Ranking the economy on the Scoville test - and applying some whole milk for a soft landing

Podcast here and YouTube up later today

Everyone is anticipating a recession.

It’s kind of like a general sense of foreboding, where everyone is watching a tree get chopped down. It will fall - eventually. It will land - somehow. But there are a lot of questions to answer in the meantime.

We are entering earnings season and the general idea floated by a lot of companies is that some sort of mild recession is coming - but no one really knows what that means. All the Davos people are on their little stage chatting about how the world is going to end - 2/3rds of economists expect a worldwide recession in 2023 but no one knows when or where or how.

The consensus is -

MILD RECESSION: The general idea of a mild recession is that growth isn’t great but things are okay. Like a splinter in your finger - something annoying but manageable. Somewhat of a slowdown in the labor force with unemployment rising (somehow, despite a gap in the labor force), housing market blowing out (even as homebuilder sentiment improves), yield signs in manufacturing (this is already happening), rents relaxing (also already happening), consumer spending will slow (but maybe not that bad?) - the data is starting to show that *something* is coming. It could start now, it could start in 2024. The slowest tree fall of all time.

And if you just search the word “mild” in Bloomberg’s 2023 Wall Street Predictions you get a bunch of things like this -

No one really knows what anything means right? The economy is basically a guessing game of sorts. It’s kinda like the Scoville test for peppers.

The Scoville Test for the Economy

The Scoville test is imprecise because its based on human subjectivity - everyone has a different mouth going on, with a different palate and taste receptors. Like yes we all know this pepper is hot, but how hot is hot - really?

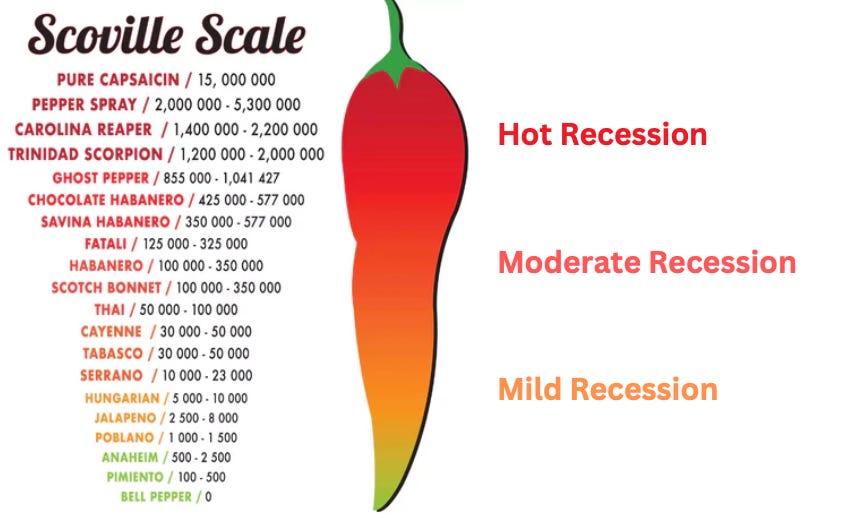

So if we decide to apply the imprecise measurement of the Scoville scale to the economy (which honestly, might be just as accurate of a framework as anything else that we do to measure things) - A really spicy pepper would equate to a hot recession, a semi-spicy pepper would be a moderate recession, and a non-spicy pepper would ideally be a mild recession.

So let’s say we have a mild recession, a subjective poblano on the Scoville scale. Now the question is - what comes next?

If the recession is mild poblano pepper, how long will it be mild for?

As Pete Boockvar has highlighted - it’s more than just how the Recession comes, it’s the recovery that follows.

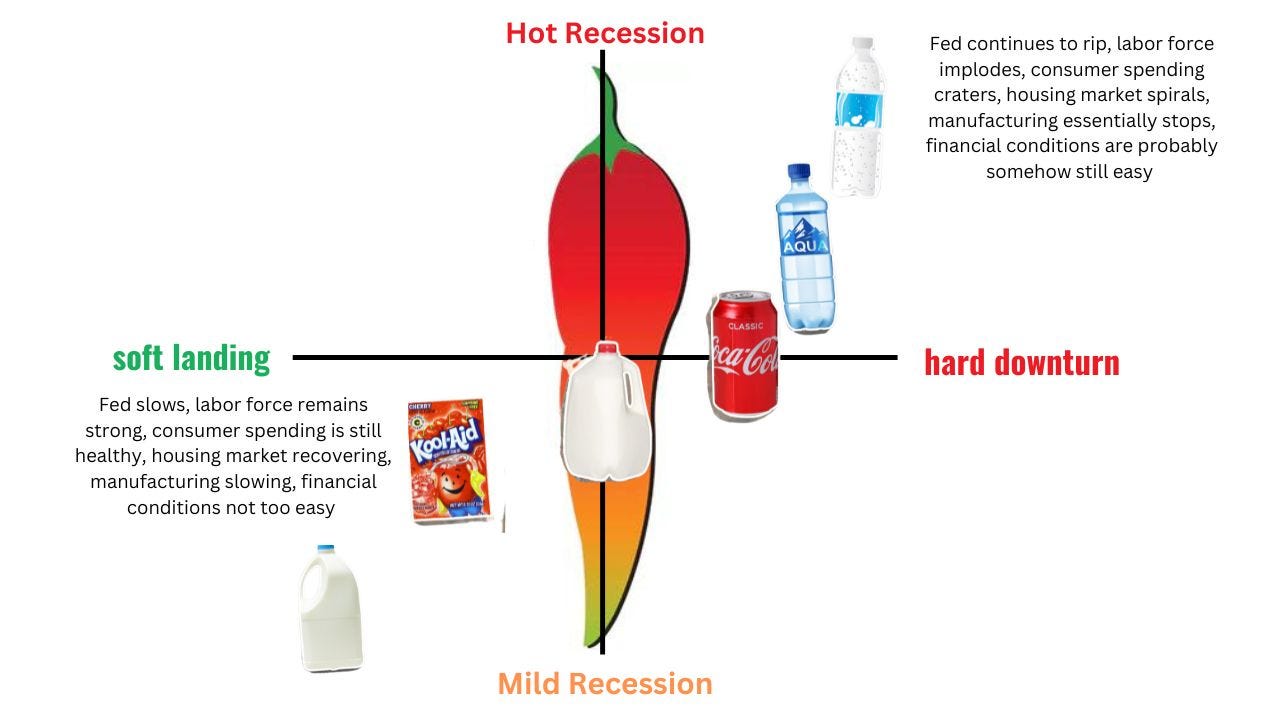

A soft landing, but how soft? Or a hard downturn - but how hard? And what does that even mean?

How long does the pepper burn your mouth for? Do we need to pour a glass of milk on the economy or can we go about our day with a slight sweat sheen on our brow? Or do we accidentally drink carbonated water which apparently makes the burning sensation that much worse?

Ideally - we want to be where the whole milk is - a soft landing, a mild recession (ideally no Recession at all). But of course, that’s where it gets complicated. With all of this there’s data - and then there’s action.

Movies: You can look at the box office for Avatar and say “well looks like people are doing super duper” like Neil Dutta said in a recent Odd Lots interview.

Sentiment: You could also point to the improvement in homebuilder sentiment and the movement in bonds (people are snapping up investment grade) and nod wisely and say “yes, the economy is absolutely moving and grooving along.”

But it gets worse: Or you could point to the tech layoffs (MSFT recently let 10,000 people go) and the collapse in manufacturing and say “well, things are not doing well at all.”

What the Fed is doing (talking, raising rates) is just starting to impact the economy. We are just now starting to see things really begin to slow down - and the question is of course - how long will it slow down for?

What is going on?

We have a weird combination of stuff right now. With the data that has come out recently, it’s clear that the economy is slowing down. But the Fed seems unlikely to budge despite this clear caution signs flashing (with Bullard booming about 50 bps, even as a nonvoting member).

And with that - the combination of the Fed not budging and the data continuing to weaken - the soft landing seems a lot more like a hard downturn. Things are slowing down but not slowing down enough for the Fed to say “oh yeah, that’s good, we will chill out now” - and the worry is the Fed will go too hard.

Some of the data points -

The Disinflationary

Industrial production fell, hiring and wage growth slowed

The Empire manufacturing index fell to its lowest level since May 2020 driven by a continuous fall in new orders and shipments

The Beige Book has also highlighted a big slowdown in the economy where things are becoming stagnant.

Retail sales are falling - they fell 1.1% in December. This is a broadbased slowdown that shows that the consumer is really not doing well (to a certain extent). They aren’t as willing to take on another 17% price hike on Slim Jim meat sticks.

This might be an unpopular opinion, but consumers shouldn’t have to take on more price hikes.

I know it’s getting more expensive for companies to make things but raising prices in the anticipation of higher prices - which is what a lot of firms did - is not good! This was a major driver of inflation in 2021, and it caused excess pain - and potentially excess action from the Fed.

It’s not just supply and demand, but it’s the influence of companies on supply and demand. If companies are charging almost 20% more per quarter for meat sticks, consumers are going to push back eventually!1

People are also running out of money. The savings rate continues to fall and people are taking on more credit card debt to finance their purchases.

Rents are falling - 3% in the last three months on seasonally adjusted annualized basis according to Conor Sen. People aren’t demanding new apartments, so rental growth has to slow as the vacancy rate rises.

Headline PPI fell by 0.5% more than the estimate of 0.1% - all signs of inflation easing for producers, which ideally means that things will ease for consumers too

Markets: And of course, on a mechanical level, the treasury curve between 3 months and 10 years is the most inverted since 1981 meaning that markets are saying “yes a Recession is coming” - but they’ve been saying this for months.

There is a lot of softness in the manufacturing sector. The consumer is starting to fight back too, with resistance to price hikes. But of course, there is the other side to that.

And the Not-so-disinflationary

China reopening: This could create some inflationary pockets across the board as three years of pent up demand is unleashed on the world.

Labor market gaps: Initial jobless claims are easing but nowhere near where the Fed wants them to be. A lot of people retired during the pandemic and they probably aren’t going to be coming back to work - which means that the labor market will have to essentially be reinvented through better immigration policy, working parents support, and support for workers with disabilities

BUT Microsoft laid off 10,00 people and Amazon’s layoffs just hit. Tech and finance are likely in a deep recession

Bonds!! Bond investors are going hog wild for bonds with nearly $600b in sales this year. Everyone wants a piece of the bond market - a sign that they aren’t that worried about a Recession. High yield is off to a slower start, but is showing signs of picking up steam too. Markets are getting comfy BUT the Fed is likely going to continue on their hiking journey

Housing market: Mortgage demand has spiked (remember, this is relative) and mortgage rates are at their lowest level since Sep 2022 - BUT mortgage payments are now are running ~45% of annual household income, a massive spike over the past couple of years

There could be more upward pressure on inflation moving forward. An “echo effect” as we start to see labor contracts reprice and residual prices move higher which could create some inflationary worries. The BoJ is going to likely make some moves too, which could create some waves of worry. Also as Mary Daly said, markets are priced for perfection.

So applying a matrix to our Scoville test- we can see what would drive the soft landing vs the hard downturn and the hot recession vs the mild recession. A lot of it boils down to the Federal Reserve, but it’s also important to pay attention to the labor market, consumer health, housing etc.

And of course, the big question now here in the United States is the labor force. We have pandemic era retirements - and those people likely aren’t going to come back unless things get really bad. Firms will likely need to continue to raise wages, and the Fed won’t love seeing that because of their worries of wage-price-spiral-land.

It will be a delicate balance. We have more headwinds ahead as we deal with the debt ceiling, digesting the economic data, and processing the momentum of a slowing economy.

Final Thoughts

There’s this whole thing in the United States of rugged individualism, where we are taught from the time we are born that the world is ours to conquer - and if someone falls as we climb, alas! They should have climbed HARDER.

And I think this is okay and fine and just-how-it-is and there is a general level of acceptance that has to come with it because there are positives - but I also think it distorts how we think about the economy.

When we think about the labor force - Target recently raised its minimum wage to as much as $24/hour and will provide insurance to workers who work > 24 hours/week - a lot of people will bemoan that and say “those people are not WORKING hard enough” which is absurd. If we can create a world where our people are taken care of, have a place to live, are not constantly worried about where the next meal is coming from - that’s net positive for *everyone*.

I thought this quote from Larry Fink was sort of funny because markets are based entirely on hope and expectations. And baseline, I think most people expect things to get better over 30 years, sure - but stocks-go-up isn’t always a happy world.

“BlackRock is a firm that tries to sell hope because why would anybody put something into a 30-year obligation unless you believe something is better in 30 years?” -- Larry Fink

We are likely facing some sort of “soft downturn” scenario, just based on the storm of data coming forth. A mild recession is *still* a Recession - even if one million people lose their jobs, that’s still a million people *losing their jobs*. Those are people with families and plans and dreams and they matter. It shouldn’t be this way.

So no one knows what a mild recession is - no one really knows how long it will last or what will happen, but the it’s the base case for a lot of people. We are starting to see the slowdown begin in the numbers - the question now is how resilient the people (not “consumers” but people) are in the face of adversity, and how corporations handle a changing economic environment.

A mild recession is subjective - just like pepper hotness. Our world is rapidly changing - models made from 1970s-2019 probably won’t fly anymore. There really isn’t anything to say in the face of a downturn, especially one that isn’t really a downturn yet.

If anything, it might be a bifurcession - tech and finance will flop around where other parts of the economy will be bolstered by a reallocation of capital. And there is no platitude for that, it’s just economic cycles and that’s all. There is no way to paint rainbows and butterflies on things like this, because suffering is sometimes just suffering. But there is hope on the horizon, and there are opportunities down the road.

If a tree falls in the forest, it does make a sound.

Thanks for reading.

Other Things

Great list of readings on energy by John Kemp. DensePose From WiFi. Republicans worry a national sales tax bill would be a ‘political gift’ for Democrats. Adam Cochran’s wild thread. Ocean Vuong’s syllabus for his Spring 2023 hybrid texts class at NYU. Twitter’s revenue is down 40% year over year.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

According to the Pepsi CEO, labor costs are now going to be the source of inflation versus commodities - meaning he thinks the labor market is going to be relatively tight still

I love Kylas smorgasbord of thoughts and chili peppers. So difficult to cite my most favorite excerpt but will stick with:

"If we can create a world where our people are taken care of, have a place to live, are not constantly worried about where the next meal is coming from - that’s net positive for *everyone*."

In short, an extremely informative overview of our dilemmas today in the economy and more information is always at least somewhat uplifting. Thanks Kyla

Very Insightful! ☺