Why Speculation Drives Markets

on short-termism, unhappiness, productivity, the FOMC, and Zillow

Last time, I talked about how money wasn’t real. This time I am talking about unhappiness, short-termism, and speculation.

If you’re already subscribed, thank you! if you’d like to subscribe hit this button here:

YouTube/podcast up soon

The Modern Dilemma

We are, on average, very unhappy.

Of course statistics are skewed, and of course, this isn’t fully representative, but on aggregate, we’ve never been more unhappy - but we’ve also never had more, right? On aggregate (I fully recognize that this is NOT evenly spread and wealth disparity is huge), most people have more things than they have ever had - access, technology, opportunity - on average, we *should* be at least incrementally happier than we were 100 years ago. (also the comments below are on average, i know a lot of people don’t feel impacted by the things I talk about)

So why are we so sad?

The few variables that most people point to (beyond a global pandemic, which is definitely a big fuel for the unhappiness shift I think)

Social media: We are constantly comparing ourselves to others, and measure self-worth by digital appearance. Our barometers are constantly having to adjust to an unattainable social standards - we will never look like an Instagram filter in real life.

Wealth flexing: There is increasing disparity in wealth, and it can feel disheartening to think “Everyone is Getting Rich - But Me” (this is exacerbated by social media)

Politics: Because of social media (a theme), we are able to peer into the lens of politics - and it isn’t pretty. We see our leaders up close and personal, see their flaws - and it compounds into a certain friction for feelings of optimism.

Consumerism as a band-aid: We often times *buy* things in order to fulfill the gaps that we might think that we have. But this is a vicious feedback loop - because short-term purchases don’t equate to long-term happiness.

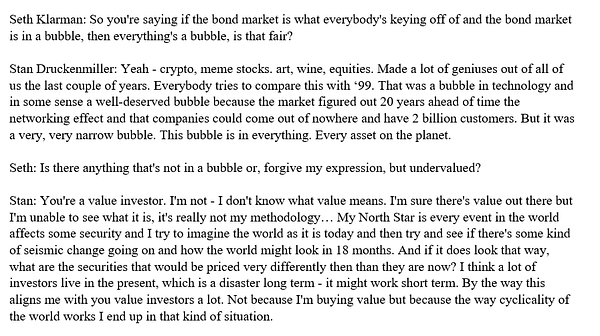

Stan Druckenmiller did an interview with Seth Klarman around the idea of bubbles (when the stock market is euphoric), and one of the most poignant takeaways for me was:

“A lot of investors live in the present, which is a disaster long term - it might work short term.”

They talked about the everything-bubble too, which arguably might be a situation that we are in - but it’s more this idea of short-termism that’s important.

The Short Term Nature

We operate with a short-term mindset, at all times. We scurry from one meeting to another during the day, we scurry from one activity to another, we scurry along in life with the evolutionary mindset of scarcity. And nothing is wrong with this, but it does shape how we interact with the world, as our sole goal is:

“Go quick, go now, execute, rinse repeat”

Most notably, we see this short-termism in supply chains with the bullwhip effect.

“Oh a shortage might happen??? Better get MUCH more than I need”

We get spooked out by scarcity and demand MORE because of that.

And then we scurry along to the next activity.

We are predisposed to an element of fear and we operate in the short term because that’s what we are biologically designed to do. And our human brains have been stretched recently - there is definitely a sense of Chicken Little telling us that the sky is going to fall at any moment (pandemic, supply chains, labor shortages, inflation fears, the climate, etc).

This is compounded by a hot and frankly kinda spooky market!! And it only seems to be focused on the short term - Tesla maybe has a deal with Hertz? That absolutely deserves billions in market cap. Short-termism, all around.

But then again - why wouldn’t Tesla command billions in pure meme value? Aren’t those the fundamentals of Tesla - memes?

What if the fundamentals that are meant to drive markets have shifted, just as we have shifted?

What if fundamentals are now FOMO and pure speculation versus an element of cash flows and profitability?

That’s kind of what it feels like - that the short-term is a quick cash grab for potentially long-term “happiness”. It does feel like the markets have become speculative tools rather than “oh yeah, this is how you will retire in 60 years”. Why wait to retire? Which is fine in practice - memes are funny - but it does require us to rethink how market systems work.

Speculation

Speculation is here. Raoul Paul had a great thread on it (Alex Good followed up with a perfect foil to it) but the main thing was that this generation is completely all-in on the gamble. Society did not meet Millennials where they needed it to - and because of that, speculation is the only solution.

The game has changed. Markets are changing, the way that money flows is changing, the way that we live life is changing. And tbh, some of it feels BAD - makes people unhappy.

EVERYTHING has become speculative. And it’s tough sometimes.

Playing with Emotions: Because with Zillow, as described in the above tweet, people (of all ages) get priced out of the market.

It’s very much like - oh housing is maybe not something we should play around with, especially considering the massive wealth gap??

Wealth Effect: Real estate is a core driver of wealth in the United States and to just see it become leveraged by a misaligned algorithm feels… bad.

So there is once again a need to take matters into your own hands, to run against the system, to build something the way that this generation thinks the world should work - and risk is celebrated because of that.

But on the flip-side of that debate - can the market handle that kind of risk? Can it handle endless speculation, that seems to blur into gambling?

The Weird Thing About Wealth

In context to the speculative markets and market endurance, we have to ask - what does it actually mean to be rich - would a full risk-on market enable everyone to get rich, and is that a good thing?

All our lives, we are taught that we should work hard, get a good job, settle down with our 30-year mortgage, but there is very clearly a growing dissent against that movement.

It comes in a few layers:

Return to analog: The return of wired earphones, the return to simplicity, and the return to nostalgia. Most generations go through some cycle like this, but I could see this being amplified by the acceleration into the Metaverse.

The Disconnect Between the Physical: I am really excited for the applications to education (touched on in my Metaverse video) but I worry that there is an increasing disconnect between the physical and the digital.

We know the world is burning - escaping into a computer isn’t going to change that.

Dissatisfaction with corporatism: There is increasing desire to live a life outside of a traditional corporate structure - not because the traditional corporate structure is bad, more so, it just doesn’t *work* the way that it used to.

But despite all the pushback, all the systemic change, all the “take the markets into your own hands and make it your own!!”, sometimes, you still have billionaires designing dorms.

Charlie Munger’s Dorms

Charlie Munger is designing dorms at UCSB. He is a very rich man, and this is a perfect example of corporatism leaking its way into everything. He paid $200mn, the place costs $1.5bn, he wants to design it or else he will pull the $200mn - and he designs it with NO windows and two exits.

When interviewed about the pushback - “I’d rather be a billionaire and not be loved by everybody than not have any money.”

Munger made his money in markets. Now he is designing (without a formal architectural background) dorms for the next generation of leaders.

And he doesn’t want to give them windows.

??????????

This is another point of friction - it feels like policy makers and leaders DO NOT care about their constituents (and they might not and tbh maybe they don’t need to).

The traditional structure to achieve wealth is no longer the “best” way to achieve wealth - wealth has become a function of making big bets in speculative markets vs investing 40 years in a corporate company. That’s very clear. And that is why we see some cracks beginning to show in the labor force.

Productivity

Productivity fell for the first time since 1981, and maybe that’s an archaic measurement, but contrasted against the strain in the supply chain, it is concerning.

Zooming out here, it increasingly feels like we are forgetting that there is an Earth beneath our feet - and we can’t exist (yet) without our physical being.

What is productivity in an online world? How does that reconcile with the physical?

The world still is here - and that’s tough to grapple with in an increasingly online reality when we haven’t really figured out our physical one, especially as we run full speed into the Metaverse.

And the system is already stretched - it’s already kinda like the Metaverse (!!) where people mess with input variables in order to make the game work for them, and try to manipulate the physical world to serve their purpose.

Gamification of the System

There are winners and losers in manipulating the physical.

Failure: Zillow

Zillow was playing a losing game. They were trying to outsmart local markets, which is very hard to do.

As Benn wrote: “Local market specialists are always better informed than you are and will systematically sell to you when your value estimate is erroneously high”. Aka Zillow was always going to get burned here.

Once again, we see a mispricng of risk - a fundamental misunderstanding that in order to make markets, you have to take on market risk. There is still a human behind all of this - and they get to ultimately choose what wins versus what doesn’t.

Winner: Bill Ackman (and OPEC)

Bill Ackman gets to lobby the Fed to lower interest rates, while having a hedge in place that would allow him to benefit if they *did* lower rates. There is a premium to having this sort of seat, obviously - and Bill can design the game in his favor (which he does a lot).

OPEC controls the energy supply, and because of that, they can manipulate our physical world as much as they want

But then of course - how do you win a game that no one knows the answer to?

The Uncertainty of Modern Policy Makers

What does it mean when no one knows?

I think this is one of the main reasons that we are broadly unhappy- because we know that no one knows, we know we’ve made a mess of things and that kind of sucks.

There is short-termism in our political system where politicians literally design policy to get themselves re-elected.

There is massive wealth effects, as most politicians don’t *get* the broad experience of the people they are serving.

With the Fed, they said that this was indeed a new world - and its very tough to implement policy meant for an old framework into a new one.

All of our monetary policy is built around a big nudge nudge - the Fed nudges the bond market, that nudges banks, then banks nudge us. It’s indirect, and the impact is a little fuzzy at times (especially because rates have been so low for so long)

Taper Time: Sure, they will pull back on $15b of bond purchases to start putting contractionary pressure on things and pivoting from backstopping the market, but they also commented that this pace could change - this is all an experiment (which isn’t a bad thing, it’s just a thing)

Supply Chain Woes: Jerome Powell came out and said that they would not be able to fix inflationary pressures that are caused by supply chain disruptions

They can make it harder for you to get a loan to GET a truck, but they can’t really do much beyond that

Maxmimum Employment: They also said that they are far from their goal of maximum employment - but they don’t really know what that looks like (maximum employment is full employment + inclusivity + wage growth).

But they can’t go make people get hired - they can just nudge nudge.

Nudge nudge probably isn’t going to work anymore.

Everything Becomes a Subscription Model in the End

The end state is subscription. This is an interesting move by Coinbase - rather than relying on trading fees, they are seeking stability of income through the time-tested model of subscription.

That’s a sign that the speculative markets will one day die down - we all know this.

Short-termism makes it so these boom-bust cycles have to bust at some point - we get collectively distracted by something else, and go look at that instead.

But the beautiful thing about short-termism and speculation is that it allows more capital to enter the system. And there is the potential for that capital to be directed to something more productive, and to change the lives of so many people.

Because we are humans, we are storytellers.

We know how to create fiction - we know how to live lives driven by the collective belief of assets.

Speculation is not net-bad. As Emil Cioran says:

“Man starts over again everyday, in spite of all he knows, against all he knows.”

The market is cyclical - we humans are cyclical, so the systems we build are too. I don’t know if it will be a spectacular boom-bust, but I do think there is a huge opportunity to rethink market systems and capital allocation - and design them in way that optimizes for the (rather tough) goal of happiness. I don’t know what that looks like.

Maybe speculation is the future, but I do think as things crumble and current systems get stretched, we have the huge chance to rebuild them.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

Excellent take as always. Have discovered your content recently, and at the risk of sounding like a groupie, I’ve found that I share pretty much the same perspectives on the various topics you’ve covered (recent grad) but could never distill my thoughts in any form as eloquently and prolifically as you have. Sincere kudos to you!

this was insighful, well done!