The Vibecession: The Self-Fulfilling Prophecy

Are we manifesting a recession?

there is a lot going on and no one really knows what is going on

If you’re already subscribed, thank you! If you’d like to subscribe, please do so here:

YouTube and podcast up soon

Also a note - I know that there is too much going on to even begin to process what is happening, and I am hoping to talk about *why* some of the stuff feels so weird and bad in this piece. I sincerely hope that you are doing okay.

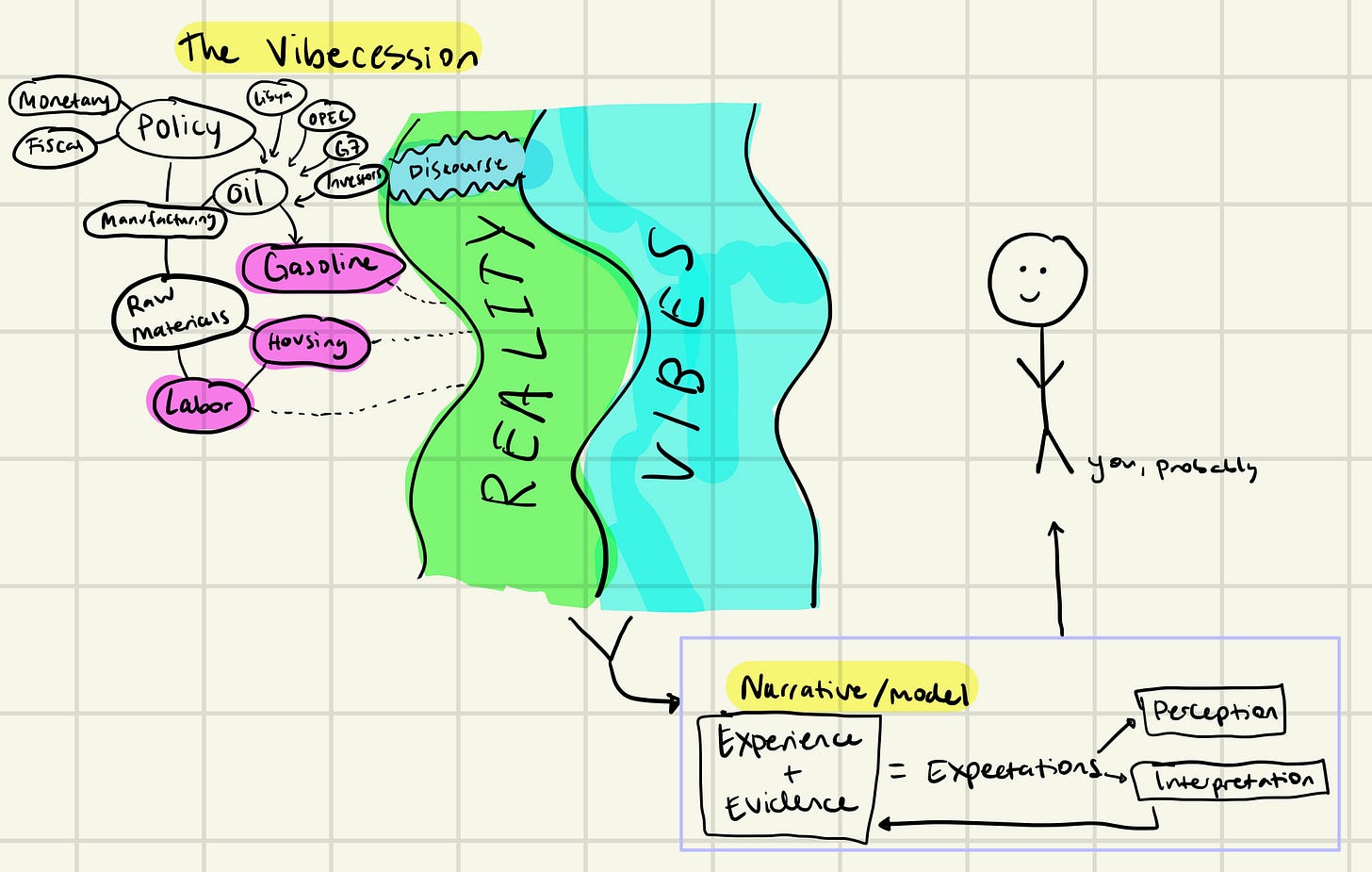

The Vibecession

All the central banks had a big hangout where they were essentially like - “wow the entire economic regime is shifting from low-inflation to whatever this is”. Jerome Powell said at the meeting - “We understand better how little we understand inflation” and I think that encapsulates monetary policy (and a lot of other things) well right now.

As Peter pointed out, inflation went from an unknown unknown (Rumsfeld’s we don’t know we don’t know) to a known unknown (Rumsfeld’s we know we don’t know), with the core point - we don’t really know what is going on.

The only certainty is uncertainty, the only conviction is the lack thereof, and the only path forward is with a blindfold.

And I know this is unpopular to say but like ? in reality, would anybody know what to do here? (and i know there is an entire cohort of people that think they could but not them)

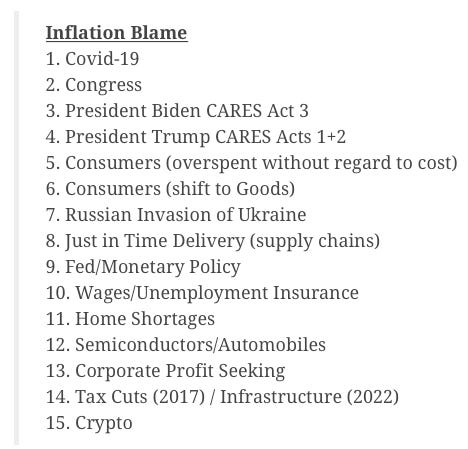

Barry Ritholtz wrote about how to place the inflation blame, highlighting -

There is so much ‘blame’ to place on all the things going wrong, and YES there should be blame placed on certainty entities. The Fed moved too slow, the Biden Administration seems to prefer moving backwards versus forwards, and the sheer mismatch of supply and demand led to systems crumbling.

Reality: It’s really easy to type out all these words and say “yeah they were wrong” but it’s much harder to live in the reality of things being wrong. Powell highlighted yesterday that it would be challenging to tame inflation without triggering a recession - which has an element of truth at this point.

Data vs Reality: The uncertainty that all this creates is visceral, and it shows up in the average person’s life in a painful and prevalent way.

It’s simple to say “but my guy, the economic data” - but that doesn’t recognize the everyday experience of many.

Recession Rooters: And as I talked about before, there are a lot of people cheering for a Recession because 1) they think they can get ahead 2) they think we deserve (?) one and 3) or they think we are already in one

This uncertainty and worry creates a frothy environment.

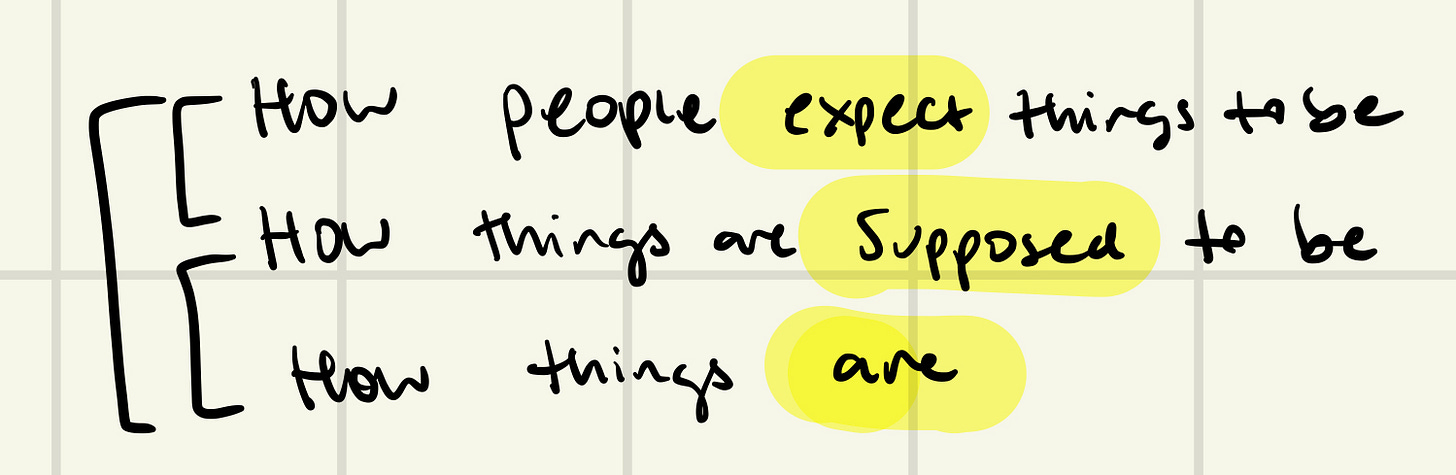

At the margin: There’s layers to the cake. When -

How people expect things to be (expectations)

How things are supposed to be (theory)

How things are (reality)

All begin to radically differ, and that’s when people can get upset. “What do you MEAN economic theory is useless and most of those lines are more art than science! Valuing stocks is just manipulating a multiple?!” - that creates cognitive dissonance, because nothing is how it is supposed to be.

People are upset: We’ve seen this begin to show up in consumer confidence measures where people see the ‘present situation’ and ‘the future’ as two very, very different things (to note, there is a gap in confidence measures, so we aren’t even confident in our confidence)

People are like “wow things are starting to suck and I think it’s going to start sucking a lot more”.

They are still spending money, but pulling back on things like airfare and travel because of the cost (also because airlines are understaffed due to the pandemic - it’s all a big loop)

But that marginal difference between expectations, theory, and reality feeds into our narrative/model for how we see the world.

The Vibecession

And that is where the Vibecession comes in.

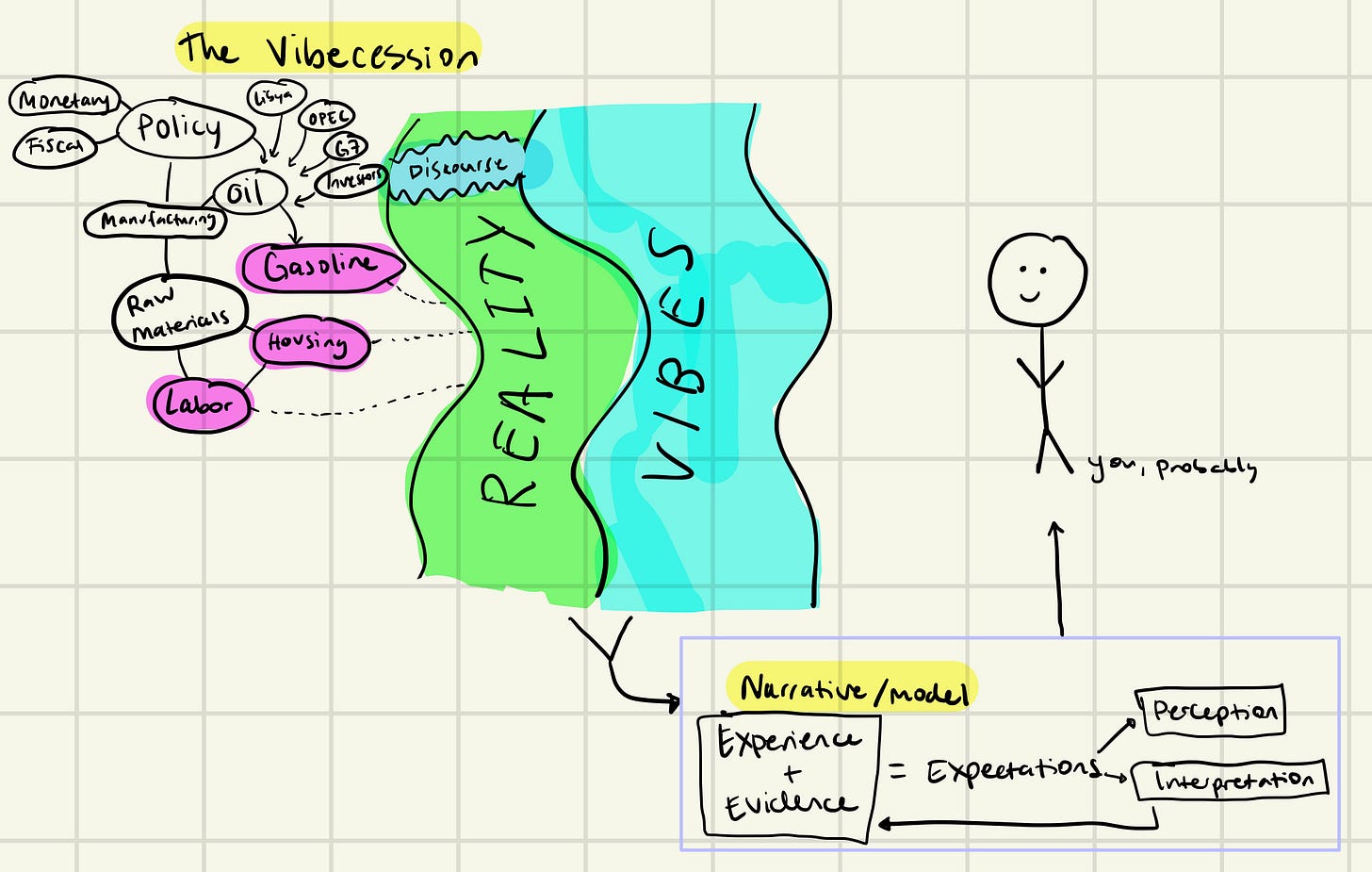

Reality and Truth: As shown above, there is an element of reality to our existence - policy decisions, manufacturing output, gas prices, etc, cannot be modified by our feeble human minds (at least right now) - it is capital-T-Truth in the Present Moment, whether we like it or not.

However, policy decisions are policy decisions - and consumer expectations can shape those decisions (like how inflation expectations influenced the Fed to hike 75 bps) but there is an element of concreteness to these in the present moment

The Interpretation of Reality and Truth: But all of those things generate vibes (scientifically speaking) that do most of the work in determining how we feel.

We take experience and evidence, shape out expectations, which warps perception and acts a forcing function for interpretation - and that is How You Feel (in the most simplistic way possible).

And that feeds back into discourse (h/t to Derek Thompson for suggesting the Tributary of Discourse) which also influences vibes, and thus Feelings

And How You Feel compounds into How Everyone Feels, and that is consumer sentiment. As I wrote about last time, consumer sentiment is *everything* because consumer spending is such an important component of GDP growth.

If people have an experience (say, living through the 2008 recession) and evidence (home prices skyrocketing) that might shape some of their expectations - “wow, another unprecedented event to live through” which shapes their perception (things suck) and their interpretation of the future (things will continue to suck) - that shapes their narrative, which can shape reality.

So when people are feeling bad (which they are right now) they might pull back on some aspects of spending - which we have seen. Inflation is the bogeyman in the room. As the Wall Street Journal wrote

Expected inflation is, in some sense, a self-fulfilling prophecy. If people expect it to continue, they might raise prices for their businesses or ask for raises at their jobs, fueling continuing price increases.

We have to manifest the right vibes.

But that’s difficult when it seems like everything is falling apart.

People like to place blame (it’s only human) and they find lots of blame for inflation, the Fed, the Current State of it All.

I think that’s the hardest part about all of this. People want a simple solution for Why Things are Bad (and I do too) but things are bad (and good) for many different reasons.

The overwhelming nature of it all creates a Vibecession. Where economically speaking, things are okay-ish but in reality… the vibes are off. People are feeling bad.

Vibecession - a period of temporary vibe decline where economic data such as trade and industrial activity are relatively okayish

The Vibes are Off

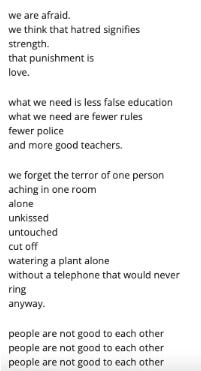

I have been stuck on Charles Bukowski’s poem The Crunch for the past few days -

“People are not good to each other”.

Markets are a profit-maximizing system. That is the point of All of This - the reason that people feel bad, the reason that the vibes are off, part of the reason that people get fired, companies go under, that McKinsey incentivized the opioid crisis - they knew it would kill people, but it would make *money*.

Money is not a moral compass.

But money is the economy. And the economy dictates what we do, and how we feel, and how we go about in the world (to a degree).

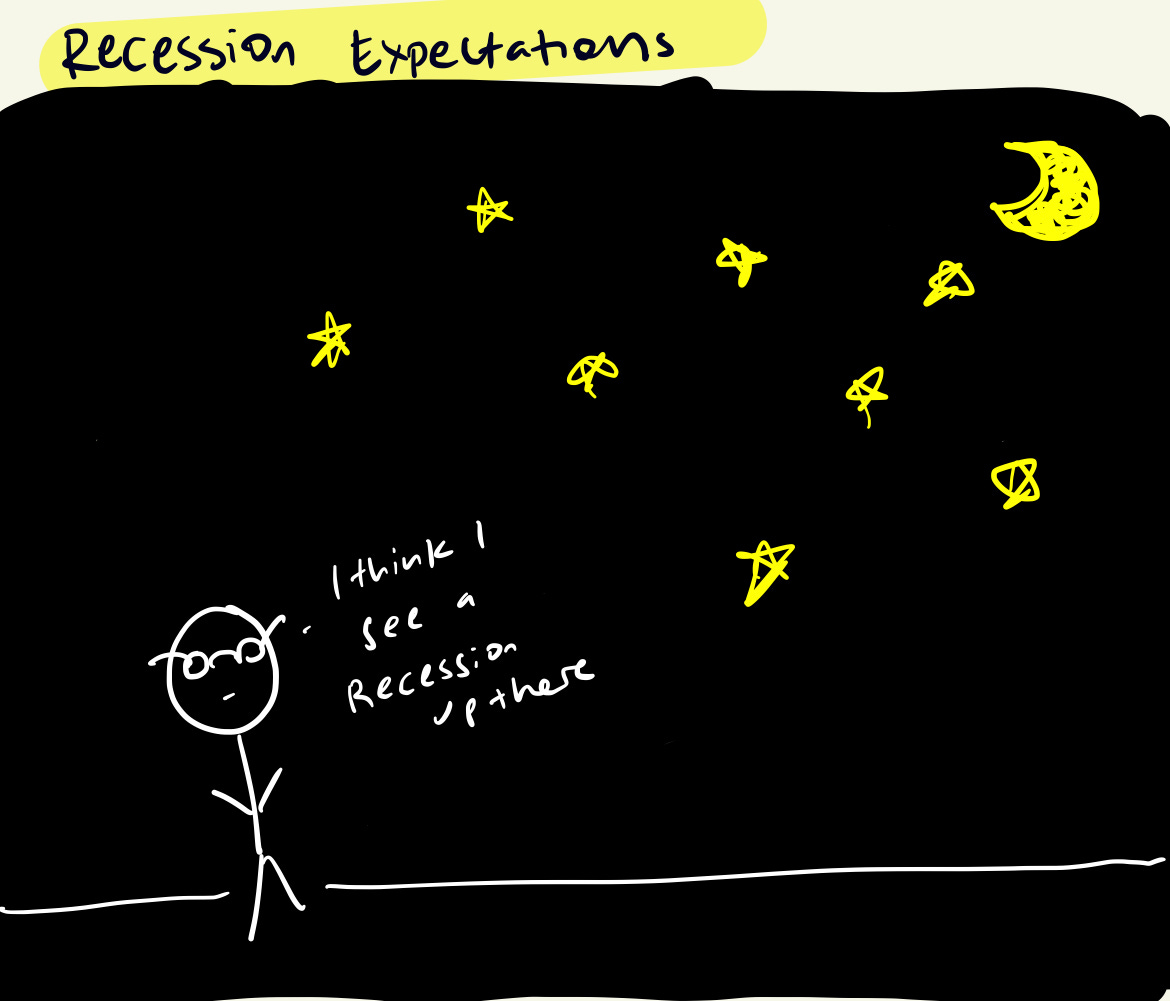

So when the vibes are off - when we think about how Recessions come about (beyond the technical aspects) it makes sense that we would somehow end up with the vibes of a Recession, but maybe not the economic reality of one (yet).

Things are Confusing

Some of the reasons that the vibes are off are because gasoline and food prices are so high. Energy is the common denominator to everything. When people see high gas prices, they feel bad. It sucks. But as George highlights - there is a difference between ‘high gas prices’ and a ‘recession’.

Energy Markets

OPEC is struggling to produce more oil - with uncertainty if they *can* even produce more and US producers are Very Focused on Returning Capital to Shareholders, which prevents them from producing a meaningful amount.

There is also political fallout in Libya, which is preventing production

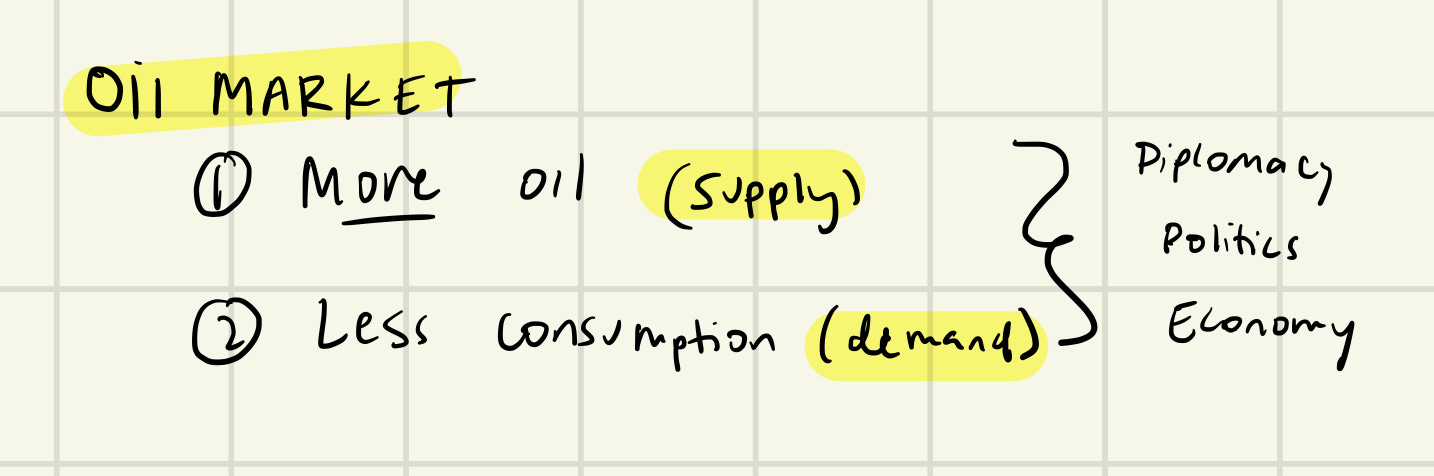

“The market is already exceptionally tight with shortages becoming critical and difficult to relieve without a massive increase in output, a recession-driven fall in consumption, or both… the oil market is confronting policymakers with a menu of options. But each of them carries a high cost in terms of diplomacy, domestic politics, the economy, or all three, making them unpalatable for decision-makers.”

We have to figure out energy. That’s what goes into everything - and as many, many, many have highlighted the Fed has very little control over that.

Things are Bad

Beyond energy, a lot of things are starting to wobble.

Life is expensive: ~15% of US renters are behind on their payments because of the unsustainable price increases that the average person has faced this year.

It’s dominoes - the people that can’t get a house are going to end up back in the rental market, which pushes rental prices up even more, which makes it more difficult to afford.

The Dallas Fed manufacturing index fell - which highlights slowing economic growth as people try to grapple with inflation, rising rates, etc etc

Midterm muddling: California is fighting inflation with inflation, which is not good. But from a sentiment perspective it could provide easing.

However, politics are making all of this more confusing - as people run for reelection, will they ignore economic principles and make all of this a bit worse?

But Things are Getting Better?

Companies are still very optimistic about the future, with net margin expectations are record highs - despite the worries of a softening in people spend.

Financial conditions have tightened significantly (without the Fed doing much) so maybe they won’t have to do much.

And inflationary pressures are easing - As Derek Thompson highlighted in his podcast with Conor Sen - Companies have significant excess inventory, shortages are easing, shipping rates are recovering. The labor market is still relatively strong. Home prices appear to be rolling over

You can say all these things - but people are still stressed out. You still have this.

Final Thoughts

I am going to write a follow-up piece to this on Saturday exploring more of the intersection of economic badness and bad feelings- there is a lot more data to point to, but I wanted to get this general idea out (also this piece is really long already).

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

i used to wonder, economics is more about how humans behave, feel, than data. this piece vindicates that thesis strongly, even if things are sunny (which they are, relatively speaking), they might to appear bad (really bad, which also they are). thus, vibes matter. a lot. As of yet, vibes are suppressed & they compound sooner than later which gives a murky, blurry picture of how things are.

in the end, Kyla & i know what we don't know...

really amazing writing, Godspeed.

Such a great breakdown of this! Thank you!