the economy is booming but the lights could come on soon (maybe)

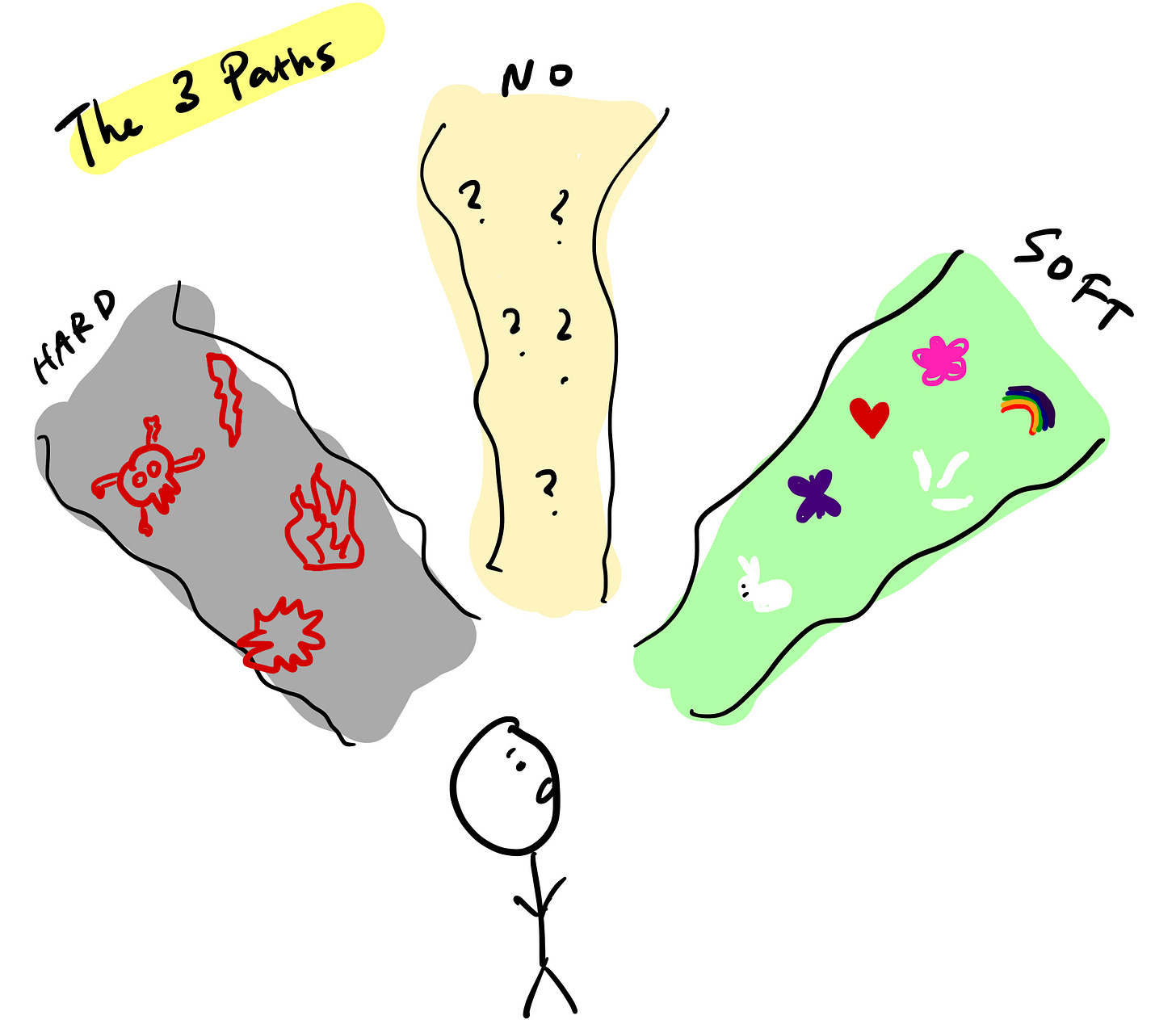

Everyone is trying to decide the path that the economy will go. Up? Down? Nowhere at all? It’s been bucketed into a 1) soft landing 2) hard landing and 3) a non-hard landing.

Overall, the economy is still moving and grooving.

Retail sales increased the most in TWO years in January. This print was mostly driven by food services and dining (7.2% gain in restaurant retail sales) as well as motor vehicles, but the main thing is people are spending, and of course, of course, the Federal Reserve does not like that.

For inflation, The CPI print came in kind of hot (it was still a small increase, but an increase nonetheless) with core services continuing to rise. Goods, something that we thought was mostly fixed, also rose. This was mostly driven by shelter costs, which should abate (eventually? homes usually cost 3-3.5x the median family income but now its 4.5x?1) with Owners Equivalent Rent and the supremely wacky way that we measure it creating some pressure.

The labor market is still strong. People are looking for cars and homes again.

The worry now is that there is a new normal of inflation. That it will just hang out around 4-5% (and to note, there are signs that it *will not* do that, but there are also signs it could? Also is this just residual seasonality and inflation just doing its hot-thing-at-the-beginning-of-the-year like it always does?)

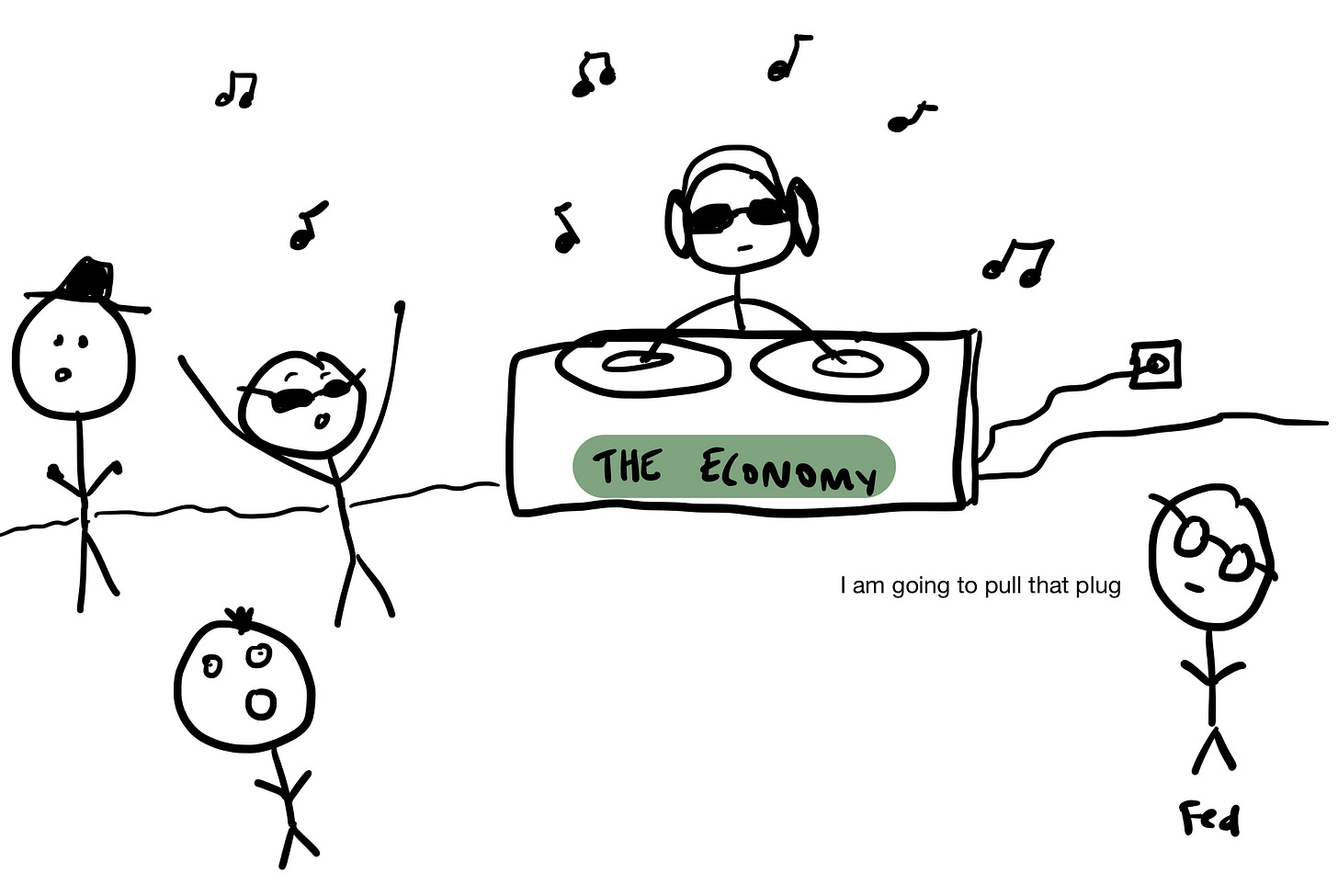

The general thing we have going on right now is an economy that is moving and grooving but dancing to the wrong song. It’s throwing it down to hardstyle EDM mixes when we really need it to maybe be more in line with a soft pop tune.

But there is also the sense that the lights are about to come on in the club!

Like, can this economy keep headbanging to nonstop music? Or is the Federal Reserve going to completely pull the plug on the whole set?

No one knows.

Soft, Hard, No

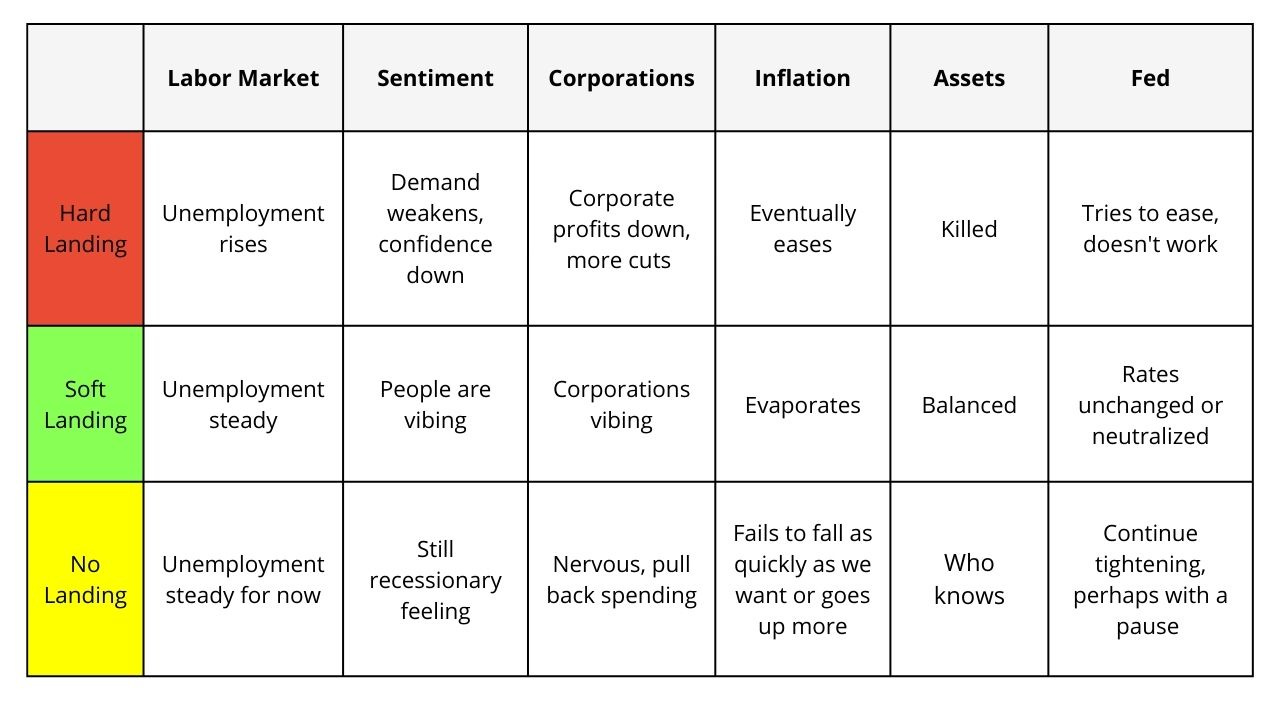

That’s why there is this whole narrative around a hard landing vs a soft landing vs no landing. I made the below table to summarize what the various landings entail:

Right now, everyone thinks that we are in the “no-landing” camp which equates to everything moving and grooving, but the music stopping sometime in 2024 (it’s still a landing, just pushed out). The proverbial recessionary can kicked just a bit further down the road.

And there are a lot of worries about where the inflation is coming from. Companies are still absolutely raising prices2. Margins are hanging on by the thread of making-things -more-expensive. Ben and Jerrys, for example, had sales volume fall by 3.6% but because they rose prices 11%, revenue was up 9%. Like come on!

This sort of spiral is very similar to the wage price spiral. The companies-raising-prices-to-recoup-costs-but-actually-create-even-more-inflationary-pressure spiral. And the Fed is paying attention to this -

What’s the right way to forecast inflation: a bottom-up analysis of recent readings on prices and wages that puts more weight on pandemic-driven idiosyncrasies—or a traditional top-down analysis of how far the economy is operating above or below its normal capacity.

What came first, the price hike or the wage increase? And what should the Fed pay attention to?

Why are people joyous, despite the Fed’s pressure?

Data is not always reality. As Greg Daco said “the data rarely, if ever, align with a gradual and smooth narrative”

The market believes that the Fed will continue its hiking journey, but financial conditions have loosened. As Joey said this is why “higher interest rates don’t always mean tighter monetary policy.”

The market wants to keep dancing, but the Fed is moving towards them quickly, slowly wagging their finger in the no-no motion. So will the Fed have to raise rates to 5.5% like the market believes - or raise it more?

And to make all of this even more confusing, a lot of people don’t think that the Fed rate hikes have moved through the economy quite yet. Rate hikes take time to show up, especially considering things like the design of the 30Y fixed-rate mortgage (same rate, thirty YEARS) which inhibits a lot of the monetary policy transmission effect.

So maybe we aren’t feeling the Fed’s impact yet.

I have a few other theories for why the economy is still booming, but one of them is that people are so sick of Things. Call it the yoloconomy, I guess.

People are still spending money on vacations, even though vacation inflation has surged. Only 5% of people think that they will be much worse off in one year, compared to the 13.6% in June 2022. Median inflation expectations remained unchanged over a one-year horizon and fell over three-years. Google trends for inflation, recessions, and stagflation have all fallen.

As the University of Michigan survey stated:

“Overall, high prices continue to weigh on consumers despite the recent moderation in inflation, and sentiment remains more than 22% below its historical average since 1978…(but) rising asset values supported gains in sentiment for some parts of the population."

People don’t want to deal.

This is in line with the Vibecession thesis, where I think that consumers have just been pushed to their limit. There’s a mass exodus out of California because of how expensive it is to live there - and home prices go up - which is logical but wow! There is a lot of nihilism, a lot of “I probably never will even see retirement, never own a home, never achieve what was once achievable for someone in my same circumstances 50 years ago”.

There is of course a limit to how much people can spend or will spend, especially in the face of real world constraints (credit card debt and a plummeting savings rate is not good). There’s this video from butterpunkk on TikTok that highlights the almost passive consumption and complete overwhelm that we all feel because of what happened over the past few years.

The more correct answer to why people are spending more money would be that credit card debt and continued dip into savings. But there is something else there, something deeply exhausted and tired.

There is this passage in The Little Prince that I think of often. The Little Prince is traveling around, trying to find his home. He meets a businessman who is “busy with matters of great consequence” of counting all the 500 million stars in the sky.

"Yes, that is true," said the little prince. "And what do you do with them?"

"I administer them," replied the businessman. "I count them and recount them. It is difficult. But I am a man who is naturally interested in matters of consequence… That means that I write the number of my stars on a little paper. And then I put this paper in a drawer and lock it with a key."

"And that is all?"

"That is enough," said the businessman.

"It is entertaining," thought the little prince. "It is rather poetic. But it is of no great consequence."

On matters of consequence, the little prince had ideas which were very different from those of the grown- ups.

"I myself own a flower," he continued his conversation with the businessman, "which I water every day. I own three volcanoes, which I clean out every week (for I also clean out the one that is extinct; one never knows). It is of some use to my volcanoes, and it is of some use to my flower, that I own them. But you are of no use to the stars . . ."

The businessman opened his mouth, but he found nothing to say in answer. And the little prince went away.

Busy with matters of great consequence. I think that the economy is confusing and weird, and we have a lot of factors that make it confusing and weird. There isn’t really anything much to say beyond speculating via probabilistic outcomes, and that’s good to do. But one thing that drives me nuts (and I am going to sneak this into the final paragraph here, a hidden tidbit) is the placement of profit over people - I think it can be different, one day, perhaps. But also one could argue that prioritizing profit is most net-good for people, and perhaps. Perhaps.

“Has the rot spread so far you cannot find value in anything not spoken in numbers”.

Here is an excellent album (it’s a brilliant mix of bluegrass and metal) as we all wait to see what is going to happen in the economic club.

Thanks for reading.

Newsletter Subscriptions

The goal of my newsletter is for it to *always* be free - but there is work that goes into writing, of course! If you think the content is valuable or would like to buy me a coffee once a month :-) I would sincerely appreciate your support.

There are three options:

The annual subscription: $110 annually

The standard monthly subscription: $10 monthly

Founders club: $220 annually or any other amount

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

Also Zillow is redoing their Zestimate which will likely create some zesty situations for home owners

I know this is nuanced and they have to pay workers etc but its very much financial magic metrics driven

This is a good and sane, and perceptive speculation, justifying the use of image, poetry and narrative to qualify ‘hard data.’ Well done.

Love the end