This is a weekly market update (I post daily to TikTok). I publish these once a week (beta phase), as well as single stock pieces (1-3x a month) and macro deep-dives. I also publish on TikTok, Youtube, and Twitter!

Youtube linked here :)

What Happened in the Stock Market This Week?

The S&P 500 rose 0.08% marking 4th month of gainz

PCE reached 3.1% - highest rating since the 1990s

The stock market was relatively flat, with some strength (finally) in communication services and technology. Healthcare pretty beaten down, and most big names were relatively flat.

stock market wyd?

Even better - AMC is up 111% over the past week. Forget everything you learned! Meme stonks are the only path forward.

Market Movers

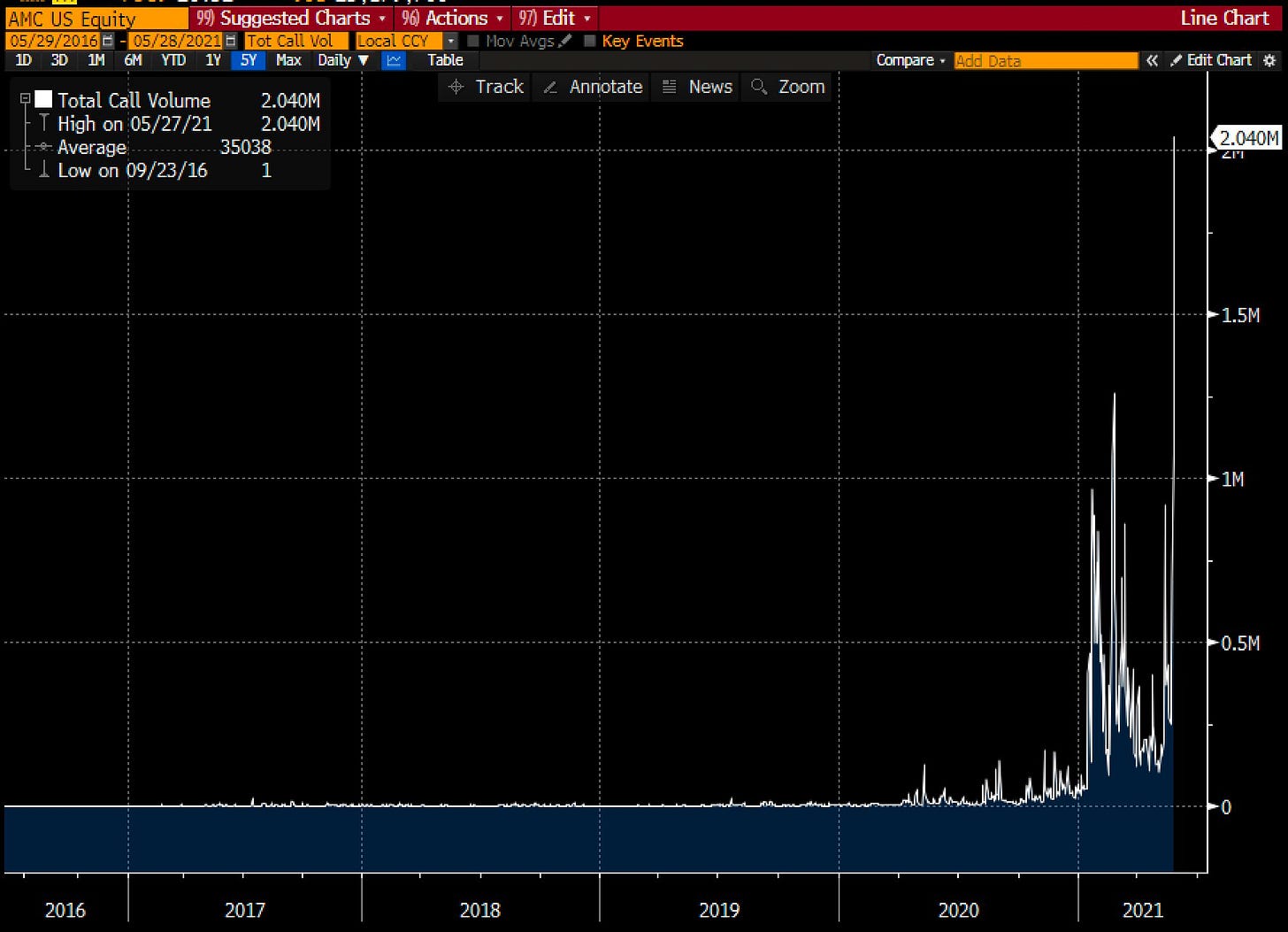

AMC had more option premium traded today than any other stock, ETF, or index. With 4.8mn contracts traded, and 58% of the contracts traded being calls - let’s just say that people like the stock

These shares were UP pre-market. Tell me more about retail investors.

There were more than 2 million AMC calls traded on Friday

GME and AMC have resulted in short losses of ~$8bn (and $673mn on Wednesday)

Why AMC and GME go up?

Because of collective belief in an asset. GME and AMC are literally - Thomas the Tank Engine - “I think I can”.

Economic Data

Durable goods missed at -1.3% vs +0.8% expected

Initial jobless claims fell to 406k vs 425k estimated

Consumer Confidence Index was weaker than expected at 117.2 vs 118.8 expected

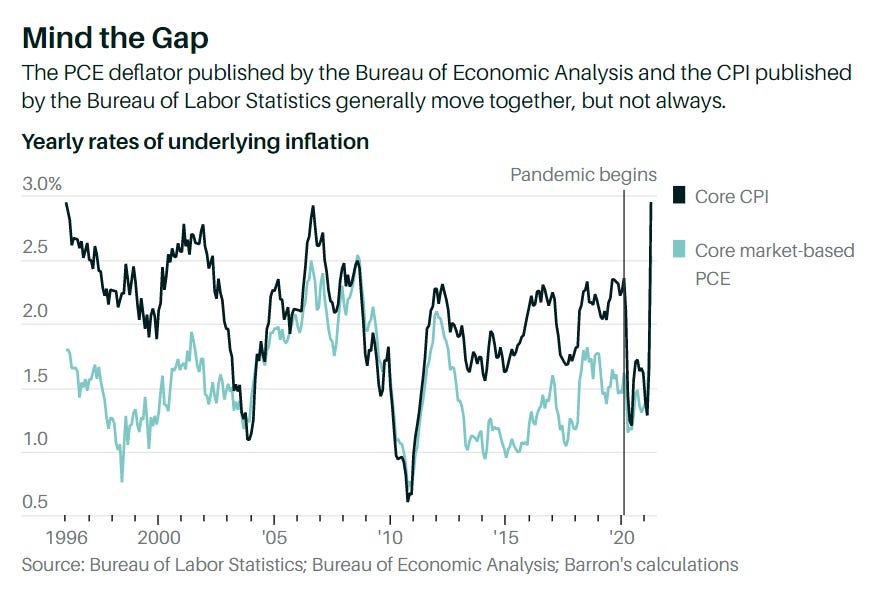

PCE (the Fed’s preferred measure of inflation) and CPI (the other measure of inflation that we have for some reason) generally move together, but sometimes they do not (like most things in economics). CPI puts a higher weight on energy, used vehicles, and housing, whereas PCE puts more emphasis on healthcare and financial services.

PCE had a massive print, but the bond market didn’t care at all. The idea is that everything in the PCE is transitory - so even though it was up ~3%, it’s nbd, because, you know - it’s transient.

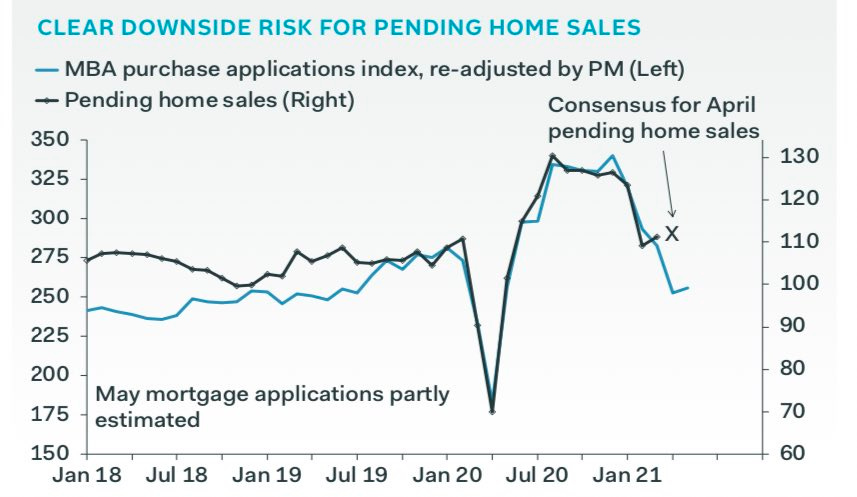

No one wants to buy homes or cars: New home sales fell 6%, and the median new home price rose 20% y/y. People are noticing the housing market froth, and slowly backing away.

Auto buying conditions have gotten worse - high demand of used cars and limited new vehicles due to semiconductor issues are putting pressure on prices of both the old and new.

The housing market is wild, but we already knew that. Someone offered the name of their firstborn in their bid - and still lost.

But rents are on the rise too (Everything Must Be Expensive) - monthly rents have risen by 4% or more in Boston, NYC, SF, Chicago, and Seattle

There is also a cabinet shortage. Because of course there is.

Economic Policy

Reverse Repo: it didn’t cross $500bn - but it is still at all-time-highs. I am going to write (and do a TikTok) on this soon because it is *confusing*

But basically RRP is a drain for reserves - banks use RRP as a place to keep rates from going too low by allowing borrowing at a fixed rate (h/t to DC), which allows the Fed to continue QE

Here is a brief explainer that I will improve upon:

BUT ALSO Federal Home Loan Banks auctioned 4-week discount notes and stopped at -0.001% (which is concerning, because the Fed is FIGHTING for rates to not go negative)

Global central bank balance sheets collectively approaching $26T; what even is ~debt~ but a formality at this point

Crypto

Crypto still going through it.

SEC charged people that were pumping coins - “promoting a global unregistered digital asset securities offering that raised over $2 BILLION from retail investors”

Ethereum trading volumes have popped

Daily exchange volumes have increased as well. Almost $90bn on May 25 ALONE.

Being a middleman is a powerful thing

I am working on a paper ab

out crypto market structure - below are some of the reasons I am working through on the reasons behind the selloff -

There are a few reasons behind the selloff:

Bearish options skew: traders were positioned skewish, lots of market selling, huge deleveraging, margin calls, liquidation

Stablecoin liquidity - USDT, USDC, DAI all trading well up til selloff, but once the selloff hit they all expanded tremendously - supplies +30-80%

Tax day: Always selling before taxes :,)

Scaled back stimulus: people don’t have the same amount of inflows, so neither does crypto

Chinese mining: China crackdown could impact crypto

Inflation data: Market is worried about inflation, lots of spillage between equities and cryptos

Speculators falling out

Can access derivatives without going on chain

Unit bias - retail has moved on to other things

Trading platforms: people can trade on Robinhood, eToro - AND get access to equity here. So when equities selloff, crypto is more likely to be more correlated.

Binance is a retail platform - they experienced panic selling and rotation into other crypto assets - retail led speculation and were spooked

GBTC Grayscale’s product - these took in a lot of btc coins, and created strong institutional demand - created a supply squeeze too - saw a weakening in demand flows

Liquidiations make everything more intense, and with lots of leveraged buying, thats a big issue.

More to come! I apologize, I feel like half this note was a big “Under Construction” sign. But much more to come.

Next Week

Earnings

Broadcom $AVGO

Zoom $ZM

Bank of Nova $BNS

CrowdStrike $CRWD

Lululemon $LULU

DocuSign $DOCU

Slack $WORK

Hewlett Packard $HPE

StoneCo $STNE

MongoDB $MDB

Canopy $CGC

C3 $AI

Economic Data

JEROME ON FRIDAY

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

Incredible as always my friend

Love your work!