Irrational Idealism: Inflation and the Federal Reserve

pretty spicy

Some brief thoughts on inflation

If you’re already subscribed, thank you! If you’d like to subscribe, please do so here:

In this piece, I want to talk about ~inflation~ and some thoughts around why it is doing what it is doing. I will discuss supply and demand, wage inflation, energy prices, the yield curve, corporate profits, crypto, etc.

Also, Ben and I will have some stuff out around this over the weekend.

YouTube here

Inflation

Inflation. Top contender for word of the year for the early 2020s (after pandemic, GameStop, etc). Inflation comes from ~many different things~ including:

Supply chain breakdown

Geopolitical tension (energy markets, also globalization is tough to optimize)

Labor/wage problem

Accomodative fiscal/monetary policy

This is sort of what people are pointing to when they say the Fed has a printer (which isn’t a true analogy) but the point is that we have existed in a time of really easy money, which makes everything a bit simpler to do (at least $$ wise)

Consumer demand

Inflation is the heat in the kitchen right now - so what’s going on?

Consumer Price Index (Consumer Spice Index?)

Yesterday we had the CPI print for January.

It came in hotter than expected - year-over-year inflation rose by 7.5% the fastest since 1982 (yikes). It rose 0.6% in January alone. And the biggest problem is that prices are rising everywhere month-over-month - broad-based inflation (harder to manage) - energy, vehicles (new vehicles finally stopped rising, but used vehicles still on a tear), meat, etc.

There are two things that is not good about this:

Inflation Beat Expectations: The problem with this month coming in so spicy is that everyone kind of expected inflation to chill out, but it did the opposite of that. Now the question will be when will it actually chill out?

Inflation Could Be Sticky: The other worry is that inflation could become entrenched - especially in shelter (long term contracts ftw) and other services. Goods inflation is a bit easier to manage (and will likely abate) but services (shelter, healthcare, transportation) are at a higher risk of sticking around for longer.

This is because unlike goods (more a reflection of supply chains etc) once services prices go up, it’s pretty hard to get them to go down again.

Goods vs Services

The inflation we are experiencing is no longer pandemic specific - it has “broadened out across many, many categories both on the goods side of the economy and on the services side” as Kathy Bostjancic said.

Goods: Cars are absurdly expensive (new cars abating, but used cars) - used cars are driving 1.7% of the year-over-year inflation increase and fuel oil prices are up 9.5% month-over-month and almost 50% year-over-year. Food has gotten more expensive (especially meat, rising 12.2% over the year).

Services: Shelter costs increased, contributing 18 bps to monthly core CPI, which isn’t great. Shelter is a big contributor to the CPI in general (~1/3 of the calculation), and costs will probably continue to go up. Shelter is broken into two different components: 1) owner’s equivalent rent and 2) rent of primary residence:

Owner’s Equivalent Rent: Home prices are considered to be a capital investment NOT a consumption expenditure (of course) so OER is a rent proxy that reflects home costs. They ask owners how much they would pay to rent their house, and that is reflected here.

*** i made a mistake here, and didn’t describe this clearly: “OER index is based on a representative sample of rentals, its not based on interviews with homeowners. The interviews are only used to determine the weights for the rental samples.” *** thank you Joey for pointing that out!

Rent of Primary Residence: This is literally just rental charge, also reflected here

So everything is expensive and the labor market is tight and no one knows when the inflation pressure could end - ideally, supply chains will ease, but ? now inflation is not really just about goods production it’s also about the cost of medical care, travel, shelter etc - all of those are increasing too.

so why?

Supply and Demand and Price Go Up

This is one of the big ones. A lot of companies are like “wow we just don’t have anything for you people, sorry about that” and then some are like “so we are going to charge you 4% more for a burrito” (the theory of inelastic Chipotle demand) and others are like “margins will take years to recover” (will discuss this more later).

Unsurprisingly, the stock market rewards the companies that are able to pass costs along

Supply and demand, a force equivalent to gravity for companies and consumers.

Not enough thing? Too many people demand thing?

Price go up OR company eat cost.

And of course, if price go up, then Inflation.

But companies themselves are living, breathing machines that pay people, as well as produce goods for others to consume. And people are demanding goods - far more than are being produced - a function of not enough workers and higher input costs. So this isn’t a supply/demand problem just from a goods production perspective, but its also a supply/demand problem from a labor perspective.

Company Costs and Wage Inflation

Not enough workers? Not enough people to make thing?

Wages go up OR company simply ? crumbles

Wages haven’t even kept up with inflation, even though the Employment Cost Index increased - “wages and salaries for civilian workers climbed 4.5% from a year earlier”. See, wages are tricky because higher wages could lead to a wage price spiral in which:

Workers say “wow prices are super high, please pay us more”

Company says “okay we get that, sure”

Company then raises their prices to offset cost of higher wages for their employees

Rinse and repeat

Companies are squeezed. PPI, the producer price index, is high too - it’s not just CPI that’s brutal out here. So companies have pressure from:

Higher labor costs: People are more expensive to hire (mostly from a shortage of them, but also because hello? inflation is 7.5%)

Higher input costs: Things more expensive to make (oh no)

All of which ends up boiling down into higher prices for consumers. However, we aren’t in wage-price spiral land quite yet - real compensation (compensation adjusted for inflation) is down 1.5% year-over-year - meaning people are still not making more than inflation (inflation-adjusted), despite wage increases. And the Fed wants to avoid the wage-price spiral - which they will manage through monetary policy.

But note - it’s complicated (it always is).

So. People *are* getting paid more, but not really. And the BoE saying “don’t ask for a pay raise” was definitely saying the silent part out loud here. It’s tough.

Energy Prices Going Down (One Day?)

Companies are also squeezed by energy costs - everyone is.

This has been a really big driver of inflation over the past year or so, mostly because of the beautiful combination of underinvestment in traditional energy structures and underproduction of needed energy sources. And of course, oil went negative in March 2020 so it was kind of tough to predict what was going on. This is a lot of different things.

Rory Johnston wrote an excellent article detailing why the energy market could be balanced (aka not as much price pressure as we have seen) - and how it could derail if one of these things goes wrong. I am adding in my own notes below.

Rebounding US shale

This market is recovering, but the U.S. fracking boom could be unbooming as they “have already tapped the maximum potential in profitable wells, and have limited room for further growth”

Further unwinding of COVID-era OPEC+ cuts

If OPEC+ produces more, price of oil goes down, because more supply - but OPEC spare capacity doesn’t look that good

All-time high production for non-OPEC producers outside the US and Russia

Geopolitical tensions with Russia are at all time highs (especially right now) but more countries are stepping up because of lack of energy security

Unchanged Iranian and Venezuelan oil sanctions

We probably won’t see sanctions lift on Iran and Venezuela, meaning no oil from them (still)

A complete post-pandemic demand recovery

So we could see things chill out in energy markets if everything goes okay - but like, how long can things go okay?

A lot of uncertainty to come.

The Bond Market and the Flattening Yield Curve

So what does the market think about all of this?

Markets are now expecting the Fed to move, pricing in ~six++++ 25bp rate hikes this year. The yield curve is flattening because the market is like “wow the Fed is going to be MOVING.” Normally the yield curve is upward sloping because people are like “yeah the future looks good from here” - when it’s flattening, that means “wow future not looking so hot”.

A flat yield curve isn’t great because that means the market is expecting economy to grow slower - mostly here because the market thinks that the Fed could tighten too fast (and into a slowing economy, a double whammy), and tighten us right into a Recession - bad!

Higher yields hurt stock valuations too - so if yields keep ticking up, that could create a bit of pressure - but also - ??

But what makes stocks happy?

The Stock Market and Corporate Profits

Price gouging?

Are businesses really price gouging? That’s the big question, right? Tracy Alloway wrote a really good piece around profit margins - and the fact that companies that are willing to raise prices and pass costs off to consumers are getting rewarded by the stock market. As Tracy wrote:

Shareholders consistently rewarding companies who raise their prices could be a headache for a Federal Reserve trying to get a handle on inflation without impeding economic growth.

It makes sense because of course it does - it’s really about pricing power and margin maintenance - but definitely contributes to the broader inflationary environment. Broadly, there is a lot of debate around how much of the price pressure we are seeing is from companies raising prices.

Joey wrote a really good piece debunking some of the core thesis, stating:

“High profit margins do not cause, and are often not correlated with, high inflation—and the jump in profit margins is not particularly large.'“

So inflation largely is not a function of companies beating consumers for every last dollar - it’s a much more complex combination of supply and demand, rising input material costs, supply chain constraints, labor pressure, etc.

BUT

You can see pressure in credit markets - reflecting a somewhat interesting story companies still have to raise prices to a certain extent to *maintain margins* - maybe not expand them- but companies are running out of room to do that.

“Thus far, passing through costs has sustained margins. But the poor performance across all corporate bond sectors paints a different picture, indicating margin pressures that are broadening.”

The credit market is reflecting worries about company growth stories, and the pricing power that they will have. That bodes negatively for economic outlook - tying into “rising yields, rising inflation, and rising energy prices” as Ben Emons says.

Crypto: An Inflation Hedge?

Crypto right now trades like a tech stock - this is because of institutional dollars, risk-on, risk-off etc. So Bitcoin goes lower when inflation goes higher, because tech stocks go lower when inflation goes higher. I’ve written about this before:

Crypto and high-flying tech are both flush with a lot of VC dollars, a lot of wall street dollars, a lot of global macro narrative dollars. Because of this, those dollars move according to the risk assessment of their holders - meaning that crypto kind of ends up trading like big tech, a lot of risk on, risk off cyclical movement. This isn’t a bad thing - it’s just how the market prices the risk that it sees.

There will probably be an eventual decoupling - where crypto trades more like an inflation hedge or a countercyclical asset - but that might take time.

But for now, the inflation hedge narrative isn’t working as expected.

It’s All Political, Of Course

Biden is very aware that high inflation is a very bad look. I mean after all, midterms are coming up!! Politicians have placed the onus on the Federal Reserve to manage it. Manchin came out swinging too:

Inflation taxes are draining the hard-earned wages of every American, and it’s causing real and severe economic pain that can no longer be ignored… It’s beyond time for the Federal Reserve to tackle this issue head on

Which the Fed will (probably). But the question is how - and how quickly?

What is the Fed Going to Do?

Maybe a 50 bps hike (right now markets are pricing in a 50-75% chance of that happening)? Maybe through shrinking the balance sheet faster than expected? Maybe?

Speed and execution: Regardless, they are going to hike in March - it’s just a question of 1) how fast and 2) how much.

How fast: If they come out of the gate with 50 bps in March, that would be a big deal. They normally move in 25 bp increments. The Fed will likely hint to the market if they are going to do that (BULLARD), but still

And of course Bullard is out there talking about having 100 bps (1%) rate increase by July which is very much “get ready for a TIGHTENING” vibes

How often: Will they hike every meeting? The more they do it, the better for slowing down the economy - but also Recession Risk.

What are they doing though? As highlighted in this excellent report by EmployAmerica (highly suggest reading the whole thing), what the Fed does with their toolkit is basically make it harder for businesses to pay people, and because people are paid less, they spend less. This manages inflation, because ~less money go around~. As the paper stated:

Insofar as the Fed can influence short-run inflation prints, it does so through financial conditions channels that cool off the labor market and likely at the expense of business investment in new capacity

Wherein esssentially:

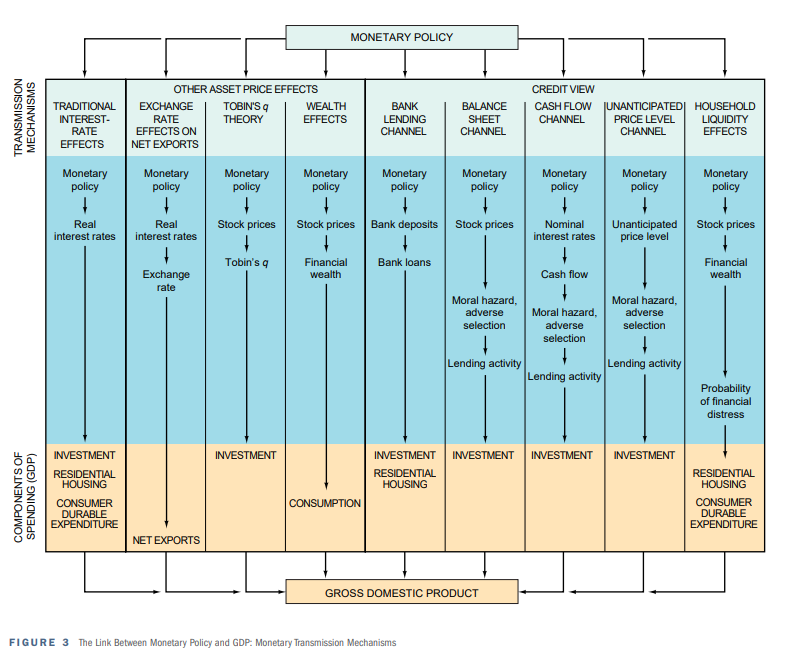

Monetary policy is fascinating. Cullen Roche has a really good piece on all the different channels that monetary policy goes through and then of course there is Mishkin’s Economics of Money, Banking and Finance - the main point is to make stuff more expensive, mostly (that will stop them from spending!)

What’s the goal? Monetary policy is broadly a function of making people spend less in order to mange inflation (very very simplifed, but that’s that). The Fed relies on a few things in order to *achieve* this goal of slowing the economy down:

People believing that they can: A lot of what the Fed does hinges on Fed credibility (which they arguably still have because look at how the market responds to the mere concept of rate hikes).

But if all the sudden, the market is like “haha Fed is lame and can’t do anything” that will make their policy actions a bit more difficult

Toolkit to work: Monetary policy is kind of indirect - which works, in theory, but also it didn’t really give us the inflation it was supposed to back in the 2010s

Also the Fed has never really faced a market like this before - last time we had a tightening cycle was 2016-2018ish, and inflation was nothing like it is now. And still, the market freaked out.

But in all, the Fed kinda has to do something. Jobs are strong, inflation is high, and people are Not Happy.

Above all, the Fed is behind the curve, making it more risky that there is a policy error of moving too fast (or too slow). Things are just spicy. As John Kemp wrote:

In contrast to recent interest rate cycles since 1990, the Federal Reserve starts this one much further behind the curve, with inflation already far above target. From this awkward point, the central bank may find it hard to stick to gradual increases, heightening the risk of turbulence in financial markets and making a soft landing harder to achieve.

or

so it’s energy prices, it’s a clearly higher cost of living, it’s higher wages but not really, but price increases anyways, and it’s supply chains and goods pressure - it’s how fast the Fed moves, how well monetary policy works - it’s a lot of little things bubbling up to one big thing - how do we fix it? it’s a tightrope right? companies have to pay people more to get them to do the work to make the things that people want because people have to spend money so GDP go up because then economy grows good but can’t grow too fast because then inflation but can’t grow too slow because recession so. so,

Final Thoughts

With all of this, it’s really easy to say “ah, the Fed must chill because what if inflation does tamper down!” or to say “the Fed better hike by 75 bps in March, because Recession is only solution!” Conor Sen wrote a good article detailing these two narratives:

An environment of "boomflation" — a combination of fast growth and hot inflation — might not be the ideal outcome, but it beats an unnecessary recession brought on by adhering to an arbitrary short-term target.

Theory is never really practice.

There are a lot of questions around the efficiacy of the Fed’s toolkit - is nudge nudge interest rates really the best thing? I don’t know - does anyone really? Right now, shelter costs are probably going to get baked in, but goods (food, clothes etc) should get some relief as supply chains hopefully recover… right?

The System itself is a function of nudge nudge - Fed nudges banks, banks nudge consumers (businesses), that nudges their spending - and rinse, repeat. And that’s fine because policy can never be like a perfect solution to a system that inherently will never be perfect.

But the frustration that people seem to be experiencing is beyond that of what the Federal Reserve can achieve. A lot of anger is around company profiteering, around not feeling helped, around not feeling like there is a future to look forward to.

These are some of my tiktok comments from my recent video on inflation. Most of them were barraging the Fed, barraging corporations, stating that life was expensive - and honestly, they are right. There is a lot of frustration - and Fed raising rates probably isn’t going to fix that.

The thing about markets is that they are a forced experimentation. We literally are living in a simulation at all times because no one *really* knows how humans are going to act.

I think that there are good things coming - humans are naturally pessimistic (a function of survival skills) but when we are faced with a constant barrage of “ah, I am Rich and You Are Not and System Makes You Less Rich” - people are going to get frustrated. What’s the solution? I would be delusional to say I knew - I think (somehow) we need to have a world where policy matches technology - I just don’t know what that looks like.

I recognize that irrational idealism is not a functional economic theory. But, I do think there is more that can be done to make it all a bit less gray. As George Bernard Shaw says:

“The reasonable man adapts himself to the world: the unreasonable one persists in trying to adapt the world to himself. Therefore all progress depends on the unreasonable man.”

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

The Fed put themselves in a terrible spot by not defining the timeline for inflation to be transitory. Now their only choice to try and slow CPI is to destroy asset prices (which will do little to solve import prices). Their choice to aggressively raise rates is akin to telling those complaining of high prices to simply not buy anything--killing demand to stop price increases.

Momma don’t let your babies grow up to be MMTers.