became a feedback loop - FOMO drives all.

Now, Coinbase is going to host it on the platform. Collective belief in an asset is enough to drive value.

Institutions are paying attention too - and JPM wants ETH: "Ethereum 2.0 shifts from an energy intensive Proof-of-Work validation mechanism to a much less intensive Proof-of-Stake validation mechanism. As a result, less computational power and energy consumption are needed to maintain the ethereum network."

The Importance of Narrative

We saw this week (another confirmation) that tweets can move markets. It’s also shifted Bitcoin’s narrative - Bitcoin, which was meant to be decentralized, the next iteration of the future, it instead dominated by a billionaire’s whims. Institutions want a piece - and they will make sure that they have access to it, however that manifests.

We saw how inflation numbers (and fear of said numbers) can move markets. I will have a bigger piece out about this soon - but the narrative drives all.

Next Week

Have some of the core economic crosspost companies posting earnings next week - will be very interesting to see how some of the bellwethers do!

Walmart $WMT

Home Depot $HD

Applied Materials $AMAT

Target $TGT

Deere $DE

Also, more economic data!

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

thank you for your service 🙏