How AI, Healthcare, and Labubu Became the American Economy

The Three Americas and aspirational displacement

Good morning from the woods!

Two days ago, I fell off my bike. We were on an incredible trail, perfectly chunky with rocks and just wide enough. I took my eyes off the trail for a second - to ask if everyone else was enjoying the trail as much as I was - and the bike slid out from under me. I was totally okay, but the derailleur, the bike’s gearing system, was completely bent out of shape.

So there I was, halfway up a hill, with a bike that could only operate in one gear. I could pedal, but I couldn't shift. I could maybe move forward, but only with tremendous, inefficient effort.

And to carry a metaphor here - the US economy is sort of like that bike. It's moving, but its gearing system is completely out of whack. The US is operating with 3 broken gears that no longer connect. There are currently 3 Americas:

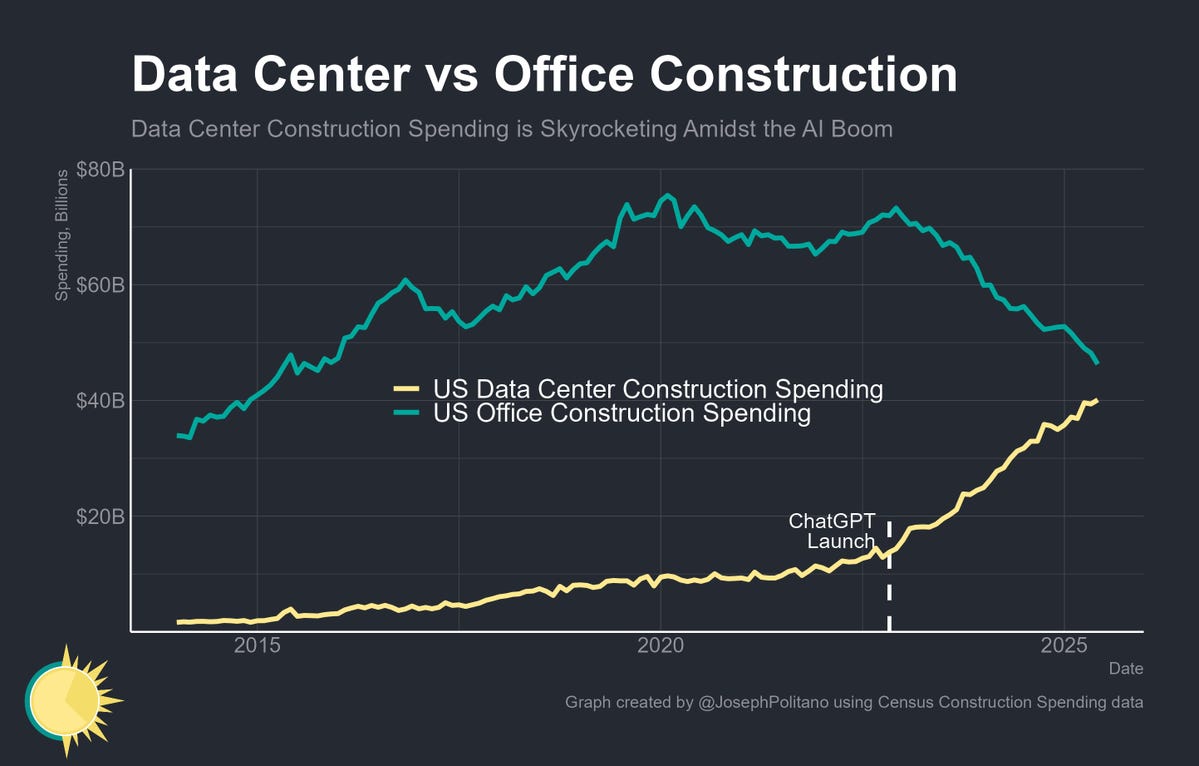

America 1 (The Speculative Class): The first America is the speculative class, and its engine is artificial intelligence. The Magnificent 7 are spending over $100 billion a quarter on data centers, which are these monumental projects of hope. They consume vast amounts of capital and electricity, a place where money and power are absorbed in a high-stakes gamble.

America 2 (The Real Economy): The second America is the real economy. With 75% of new jobs in healthcare and social assistance, our workforce is being absorbed by the essential but underfunded ‘maintenance economy’ of an aging population. While it props up the labor market, it fails to generate the type of wealth that fuels the stock market or long-term growth, as resources are poured into maintenance rather than creation.

America 3 (The Memes): The third America is the bridge between the other two, acting somewhat as a psychological gold sink for those who are priced out of a house and a future. The money spent here is largely speculative and doesn't build a sustainable future (is memecoin investing productive, I don’t know) but it gives people a sense of agency and hope within a system that otherwise offers them little.

It’s a very strange world.

America 1: The Speculative Class (AI)

Let’s start with the gear that gets all the attention - the one that's supposed to be powering us into the glorious future, the world of AI.

AI is weird. Derek Thompson wrote a nice piece on the good and efficient parts of AI, noting that it’s making workers more productive (or at least, the workers think so), changing our language (delve), and absorbing a massive amount of cash. But there’s also the psychological impacts of AI:

People are getting addicted to it and it could be breaking brains: OpenAI rolled out a new version of the model, changing some of its sycophantic tendencies (where it would tell you how smart and beautiful you were, not matter what you said). It was feeding people’s delusions and causing “Chat-GPT induced psychosis”! That’s not a tool that we need during the age of everythingspiracy!

It could also making people stupider, inserting itself between us and the real world, creating a “technological wedge” as Ewan Morrison describes, and potentially (?) taking all the jobs (or at least the narrative of jobs) - outside of healthcare, at least.

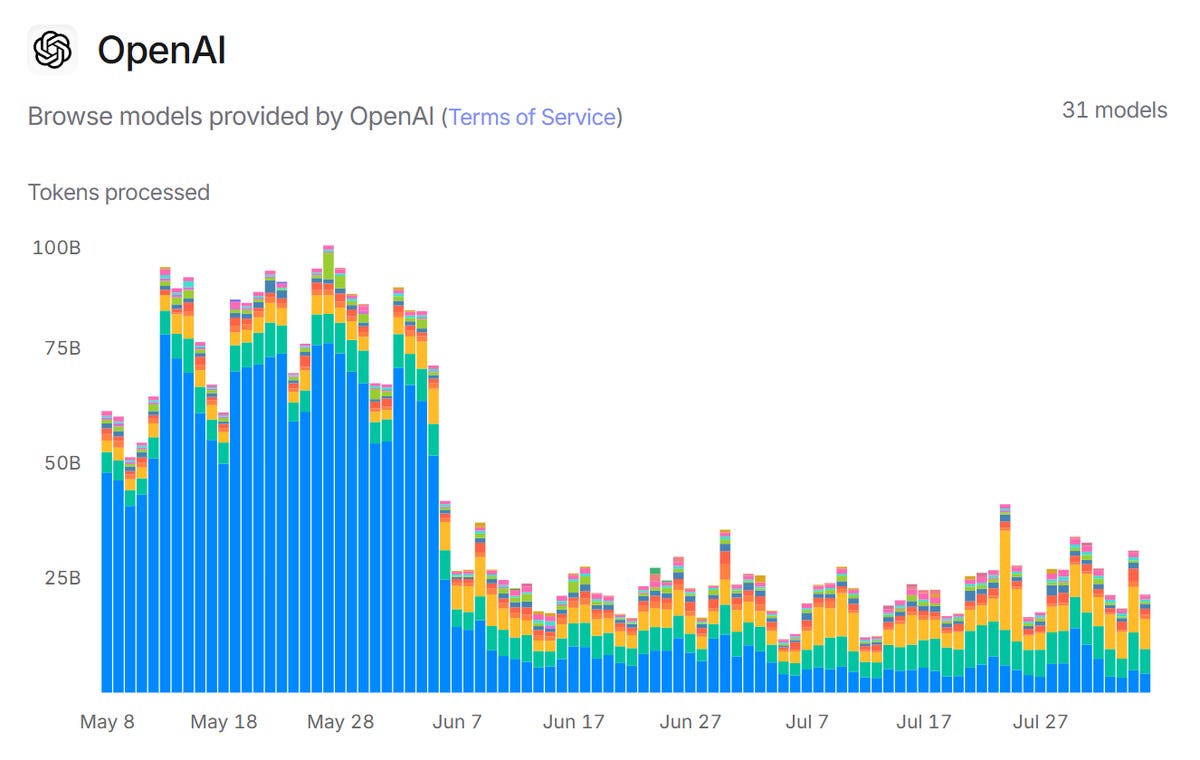

It is impacting both how students learn (perhaps, making it so they don’t learn at all) and the jobs they might get (perhaps, taking their jobs). And interestingly, in the chart below, OpenAI usage drops off around June 6th - around the same time that schools let out. AI is perhaps a school tool above all else.

Google knows this - they are providing Gemini for free for students for a year and investing $1b in AI and career training for every college student in America.

It’s just so strange! How we teach students are going to have to change (more written in-classroom essays and a bigger focus on process over outcome) but overall, everyone has more questions than answers right now - is AI the next iteration of the Internet? Is it simply here to give all of us infinite boyfriends and girlfriends? Will it replace the entire employee population at Salesforce? All three? Who knows! But while we're still figuring out if AI is breaking our brains, we're betting the entire economy on it.

AI is making things more expensive but it’s propping up the economy

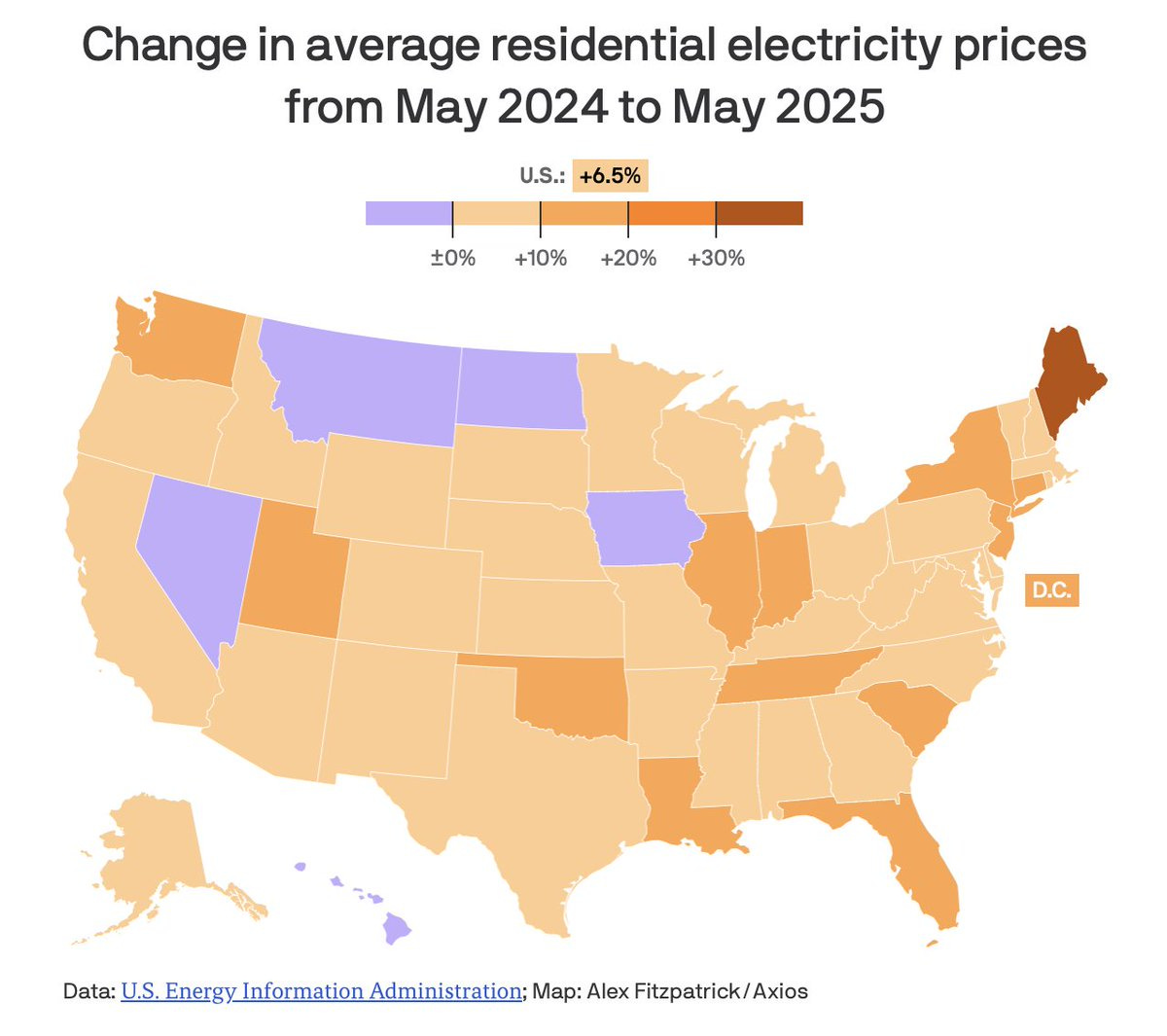

AI takes a lot of power. It’s putting huge pressure on the consumer, with electricity costs ticking upwards at the same time that Trump decides there is no need for renewable energy. (Tyler Norris has a good read here saying (1) yes the higher electricity costs are data centers and (2) here’s how we can fix it).

And companies like Meta are essentially acting as a technological and financial arm of the government, fueling fiscal expansion, as Jason Furman described. Someone has to prop up the faltering US economy which is starting to buckle under slowing growth and tariff uncertainty. So we get data centers (which contribute $26 in taxes for every $1 in services they take)1. But who is all of this really for, you know?

I mean, financially, it’s working for the people in the business!

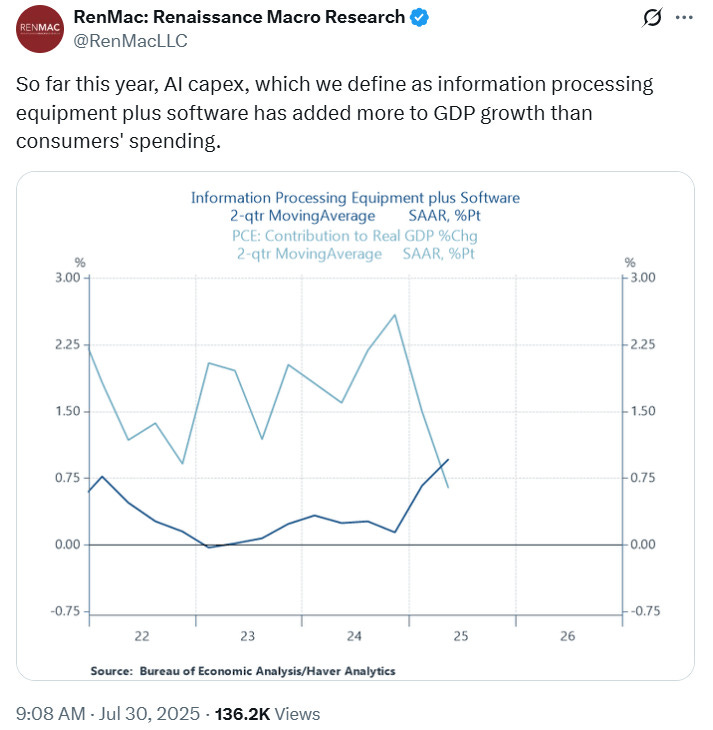

AI capital expenditures are a large (and growing) percentage of GDP

The Magnificent 7 have spent “more than $100 billion on data centers in the last three months alone” and “Morgan Stanley estimates that capital expenditures on AI could exceed $3 trillion in the next three years” according to Bloomberg.

These companies are now 35% of total US market capitalization (Nvidia and Microsoft alone are almost 15%)

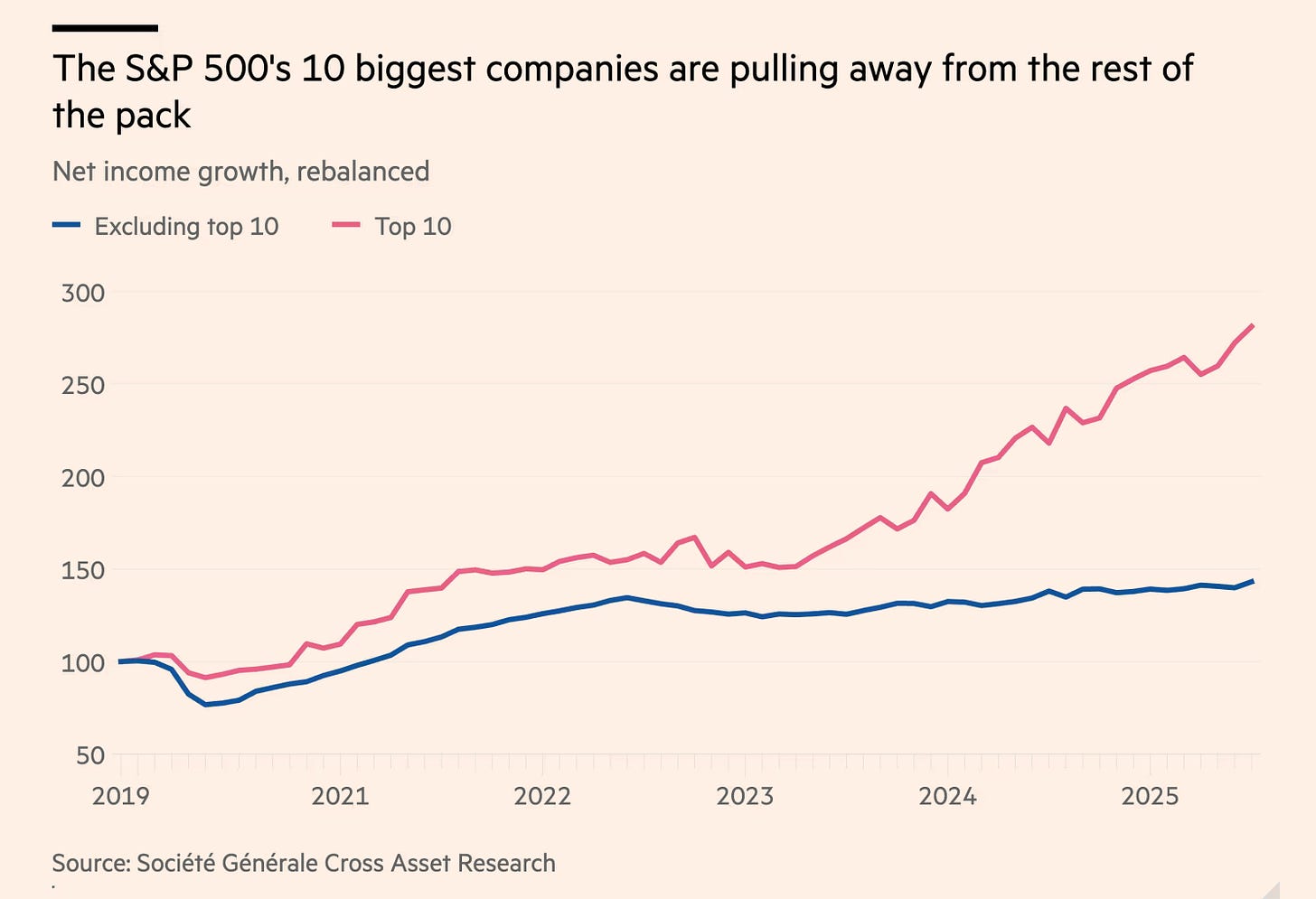

The 10 biggest companies have driven almost all of the S&P 500’s growth over the past two years.

AI is spending more than consumers are, which feels fitting as it seems the end goal is to replace them (?). Again, who is this for? What is it really supposed to do? I don’t know if anyone really knows. I like elements of AI (I wish that everyone would stop being like “let’s replace artists” and instead say like “how can we help people order medicine) and think it has a future but it’s confusing.

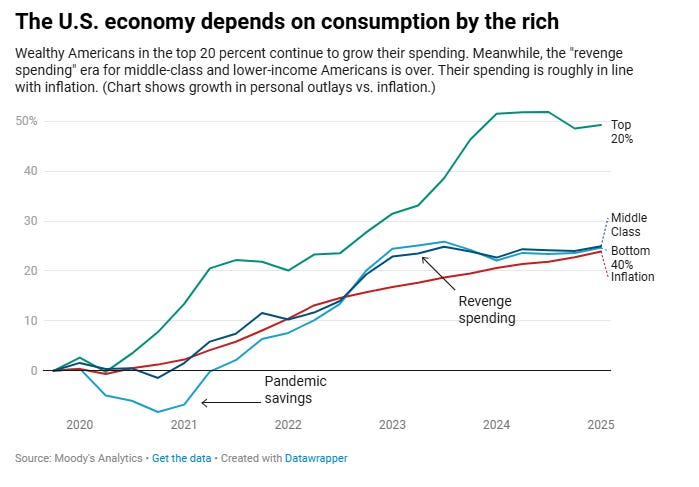

The economy is dependent on data centers really working and continued consumption by the very wealthy as Heather Long wrote about recently. There is no in-between.

What about a world beyond AI?

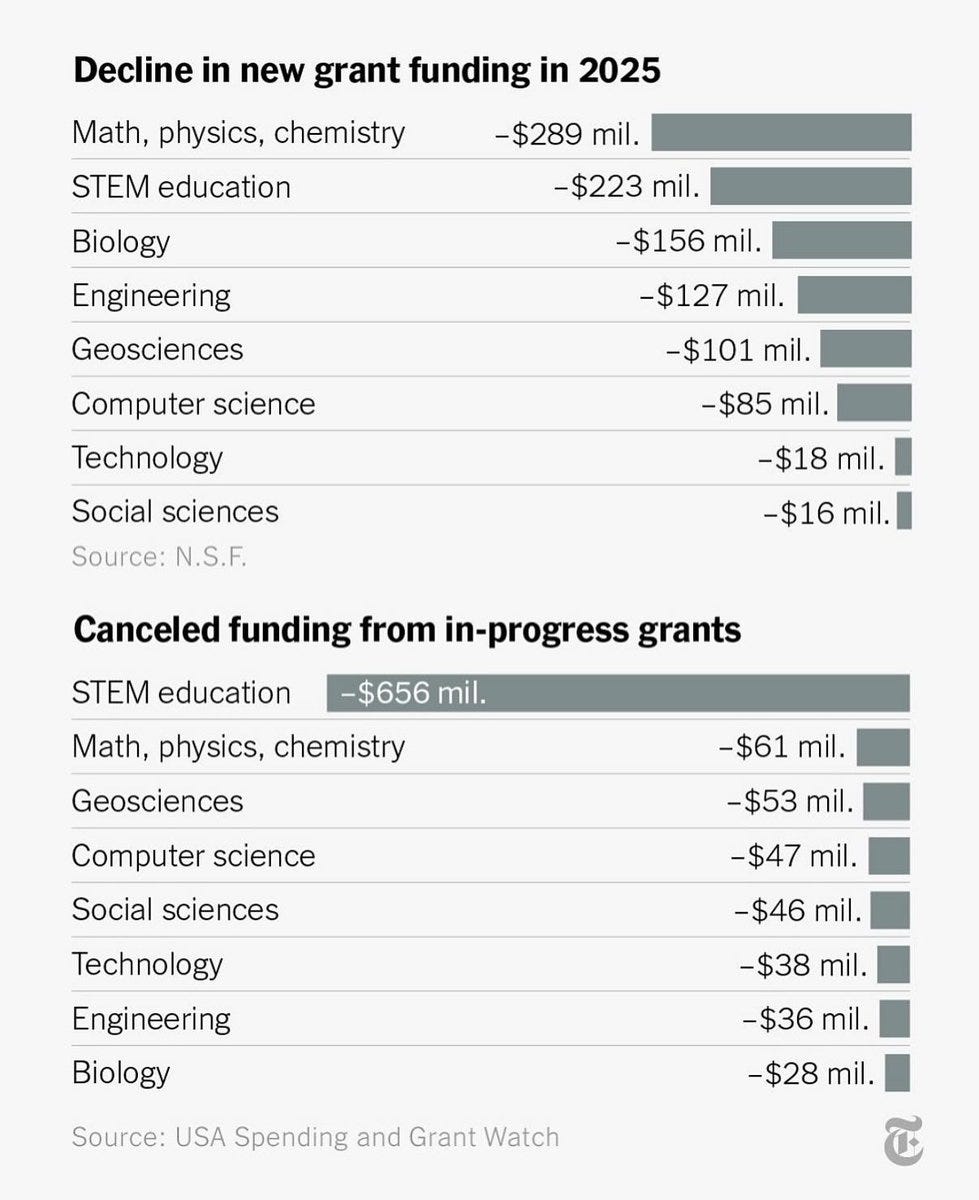

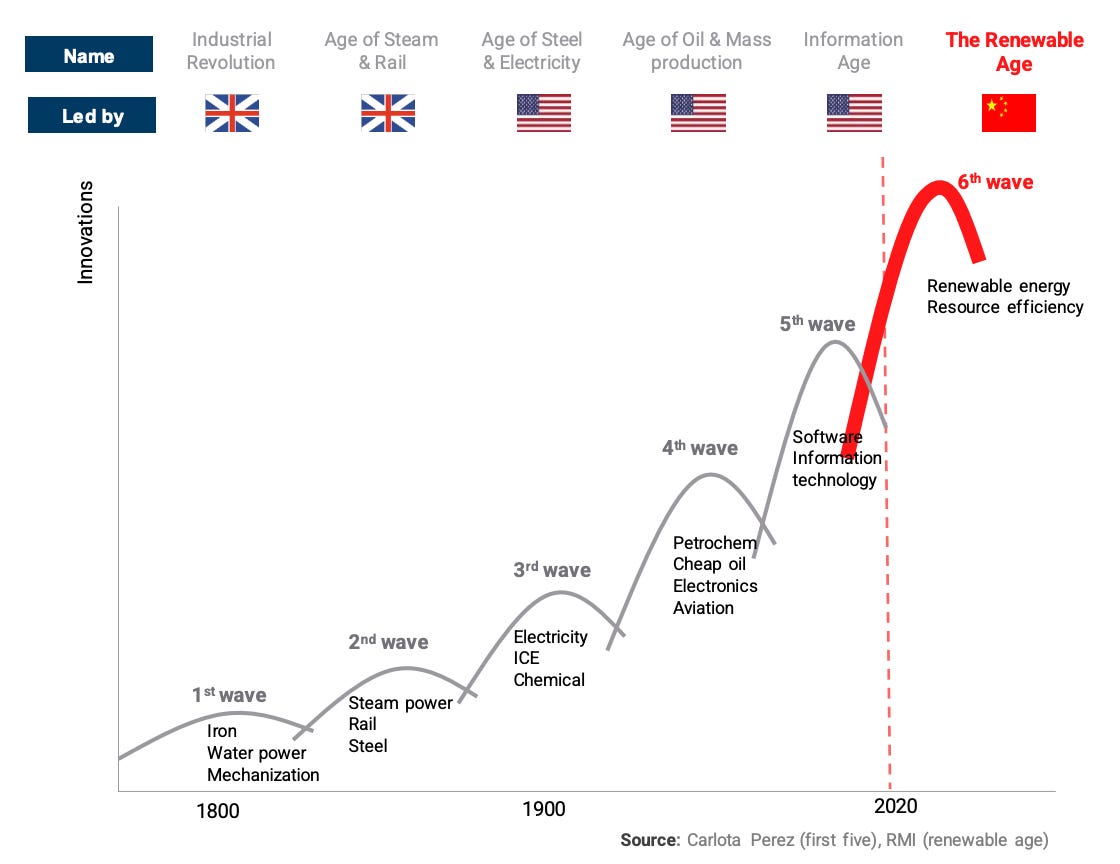

And as we are funneling a ton of money into AI, at the same time, we have seemingly decided to pass off all other science and innovation to China. They are now completely winning - 13 of the top 20 research institutions in the world are now Chinese. The Chinese Academy of Sciences is No.1 on the 2025 Nature Index, beating Harvard.

It’s internal destruction. China is winning and the US is actively losing.

RFK Jr just cancelled mRNA vaccine research, very real and important work that could have helped treat cancer.

Science funding has been cut by 50% in the US. We were once the gold standard for important research and now that China is closing in, the administration has responded by gutting the National Institute of Health and the National Science Foundation.

But the pendulum is of course swinging back - Doge fired 550 people at National Weather Service, and now there is special permission to hire 450 people to “relieve critical shortages”.

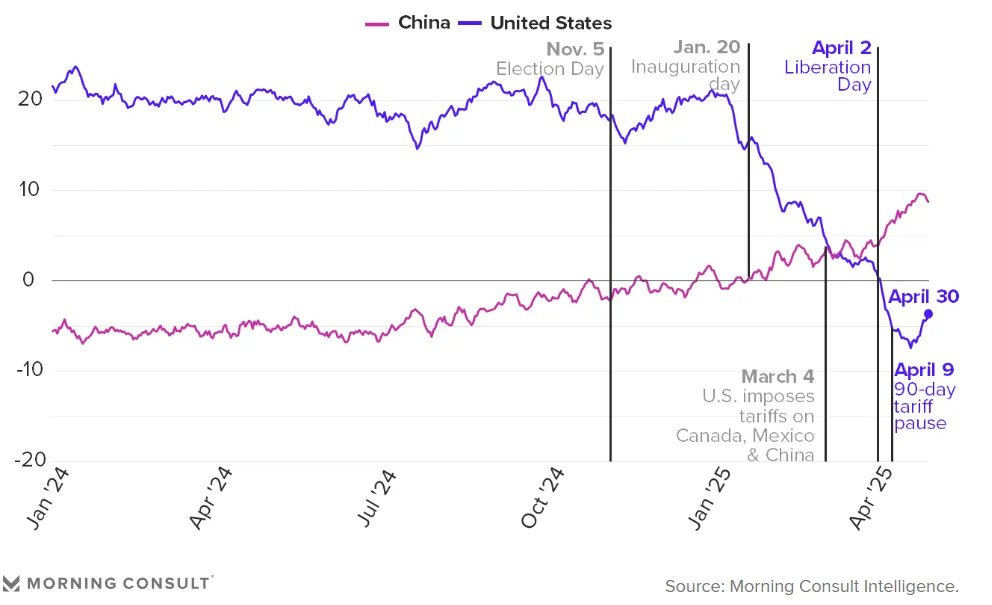

This weird one-step-forward-one-step-back is also why China is more popular than the United States right now - the US offers nothing more than AI and various types of gambling and volatile tariffs, whereas China has offered massive advancements in science and technology and a future that people can actually believe in. China is succeeding because of its outsized investment in the future and the US is failing. As Albert Pinto wrote “For the first time in two centuries, the West is no longer the leader in future technology, but the follower.”2

The US seems to be

Simultaneously living in the past (the focus on the energy of the a different era, like fossil fuels and coal)

Trying to manifest new technology to save itself in the future.

But that technology requires the energy of the future - solar, nuclear (not on the moon, probably), and wind (Heatmap has a great read on that here).

We need to live in the future to build the future!

And Trump has now decided to tariff semiconductor imports at 100%, exempting companies that move production back to the US (the trick here is to simply announce that you’re moving production to the US). TSMC is exempted. Apple3 is exempted (Tim Cook gave Trump a 24-karat gold engraved trophy and promised to invest $600 billion in the US4). The Intel CEO was not so lucky.

What happens when you isolate all your trading partners?

The rest of the world is trying to move on without us (one example out of many - Japan is turning to Brazil for beef now). Tim Sahay and Kate Mackenzie wrote in BRICS in 2025 about how the world is trying to get away from the US at the moment:

The postwar geopolitical order rested on three pillars: American hegemony, the fossil-fuel energy system, and an open, multilateral trading order. America has now attacked each pillar at the foundation of its hydrocarbon global order. There are now two competing global models of energy and influence: one based on fossil fuels, one on green technologies and a new model of sustainable development. China’s technology is finding new markets around the world because lots of people want it. But there is so far no real wraparound support of finance, trade, and tech transfer—as no new international order of sustainable governance has yet been built.

This ties into what Gillian Tett wrote about a few weeks ago - the “core thesis is that China today has hegemonic control of manufacturing (via its dominance of key supply chain nodes such as rare earth minerals) but the US has hegemonic control of finance (because of the dollar’s reserve currency status).” The US still has the dollar, even after all of this. We are still the financial stronghold. But for how much longer?

As the US is ramping up “mercantilism and isolationism” to try and throttle China Tett notes that “in places such as Asia, cross-border trade is still rising; for many countries globalisation is far from dead”. Other countries know what works - comparative advantage, free trade, trading with China - and are following that!

The US seems to developing a data-center driven economy that works for the very few at the expense of many (Noah Smith has an interesting read on the risks of that here). Spend or sink. The problem is, the world might not need another round of software and information technology - and instead it might need the things that power those things like renewable energy and resource efficiency, which China is focused on and the image above shows.

In the meantime, America 2 grapples with a very different reality.

America 2: The Real Economy (Healthcare)

The second part of the economy is healthcare5.

75% of the jobs added in July were in healthcare.

Healthcare, social assistance and state and local government made up almost 70% of the jobs added in the past year.

Most of the other sectors are shedding jobs (Manufacturing lost 11k jobs in July).

Almost 20% of consumers have said it’s hard to get a job right now, up 5% from January.

20% of the US population will be over the age of 65 by 2030, meaning that that the care industry is only going to continue to grow

Healthcare is where the jobs are, but it’s not where the money goes. It’s Nancy Fraser’s crisis of care. This industry props up the labor market but not the stock market. Healthcare stocks are one of the worst performing sectors this year. That's mostly because healthcare costs are still unmanageable for both the patient and the service provider, and despite being the only sector adding jobs, there are still workforce shortages.

It’s a very clear example of the fundamental disconnect between the stock market and the economy. And that’s the important thing - we have these two parallel worlds, both:

Replacement economy in the form of what AI has promised itself to

Maintenance economy that is designed to care for our aging population.

This creates an interesting push and pull - the healthcare economy is exceptionally stable, dependent on an aging population and continued health problems (and solutions, like GLP-1 drugs). The technological economy is blowing through cash (Meta has about $12 billion in cash left after burning through $30 billion the last two quarters) and creating a product that hasn’t really found a fit quite yet.

So then a bunch more questions - Do we end up in a real world where people are at a cognitive disadvantage if they don’t use Meta’s AI glasses? What happens when many of the jobs are in maintenance rather than creation? AI can certainly help healthcare, and it is, but what happens next?

America 3: Memes

So we have AI, right, the big shiny thing that the US is betting its entire economy on as it isolates itself from the world - and then we have healthcare, where an extraordinary amount of resources are going to have to go (and again, AI can likely help here, but it will require an immense amount of labor). Joe Weisenthal, of the very famous podcast Odd Lots, wrote about the bifurcated economy, stating that the rise of healthcare and AI:

Makes it easy to envision what a stagflationary environment looks like: an economy that exhibits mediocre growth across many sectors, but which sustains a fairly high level of resource utilization, because there’s so much demand for social assistance (soaking up labor) and demand for electricity and certain types of industrial gear (soaking up capital) due to the AI buildout

But what does everyone else do? What about the trifurcated economy? What about people that are shut out by AI and don’t touch the healthcare economy? What do they do?

Bet?

Well… meme stocks have started bubbling again - acting somewhat as a psychological gold sink. Goldman Sachs Speculative Trading Indicator has hit its highest level in over a decade. American Eagle rocketed up 20% on Monday after Trump tweeted that their campaign was “the hottest ad out there” (it erased almost all of those gains the next day). But it’s more than just that.

This is the Labubu/Fartcoin economy - the attempt to maintain agency and community within constraints rather than spending energy fighting battles with Sam Altman who says things like“the whole structure of society will be up for debate and reconfiguration” due to AI. There are two core things to understand here"“

Aesthetication: Labubu6 are functionally plush bunnies with plastic people faces and the pointed teeth of a jack-o-lantern. They are sold in blind-box packaging (you don’t choose them, you open a box and receive your fate) by a Chinese company called Pop Mart (There's something strangely poetic about importing economic nihilism from China too. We're buying blind-box toys from the country that just overtook Harvard in research output. They sell us $15 mystery boxes while they build the actual future!) Over the past six months, they’ve generated almost $1 billion in sales.

Gamification: Fartcoin is a memecoin born out of an AI project called Truth Terminal. It launched in late 2024, reached a peak $2 billion market cap in January 2025, and now sits at about $1 billion. It increasingly appears to be an alternative to the risk-free asset of US Treasuries.

Labubu and Fartcoin are the economy people can actually participate in. They’re a form of symbolic participation, what happens when ownership is out of reach and when expression replaces accumulation.

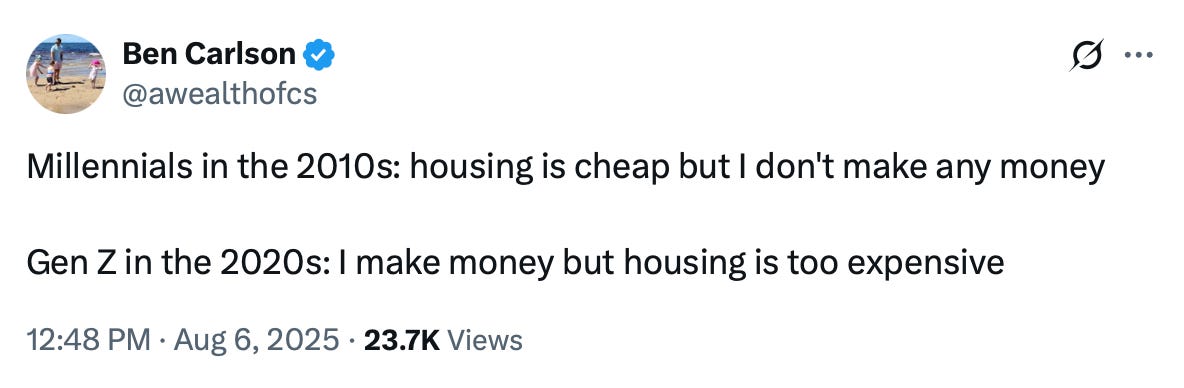

Both represent a form of aspirational displacement. This is the idea that when you can't afford a house, you buy mystery boxes that might contain a rare variant and then that’s good enough. It’s a way to perform relationship to consumer culture. When you feel shut out of institutions, you buy meme coins that turn financial nihilism into a form of cultural expression.

Conor Sen has talked about this idea a lot, pointing out that consumption is contributing far less to GDP growth now than it was in the late 1990s. Nick Magguilli wrote about the idea recently too. He essentially says that people (who would normally buy a house) are throwing money into financial assets because housing is just too expensive.

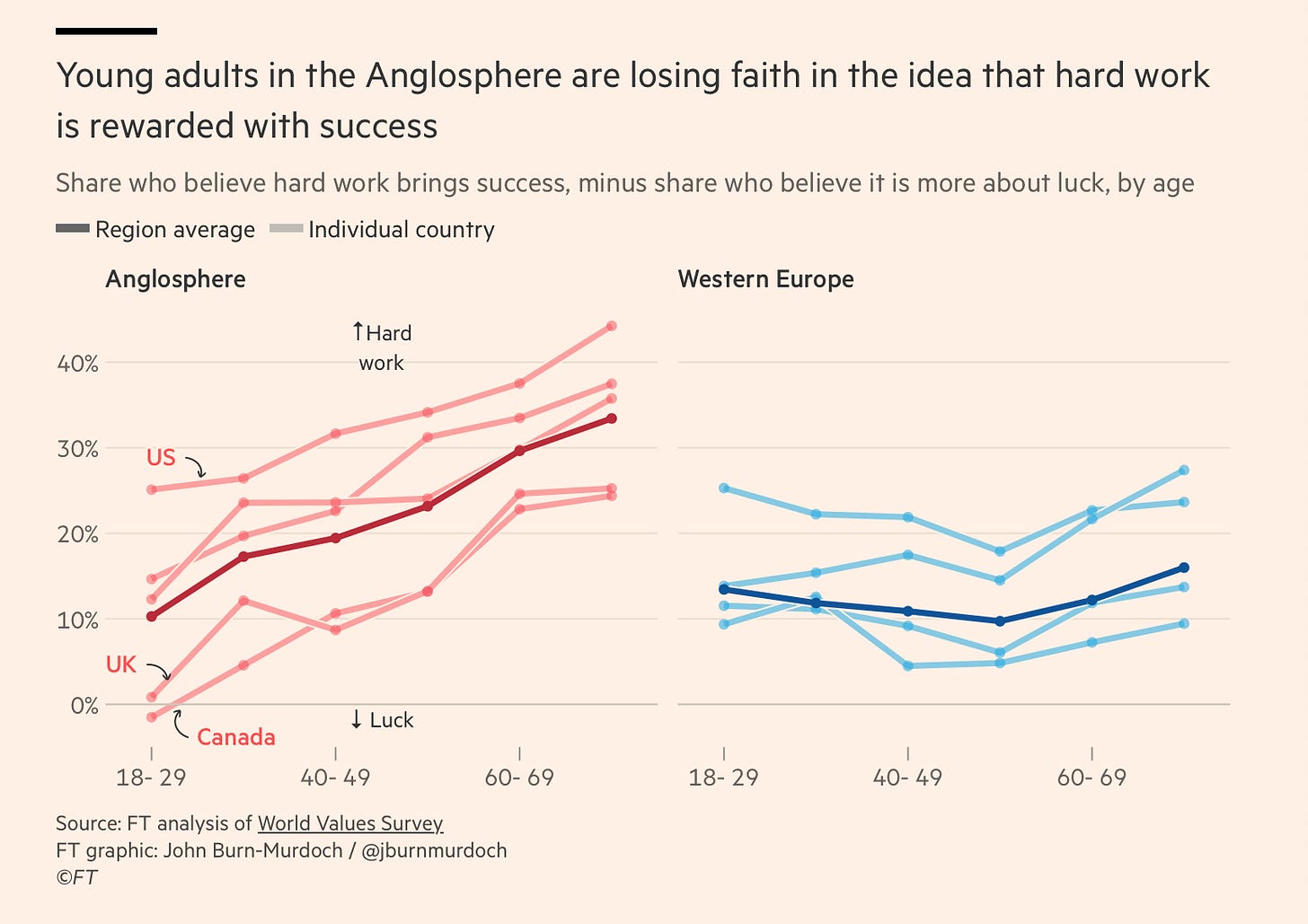

John Burn Murdoch points out that young people are extremely unhappy in the Western world because society broke its promise of a home them - there is no faith in the future of the system, so people turn to ripping each other apart.

Memecoins and mystery boxes are a way for people to feel they are participating in the boom, even as they are priced out of its tangible rewards. When institutional financial advice assumes you have disposable income, long time horizons, and faith in market stability – none of which apply to most young people7 – meme coins become a rational way to engage with financial markets as you’re betting on volatility rather than growth.

Something that troubles me is the idea that maybe everything is becoming financialized because financial markets are the last remaining system capable of aggregating distributed information and enabling coordination at scale. Like obviously the above example8 is wild and absurd, but it’s a very efficient form of communication. And when traditional institutions (media, education, political parties, local communities) lose credibility, people turn to markets for economic coordination and for truth discovery.

And the institutions are losing credibility. Trump fired the head of the Bureau of Labor Statistics after we got a not great jobs report, which is (1) not great (2) threatens the trust of US data (3) subsequently threatens the trust in the US dollar and US Treasuries. The same day that happened, Federal Reserve governor Adriana Kugler resigned, giving Trump the chance to nominate a ‘shadow Fed chair’ which creates even more uncertainty (right now, two Kevins are in the running).

Las Vegas tourism is declining and people are like “oh the young Americans are at fault” which ignores that (1) betting is different than gambling and (2) the US is becoming Las Vegas - but everywhere. We are essentially building a glorified, speculative fantasy while China focuses on the foundational, "boring" work of scientific and technological advancement.

The Three Americas

So those are the three Americas. Stocks are just chugging along, driven by AI and memes. There is excitement over lower interest rates (at what cost, who knows) and liquidity. And the stock market can look past all sorts of problems, because all it really needs to care about is data center build out and memes.

“Real” companies like “carmarkers, airlines, and companies manufacturing household durables such as refrigerators and washing machines” have been absolutely hammered under tariffs and economic conditions.

As David Stubbs said “The hope is that AI investment will keep the economy going. But you have to acknowledge that some of the tailwinds from greater migration and greater fiscal spending have run their course.”

So, if we zoom out, the U.S. economy's broken gearing system is powered by these three separate things: institutional speculation on AI, the demographic obligation of healthcare, and the psychological relief of memes. In a healthy economy, labor builds the future, but in our economy, labor (as is necessary) maintains the aging population, AI speculation builds a future with a 'You’re Not Invited' sign for most people, and memes let us pretend we’re still part of it. We have created a world where the only things that grow are this fervent hope that AI works, nursing rosters (thankfully), and the hope that your meme coin might moon.

On that trail, Zach was able to fix my bike with his depth of knowledge and care. He essentially bent the derailleur back into place. The same thing exists for our economy - the knowledge and care here is incredible. The three economies can and must connect. We have the tools. We even have the resources - we're spending trillions on AI infrastructure, after all. Memes don’t have to be the only thing we believe in.

Thanks for reading.

OpenAI just announced that they have developed a version of GPT-o4 that runs locally on laptops or phones - which should put less pressure on the data centers but the consensus seems to be that data center demand will be unbounded

As Albert points out, this has very real consequences - if we stop getting foreign inflows to the Treasury market, we are going to have a much bigger problem than a culture war

India, who produces most of Apple’s iPhones, just got hit with an additional 25% tariff for buying Russian oil to ensure India’s energy security. There is probably a world where a country gets mad enough to stop making the things the US relies on. And we can’t bring manufacturing back that fast.

As James Surowiecki pointed out, Apple’s capital expenditures and R&D spending were $41 billion in 2024 - so it’s going to be a challenge to hit $600 billion in four years

AI is trying to replace all jobs (it’s not working, at least right now. The main use case seems to be yelling at grok online and making pictures.

Student loan payments have started back up, and now 10% of balances are 90 days behind. Household debt is skyrocketing.

The person who did it just wanted to “go viral”

I have nothing of substance to add to the conversation. I’m just here to stan Kyla for being a voice of reason in an age of insanity.

Must read stuff every time