The Federal Reserve's Wager

on tradeoffs, oil, outcomes, positive expected value, and believing

Last time, thanks and an update on all the things in the market. Today, oil.

If you’re already subscribed, thank you! If you’d like to subscribe, please do so here:

YouTube/Podcast up soon

Topics covered this week on Everything You Need to Know

The World is Falling Apart? (with Ben Wheeler)

I was also featured in the Bloomberg 50 (Ones to Watch)!

My Spotify Wrapped was absolute chaos.

Literally what is the Fed doing

“wait until we see the whites of their eyes. We never said we’d let the army march over us. And so the army is upon us, and so now we’ll begin to fire” - Randal Quarles, Fed Chair Governor

Right now, the market is abuzz with the word “tighten” - it’s very much will-they-or-won’t-they vibes as everyone tries to figure out what the Fed will decide at their December meeting.

as a quick note, tapering is things that modify central bank activities (reduction of the balance sheet) and tightening is an actual course of action (raising rates).

It sort of reminds me of Pascal’s Wager - the idea that there is positive expected value in the bet of believing in a God, because you lose nothing if you’re wrong, but if you’re right, you gain everything

another note, I am not commenting on religion here. Believe in what you want! I just think the framework is interesting

In Pascal’s words:

"God either exists or He doesn't… there is at least 50% chance that the Christian Creator God does in fact exist. Therefore, since we stand to gain eternity, and thus infinity, the wise and safe choice is to live as though God does exist.

If we are right, we gain everything, and lose nothing.

If we are wrong, we lose nothing and gain nothing.

Therefore, based on simple mathematics, only the fool would choose to live a Godless life... You have nothing to lose. Let us estimate these two chances. If you gain, you gain all; if you lose, you lose nothing. Wager, then, without hesitation that He is.”

I am not going to talk about religion in this piece, but I am going to mirror this decision framework to the Fed (which feels like an absurd statement, but welcome to the brain)

The Wager basically says that it’s a good idea to bet on God because the expected value of believing (aka eternal heaven) is greater than the expected value of not believing (who knows what happens next)

How does this apply to the Fed?

The Fed’s wager is on Price Stability and Maximum Employment - should they make a bet that the economy is hot, and ready for them to begin tightening? If they are right, they reel in a hot economy… but if they are WRONG - they could cause a Recession

So of course, this isn’t as linear as believing in a God or not - there are a lot of different outcomes to consider.

But which ones have a positive expected value?

But maybe the Fed somehow got the biological system that is the economy correctly - with this dual mandate of maximum employment and price stability, they were patient for job growth to catch up to inflation. And based off the most recent jobs report, they are getting closer to that goal of maximum employment (inclusivity in the labor force).

So we can sort of play a little game here (please hang with me lol) - applying the same decision theory framework to tightening and the Fed. There are a few different scenarios that we could have here based on what the Fed does:

The Good:

If inflation/maximum employment DOES exist and the Fed DOES tighten: that’s good!!! Just saved the economy from going into maximum overdrive mode, heck yeah

If inflation/maximum employment DOESN’T exist and the Fed DOESN’T tighten: this is also good!!! We avoided doing things that are bad, high fives all around

The Not-so-Good:

If inflation/maximum employment DOES exist, and the Fed DOESN’T tighten: okay this is probably bad!! The economy could get real spicy, real fast, and prices could rocket!

If inflation/maximum employment DOESN’T exist and the Fed DOES tighten: Okay yikes!!! Probably a Recession

So the Fed has to do a bit of probability theory, bit of game theory, a bit of economic theory in order to figure out what their decision should be!! So it gets into a whole game theory matrix (below is a very rough example of payoffs)

this is just a rough sketch, illustrative purposes only!

So if the Fed has to decide - do they wait for jobs to get where they want them to? Do they wait for inflation (which is now being fear mongered by absolutely everyone (and for potentially reasonable reasons))?? And one could argue that the payoffs are not as linear as I made them to be - it could be something like this (note, the numbers are totally made up, just illustrative):

For example - they choose to tighten into maximum employment (payoff is 5) and inflation (payoff is 5) (5,5)- they do fine!

But what if they decide to NOT tighten into inflation and maximum employment! Payoff is -30! (-30,-30) Horrible!!!

This is because maybe the job market has a much bigger influence on the economy versus price stability - just maybe!

So if the Fed decides to tighten into a weak job market, that could derail everything, and be MUCH more impactful than dealing with inflation.

What is the impact of tightening versus not tightening??

So it’s tightrope. The market is a biological being.

But that’s just overcomplicating stuff - main takeaway is that there isn’t an easy answer to economic policy. Sure, you could raise rates, but does that fix the supply chain? And do asset purchases make people go back to work??

Is policy even effective?

Jobs Market

Today’s most recent jobs report can give us an answer (sort of) - it tells us that things are just super wacky right now.

The jobs report is composed of two surveys

Employers: payroll and wage figures

Households: the jobless and participation rates

The report today was weird because there was a clear gap between payroll and household numbers. The unemployment rate fell to 4.2%, which is good (and signals tightening and tapering time), but the numbers are ~not adding up~.

“One of the weirdest reports I have ever seen,” said Danny Dayan, chief investment officer at Dwd Partners. (ahhhhh)

There is a bit of a conundrum here!! Job growth flatlined (the smallest gain in 2021), but households are employed more?? 4.2% unemployment is solid, but what is actually going on?

The establishment survey suggests employment rose just 0.1% in November, with payrolls increasing only 210k versus the revised 546k October gain

But the household survey suggests employment surged by 0.7% (+1.1 million)!

A miss on headline numbers BUT Wage growth is absolutely flying because you have to attract people somehow right??

So we have to wait for the revisions to really figure out whats going on.

So will the Fed say okay, we see that job growth has flatlined, no tightening! Or will they go forth and tighten anyways, because of the inflation woes? We will find out on December 14th, but the members of the Fed have been increasingly vocal about their desire to tighten.

However, bond markets don’t care about these hypotheticals. And they are showing that the Fed is looking to tighten.

Bond Markets

The yield curve has been flattening the whole week, for a few reasons.

As a note:

Bond yields and bond prices are inverse - they move in opposite directions.

If people are buying up bonds (bullish) - their yields are gonna go down because their prices are going up.

If people are bearish bonds - yields up, prices down.

So we are seeing bearish moves in the front end of the curve, with the 2Y spiking (yields up, prices down).

Why is a flat yield curve a big deal?

Basically it means that the future looks bleak. People are not excited about the economic outlook - this comes about when the Fed is looking to tighten (which they are now). So the bond market is pricing in hikes, and also pricing in a suppression in growth because of those hikes.

Also the VIX is very high right now??? implying ~2% moves per DAY which is very much a lot.

Quickly, oil

MY HILL: WE CANNOT HAVE GREEN ENERGY POLICY WITHOUT GREEN ENERGY INVESTMENT

OPEC

Oil has plunged nearly 25% in just few weeks. Most because of the virus?? But Biden was freaking out a few weeks ago, and went into the Strategic Petroleum Reserve to fix this and now??

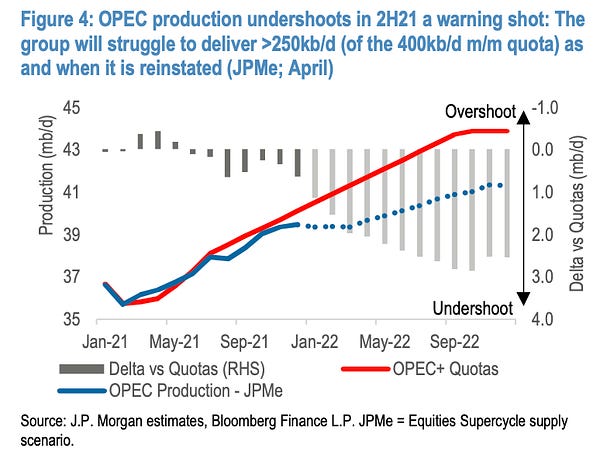

OPEC+ has agreed to proceed with its next scheduled production hike of 400,000 barrels a day (after not agreeing to Biden, now they agree)

They can revisit this decision at any moment

Russia and Saudi Arabia definitely did not want to expand production (and honestly, they probably can’t)

They might back out once they “revisit”

But why did they agree in the first place?

Politics, of course. The US has asked them to increase output to put downward pressure on prices

Spare capacity: It’s questionable if OPEC+ can even produce more - as I touched on last week, they are hitting up against spare capacity.

Russia has been pumping crude at near-full capacity

Japan’s Flippening

Japan has encouraged new investment in oil and gas (even after the diaster that was COP26) because we can’t just not invest in something that we still use everyday, whether that be good or bad!

Japan wants green energy. We all want green energy. But we have to deal with oil before we can actually have it, which is unfortunate - but

MY HILL: WE CANNOT HAVE GREEN ENERGY POLICY WITHOUT GREEN ENERGY INVESTMENT

Final Thoughts

Everything is a bit decision matrix, when you think about it (haha, a small pun there). But seriously, the economy is a bit of a tightrope at the moment. You can tell that market participants are on edge - that they have expectations for SOMETHING baked in. And that’s important for what actually happens, because ultimately the narratives that market participants drive flows, which end up driving the broader market.

So it’s a bit of a wait and see game - what will the Fed do? What’s going on with the debt ceiling? What will the Omicron do? What will OPEC+ do? What will the yield curve do? What will supply chains do? What will energy prices do (looking at you, nat gas)?

So we kinda circle all the way back to Pascal’s Wager (in a way). This is truly the “supreme paradox of creation”. Pascal was around during a time in which the world was rapidly changing - and so for him, religious truth was the Thing, whereas scientific truth was always being proven wrong. Every day someone would could come out with a new theory.

To him, you should just take calculated risks - the probability of there being a God, and you benefiting from that God is high - there is positive expected value on that bet.

But as he also said:

“We run heedlessly into the abyss after putting something in front of us to stop us seeing it.” - Blaise Pascal

There are no certainties. All you can do is set yourself up for positive expected value outcomes - make good bets over a long period of time. Make calculated risks, minimize variance, use the best information you have, and understand all the potential outcomes.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

I laughed my way from the insta videos to this substack. oddly satisfying to actually be observing your intelligence in prose

Aka if anyone has < 30 DTO calls (that was likely bought from the dips), you and I will likely kaboom!!!