Alright so there are quite a few things going on right now - I was originally going to write about something else (hence the delay, sorry!), but gotta address this market first. What is happening?

If you’re already subscribed, thank you! If you’d like to subscribe, please do so here:

Topics Covered This Week on YouTube:

In this piece I am going to walk through the 5 core drivers of what might be going on right now (as always, most of my knowledge is amalgamated from others - these are synthesized opinions!)

Geopolitical risk

Inflation

The Federal Reserve

The Markets (stocks, bonds, and crypto)

The Economy

Or

#1 Geopolitical Risk

Russia and Ukraine

There is a lot of posturing in this situation - the whole entire vibe is will-they-or-won’t-they, when will they? will they at all? will it be from the east? from the south? from the north? No one really knows - it’s a lot of trying to piece things together from what Russia has done before, and what they are planning to do now.

Could it be Soon? Every hour it seems as though we are getting closer to a potential invasion - whether that be Japan taking a stance, Germany waffling based on energy worries, or China speaking out (which is unheard of).

It’s important to understand why this might be happening. Russia wants to invade Ukraine (hypothetically) because Putin is likely chasing the goal of Ultimate Unifier of Everything (that he is Vladimir 2.0) - that it is his calling to reconnect and reunite - a great quote that encompasses this is “Putin has a hard time telling a story about Russia's future, so he resorts to myths of the past” from Timothy Synder.

As Putin writes in On the Historical Unity of Russians and Ukrainians:

It would not be an exaggeration to say that the path of forced assimilation, the formation of an ethnically pure Ukrainian state, aggressive towards Russia, is comparable in consequences to the use of weapons of mass destruction against us.

Putin is trying to prevent any sort of Western assimilation, any change that would come from the Ukraine joining NATO. Putin wants things to revert - and any movement from the West to prevent that from happening is essentially a nuclear bomb - a weapon of mass destruction. You can’t *really* do analysis around that.

But because we have a Global Economy, Russia’s actions do not exist in a vacuum (which is why Germany is waffling) because ENERGY (more on that later).

China

China is flying over Taiwan again. Lots of geopolitical risk here, just from uncertainty.

China and Russia: what is interesting with China is they actually spoke out against Moscow - stating that they didn’t *say* that they supported an invasion of Ukraine.

This dialogue is unprecedented, and just an overall interesting sign of the times.

General Political Instability

Kazakhstan just went through a government shakedown - with protests that quickly turned violent, and just as quickly were shutdown (with help from Russia). Kazakhstan is a huge part of the crypto energy complex - when their electric grid went down, it resulted in a ~12% drop of Bitcoin’s hashrate.

Right now, Central Asia is suffering from rolling blackouts (including Kazakhstan) which is truly horrific - underinvestment in the grid creating a whole host of problems.

Crypto mining has unfortunately exacerbated this already precarious situation - and these blackouts do put pressure on the crypto markets

Once again energy is a CORE component of this entire narrative.

#2 Inflation

Energy Markets

Energy is the common denominator in a lot of the problems that we are seeing. Russia invading Ukraine would put 1/3 of Europe’s gas supply at risk and create a tense environment for their already very high energy costs.

Energy is difficult because we are trying to rotate away from fossil fuels. That’s part of the reason that Europe is in the state that it is in - because they wanted to use green energy, but green energy wasn’t ready to be used, a combination of:

ESG aka greenwashing (I know, I know - it’s really unfortunate, as ESG as a premise is so promising - but not in action) leading to:

Underinvestment in key energy sources

So if Russia does invade Ukraine:

Europe will probably lose a source of gas as Russia (Gazprom specifically) supplies 1/3 of their gas consumption

Europe has to bid in the global market, facing increasing competition from Asia

Europe has underinvested in oil and other dirty energy sources like coal because of green energy policy

Germany even shut down a nuclear plant because of the region’s focus on solar, wind, and other renewables

All of which has evolved into the US intervening to organize some sort of export plan with Qatar to prevent Europe from freezing - but that’s not going well.

A Biden official on conference call with reporters this a.m. confirmed Biden admin asked Qatar for help, but downplayed our scoop that Qatar won't help much—said lots of LNG suppliers "at flat out max capacity" so US strategy is to tap smaller volumes from multitude of sources.The U.S. is working to ensure Europe has alternative natural gas supplies in case Russian flows are disrupted, but don’t count on Qatar’s LNG to come to the rescue, per @simonefoxman @BenBartenstein @JenniferJJacobs https://t.co/iefaXsGyrs

A Biden official on conference call with reporters this a.m. confirmed Biden admin asked Qatar for help, but downplayed our scoop that Qatar won't help much—said lots of LNG suppliers "at flat out max capacity" so US strategy is to tap smaller volumes from multitude of sources.The U.S. is working to ensure Europe has alternative natural gas supplies in case Russian flows are disrupted, but don’t count on Qatar’s LNG to come to the rescue, per @simonefoxman @BenBartenstein @JenniferJJacobs https://t.co/iefaXsGyrs Jennifer A. Dlouhy @jendlouhyhc

Jennifer A. Dlouhy @jendlouhyhc

The premise of green energy is fine - in fact, it’s GREAT to care about energy sources, and even better to want to make a green energy transition. I am 100% behind that. I dream of it! However, as Seb Kennedy writes:

Not only is Europe taking an ad-hoc approach to procurement of a fuel that will (despite best transition efforts) remain of vital importance to ordinary people and their livelihoods for years to come, it is also leaving the rest of the world to determine which sources of new gas supply enter production, and those that don’t.

Change is not incremental. We can’t just wake up one day and say “oh yeah, now it’s time for me to only use wind :) no worries at all”.

Infrastructure and investment is not in place for that

Which is why Europe is in an energy crisis

And also is why Germany is waffling on Russia - because Nordstream2, the pipeline that come from Russia into Germany - is very, very important.

Japan just turned back to fossil fuels - we can’t have green energy policy without green energy investment.

Because there wasn’t enough change in ENERGY INVESTMENT despite the large changes in energy policy.

Change only works if it moves the needle in a direction of growth - you can change all you want, but if you can’t simply draw a circle and call that progress.

Supply Chain Breakdown

This is pretty well known, but part of the problem is that supply chains are not solid - whether it be from bad U.S. policy, geopolitical risk, etc, we have become very reliant on just-in-time everything. And when things are broken, that model no longer works - despite consumers still demanding the same amount of goods - leading to inflationary pressure.

Labor/Wage Problem

This is improving, but we still have shortages of key workers that are incredibly important to a functioning economy!

Whether it be from a wage mismatch (although wage growth could put upward pressure on inflation soon :-/ such a strange paradox) or from worsening immigration policy, there is a need for more workers across many industries, leading to inflationary pressure.

Pricing Pressure

Both supply chain breakdowns and labor/wage issues lead to pricing pressure for companies. Compound that with the already existing inflationary pressure, that creates a very tough environment for companies - leading to some weakness in recent earnings results, for example.

Weaker Earnings

Earnings are expected to be strong for 2022, but I think what happened with Goldman Sachs last week is important - they missed on earnings for a few reasons:

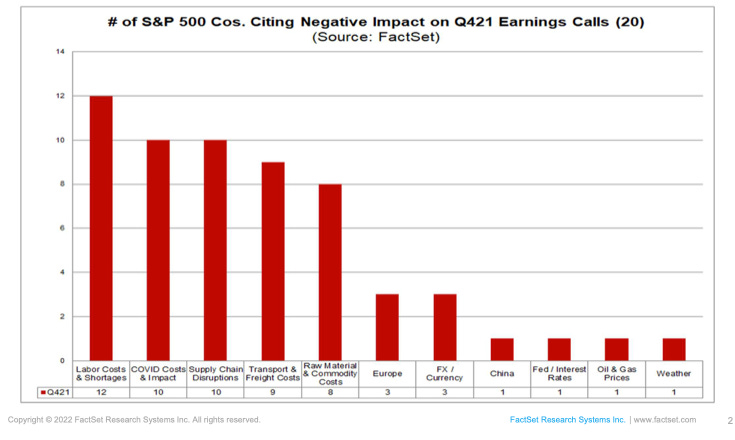

Labor issues - they had to pay up big time to retain and attract talent, which bit into their bottom line substantially (circling back to the labor/wage problem above) - to the point where “60% of S&P 500 companies are citing the negative impact of labor costs for Q4 on earnings calls” according to Factset.

Missed expectations - If you miss, you MISS. GS, NFLX and PTON are great examples here - we have pretty astronomical expectations of companies (partially because their valuations are so astronomical sometimes) and now, market punishes big for a miss.

The reasoning? If you can’t do well in times of money-aflowin-Fed, you’re probably definitely not going to do well during money-aclogged-Fed

#3 The Federal Reserve

The Fed is in charge of managing price stability and maximum employment - and as outlined above, price stability definitely needs to be managed. To manage inflation, the Fed is likely to do two key things:

Raise Rates

This makes economic conditions less easy, a signal to everyone to slowdown and chill out

The market is pretty confident that the Fed is going to do this. Fed fund futures are reflecting a hike by their March meeting - but there is a lot of speculation on how *many times* and how *often* the Fed is going to raise. 7 times? 8 times? 3 times?

The speed at which they do this is important - if the Fed slams on the brakes in the middle of a 70-mph highway, there is likely going to be some sort of pileup. They need to proceed carefully.

Shrink the balance sheet

This can be more passive (balance sheet runoff) or more active (sell assets from the balance sheet, suck liquidity), depending on how fast the Fed wants to go. King Zoltan describes it as “scraping paint off the wall”

But does the economy actually need to cool down?

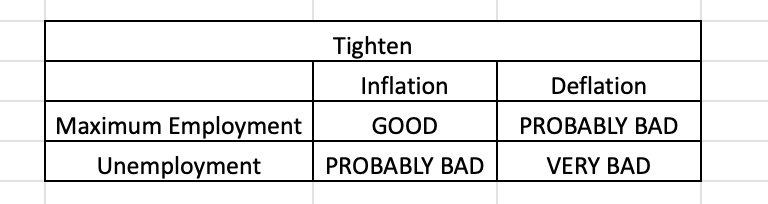

Of course, the question is - is it really time to hike? (I know, what a mess) I’ve written about this a bit - the Pascal’s Wager that the Fed has to price in.

They think that employment is good and inflation is high - so if they tighten and inflation *really* is high and we are *near* maximum employment, that’s good.

However, if they tighten and we actually have transitory inflation or actually elevated unemployment, that’s very bad.

Regardless of what is true vs. what isn’t, the market is starting to understand that the !!Fed means business this time!!

The bond market is aware of the Fed’s hiking plans, and is actually already doing their job for them with rising real rates - conditions are tightening.

The stock market (and crypto) is starting to catch up to the bond market (explaining the red on everyone’s screens over the past few days).

Everyone is waiting with bated breath for this week’s return of “The Fed in Paradise: Raising Rates” (which I will be covering on my YouTube (sorry shameless plug!)).

#4 Markets

The Bond Market’s Response

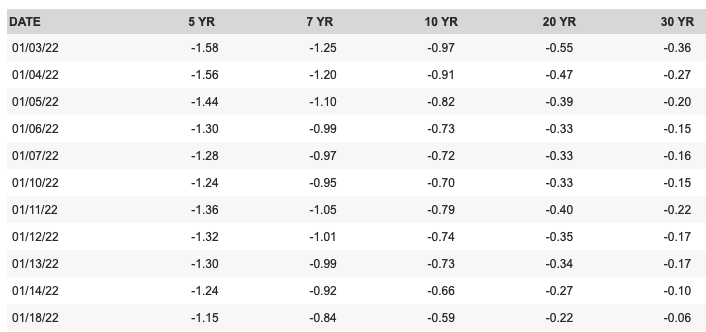

The bond market is responding - yields on the 10Y have started to reflect that “ah yes, the Fed is serious” - but what’s interesting here is that the market believes that the Fed will do it, but they don’t believe the Fed will do a good job.

The market currently is pricing slower economic growth, as evidenced by the flattening of the yield curve. 10Y is not looking as hot - the front end agrees that the Fed is gonna do their thing, but the long end is nervous about the impact that the Fed’s thing will have.

It seems like the market is less comfortable with the idea that the Fed can orchestrate a soft landing at a time of elevated inflation. As rate hiking expectations go up, longer-term rates keep going down.The gap between 2-year & 10-year Treasury yields has sunk to its lowest since late 2020. The yield curve is currently being driven by the front end; as analysts talk up increasingly aggressive rate hikes in the near term, longer-term inflation and rate expectations are declining https://t.co/hxNnt9YCTX

It seems like the market is less comfortable with the idea that the Fed can orchestrate a soft landing at a time of elevated inflation. As rate hiking expectations go up, longer-term rates keep going down.The gap between 2-year & 10-year Treasury yields has sunk to its lowest since late 2020. The yield curve is currently being driven by the front end; as analysts talk up increasingly aggressive rate hikes in the near term, longer-term inflation and rate expectations are declining https://t.co/hxNnt9YCTX Lisa Abramowicz @lisaabramowicz1

Lisa Abramowicz @lisaabramowicz1Real rates are starting to tick upward, meaning that people are feeling a bit more uncertain about the economy - and ability of the Fed to execute

Source: Markets & Mayhem The important thing to keep an eye on here will be the yield curve. If it inverts, people will start ringing their Recession bells, and that’s when things could get dicey for the growth outlook

The Fed thinks that the terminal rate (peak of hiking cycle, when monetary policy is neutral) is between 2 - 2.5% (we have a long way to go) but the market sees this terminal rate around ~1.8%

This means that the Fed is going to have to slow down - and that the economy/market won’t be able to *handle* the tightening that they currently have planned.

Overall, the market thinks that the Fed is going to act - but it doesn’t believe that it will be able to prevent a hard landing.

However, the credit markets are still standing strong.

If this begins to get messy (corporate bonds *need* to be stable, or else we get March 2020 2.0) that’s when we could see the Fed retrace.

But spreads are still tight (meaning that U.S. corporations aren’t seen as super risky) and borrowing costs are still quite low, even for high-yield companies.

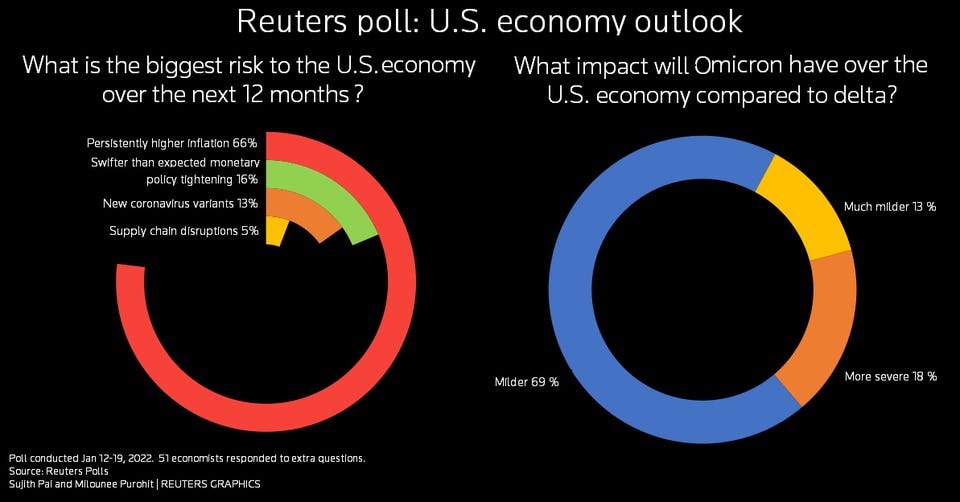

Given all that, the Fed can’t just not do their thing - people are VERY worried about inflation (66% think its’s the biggest risk to the economy over the next 12 months!! (and it’s a political hot potato)). So the Fed has to do *something*.

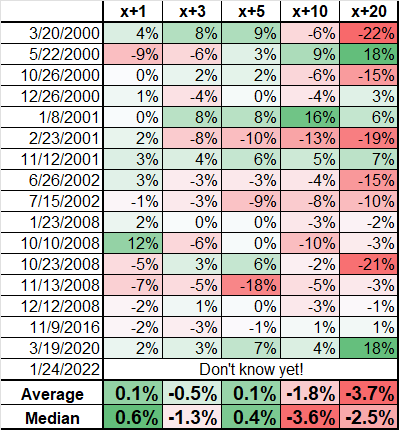

The Stock Market’s Response

The stock market is not happy, to say the least (subsequently, crypto is not happy too) as we’ve seen. People are freaking out - the market is literally swinging 4% in one day:

Higher bond yields put pressure on valuations because the prospect of forever growth and very far out cash flows don’t seem nearly as appealing

This has also put pressure on crypto (which has begun to trade like a tech stock due to institutional dollars)

So people rotated away from high flying growth and went into some more stable sectors like energy and utilities (also ProShares UltraPro Short QQQ ETF YIKES)

The market also punished companies for doing poorly (RIP NFLX and PTON)

VIX is ticking up, which puts doward pressure on stocks (and is usually seen as a signal of broader uncertainty)

The Fed tightening will mean less liquidity for the stonk market, which puts pressure on risk assets. It doesn’t really make sense to allocate to them in a world of fewer YOLO dollars. So the stock market gets sad when the Fed signals that the party might be ending (more on why this actually doesn’t make sense later).

BTFD

Retail has been encouraged to buy the f*cking dip - but what if it stays dipping?

Retail got pretty beat up yesterday, but still emerged as net buyers - reallocating, but still. BTFD has been the chant of the bull run - and sure, on a long enough time frame things will go back up eventually, but for now, a lot of newer investors are likely net negative.

#4.5 Private Market Valuations'

just a quick note in the context of this broader macro narrative

Crypto and high-flying tech are both flush with a lot of VC dollars, a lot of wall street dollars, a lot of global macro narrative dollars. Because of this, those dollars move according to the risk assessment of their holders - meaning that crypto kind of ends up trading like big tech, a lot of risk on, risk off cyclical movement.

This isn’t a bad thing - it’s just how the market prices the risk that it sees.

There will probably be an eventual decoupling - where crypto trades more like an inflation hedge or a countercyclical asset - but that might take time.

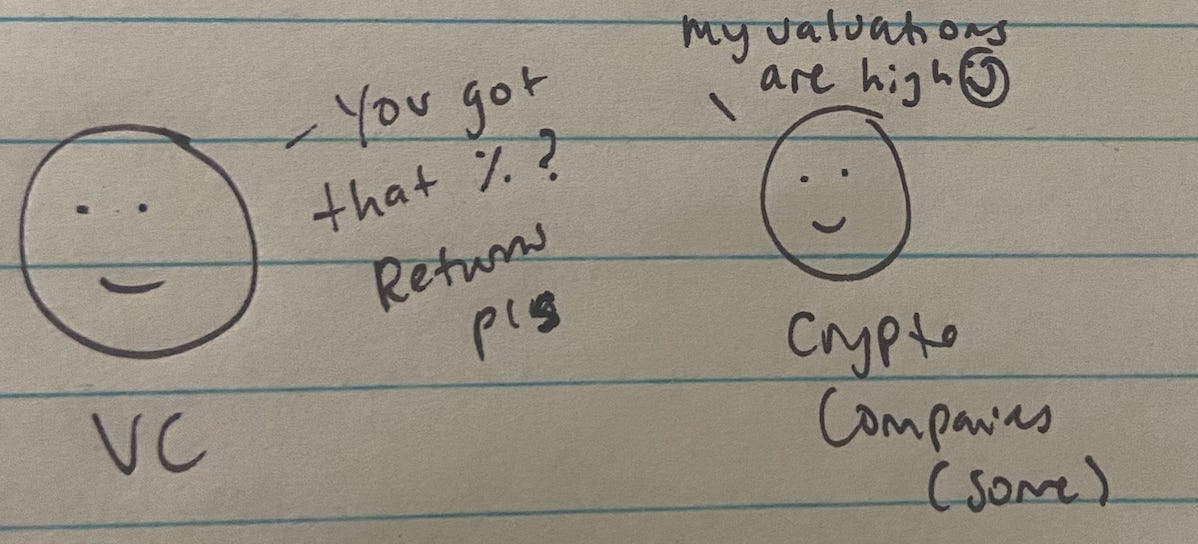

VC dollars are flowing in - HUGE amounts of VC dollars, pushing projects up to $100-$200m valuation, pre-product, pre-idea, pre-pitch deck - and that puts pressure on the entire market. What’s important here is that:

VC dollars (and public market funds) see crypto as a way to make yield

VCs have to allocate the huge amount of capital that they have (going back to the liquidity narrative around the Fed)

So what do you do? You place big bets on an industry that is currently attracting a large talent pool and at least has the thirst for innovation.

Blackrock is launching a Blockchain and Tech ETF - crypto isn’t a private market fad

So people see that - they say “the delta on this growth surely should deliver some sort of return to my stagnant returns” and they invest - and they invest whatever they need to get a slice of the return pie.

This could be interesting in the context of a potentially slowing economy.

#5 The Economy

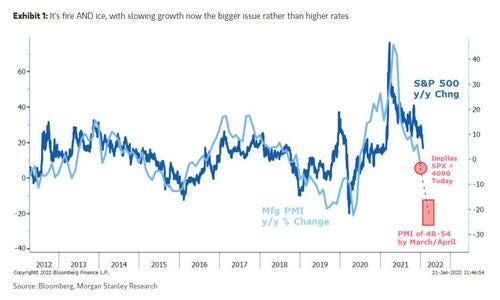

The big worry is that the Fed is hiking into a slowing economy - that the growth that we’ve seen from somewhat emerging from the other side of the pandemic isn’t really growth at all - that the entire economy is actually a big vaporware tech stock.

If the Fed hikes into a slowing economy, that will make Everything Kind of Difficult - so the labor market will suffer, businesses will suffer, stock market might get kind of sad (and inflation might not even go away) - that’s objectively not the vibe that the Fed wants.

We’ve seen some weakness in recent manufacturing numbers, and consumer confidence fell for the first time in 4 months - meaning that the economy might not be as as strong as we think it is

If the Fed hikes into a weaker economy, that makes them hiking us into a Recession much more probable - which isn’t good at all

The Fed is trying to orchestrate a soft landing - but if Consumers (evidenced by slowing demand and lower confidence) and Businesses (watch earnings and capital investment) begin to show weakness - that could mean the soft landing is rapidly becoming a crash back to Earth

Slower economic growth, the probability of a recession, a weaker labor market - all of this is a worry for the market. It has already flashed red to the Fed.

What if it was Transitory?

That would be very bad for the economy.

This is something that came back to bite the Fed - one of the most notorious things that Jerome Powell said - “inflation is transitory”, so notorious that they had to retire the term.

The reason that we have inflation is (roughly) five-fold, as outlined earlier:

Supply chain breakdown

Geopolitical tension (energy markets, mostly, but also globalization is tough to optimize)

Labor/wage problem

Accomodative fiscal/monetary policy

This is sort of what people are pointing to when they say the Fed has a printer (which isn’t a true analogy) but the point is that we have existed in a time of really easy money, which makes everything a bit simpler to do (at least $$ wise)

Buy a house (low mortgage rates), speculate in markets, buy a car, etc - easy conditions do lead to upward pressure in prices

Consumer demand

So let’s say that consumer demand tempers, that supply chains recover, and the labor market reaches maximum employment where everything is perfect - that would essentially mean that inflation *was* transitory, and that the Fed is making things a bit rough. We can look at inflation expectations to get an idea of what the market is thinking

Midterms

Everything is political. Biden has already made it pretty clear to the Fed that they need to clean up this inflation mess - (“stupid son of a b!tch”) and with midterm elections coming up - no politican is going to want have people worried about higher prices. This makes the Fed’s job not one focused purely on the economy (and let’s be real, the stock market) but also the ~political climate~ which is very difficult to optimize for.

Final Thoughts

No one can figure out what the change means. It’s sort of funny because stocks DO OKAY in higher rate environments - it isn’t like rates go up and the whole stock market gets trucked - things are okay, but because we live in the extreme edges of the distribution (yelling into the void, “the world is MELTING because of rate hikes”).

But alas, each time we learn the same lesson, we must learn it differently.

Things change, but they remain the same.

Peloton and Netflix and other growth stocks have been supremely beat up over the past week+ or so - it’s become a reversion to the mean. Old stodgy companies like Old Dominion replacing the hot, shiny startup of Peloton.

There are more questions than answers right now, which is okay. We haven’t really had a prolonged period of tightening. 2016 - 2018 was most recent, but the September 2019 repo market freak out made it clear that the market was not happy with the Fed.

But for right now (this second at least), the big question: is the pullback in the market overdone?

JP Morgan thought so. They said “policy tightening is likely to be gradual and at a pace that risk assets should be able to handle and is occurring in an environment of strong cyclical recovery”.

Is the economy strong? It seems as though there are weak spots - certain points in the labor force, the continuous shortages, the lapse of fiscal stimulus that provided a floor for consumers - now, the economy has to continue forward on wobbly legs, with the thousands of small businesses that shuttered, the many that left the labor force, and the sheer amount of uncertainty that exists on the macro stage.

I think there is a general feeling of complacency, anger, and distrust - because it has become increasingly clear that things just really aren’t a vibe - just look at the U.S. Economic Confidence Index - people aren’t feeling great.

We look at things purely through the money lens of the economy sometimes. But the economy and markets are much more than just stock and flow - it’s human behavior. And when we think about coming out the other side of a pandemic (maybe?), there was a psychological human cost to that. There’s a human cost to ALL OF THIS.

Markets are mechanisms that price change - reflections of ourselves. They tell us what we want to see, what we want to believe. When things get rough, it’s super easy to get pessimistic - in fact, it’s human nature to do so. Reflexivity begets reflexivity.

Things stay the same, but they don’t. We live in a loop, but we don’t. When describing what Wordle actually means to us as a Society, C. Thi Nguyen (the author of the excellent book Games: Agency as Art)

Games are unique as an art form because they work in the medium of agency. A game designer doesn’t just make a world; they make an alternate self for you… By (usually) giving everyone the same objective, games artificially align our interests. This designed narrowness is what enables the strange intimacy of game-playing.

The stock market is a game (sort of). Or at least, it was (is?) - a measure of artificial interests, GME/AMC bidding up worthless stocks, companies commanding wild valuations, all in the hopes of “make money”.

Everything is a game until it is not. We sometimes get caught in the game, which I think happened to many in the most recent crypto/stock cycle - the game becomes us, we are defined by the money we make, by the gains - money becomes a religion. And when the losses come - well, so does the loss of faith.

However, the game is changing - the possibility to enact change with some elements of crypto/web3, the need for alternative energy sources, demographic shifts - it’s a constant evolution, a constant shift of the economic game.

It’s hard to win the economic game - the Fed has their toolkit to shape the monopoly board, but the efficacy of those tools are a completely different discussion (and truthfully, one I am not qualified to lead!) But I think it will be an interesting few months to see if raising rates actually does help inflation + normalization - or if we’ve eased ourselves into “it’s different this time”.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

Great write up! When are you launching an NFT for your community content :)

thanks for painting the whole, gnarly picture so succinctly. keep up the good work! I look forward to your posts.