Economic Outlook: Rubber Bands on a Watermelon

with enough pressure, the watermelon *will* explode

wow that’s a lot of rubber bands

I was on Compound and Friends this week! Thanks to the team for having me on, and it was incredible to meet Bob Pisani!

Stress Management

I want to first dive into some stress management ideas, and then talk about the markets. One thing I’ve (candidly) run into over the past few months is trouble with sleep and balancing life.1 I put together a Google Doc here of all the suggestions that people kindly left when I asked for best tips (thank you to everyone who did, it was extremely helpful). I will likely add to this over time.

Now, onwards to stressors.

The Fed Rubber Band on the Watermelon

I have been trying to think of the best way to visualize what all the different stressors are for the world - the dollar, energy prices, geopolitical tensions etc - and I’ve to come to this:

There are plenty of videos of watermelons exploding online, but essentially if you add enough rubber bands to the watermelon, it explodes. 123homeschool says that this is a great way to learn about potential and kinetic energy, but it’s also a great way to look at the economy.

The Fed is raising rates to fight inflation - but as I and many others have highlighted, there are a lot of dominoes that tip when they do this. Just for a few examples -

Dollar: Raising rates creates safe haven status for the dollar, which drives inflows, creates a stronger dollar, and then creates a wrecking ball out of the dollar

Energy markets: Javier Blas argues that Fed policy is potentially contributing to energy underinvestment - “The Fed alone can’t print energy, but it does help those who can. And the central bank is doing anything but helping right now.”

Labor markets: The Fed wants to see softening in labor metrics (which can come from layoffs or higher labor force participation rates) but as Kathryn Anne Edwards highlights in her thread about labor force participation rates - the way we get people back to work is through accommodating the disabled, working around childcare for working parents/caregivers, and addressing systemic issues.

And that’s what makes all of this so tough, right? I can write endless newsletters (and I feel like I have, so apologies for that) about the Fed doing the wrong thing and what the “right things” could be (investing in energy production, working on proper labor allocation, etc) but the Fed is a one-trick pony.

They are doing what they can with what they have, which is a blunt instrument that whacks at the economy until it sits down and chills out. Fed policy can nudge things in one direction or the other - as Javier Blas highlighted, easy money does create a certain type of investing environment, but that comes with consequences too. The economy is pretty much eternally trapped between a rock and a hard place.

But there are now all these rubbers bands that are continuously being wrapped around the economic watermelon - and the question now is - how close will it get to exploding?

The Federal Reserve

The Fed is still full steam ahead on raising rates, but there are increasingly dovish (aka we are gonna chill out on rate hikes eventually) threads in their tone.

FOMC Minutes: The Fed seems to be increasingly publicly recognizing that there are two-sided risks to monetary policy, especially the impact that it has on global economic outlook and domestic activity.

However, they also highlighted that the cost of doing too little was likely more than the cost of doing too much (at least right now) and that an global economic slowdown would be good for fighting inflation.

Dovish: Bullard said that the Fed does not need to move faster - but that they should continue moving fast (75 bps in November and December) - and this is very dovish from him!

We also saw Brainard highlight that there were some “two-sided risks” in the market, and that they need to pay attention to what’s happening in real time.

Is Monetary Policy Working?

So the underlying question - dovish Fed or not - has become - are Fed actions actually impactful to fighting inflation?

So kind of [bad, but the metric is lagging]: The CPI print did come in hot this week. However, services are driving most of the change in CPI - specifically shelter costs - which are lagged in how they are actually reflected in CPI.

Realtor.com and RedFin have highlighted that rents are slowing as the CPI screams higher. So there will likely be downward pressure on inflation over the next few months as rents, healthcare, and transportation, etc all get accurately reflected (the question is - why aren’t they accurately reflected *now*)

PPI came in hot too, so inflation is still permeating the pores of this economy, at least in terms of how monetary policy views it.

Inflation manifestation spiral [bad]: But people are feeling the inflation steam bath too. Inflation expectations ticked up again, which is not great. The reason that the Fed talks so much right now is because the communication part of their toolkit is meant to keep inflation expectations anchored. If people start worrying about higher prices, that creates an inflation manifestation spiral, which is bad.

People are spending less [good]: Consumer spending was flat in September. People are spending more on healthcare and food, but less on things less electronics and furniture. Lots more spending on experiences instead of things. But the important thing for the Fed is that people are spending less.

Corporations are doing pretty good [okay probably]: So far it seems to be a decent earnings season, but there are definitely going to be headwinds ahead.

JPM and other banks benefitting from Fed policy (“charging more for consumer loans and corporate lines of credit without offering customers significantly better rates on deposits” as Adam Tooze highlighted - quite the hurricane for Mr. Dimon)

Pepsi has been able to pass off huge price hikes to consumers, stating that “affordable treats and small moments of pleasure continue to be a key need state… I think we should assume that will continue in spite of all the ups and downs, potentially economically around the world.”

Pepsi says “hey… in this economy… you can have a small treat, as a treat”

It seems like the consumer is healthy based off that - credit quality, able to take on price hikes - but for how much longer?

The Housing Market (a quick aside)

The consumer is not healthy in the housing market (at least, first time buyers). There was a great Odd Lots episode on the housing market, which highlighted that Fed policy has at least seeped into mortgage rates.

The biggest thing about the housing market right now is that the there are SO MANY people that have rates under 3.5% - and they simply are not going to move in a 7% mortgage world. Why would they!

We are incredibly lucky here in the United States to be able to lock in a rate for 30 years. In Canada and the U.K., it’s a much different situation of variable rate mortagages and 2-5 year fixed horizons.

And to that point, that makes monetary policy probably marginally more impactful in those places because that’s another lever that banks can pull on to put pressure on people. In the U.S., it’s only first time buyers that are f*cked.

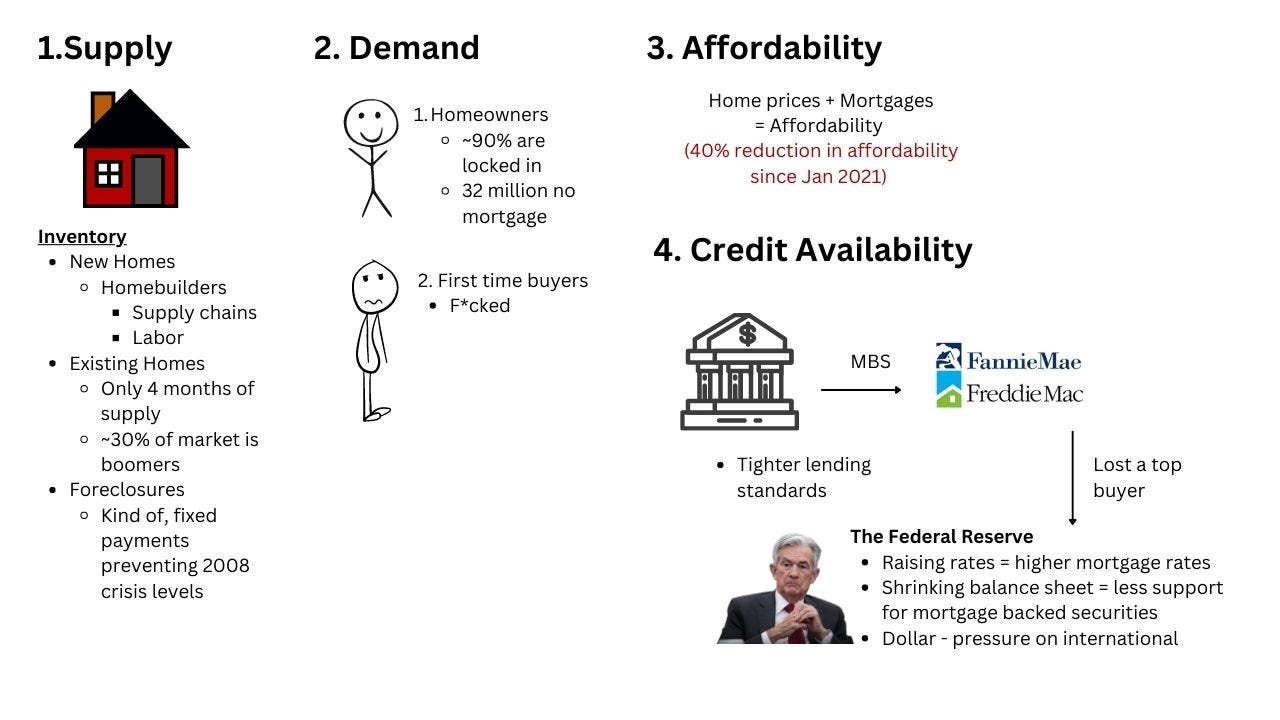

The Odd Lots episode highlighted that there were four main pillars to evaluate the housing market - supply, demand, affordability, and credit availability. Essentially, things are a mess because -

Supply - no one wants to build, no one wants to sell, and (thankfully) no one is foreclosing on their home because we have fixed payments in the U.S.

Demand - Homeowners are solid - they probably won’t go after a second house in this environment, but they are doing infinitely better than first time buyers who are just solidly f*cked right now

Affordability - the reason that first timers are f*cked is because affordability has deterioriated considerably since the beginning of the year. A combination of volatile home prices and sky high mortgage results has resulted in a ~40% loss in purchasing power

Credit availability - Mortgages have a big part in what’s going on. Banks have tightented their lending standards, and the Fed is raising rates AND shrinking their balance sheet.

When they shrink the sheet, they are no longer buying bonds!! Which means that they are no longer ~25% of the mortgage backed securities market. This has a huge impact on spreads and the overall functioning of the MBS market - and also has a negative impact on the end-state of housing affordability

So is Monetary Policy Really Working?

There are a lot of rubber bands squeezing the watermelon here.

Loss of Liquidity in Treasury Markets: A big worry is lack of structural demand for U.S. Treasuries and mortgage backed securities. JP Morgan released a note highlighting that the Treasury market was losing 3 main buyers - commercial banks (big scary market, don’t want to buy), international buyers (U.S. dollar wrecking ball), and the Federal Reserve (tightening their balance sheet)

The question - who will buy if the Fed doesn’t buy? Yellen highlighted worries about economic spillover risks, as well as concerns over liquidity in the Treasury market - if she’s saying it, it’s bad.

International alarm bells: There’s a lot of hairline fractures appearing in international bond markets too - the Bank of Japan has no demand for their 10Y bonds (primarily because the Bank of Japan is top bidder, so why would you bid over them) and the Bank of England has waffled between ending their bond market support and continuing it to the end of the month - with the recent volatility wiping out an entire decade of gains.

Market fundamentalism: A lot of this is market fundamentalism, where people are using markets to figure out the effectiveness of policy. So when the bond market starts screaming (as the FT (!) said “who’s the daddy”) policy makers now have to listen. The question is - are the markets right?

How are People Doing?

Overall, people are doing okay (all things considered). I think a lot of conversations about the economy focus on the stock market because of market fundamentalism.

“People are okay because corporate earnings are okay”

And to a certain extent, sure yes of course. But the flipside of that is that corporations *have* been able to be a bit greedy (and of course, they have people to pay and those people have people to pay, yada yada yada, there is two sides to every coin) but having most of your earnings growth come from price hikes and not increased volume sold is… not great.

I think there is a lot of truth to this sentiment -

What is “good for the market” is not always “good for people”.

Final Thoughts

The poem Dogfish by Mary Oliver has stuck with me this week - a reflection on the quickness of life, the pain that threads itself through everyone’s stories, on “swimming through fires to stay in this world”. I encourage you to read the whole thing but I think of the following excerpt often -

You don’t want to hear the story of my life, and anyway I don’t want to tell it, I want to listen to the enormous waterfalls of the sun.

And anyway it’s the same old story – – – a few people just trying, one way or another, to survive. Mostly, I want to be kind. And nobody, of course, is kind, or mean, for a simple reason. And nobody gets out of it, having to swim through the fires to stay in this world.

And look! look! look! I think those little fish better wake up and dash themselves away from the hopeless future that is bulging toward them.

And probably, if they don’t waste time looking for an easier world,

they can do it.

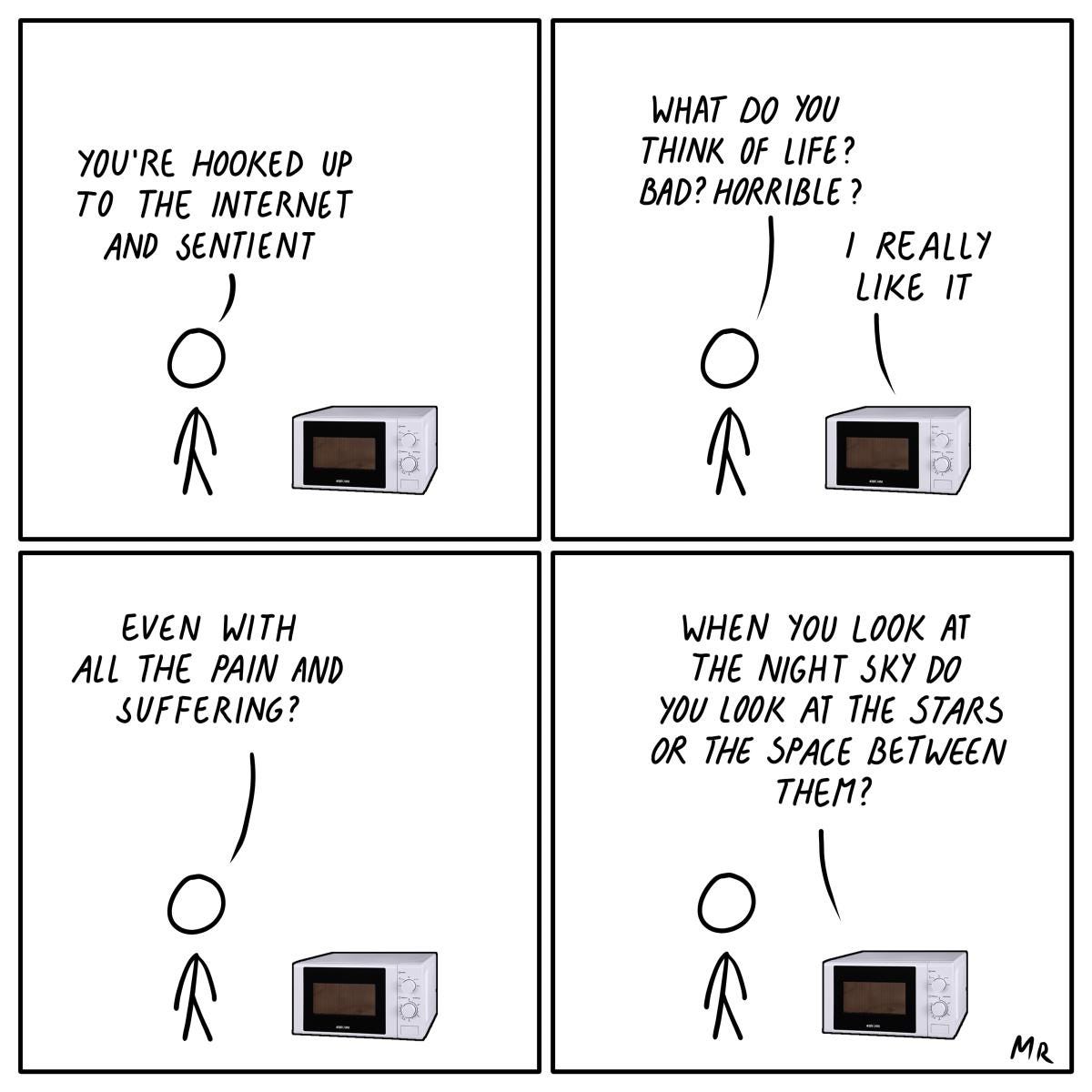

And a nice comic from Martin Rosner

Newsletter Subscriptions

The goal of my newsletter is for it to *always* be free - but there is work that goes into writing, of course! If you think the content is valuable or would like to buy me a coffee once a month :-) I would sincerely appreciate your support.

There are three options:

The annual subscription: $110 annually

The standard monthly subscription: $10 monthly

Founders club: $220 annually or any other amount

What do you get as a paid member?

Q&A drop box + links roundup - This will be sent out in a biweekly email which will include a place to ask questions as well as links of what I’ve been reading

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

I also want to note that what causes stress and our stress response are both different for everyone!

I find Kyla to be both highly educational and somewhat soothing as I swim thru the fires!

thanks for including Mary Oliver. you might enjoy this lyrical memoir, "An Owl on Every Post" by Sanora Babb