This is a weekly market update (I post daily to TikTok). I publish these once a week (beta phase), as well as single stock pieces (1-3x a month) and macro deep-dives. I also publish on TikTok, Youtube, and Twitter!

YouTube here

BROUGHT TO YOU BY

There are a lot of apps out there for buying and selling stocks. Here’s why I like Public.com.

✔ Social feed for sharing your ideas with friends and other investors

✔ Town Halls where you can ask C-suite execs your questions, like how they view company culture and what they think of category trends

✔ Daily audio shows, live in the app, so you can follow market news alongside trusted financial journalists and expert guests

✔ A transparent business model with trades routed directly to the exchanges—not through third-party market makers

Join me on Public and use code KYLA to snag a free $10 slice of stock when you open an account.

*This is not investment advice. Valid for U.S. residents 18+ and subject to account approval. See Public.com/disclosures/

Infrastructure and Biking

I ride a bike. I do not own a car. I bike around Los Angeles - and Darrell’s point here is really important. There is a lot that could be done for 1) biking infrastructure and 2) biking safety. It would be incredible to see more people embracing it as a form of transportation.

Market

Good job, market!

The market had a big mood swing early last week, but mostly recovered into the end of last week. Seeing a bit of weakness this morning, but considering that the world was “burning” on Monday of last week, things are a lot “better”.

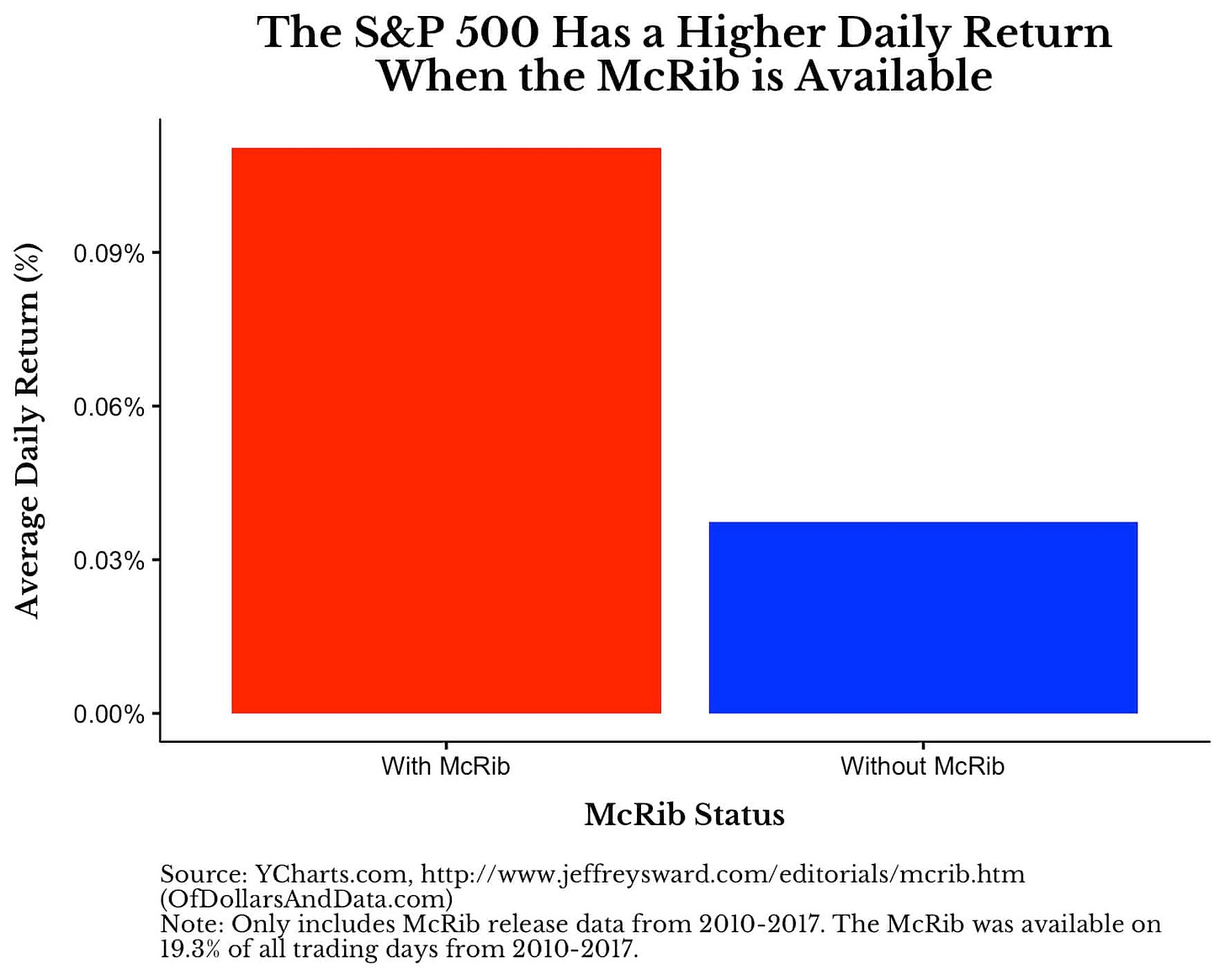

Why did the market wack out at the beginning of the week? A multitude of reasons really - “Powell, Congress, Inflation, growth peak, the delta variant, IPO quality, valuations, and an absent McRib” - basically, the market will wack out periodically. The day to day fluctuations are to be expected in a 24/7 news cycle.

But that doesn’t always mean that the swings have an overt reason - it underperforms when the McRib is off the menu - but that doesn’t mean that the market is reliant on McRibs for returns (correlation vs causation, if you will)

In all seriousness, the market was WEIRD this week. Energy finished the week strong after lagging pretty heavily at the beginning, utilities were tapped out by week end, small caps bounced - basically the market reversed itself over the course of 4 days. The main reason is that the breadth is pretty weak - volume very low (likely to a lot of people being on vacation)

Once again, the power of luxury - FarFetch, a luxury retail platform has a buyer that spends ~$1,400 on an order. That’s WILD - and speaks to the 1) stickiness of luxury and 2) the power of brand

No Laws: Hard seltzer sales in the U.S. are now slowing dramatically, with just a 4% gain during the 4-week period ended July 11! I spoke about this briefly in one of my YouTubes - this will be a trend as people 1) explore wines and 2) explore the other mixed drinks (you can buy canned vodka soda, mai tai’s etc now)

Dominos: DPZ was one of the best performing stocks on Thursday. I STILL believe that at the end of their run, Domino’s will be known as a Fintech company, not a pizza company. Big beat in earnings.

Inflation? No one really knows what is going on - most CEOs don’t know the Fed’s inflation target. And this isn’t something that they should know (to an extent) - they need to know the dynamics of the industry more. The Fed conducts “targeting” (and targeting takes time). However, they probably should know a bit about inflation - I am pretty surprised with the below data.

Tesla Ad revenue: Tesla spends $0 in ad revenue - whereas Hyundais (which I used to sell, fun fact) spend ~$2k. If you don’t have a memeking for CEO, it’s HARD to spend $0 on ads - Elon Musk is both the CEO and the CMO, to an extent.

Is climate the next crypto? I think that we are going to see an increasing narrative around climate over the next few years (climatetech becoming an even bigger space) - hopefully even sooner to bite into the problems that we already have

Inelastic market hypothesis -

“$1 of equity inflows drives $5 of incremental equity market value and 2/3 of the markets return over the last year can be attributed to inflows, higher than normal.

There is lots of $$$ going into the market - driving roughly 70% of the returns!! The big question is what will happen next year - when the inflows slow?

Lumber is crashing

And final thought - I think the financial advisory/mutual fund business is going to drastically change over the next 10-15 years. This generation isn’t going to invest the same way that advisors think they are - nor are they going to accept an advisor - it’s going to be much more DIY.

I am thinking a lot about this space, so please reach out on Twitter (@kylascan) if you want to chat (or any other platform really)

The below tweet? That’s the industry. It has to change.

Economy

The bond market is absolutely wild. 10Y swung around this week. The bond market usually gives a pretty decent sign of what the broader market is thinking - and with these swings, it seems that the market is pricing in a macro deflationary movement and the concept of negative rates. The bond rally has been weird - and no one can ~really~ pinpoint what’s going on.

It’s getting more expensive to buy the things - which is why companies that can pass on the costs are outperforming. It will be interesting to see how the deteriorating conditions impact how GDP growth etc., moves over the next few quarters.

There were lots of beats in the economic calendar this past week!! - Housing starts more than consensus, home sales slightly beat - things hot over in housing.

Also lots of weakness - building permits a bit weaker than expected, jobless claims a bit higher than expected (which will put pressure on the Fed’s dual mandate, which I REALLY don’t know if they will ever solve (no taper, ever)

Crypto

Another multi-billion Crypto SPAC!!! - Core Scientific - one of the largest Bitcoin mining companies is going public at a $4.3bn valuation. (w o w)

DeFi Warning: SEC Chair Gary Gensler has a warning about the synthetic stocks popping up on blockchains: firms selling the tokens are likely to end up in trouble with regulators - and he made a comment about “stable value tokens” too

They actually had a meeting on Stablecoins - stating that it could be a “national security” risk.

The end game is that if they can’t figure it out, they probably will regulate - this was a presentation on the preparation of a broader report. I believe that we will see increasing language on regulation over the next several months.

At least Circle has most of their reserves in cash (Tether is not quite as ~lucky~)

The B Word Conference happened this week - it was relatively boring (I made a TikTok about the 2030 version) but mostly spoke to the increasing acceptance of crypto.

Week AHEAD

VERY BIG WEEK.

Earnings going really well so far -

Good news for stocks: Q2 earnings season is now underway and earnings continue to soar. With only 39 companies reporting so far, the Q2 growth estimate is already up to 71%. This brings the 2021 calendar year growth estimate up to 37%.

Good news for stocks: Q2 earnings season is now underway and earnings continue to soar. With only 39 companies reporting so far, the Q2 growth estimate is already up to 71%. This brings the 2021 calendar year growth estimate up to 37%.

Let’s see how it continues!

#earnings for the week eps.sh/cal $AAPL $TSLA $AMZN $AMD $MSFT $FB $UPS $BA $LMT $GE $SHOP $F $PFE $GOOGL $XOM $PINS $HAS $TLRY $MMM $PYPL $V $OTIS $TDOC $QCOM $X $SBUX $MCD $RTX $JBLU $WM $LOGI $SPOT $YUMC $MA $CHKP $CAT $NOW $SHW $LRCX $LII $MT $PHM $PHG $BMY

#earnings for the week eps.sh/cal $AAPL $TSLA $AMZN $AMD $MSFT $FB $UPS $BA $LMT $GE $SHOP $F $PFE $GOOGL $XOM $PINS $HAS $TLRY $MMM $PYPL $V $OTIS $TDOC $QCOM $X $SBUX $MCD $RTX $JBLU $WM $LOGI $SPOT $YUMC $MA $CHKP $CAT $NOW $SHW $LRCX $LII $MT $PHM $PHG $BMY

Economic Calendar

FOMC meets on Tues and Wed of this week! Also PCE data out this week! Lots of noise, but this will probably be less surprising than their June meeting in terms of *accommodative surprise*. Not much will change, but keeping an eye out for language on asset purchases and the Delta variant.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

Very interesting final thought...

" I think that we are going to see an increasing narrative around climate over the next few years (climatetech becoming an even bigger space)" -- I hope you'll say more about this soon...