Data versus Reality

part 2

there is a lot going on and no one really knows what is going on (part 2)

If you’re already subscribed, thank you! If you’d like to subscribe, please do so here:

YouTube and podcast up soon

Here is Part 1 of this piece

People think that things are bad, and they are right. You can’t seriously look at someone who has had their grocery bill double in price and say “welp look at those industrial production metrics” (which are now slowing down).

There is a gap between the “reality” of economic data and the interpretation of that reality for the everyday person.

People are worried: Google searches for Recession have surged - but searches for unemployment benefits are at low levels. The job market is stable which is good - but inflation is eating into savings, wages are flat, etc - which makes it bad for people right now (even if unemployment is low).

Inflationary pressures have impact: People are beginning to fall behind on their rent, the housing market is still a nightmare, and a summer BBQ is 17% more expensive than it was last year. That is not sustainable. People cannot keep on managing higher prices for daily necessities with stagnant income (which is a whole mess of wage-price spiral worries etc., nuance.).

But how do you even fix that? And that’s the whole problem, right? California was like “$1,000 checks for everyone” which will ease consumer pain but it will only worsen inflation.

If supply remains the same but demand goes up - that’s the equation for higher prices. But people need support during times of uncertainty, so it’s a constant balancing act of ‘how pain can they handle’ versus ‘how can we fix it’.

Monetary policy is all about normalizing supply and demand (to an extent) - we either have to produce more or stop buying stuff (simplified).

More Supply

Energy is the common denominator: Energy goes into everything. Food, gas prices, etc. This is one of the hardest things to solve because the incentives of oil companies are totally skewed (and it take a long time to ramp production up, etc).

There is a lack of supply: Since the mid-2020s the U.S. has lost the ability to process over 1 million barrels of crude per day. Russia is still a core producer of oil, but that’s dicey. Libya is in a political crisis. OPEC+ is tapping at the door of spare capacity (how much more oil they can produce basically) and are saying “ah no more oil left”. But as Javier Blas highlights, things are a balancing act -

“If OPEC+ runs completely of spare capacity, or investors believe it has, then oil could become a runaway market. From today’s standpoint, more crude is needed. But it’s also clear that high prices are part of the solution to the current problem: oil demand needs to decelerate.”

The ever-tricky normalization of supply and demand

Lack of desire to increase supply: Exxon will be posting a huge quarterly profit of ~$18b. They are investing in more oil production, but also are tripling their share repurchases to $30b in an effort to return cash to shareholders. It’s reductive to say that the whole reason oil prices are high is because of price gouging, but there is an element of that in there. But it makes the energy equation that much more difficult to solve.

We need policy to produce: There are several things that fiscal policy could do to expedite our oil - which EmployAmerica has discussed extensively.

Investors have incentives too: People are not interested in investing in oil when they don’t think they can get good returns from it! The investment industry is not altruistic. If you only care about money, you’re going to look at the slowdown across the economy and rising interest rates and go invest in something else - and that hurts oil production.

Oil companies have zero future policy support: The other reason that investors don’t want to invest is because policy wants to get rid of oil. As Allen said - "I want to make you extinct in 5 years. max 10. but also please spend a shit load of money in the next 3 months." Why would you invest more if you know someone is trying to get rid of you?

Solving supply is difficult - in good news, freight rates have been falling, down almost 40% from the highs and companies like Bed Bath & Beyond are going to discount all the excess inventory they have which will hopefully help ease things too. But still… energy.

Less Demand

There are some signs of price pressure easing: Noahpinion wrote an article discussing this in-depth - (1) falling freight rates (2) commodity prices (3) rents (4) GPUs and (5) the uptick in inventory will all help push prices down.

But composition of inflation might make it difficult: As Lisa Abramowicz highlights - the US has a lot of services inflation versus physical goods inflation which makes it so the Fed “will likely go further in hiking rates into restrictive area than other central banks”

People are spending less, so that’s good (eh): Consumer spending rose 0.2% in May, which is quite the cooling from April, which was revised down to 0.6% from 0.9%. People are spending less on things like cars but are spending more on services - housing, utilities, etc.

So we are seeing some easing in demand - which might help abate inflation - but energy supply is still concerning. It’s still a balancing act - which is why the Fed is coming in fast and furious.

What is the Federal Reserve to do?

The Fed is hell-bent on going after inflation - which is good as inflation is horrible and painful for everyone. But the labor market is also really important - and arguably has *more* impact (relatively speaking) than inflation does.

This is the Fed balancing act - how hard are they going to swing at inflation while making sure the labor market is okay? Unemployment is sticky - higher prices are too - but people losing their jobs is really, really bad.

And as many have highlighted, the Fed has a toolkit that can only turn the dial back on demand - through the forcing function of Making Life Harder by raising rates - which isn’t great. The Fed is now laser-focused on ‘calming things down’ - but ‘calm things down’ is more of a knockout punch versus a chamomile tea.

And the Fed is hyper-vigilant right now.

Stocks: The Fed will be watching equities - if those start popping off, they could push against it, as StanChart highlighted.

Previous mistakes: They will be watching all the things they got wrong - fiscal stimulus, the composition of inflation, the potential for another taper tantrum.

Big Fed Moves: This could make them more reactive and hawkish and more likely to risk Recession.

All the central banks had a hangout this week and the whole conversation was around setting the vibes (which might not be the best way to *say* that, but it’s the truth). Here are some snippets from the conversation

“Is there a risk we would go too far? Certainly there’s a risk. The bigger mistake to make—let’s put it that way—would be to fail to restore price stability. The risk is that because of the multiplicity of shocks, you start to transition into a higher-inflation regime. Our job is literally to prevent that from happening, and we will prevent that from happening.” - Jerome Powell

“I don’t think that we are going to go back to that environment of low inflation” - Christine Lagarde

“The process is highly likely to involve some pain, but the worse pain would be in failing to address this high inflation and allowing it to become persistent.” - Jerome Powell

The Central Bankers are intent on restoring price stability and they recognize that things could get bad. The bond market believes the Fed (good for credibility, as Kathy highlights) -

But the whole point is that maybe the Fed won’t have to go as hard as they think they will - which is net-net pretty good. The market is pricing in lower inflation worries. But this is a rapidly unfolding situation - energy is still weird, the housing market is easing but still has ways to go, and our systems are crumbling.

Just because the market is pricing it in, doesn’t mean the everyday person feels that.

It’s complicated, which I know isn’t the thing everyone wants to hear, but, that’s the truth of it.

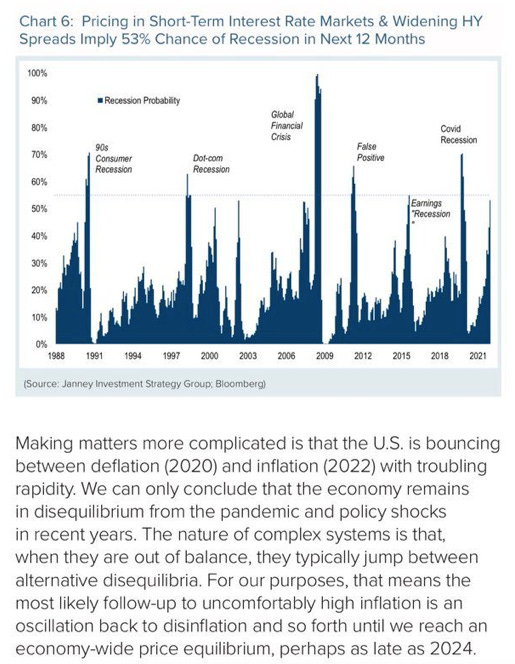

I think this from Guy LeBas is a good look into what to expect.

So are we in a recession?

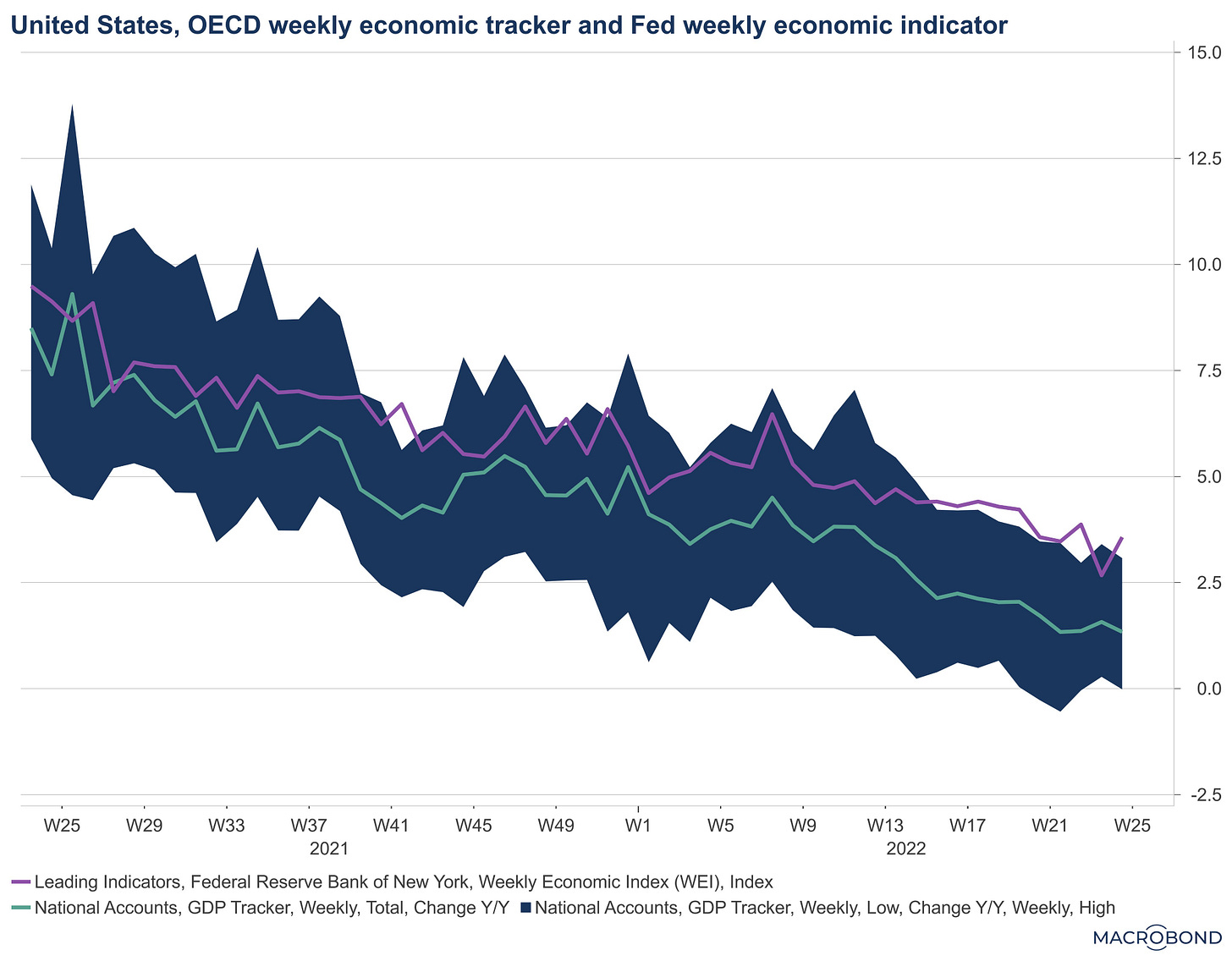

Lots of people have highlighted the Atlanta GDPNow metric as saying that we are in a recession. Claudia has a great thread on the pitfalls of using the GDPNow as a indicator of a recession. And as Julius highlighted, metrics like the St. Louis Fed Nowcast and the US weekly and OECD weekly economic indicator look really different than the Atlanta Nowcast - showing a slowdown, but definitely not a recession.

And even how we measure GDP is a bit wonky, which Matthew Klein has an excellent post on. As he writes

Nearly $1 trillion of economic activity is missing from the U.S. GDP numbers… my strong suspicion is that existing methods for tracking capital spending by American businesses on both physical and intangible assets are failing to capture what companies are actually doing.

The consensus seems to be that the economy is slowing down, but we aren’t *in* a Recession quite yet. And I want to recognize that this is similar to telling someone that is stuck in a hole “well hey, at least you haven’t fallen to the bottom yet”.

It doesn’t really matter what the data says if people are feeling bad - and they are feeling bad.

The only reason (simplistically speaking) that it’s important to look at data is because it shows that things could be getting better soon.

Inflation could be easing. The labor market is still okay. The Fed might not have to go full fast and furious mode.

I was dragged into some corners of Twitter with my recent post and there is a lot of anger, which like, yes, I am angry too. It’s frustrating and stupid and dumb because the Fed should have moved faster, fiscal policy should be more additive to monetary policy, oil companies should recognize we are in an energy crisis, and etc etc. A lot of people will comment things like this -

And like sure, I don’t know. You can look at what companies are saying (although that is manipulated too probably maybe who knows). All data is probably Not Right.

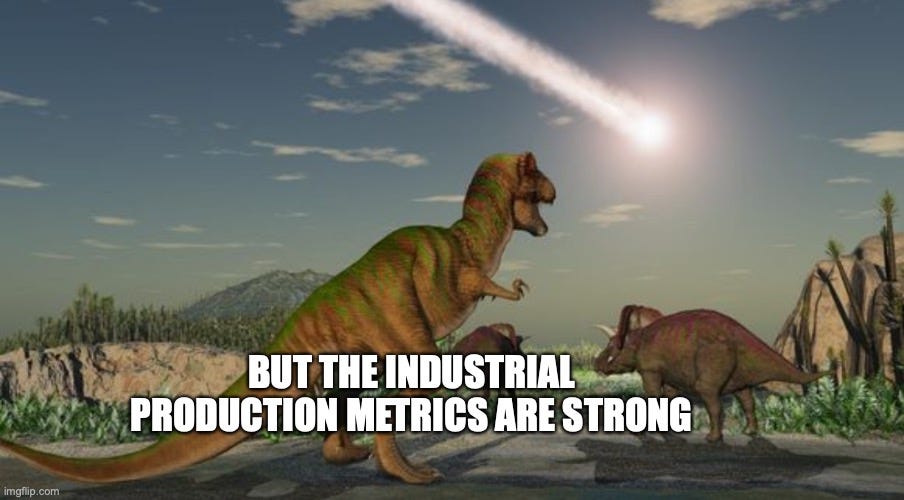

But it just goes back to the point made earlier - economic data is sometimes similar to this -

And that’s why consumer sentiment (how people are feeling, what they are doing, etc) is important. I think this snippet from the book Noise by Fischer Black (of Black-Scholes) explains it well too. “Expectations follow no natural rules”.

And SO many have described something similar - reflexivity, animal spirits, etc - this paper from Alistair Macaulay and Wenting Song details it well.

As Jonathan Ferro highlighted

Things move quick.

The most important part of this is people. That’s all that matters. There is some truth to this too.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

Feels like the 2nd derivative of bad vibes has peaked and things are gonna be alright.

"Inflation could be easing. The labor market is still okay. The Fed might not have to go full fast and furious mode."

Thank you Kyla!