Announcements:

I was on Marketplace this week! Always such a joy!

ALSO I am writing a book! I’ll have more information in coming weeks, with preorders available in late May/June and it will be available worldwide! It will be very similar in style to this newsletter, and my goal is to make it fun - and to help everyone understand this big weird economy that we all play a role in.

The Banks?

So one thing that has been a Big Question for a lot of people lately is the question of deposit insurance, and the concept of money.

What does it mean that SVB got technically bailed out? Are all the banks going to be implicitly bailed out now? Whose deposits are okay? What is the point of the banking system if everything is insulated?

Is money… safe?

And this gets into this really funky space of “What is Money” because turns out, there are a lot of views on how money circulates, whether or not bank deposits are government money, and why there are these behemoths that can take a public good (money) and go and be mad silly with private risk taking for private profit?

And of course, people start yelling at this point.

“The entire economy is built on fractional reserve banking! Money is created through lending! Your checking account is a liability of the bank!”

All of which is true! Doesn’t make it any less weird!

Public Checking Accounts

Banking is somewhat of a franchise arrangement in which the government says “hello Banks you can earn big bucks by distributing this resource of money to the public on behalf of the us, the Government, and the public will believe in you because we believe in you.”

This is a pretty sweet model, theoretically.

But of course, banks are dumb sometimes. They wreak mass havoc when they do fail, as we saw with SVB. The mess can become a crisis of confidence, which is how things get really bad.

If people are like “I don’t believe in banks” we get bank runs.1 Bank runs are very bad, because the economic system more or less hinges on the confidence that people have in the banking system. The money that the banks hold, deposits, must be perceived as safe, because we use them as money. It’s really essential to all economic transactions!

Freaked: So right now, people are a little freaked, and deposits are zooming around. This has led to consolidation, the sister crisis to contagion.

When people get freaked, money goes to big banks because everyone is like “JP Morgan certainly won’t fail” and almost reflexively, that mindset (and deposit flow) ultimately makes them too big to fail. Depositors go there because they know it’s “safe”.

Well yikes: And that creates a problem because then you have all these small and midsize banks that are experiencing deposit outflows. Community banks serve a really important role in the localities that they serve, and if we see money flow out of those places, it contributes to the credit crunch that’s already happening due to people freaking out.

So we end up creating big old goblin banks, which are inherently backstopped by the government as “systemically important” which brings up a bunch of other questions.

Like - are they government banks?

Saule Omarova went on Odd Lots2 and spoke about the weird relationship between banks and money - where we have private entities (banks) issuing a public good (money) and conducting private risk taking to make more money on the money, the problems we have when they reach goblin level, and managing the issues arise when people get freaked, like what happened with SVB.

She proposes a model in which deposit accounts would be the Federal Government’s responsibility via public checking accounts but banks could offer things like CDs or money market accounts as a way to make money. The main goal would be to “limit the incentives of the banks to abuse a public subsidy”.

The whole episode is very good and contains much more nuance than I break out here, but the general idea is that some sort of public checking account with the opportunities for the banks to make money through various financial instrument offerings would be good and maybe limit their goblin activity and the havoc they wreak.

And of course, this sort of breaks the concept of money a bit and is a hotly debated topic

Should money be a public monopoly? How much of a role should the government play with the banking system?

As Nathan Tankus highlights it’s ultimately a conversation about the “role of the bank charter, the FDIC, and the Fed in bank money creation versus the theoretical ‘discipline’ of uninsured depositors”.

Like where are we on this spectrum? Are bank deposits are government money? considering the implicit role that the government (could? should?) have in insuring them beyond $250k? Because ultimately, the government is currently giving the banks the most powerful asset of all - confidence. There is the inherent expectation that regulation will step up and soothe the cries of the banks when they stub their toe on the coffee table.

Matt Levine wrote about this a few days ago -

The confidence trick, the multiple equilibria where trust in banks makes them trustworthy and distrust in banks makes them fail. Bankers and bank regulators tend not to talk in these terms, in part because they tend to take a more practical view of what they are doing each day but also because talking about it ruins the magic. But they know it in their bones; at a deep level they understand that they are creatures of social confidence, and that preserving that confidence is their most important job.

It’s about confidence! That’s why the FDIC, Treasury, and Fed all went Power Rangers mode to save SVB - so people didn’t freak. There was an FT article from Sheila Blair, the former chair of the FDIC, on how wacky it was for those entities to come out guns-ablazin’ to help out SVB and FRC.

At combined assets of $300bn, these two banks represent a minuscule part of the US’s $23tn banking system. Is that system really so fragile that it can’t absorb some small haircut on these banks’ uninsured deposits? If it is as safe and resilient as we’ve been constantly assured by the government, then the regulators’ move sets dangerous expectations for future bailouts.

Confidence! Vibes, as some would say! She continues -

The mere fact that regulators designated two midsized banks as systemic implies they think the system is fragile. My instinct tells me that most regional and community banks are basically sound. The main thing we have to fear is fear itself cascading into bank runs that will force otherwise healthy banks to collapse.

And finally -

The government needs to be very careful in its communication, lest its own overreaction causes the very deposit runs it wants to avoid.

And that’s like the KEY point. The mechanics of banking regulation is big and complicated and confusing, but the main thing is they have to have this foundation of confidence, and that comes from communication.

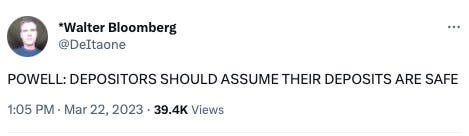

And we had a sort of messy communication situation yesterday! With Yellen testifying before Congress right as Powell was giving the FOMC presser.

They both said seemingly two very contradictory things. It sounded like Powell was like “hey everyone, good vibes, deposits safe and snuggled in our arms” whereas Yellen was like “actually we are throwing your money into the jaws of hell”

But they were actually talking about two very different things as Victoria Guida highlighted. Yellen was talking about how they are NOT raising the $250k deposit insurance from the FDIC, whereas Powell was talking about how they COULD have more lending programs like the BTFP protecting banks.

AH! Right?

As both Kai and Joe pointed out, they are trying to talk about both sides of the coin and appease everyone by saying things that are fuzzy so they are hedging any freak outs. But communication is key to preventing a crisis (to maintaining the vibes so to speak) and it’s clear that the vibes aren’t really being maintained in the current model.

People are spooked!

There needs to be some sort of implementation of technology - a dashboard for bank solvency, for example - that can soothe beyond the doublespeak that policymakers in an attempt to appease.

I also think we need to see some social media from the big banks on what they are doing and how things are moving and grooving. If the SVB taught us anything, it’s that if you scream loud enough, a fire will start eventually, and the way to hedge against that is by screaming back.

Talking about weird things is key to making them less weird!

Talking about weird things is also the first step to reinventing them. To making them better, as Saule Omarova and so many others have been working on.

One of my favorite authors is Matt Haig - he writes about the human experience in a painful way, not shying away from exploring the depth of emotion. In Notes on a Nervous Planet, he writes

If everyone is getting out of bed too early to work 12-hour days in jobs they hate, then why question it? If everyone is worrying about their looks, then worrying about our looks is what we should be doing. If everyone is maxing out their credit cards to pay for things they don’t really need, then it can’t be a problem. If the whole planet is having a kind of collective breakdown, then unhealthy behavior firts right in. When normality becomes madness, the only way to find sanity is by daring to be different. Or daring to be the you that exists beyond all the physical clutter and mind debris of modern existence.

Thanks for reading.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

The Federal Reserve was actually invented to prevent bank runs because the end of the 1800s was just plagued with absolute freakouts. JP Morgan (the og!) was real sick of bailing everyone out, so after the Panic of 1907, the Fed was created

Odd Lots does such an excellent job at breaking down everything going down

congrats on the book deal :) I'll be in line for it! :)

The franchise arrangement is a great analogy. Ultimately, yes, it is public money, partly cuz the government is willing to be the back stop, as they prove each time these banks get into trouble.

Also, yes, most money is created by bank lending and is a liability of the bank. But the govt provides the reserves behind the scenes to make the payment system work, which "effectively" monetizes that credit into government money. (not so sure about that fractional reserve thing / that's kind of a myth)

So, yes, I'm on board with your comment about all money is government money, and is a monopoly of the state. Sorry, Thatcher.

I like your writing style!