This is a quick note just based on what is happening - there is a LOT of misinformation floating around out there and this story is rapidly evolving, so I plan to follow up on this piece with more insight to the impact it could have soon.

The article begins with talking about Evergrande as a business, then the relationship of debt to China, and end with a worst case and likely case for what China could do.

A not so ever grand moment

TL;DR

It is highly unlikely that a financial crisis is going to unfold on the back of Evergrande. This is probably not Lehman 2.0, mostly because China can step right in and restructure the situation (literally and figuratively).

The big question is what will China do? Will they step in? Will they use Evergrande as an example? What does that mean for future credit unwinding? I think that there is a belief that the government will step in - and they have to a certain extent - with the main goal of showing the power of the CCP. But the shakeout here could be impactful for not only the Chinese property sector, but also for the debt bubble across the world.

What is Evergrande?

Evergrande is the second largest real estate developer in China and formerly the world’s most valuable real estate brand, and now the world’s most leveraged. They do a lot more than real estate though - they own a football team, a bottled water company, and solar panels, and some pig farms, just for a few quick examples.

In their annual report, they state: “Evergrande has completed the transformation from real estate to ‘diversified industries and digital technology’ through:

Evergrande Auto: The goal to become the world’s largest, powerful new energy vehicle enterprise. They are now trying to sell this arm of this business. No one wants it.

Evergrande property services: The goal to become the world’s largest intelligent urban service provider

HengTen Networks: an online media streaming platform

Fangchebao Group: The largest online and offline transaction and service platform for properties and automobiles in the world

Evergrande Fairyland: An indoor entertainment facility that sounds like its an iteration on the metaverse with “phyiscal amusement and online entertainment”

Healthcare: They have between 30-70 healthcare projects operating off its data platform, that offers customized medical and healthcare solutions

Evergrande Spring: Healthy food product shopping platform

They diversified their brands - but in the end, that doesn’t seem to ~have mattered~.

Evergrande has a very big debt problem. Their business hasn’t been doing so hot (with their sales in August being about half of their sales in June, and with sales expected to continue to decline this month). They are struggling, and have been for a while. They have stopped paying their employees. Their stock has cratered.

Things are not looking so grand for Evergrande.

Evergrande currently has a perfect storm of badness:

Falling revenues: They aren’t selling property at the clip that they need to. Sales have continued to fall, with sales halving over the past 2 months, and continued declines expected moving forward.

It seems as though consumer confidence is getting a bit shaky too - people are losing trust in the institution, and that’s incredibly harmful to sales.

High debt-servicing costs - Evergrande stopped paying interest on its debt and their onshore bond trading was suspended, and that makes creditors pretty unhappy. They tend to not like you once you stop paying them.

Lack of liquidity: Evergrande can’t sell their stuff. They can’t get access to more debt. They are in quicksand, and they need a really strong rope to help pull them out.

Too many lines of business: They do too much - “new energy vehicles, sports (they own a football team) and finance (they own a wealth management arm) - (which has) stretched the firm's liquidity to breaking point”. It’s great to have a diversified portfolio pie, but there is such a thing as too much diversification

Missed payments to contractors: For example, they haven’t paid their suppliers or their builders who are working on the real estate properties. This cascades down the entire supply chain, and is one of the worries of contagion.

Failure to sell assets: They cannot sell their businesses - no one is biting at their electric vehicle line, and the only sales that they are getting is through their preordered properties. How do you pay back debt if you have no cash?

The main thing here is that they took out a lot of debt to purchase more things (like pig farms). These didn’t shake out the right way, and now Evergrande has way too much debt and not nearly enough sales, and a bunch of side projects that are a cash suck.

Evergrande has to deal with their ~$300bn in liabilities - with ~$88bn of that being debt. Houlihan Lokey (the company that helped Lehman) and Admiralty Harbour Capital have been hired to assess its capital structure. And it’s a big question as to how they will ~deal~ with it.

Baseline:

In order to grow, Evergrande took on debt.

And debt is good and all, until you don’t have the $$ to pay it back.

If you can’t that’s when you default. They can either restructure (better for bondholders) or liquidate (bad for everyone). And the Chinese government might have to step in.

And that is the most important question - how China will deal with it? Because China doesn’t really like overleveraged real estate companies.

Debt and China

China has a LOT of debt.

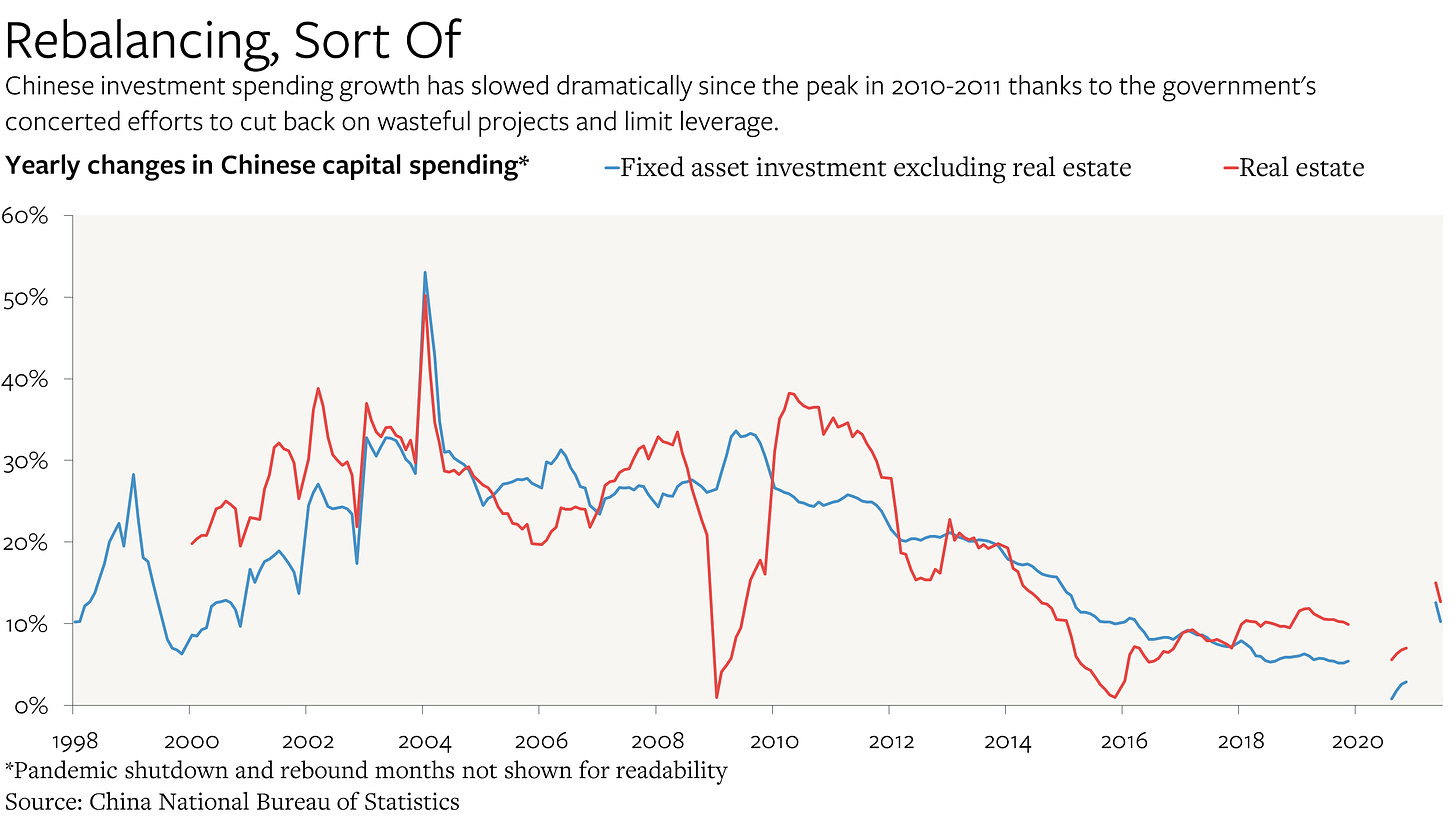

China has pursued a growth at any costs strategy - and you can’t take out a little bit of debt with that sort out mindset - you have to take out a lot of debt. As Michael Pettis highlights, increasing debt ALONGSIDE an increasing GDP is not a big deal, but it’s when the economy can not absorb it (like when domestic demand falls) - that’s when things get bad.

When growth is good, there is a risk-on sort of vibe - if things are going really well, why not take on more risk, why not outperform, why not take out more debt - that’s when you grow the quickest right?

More debt, grow quick!

But when the economy can’t absorb it - when housing prices start to tumble, when consumer spending takes a dive - that debt doesn’t look nearly as appetizing.

And now Evergrande is grappling with that slowdown - swaths of debt to pursue growth at any cost - with the realization that eventually, you have to have cash to get out from underneath of all of this.

And they just don’t have cash.

Presold apartments: They haven’t been able to sell any of their many business units - the only cash has come through their presold apartments, a pipeline that will likely dry up quickly.

To make matters worse, the government has made deleveraging a priority (they don’t want debt-bloated companies anymore), so this could be telling in regards to what they choose to do around Evergrande, a highly leveraged company.

China has existed in a very leveraged world - but they don’t want that anymore. So Evergrande, and it’s very debt-laden balance sheet, just isn’t that appealing to the Chinese government.

So what happens if there is a default?

The most important thing to remember here is that companies are ecosystems; they have employees, suppliers, creditors, customers, competitors, and regulators to respond to. So everyone’s got some exposure to Evergrande volatility!!

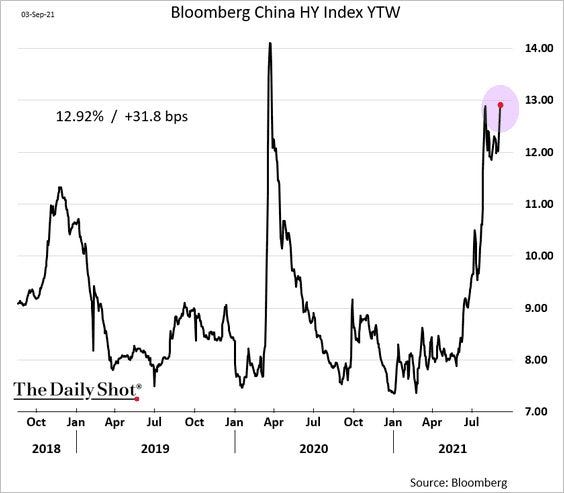

The HY market is responding in kind, with Evergrande causing upward pressure for the entire index.

This is because there is an element of contagion risk, as Saxo writes: “A default poses funding problems to Chinese real estate corporates and the Chinese banking sector, which inevitably increased exposure to the real estate giant during the past decade.”

This is already showing up as shares of other property developers are falling, and yields on other high-yield bonds are spiking across the board, as shown above.

There’s a couple reasons why a default could be bad (with more to come as this shakes out)

Employees: The employees are very exposed to Evergrande through two main funnels.

Getting paid: Obviously, they haven’t been getting paid, but if the company fails, that means a lot of lost jobs.

Wealth Management: Evergrande also has wealth management products, offered through an “internet finance affiliate”, which their employees have their $$ tucked into. So not only are employees going to lose their income, but they could also lose their savings.

The long term consequences of that are pretty significant. They employ 123,000 people.

Supply chains: Evergrande is one of the largest real estate developers in the world. If they go under, it will reverberate down the supply chain.

Builders won’t get paid. Materials suppliers won’t get paid. Projects won’t get finished - and they have over 1,300 projects in more than 280 cities and work with 860 companies according to their website. So either those projects will go stagnant or someone else (the government, potentially) will pick it up

Banks: There is some exposure to Evergrande debt abroad, with the liabilities “involving more than 128 banks and over 121 non-banking institutions.”

This could shake out poorly depending on how much exposure the financial institutions have, and if they have exposure in the form of ~x levered structured products~ a la the Great Financial Crisis.

Property Companies in China: If Evergrande goes under, it could very much be “oh no, are we next” sort of moment for the other property developers. Comparables could get squished by creditors, and there could be a shockwave effect, similar to 2008 in the United States again.

A lot of the noise is around what will happen if a default on their debt does occur - will this be a Lehman moment, with banks and the entire financial system getting scorched, or is it just bondholders getting slightly burned by the stove?

And the question is what will become of the intervention - will the bonds that Evergrande holds (~$88bn of the total $300bn in liabilities) go to zero? And what are the consequences beyond Evergrande for that?

What will China do?

Most of the narrative boils down to - what will China do? Will they save Evergrande? Will they let it implode?

And what will that decision mean for the rest of the financial system?

Regulators have already warned Evergrande that they need to get themselves together - which Evergrande hasn’t done yet. According to the Global Times:

China's central bank and the banking and securities regulators summoned Evergrande executives in mid-August to discuss the firm's present situation, urging the property developer to fully implement the central government's strategic measures aimed at maintaining the sound and sustainable development of the property market by not extending business activities, actively tackling debt and promoting stability within the property and financial markets.

I’ve outlined the worst possible scenario and the best possible scenario below. The bear case is pretty dramatic.

The Very Bad Case

The main risk seems to be some sort of cascade effect:

Property sector: Real estate prices would fall. Other developers would have trouble getting money. This could spiral as they could have to cut prices in order to raise cash quickly to pay off existing debts. Home prices spiral.

Consumer Sentiment: Real estate would have a similar shadow as 2008 did here in the states.

Abroad: The financial system could have exposure (As we know, Evergrande’s liabilities sit within 128 banks and 121 non-banking institutions, according to Asia Financial) and the fallout of their debt could lead to cross-defaults.

The rest of the high yield market: Contagion once again, with the Evergrande blow up leading to sell-offs in other HY bonds.

Housing prices are already looking wobbly on the back of the Evergrande instability - "home sales by value slumped 20% in August from a year earlier” according to Caixin Global.

So here it’s a -

Evergrande Implosion = Propety Market Fallout + Consumer Confidence Collapse + Shockwaves Abroad + HY Sell-off

Essentially, the Very Bad happens, and it becomes Pretty Bad everywhere. This is unlikely.

The Likely Case

China has done a lot of work to contain contagion in their financial + property markets with the key goal of deleveraging companies. They are on top of this stuff. They intervened with Huarong because they knew they had to stop the contagion.

Michael Pettis makes a point that China and Evergrande are insulated to an extent for two reasons:

China intervention: Evergrande does have a “risky” balance sheet but China is still able to step in and restructure the $300bn in liabilities that they have because regulators can limit risks in a closed-ish economy like China has.

Essentially the government does have enough power to contain this and likely will. And it’s not going to have the same shockwaves as 2008 did.

But, with that said the issue becomes when China opens up the door to foreign money, which gives regulators less control over the “stepping in”.

And institutional investors have increasingly gotten involved with China.

Just from a government perspective - “by the end of August, the country's central government bonds held by foreign investors surpassed 2.2 trillion yuan (about 340.74 billion U.S. dollars), up 17.3 billion yuan.” This development could shape this likely thesis in a different way in a few years.

Essentially things will be okay - China will likely step in if they think that there is significant contagion risk. Bonds will likely either restructure (big haircut) or liquidate (bad, but not horrendous).

So What’s Next?

The very big question is: will China bail them out?

There are very mixed reviews on this answer - and I don’t know what will happen. Enodo Economics says that China will bail them out and do its best to delay default, with the goal to restructure all the debt and pay back contractors, suppliers, home buyers etc. Saxo Bank says no, the government won’t bailout - they want to get rid of overleveraged companies and don’t want to deal with that $300bn of debt themselves.

Some people are firmly in the camp that China will bail out Evergrande, others are firmly in the other.

This note from Kevin Tellier is important too - regulation and innovation go hand in hand - and Evergrande could be used as an example of what innovation IS NOT, a highlight of what should not be done.

The premise seems to be here is that the government will step in to save companies like Evergrande. But China seems to be shifting away from that superman sort of model - they’ve had several warnings about being overlevered, and the question becomes - will they use Evergrande as an example?

George Soros said that Evergrande going under could cause the economy to crash but a lot of people refute that - with the assumption that the contagion will be relegated to China and China alone.

But these sorts of things can have domino effects.

I think (and this is just my opinion on a rapidly evolving issue, so take it at face value) is that the CCP is trying to make an example. They have cracked down on Tencent, Ant Financial, Didi, Alibaba, etc (I wrote about that here with Perth Tolle) - which seems antithetical to the previous ~growth at any cost mindset~.

Because I don’t think that China is growth at any cost anymore.

China cracked down on Tencent because they didn’t want kids gaming all day (listen to this Odd Lots with Dan Wang for more on that) but it increasingly seems that the CCP will crack down on anything that is a competitor to the power of the CCP.

Evergrande got really big and got really bloated with debt. But I wouldn’t be surprised if China chooses not to save them because they want to show how powerful the government is - and that at the end of the day, the government is all that you can rely on - not private tutoring companies, not public internet companies - just the CCP.

This is mostly about the power of the CCP now. And how they choose to communicate that through Evergrande is to be determined.

I will follow up soon with more synthesis as I read the thoughts of others, but this is definitely a very interesting situation unfolding.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

Best write up I've seen. I'm still on the fence ATM but interested to see what develops...

Great work! Very informative and well-written