An Orchestrated Recession? Trump’s Tariffs, AI, and the Future of US Power

Why Trump is Doing What He is Doing

the threats become real and how to respond

Tariffs and More

So, the tariffs are here (except maybe they will go away soon). As Trump said in his speech on Tuesday night before Congress:

Tariffs are about making America rich again and making America great again. And it’s happening, and it will happen rather quickly. There’ll be a little disturbance, but we’re OK with that. It won’t be much.

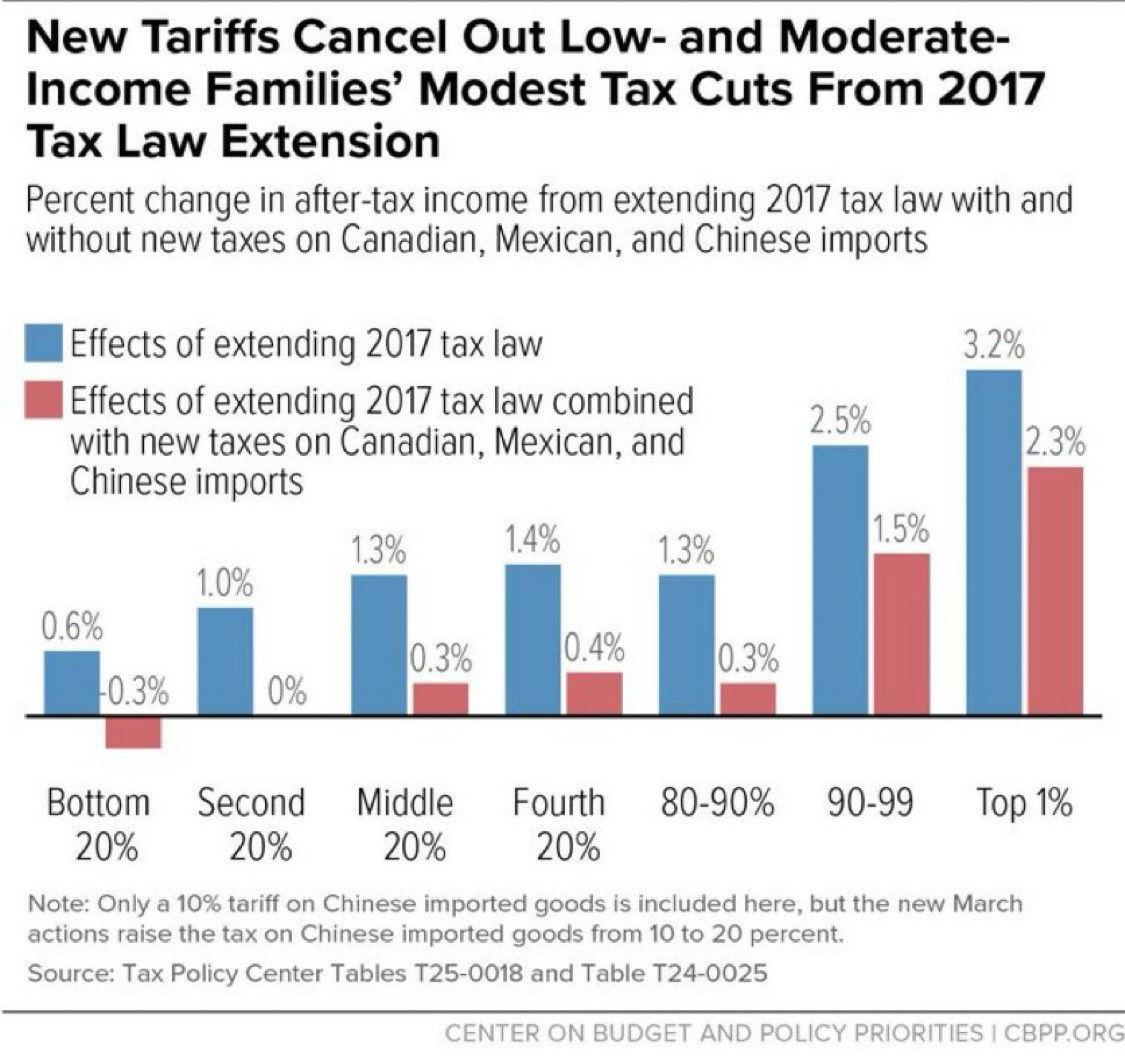

We're now looking at a 25% tax on Mexican imports, 25% on Canadian imports (except energy at 10%), and 20% on Chinese imports, most of which will be shouldered by the US consumer. Joey Politano (one of the best) wrote a detailed write up here. On top of these tariffs, there is a looming government shutdown, talk of easing sanctions on Russia, the stock market is selling off, consumers are worried, the House GOP budget plan pushes for $4.5T in tax cuts, and GDP looks set to shrink. Then we have AI which could permanently change the labor market and geopolitical balance in ways that we just aren’t paying attention to at the moment.

It’s a lot!

In this piece, we will look at what looks like a scattershot economic upheaval (from sweeping tariffs to massive federal layoffs) and consider the chance that is in fact part of an orchestrated reset. There is a lot of speculation in the piece - but layered on top is the rapid rise of AI, which could either amplify or undermine the administration’s economic strategy.

Throughout the halls of history, a bell has been rung that cannot be unrung over the past several weeks. This is a fundamental rewiring of the North American economy. On purpose. But… why?

An Economic Downturn

So there are a few theories here, which range from (1) Donald Trump just really likes tariffs to (2) the administration is orchestrating an economic slowdown, partially influenced by the potential of AI, partially to reset real estate. Elon Musk has said as much:

Treasury Secretary Scott Bessent, who really wants 10Y yields to go down and is focused on increasing the ‘desirability’ of Treasuries (which is a sign of slowing economic growth expectations), said this on CNBC when asked about the potential of a recession:

We're going to reprivatize the economy and as we bring down government spending and get the private sector moving again. That may not be a perfect one to one ratio.

He then added that when asked when it becomes "Trump's economy," the President said: "probably six or twelve months out. I think I would agree with that." Welp.

Six to twelve months. That's the timeline for setting for economic responsibility. But what happens in the meantime?

The Tariff Earthquake

Trump announced the tariffs with his characteristic bluntness, telling reporters on March 3rd: "No room left for Mexico or for Canada. They're all set. They go into effect [March 4th]" The market literally cratered as he talked (the folly of taking one seriously but not literally or something) despite Bessent coming out and saying “Wall Street, don’t worry… it’s just Main Street.”

A tariff is a tax imposed on imported goods1. Like all taxes, they are a source of government revenue. Tariffs are paid by the importer, the person bringing the thing in from abroad, and the costs are typically passed on to consumers (despite Trump's claims otherwise).

Pass Through: There’s debate on how much of the cost does get passed along, but the Tax Foundation estimates that the current state of tariffs would result in an average tax increase of $1,072 per US household in 2025. (Target is already warning of price hikes and automakers are extremely concerned as cars are expected to go up by $12k)

Businesses: There’s a very good paper from Alberto Cavallo et al, that shows that the 2018 tariffs fell on US firms (the importers, not the exporters like China) with uneven impacts on retail prices, stating in a summary thread “if tariffs persist, and firms can no longer absorb the costs, higher consumer prices are likely to follow.”

The US imported about $413b worth of goods from Canada, $505b from Mexico and $440b from China in 2024, so this is a very large part of our economy that is now facing a significant economic headwind. This is the largest US tariff hike in a century, one that puts the (disastrous!) Smoot-Hawley to shame. As David Kelly said:

The trouble with tariffs, to be succinct, is that they raise prices, slow economic growth, cut profits, increase unemployment, worsen inequality, diminish productivity and increase global tensions. Other than that, they’re fine.

Warren Buffett said that “[Tariffs] are an act of war, to some degree.” Tariffs aren’t just about an economic cost, but a cost to trust, goodwill, and social cohesion, all of which can’t be fixed by take-backsies. Resolutions have been introduced to Congress to terminate Trump’s authority to impose tariffs on Canada and Mexico, but the retaliation has been swift and severe.

Canada has implemented retaliatory tariffs on $155 billion in American products. Ontario's Premier Doug Ford even added a new threat - to cut off nickel exports to the US to put pressure on its manufacturing sector, and to force Canadian liquor stores to remove US-manufactured alcohol from shelves. Prime Minister Justin Trudeau will not lift Canada's retaliatory tariffs if US President Donald Trump leaves any tariffs on Canada in place. And Mexico's President Claudia Sheinbaum said her government will retaliate on Sunday.

China has announced 15% tariffs on US chicken, wheat, corn, and cotton, plus 10% tariffs on sorghum, soybeans, pork, beef, aquatic products, fruits, vegetables, and dairy products. More importantly, have also vehemently retorted against the tariffs, stating, “If war is what the U.S. wants, be it a tariff war, a trade war or any other type of war, we’re ready to fight till the end.” Which is alarming.

The European Union is likely next on Trump's list, with him threatening 25% tariffs "on cars and all other things" arriving from the 27-nation bloc, which he characterized as "formed to screw" the US.

Inside the US, Trump has also told American farmers to ‘get ready to start making a lot of agricultural product to be sold inside the United States’ which is troubling because (1) Trump spent $28B subsidizing farmers for the much smaller tariff impacts in his first term and (2) the US imports about 80% of the potash used to fertilize American farms from Canada. They can’t just start making stuff here all the sudden.

There is an assumption from Republican representatives that their constituents will "do what it takes" to support the president's policies on tariffs and that it will just “take a little patience on the front end” which does feel like a lot to ask people who voted for Trump because he promised to ease their economic pain.

Young people are turning away from him for this very reason (support for Trump handling of the economy among young men slipped -14 points between mid-January and mid-February) via a report from Puck News. The Republicans have also stopped doing town halls, which is the exact opposite of what an elected representative of the public should be doing right now.

And to provide a counterargument here (although there isn’t much of one - most research does point to broad-based tariffs being harmful, just look at what happened to McKinley) - there might be some improvement to domestic manufacturing, but considering almost every industry imports something from abroad, the improvements will be slim and at a great cost to the rest of the economy.

It's a very ineffective and counterproductive way to improve things.

The Data Pointing to a Slowdown

So anyways, onto the broader slowdown. Jake was quite prescient here:

I really don’t know how to write this piece without sounding like a tinfoil hat, but the data and stances have made it pretty clear. The evidence for slowdown, intentional or otherwise, is in front of us2.

Actual GDP: The Atlanta Fed's GDP Now projections have absolutely collapsed. Four weeks ago, they were projecting +3.9% growth for Q1 2025. Two weeks ago, they fell to +1.5%. And now? They're forecasting negative 2.8%. That's a staggering drop in just one month, due to:

A drop in real private fixed investment (businesses don’t want to invest in uncertainty, which is why some of them are paying millions of dollars to meet with the President at Mar-a-Lago3 and why BlackRock now controls the Panama Canal)

Also - American factory activity last month edged closer to stagnation (slowing growth combined with faster inflation) as new orders and employment contracted and a gauge of prices paid for materials jumped to the highest since June 2022.

A drop in consumer spending as people grow increasingly concerned about the economy

A huge uptick in imports as businesses tried to prep for tariffs.

Measuring GDP: The administration has also talked about changing how they measure GDP to exclude government spending. Brian Albrecht has a good write-up of GDP here, basically saying “listen, we already have a GDP number that excludes government spending and it’s very similar to the regular GDP number”. The administration has also disbanded the 2030 Census Advisory Committee and the Federal Economic Statistics Advisory Committee, which is worrying for getting accurate economic data.

Vibes: Consumer sentiment has cratered to levels we haven't seen since November 2023. The University of Michigan survey shows inflation expectations rising from 3.2% in January to 3.5% in February - the largest increase since May 2021 during the early pandemic inflation surge.

And of course, there's the massive federal job cuts: over 250,000 federal employees have lost their jobs so far. That's 10% of the federal workforce gone in a matter of weeks. That's about half of the job losses we saw in February 2009 during the financial crisis.

But it has a ripple effect - federal employee firing means approximately three jobs are affected when you consider the contractors associated. Just look at Oklahoma, where 600 federal employees at Tinker Air Force Base facing termination represents nearly 2,000 livelihoods disrupted in a single community. That will be tough for any community to recover from.

The slash-and-burn approach to governance: The administration has informed NOAA that two buildings critical for weather forecasting will have their leases canceled – including the weather forecast nerve center in College Park, Maryland. There were also mass layoffs at the NOAA, which could disturb the economy in ways we can’t really imagine at the moment, as understanding weather is foundational to understanding the flow of goods and services.

Martin O’Malley, former Social Security commissioner, has given 30-90 days before Social Security collapses based on the recent actions of the government in cutting jobs and closing field offices.

Trump has also now discussed cancelling the CHIPS Act, which nearly quadrupled US investment in manufacturing. There are many more examples here of policies that will likely hurt more than help.

Alienating allies: Trump has made it very clear to our allies that the US is not to be trusted right now, following the Curtis Yarvin isolationist playbook pretty closely (Yarvin is wrong about a lot, but Trump seems to be following this).

Back in January 2022, Yarvin wrote that Trump should withdraw all US forces and diplomats from across Europe. He wrote “In fact, I think that if America could decide that we have no dogs in any fights besides our own—and who would fight us, but to fight our dogs?—this “world without allies” would prove superior not only for all Americans, but also everyone else.”

The situation with President Zelensky in the White House was extremely embarrassing (Zelensky is now being coached on how to talk to President Trump) and it was just another sign of the ‘world without allies’.

Howard Lutnick, the US Secretary of Commerce, has said that the Trump administration would balance the federal budget with spending cuts, saying that would help growth and reduce the interest rates paid by consumers. He ended with “This is going to be the best economy anybody’s ever seen. And to bet against it is foolish.” So, there is some sort of plan here.

The Strategy Behind a Slowdown

So why would anyone want a recession? There are several strategic reasons that become clearer when you look at the bigger picture:

Political timing: If a recession hits now, the recovery could be timing perfectly for the 2028 election cycle. Create a slump now, rebuild later, and take credit for the recovery just in time for reelection campaigns.

Market dynamics. A recession would force the Federal Reserve to aggressively cut interest rates, potentially boosting real estate and financial markets after an initial downturn (Trump is a real estate man, after all).

As mentioned, Bessent has actually said they're "focused on increasing the desirability of Treasuries" - a recession would help achieve exactly that by driving investors to safe-haven assets.

This might explain why Trump's Secretary of Agriculture Brooke Rollins suggested that the solution to high egg prices is for Americans to "get some chickens and raise them in your backyard” (great during a bird flu). There is no plan other than a slowdown, and no sign of aid if the slowdown comes.

Budget strategy. An economic downturn provides justification for cutting social programs like Medicaid and SNAP benefits while simultaneously pushing through $4.5 trillion in tax cuts. In a growing economy, these cuts would seem contradictory, but in a downturn, they can be framed as "necessary austerity" and tax cuts can be seen as “freeing up capital”

The ideology of creative destruction. The administration seems to be pursuing (rather haphazardly, even if you agree with the policies) the idea that you must tear down existing structures to build something new. We've heard this rhetoric with phrases like "drain the swamp" and "dismantle the deep state." In economic terms, it means deliberately breaking down economic structures to rebuild them according to your preferred vision.

Looking at the broader strategy at play, what's becoming evident is a profound ideological split within American capitalism itself. One group – now ascendant in the administration (like those involved with the crypto strategic reserve) – appears to be using this moment of global uncertainty to deliberately create economic turbulence. In this worldview, short-term economic pain isn't just an acceptable cost; it's a necessary cleansing mechanism to reset the economy toward this nationalist vision.

When administration officials talk about "reprivatizing the economy" or making Treasury bonds more "desirable," they're reframing what would typically be seen as economic contraction as something aspirational. As Ben Carlson meme’d - “It's all about messaging when you try to destroy the economy: they're not "crashing the economy" – they're "lowering mortgage rates’”. They're not "triggering inflation" – they're "reshoring American manufacturing." It's a perspective that treats economic suffering as a form of tough medicine rather than a policy failure (good ol’ ABCT).

So basically,

10Y yields go down, stocks go down, everything goes down, economy slows, the debt gets refinanced, the Federal Reserve has to cut rates, then everything explodes upwards again, and boom. A beautiful, linear economy.

But.

Confusion is more powerful than uncertainty. If people don’t know which way is up or down, then it’s very difficult to make any sort of decision. This path assumes a lot out of the American public, and assumes a lot of goodwill from others.

This Path Makes a Lot of Assumptions

We don’t really have a lot of goodwill. Alienating allies is a good way to 1) end up alone and 2) dislodge the dollar as reserve currency. Katie Martin at the FT wrote a great article here about how desperate investors are to get away from the United States at the moment. Julia Coronado pointed out the following as an erosion of USD hegemony:

Erosion of rule of law referring to cuts to government contracts

Undermining R&D research, innovation & services economy

Mar-a-Lago accord of devaluating $ and issuing non marketable long-term debt (illiquid markets)

If we lose reserve currency status, none of these games will matter that much.

Germany is already building out their defense, with a 500 billion 10Y fund for investment, all defense spending above 1% of GDP not counted for the debt brake, and a big commitment to building out, mostly because the US cannot be trusted.

So we have an economic slowdown, orchestrated or otherwise, but the mindset around the slowdown represents a profound shift in how we think about economic management. We are moving away from stability as a primary goal toward volatility as a tool for transformation. For those of us who will live through the consequences, it's a high-stakes experiment with our economic future.

The AI Thing

But.

Ezra Klein had a very interesting interview with Ben Buchanan, the AI adviser for Biden, that essentially boiled down to “AGI is here and it’s going to disrupt everything as we know it”. He states:

"I think we are on the cusp of an era in human history that is unlike any of the eras we have experienced before. It's not web3. It's not vaporware. A lot of what we're talking about is already here."

So on one hand, we have an administration deliberately rewiring America's economic relationships with the world through tariffs and deglobalization. On the other, we face the emergence of AI systems capable of performing most cognitive tasks better than humans.

Both reflect a shift away from the global systems that defined the post-Cold War era toward something more fragmented, more nationalist, and potentially more volatile.

And so if one wished, one could argue that the administration's focus on deglobalization through whatever they keep doing creates some sort of economic space for technological transformation (aka a forced recession would force companies to restructure supply chains, rethink labor costs, accelerate automation, and create room for AI).

Meanwhile, the technological revolution promises productivity gains that could theoretically offset the economic drag from deglobalization. It's not merely a recession, it's a sparkling reconfiguration of the labor market in preparation for an AI-driven economy. The six-to-twelve-month timeline mentioned by the Bessent aligns well with projections for major AI advancements.

But - counterarguments and grounding - the CHIPS Act’s cancellation may undercut American leadership in AI hardware, given that advanced semiconductors are critical to training and running large-scale AI models. So. It is murky.

The national security dimension of all of this cannot be overlooked. As Buchanan observes: "I do think there are profound economic, military and intelligence capabilities that would be downstream of getting to AGI... And I do think it is fundamental for US national security that we continue to lead in AI."

So. Maybe that’s the plan.

Navigating the Economic Uncertainty

So what does all this mean for your money? None of this is investment advice, just thoughts. We're entering what investors call a "positioning moment" – where the landscape is changing quickly enough that conventional wisdom needs reassessment. Consider:

Stable funds could be a good option if you’re worried about the volatility.

Gold is hitting new highs, European equities outperforming American ones by 10% (and likely will continue to do so, based on Germany’s move), the flight to defensive sectors… etc. Markets are pricing in turbulence that official projections won't acknowledge. There is value in diversification always, but especially now.

Look for companies with pricing power, low dependence on imported components, and minimal exposure to retaliatory tariffs. They are positioned very differently than those caught in cross-border supply chains. This isn't just about whether stocks go up or down – it's about which segments of the economy are being structurally advantaged or disadvantaged by this policy direction. Pay attention to those companies.

I don't know exactly how the next year will unfold. Perhaps it all works, and I certainly hope for the best. Economic systems are complex, and speculation is humbling! But I do know we're watching a high-stakes reconfiguration of economic relationships that will create both vulnerability and opportunity. How we position ourselves within that landscape – thoughtfully, deliberately, with clear eyes about what's actually happening rather than what we wish was happening – matters now more than ever.

Closing Thoughts

There's a worldview taking shape through these decisions that sees economic integration as weakness and disruption as strength. It's a vision that places nationalist economic ambition above the stability that most economic policy has aimed for in recent decades. The key takeaways:

Tariffs cause short-term disruption and broader global mistrust.

The administration appears to be pushing an intentional slowdown to engineer a reconfiguration.

AI acts as an accelerant to or partial justification for these moves.

There’s a mismatch between “economic nationalism” rhetoric and who benefits in practice.

The human costs of this experiment will be distributed unevenly. When we talk about "recessions" in the abstract, we lose sight of what they actually mean: families making impossible choices between medication and food, young graduates sending out hundreds of resumes without response, small businesses that represented decades of work closing their doors.

The difference this time is artificial intelligence. Previous economic restructurings could rely on human adaptability across generations. This transformation is happening alongside technological changes that could fundamentally alter what human labor is worth. The timeline mentioned – six to twelve months before this becomes "Trump's economy" – aligns well with projections for major AI breakthroughs that Ezra Klein describes as "an era in human history unlike any we have experienced before." Whether this administration’s hard reset will position the US as a global AI leader or weaken the country’s competitiveness in the face of rising powers remains an open question.

And economic systems do exist to serve human needs, not the other way around. When we start treating market turbulence as therapeutic (as a necessary cleansing rather than a failure of management) we've inverted this relationship entirely. We've put the system above the people it's meant to serve.

The promise was economic nationalism that would benefit American workers. The reality we're seeing unfold is policy that's likely to hurt those same workers while primarily benefiting those with enough money to weather the storm and capitalize on distressed assets afterward.

It's why we're seeing this flight to safety, the gold rush, the repositioning of capital. Money is being moved by people who recognize the gap between rhetoric and outcomes. Much of it is wait and see.

This (maybe) orchestrated slowdown may or may not pan out for the administration’s goals, but the real-world stakes compounded by an AI revolution are monumental for workers, businesses, and global stability alike. A bell has been rung.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

Explainer video here and I produced an Indicator for Planet Money episode on them

I know this sounds Ray Dalio-esque but I think there is some truth to it now

The other option is investing $75 million into a crypto project backed by the Trump family and then you can get your civil fraud case dropped

This post gives too much credit to the Trump administration, implying they knowingly lie with a grand strategy in mind. I don't think they see their falsehoods.

Musk believes he's cutting the deficit when he's not.

Trump sees tariffs as a powerful tool when they aren’t.

The economy isn’t ready to capitalize on AI, but Trump and his team likely don’t realize that.

As someone in AI, I know its value comes from training on internal data—90% of companies lack the data quality to make it work.

Trump isn’t trying to break the economy on purpose; he’s playing chicken, convinced Canada and Ukraine will blink first. He and his team believe they can thread the needle—but they can’t.

I believe that very soon, the private worries of business leaders and politicians will start to spill into the open much quicker and more aggressively than Trump anticipates. When that happens, how he reacts remains to be seen, but he certainly won't be able to maneuver like he is now.

I became a supporter after this post. There’s lots of creator commentary on this administration but not enough breakdown of the plan and vision. This provided me with some relief by understanding the administrations plan in more detail with references.