A piece on NFTs and the ownership economy. I also publish on TikTok, Youtube, and Twitter!

YouTube/podcast up soon (please subscribe for updates heh)

(please feel free to provide feedback - i write for you - so write me back if you feel inclined!) this is long (brevity is usually favored, but alas) so it *will* be cut off in your email.

Looks rare!

Last week I wrote about Signal as a Service - and I wanted to build on that with the idea that this whole thing is not actually something that can be solved (i know, i know). Mostly because we currently don’t have tools in place to solve for x and y - or really -

The goal of this piece is to explore NFTs - what they are, why they exist, and ultimately what they mean (or what they don’t). Through the lens of Galaxy Brain bc tbh, that is sometimes what it requires.

Caveat: My work is always a WIP and parts might be off. It’s a journey, not a destination!

The Rock (not Dwayne) and the Vortex of Technology

What are NFTs?

NFTs as a Medium vs a Message

A Quick Example from Gaming

But VALUE?

Why, or Most Importantly, Why NOT

Pluralism and Communities

The Intersection of Fiction and Reality

Owning the Online

The Rock (not Dwayne) and the Vortex of Technology

People are buying pictures of rocks.

In completely related news, one of my favorite stories by Edgar Allen Poe is A Descent into Maelstrom (a brief summary):

In this story, 3 brothers are fishing on the ocean. A vortex appears, and the 3 brothers are trapped. They spiral - literally and figuratively. One gets lost in the sea. The other loses his mind. The main character is still on the boat, ready to give up. But he begins to study the vortex, noticing the patterns, the weak spots, and eventually comes to the path out - and he jumps. He is safe. He is above sea.

This is a *metaphor* for being immersed in media and technology. We are all stuck in this vortex. It is only when we focus on the weak spots in the vortex of it all that we can escape the technology that is all around us.

But what happens when we can’t escape the vortex?

The metaverse is this promise of the convergence of physical reality and the Internet - the next iteration of our future. The Online becomes our everything.

It’s inevitable. We become the vortex.

The thing is, any new technology already becomes an extension of ourselves. Our phones are a second hand. Our laptops are quite literally our laps - we become the technology we use. As much as we create tools, the tools create us in turn.

So now, as we digitize every aspect of our lives - we are slowly becoming the metaverse, slowly becoming this vortex. Which is great. But there is still an element of froth to this stuff that is like ???? is this really sustainable? WHAT ARE WE VORTEXING INTO?

Like with NFTs, for example.

So what’s going on?

Short answer: Crypto funds, crypto millionaires, and brands are having a blast exploring a new market. Collecting is a favored activity amongst the very rich. Maybe a bit of laundry with the money, but that is inevitable across the financial world.

Long answer: Read below :)

What are NFTs?

NFT: A Non-Fungible Token is essentially a digital fingerprint (unique) on the blockchain (on a smart contract platform, most commonly Ethereum) - and it can be anything from real estate to art to tickets to a football game. As Linda Xie writes, “NFTs are just digital abstractions used to represent assets that are one of a kind.”

What does it do?

Action: You can own and trade NFTs. You can also borrow, lend, fractionalize, or collateralize your NFT.

Structure: NFTs can’t be broken into pieces (like USD) or equally exchanged for something else. It’s IMMUTABLE - a unique digital copy of something that is uniquely yours.

Location: They exist on platforms like OpenSea, Rarible, and Makersplace

Where does it go?

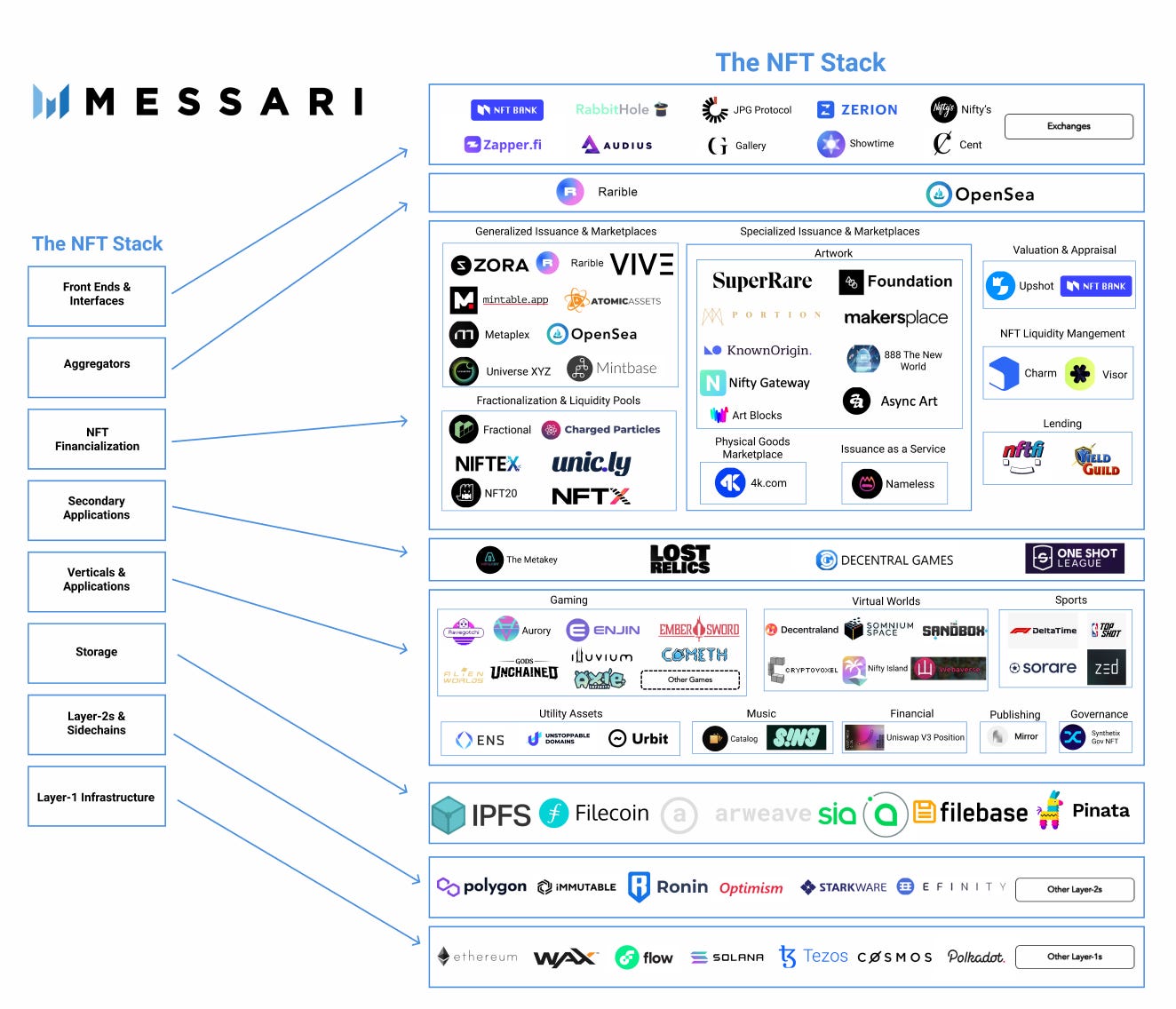

Here is the Messari NFT stack - NFTs go a lot of places (read full piece here)

Identity: NFTs are tracked by Metadata which “provides descriptive information for a specific token ID” So usually the date, type of ticket, name etc.

Storage: This exists on-chain (in the smart contract that = the tokens) vs off-chain:

On-chain is good because then the project can be updated and the *logic remains consistent*. But there is a storage issue - so the metadata sometimes has to go off-chain (either on centralized servers) or on the InterPlanetary File System.

Okay, but what are they?? (a few examples here, there are many more)

Some other examples are sneakers, writing, collectibles, domain names (kyla.eth anyone?), and real estate

Gaming: This is really where the NFT world all began. In-game items are very popular. Whether it be skins or cards - these NFTs can unlock in-game play and serve for functionality in in-game economies.

Axie Infinity is a really great example. Discovering and collecting and trading is what humans love to do - and that is what games like Axie enable. It’s also very profitable, with people pursuing the game as a full-time gig

Play to earn and play to LEARN is huge here - @rabbithole_gg and @Coinbase, Axie etc are all really executing on this concept. Flipping the script of how video games are seen and used.

For a Web2 example (heh) Fortnite made $2.4bn selling costumes in 2018.

Art: This is the most common case at the moment (in the mainstream) - jpegs of art.

The NFT of that $1.3mn rock is a token that represents VERIFIABLE OWNERSHIP of that rock, secured on the Ethereum blockchain (usually)

Also, you can hang out art in the halls of the metaverse so win for the vortex

Yes sure, you CAN download the jpeg - but you can also take a picture of the Mona Lisa. NFTs are the pointer to the asset, not just the asset themselves.

Social tokens: Think of the creator economy - now think of *economy of a creator*

Social tokens (or NFTs for creators, etc) flip that on their heads and say “NO, we will MAKE an ECONOMY out of this CREATOR!” We all will be our own little economies eventually.

That is what social tokens solve - you get access to creators who tokensize their time, and the audience can interact and engage.

Tickets and Access: Event tickets are an og NFT ($68bn market by 2025! TAM!!)

NFTs are a noun, not a verb – they point to the asset, they aren’t the asset themselves. It becomes property that you can buy or sell just like any other property (as long as the market is liquid). And humans love property (especially ones that come with Homeowners Associations!).

So we have all this stuff. Art. Games. Creators. Tickets. But we don’t ~really~ own that (right now).

The TLDR is that we have been online for a LONG time but we’ve never OWNED our online. The platforms have always been in charge, and they take a big cut from that (Facebook, Twitter, Instagram, TikTok)

This is the world in which we Own the Online.

Fast facts about NFTs (courtesy of kram.eth)

NFTs are going off for many, many reasons.

One way that we own our Online is because the Online is increasingly becoming standardized. Despite the decentralization narrative (or perhaps because of it) standardization of the Online leads to more network effects, as Brian outlines.

NFTs are becoming standardized, both in how they come to market, how the everyday person buys them - so their flywheel is a spinnin, as the techs say.

Users: 2x’ed from 782k on Jan 1 2021 to a cool 1.42 MILLION on Aug 17

Volume: Hundreds of millions. By the time this piece gets published, my stats will be wrong - so just assume that its roughly $200m/day (and it was $125m on Aug 22)

Monthly sales: > 5x’ed - from 42k sales last August to 230k sales this August

Comps: For a small slice of an example, the traditional art market has a value of ~$1.7T so there is a ton of room for these little nonfungibles to run

Okay, so why did this rock sell for $1.3million?

This gets into the message - what do these NFTs really *mean*?

NFTs as a Medium vs a Message

I’m going to throw some philosophy into this analysis bc why not - so let’s analyze this through the lens of Marshall McLuhan:

Pervasiveness: Marshall said: "We don't know who discovered water but we know it wasn't a fish. A pervasive environment, a pervasive medium is always beyond perception."

Summary: Because we exist in our world, we often times can’t parse it. So as fish, we can’t tell that we are in water, bc we’ve always been in water.

Application: We can’t parse what is going on in NFTs because our worldview has just been traditional structures for a really long time

Tools: He says we make the tools - but the tools make us as well.

Summary: We become the technology (getting back into that idea of the Edgar Allen Poe vortex).

Application: Finance is a culture. We are increasingly defined by what we make and own. We are becoming the vortex.

Medium: Finally, Marshall is most well known for “the medium is the message”.

Summary: It’s not always about the thing, it is about how/where/when the thing does the THING

Application: This is what NFTs/crypto/financialization *means*. It’s not about rocks getting NFT’ed. It’s more than that.

But Brands are Involved!!!

We are mostly getting lost in the rock sauce (maybe its just me). There is euphoria happening, sure - but this is for a myriad of reasons (including the fact that a bunch of crypto people are very, very rich) and brand engagement (Budweiser buying beer.eth).

This is SPACy: So yes, big brands like Budweiser and Visa are getting into the game. But FUNNILY ENOUGH it reminds me of SPACs,

Where hedge funds just get a ~little bit~ of exposure (enough for a big payout), enough investment to not flip it, but it is just pennies in the bucket.

$150k to Visa to buy a crypto punk is 0.0007% of their revenue, for context.

It’s about playing the game - just as how I wrote about how legislation proves legitimacy, brand engagement proves an element of mainstreamy-ness

THIS CREATES FOMO AND A FEEDBACK LOOP BECAUSE NOW EVERYONE WANTS BEER.ETH

Most importantly, The message is fleeting. The medium is what matters.

The medium (i.e., the metaverse, NFTs, ETF products) are going to have much more of an impact on human experience than immediate content.

You might say - “Leonardo’s piece just sold for $450mn! Wdym??” And the answer is that the NFT process, the NFT platforms - that’s going to drive a lot of value. NFTs will still be valuable, but the *medium* even more so.

This isn’t about rocks, this is about Web3 tools being implemented so we build our own little economies

And feedback loops. If Budweiser is playing, we all should be playing.

We have been here before, just in different iterations.

A Quick Example from Gaming

Games have been using NFTs for years with digital skins, characters, in-game items etc. People buy this stuff so they can flex (and fit in).

And now gaming exists in a entirely different form where there is ownership not only IN-GAME but OF-GAME.

metavestor put together this excellent graphic detailing the fact the video game is more than just the video game - its for “gamers and asset holders”.

Examples would be Axie Infinity, Illuvium, Parallel, with YieldGuild “bridging the gap between NFT holders and gamers in a mutually beneficial way” as metavestor writes.

Nothing is ever new, just recreated.

vALUE?

Meltem had wonderful views on the bubbleness of it all (because the NFT space is indubitably bubbly) - it’s wealth. We just have a LOT of rich people. They want to flex.

We don’t always act rationally.

And as Frank Rotman points out: ‘The truth is that the human psyche is complex and not all decisions are made to produce an “optimal outcome”’. We are making decisions based on our higher-order needs as Frank outlines (I added a few):

Values: This comes with the conjunction of finance as a culture.

We are buying things to express ~who we are~ as people.

This gets into the ownership economy too - but the main thing is that we are making our values public - and that comes with buying things that represent those values.

Community: We want friends. Apple, Peloton, etc all have achieved this - we crave being a part of something.

0N1 Force is similar - each “NFT grants access to benefits, including participation in a collaborative role-playing game (RPG) that takes players into the 0N1verse” (it had $67m in sales volume this past weekend)

Status: This is what I focused on last week - we want to feel special.

Utility and scarcity play in here - both somewhat a function of status - but you can access things other cannot with your NFT, and its valuable because no one else has it :)

Uniqueness (adding my own to his list and bringing the non-fungibility aspect in)

This is most prevalently seen in projects like Cryptopunks and Pudgy Penguins where ~none of them are the same~

Memes - 6529 wrote a brilliant thread on this concept where myths allow us to believe in the society that we built up around ourselves.

Collective belief drives the value of an asset” - here, collective belief drives the value of everything.

The most important word is “collective”. Collective belief.

Are our beliefs rational? Do they need to be?

Why, or Most Importantly, Why NOT

During the Enlightenment, thinkers brought three primary assumptions to every theory:

Every question has a single correct answer

Because of this, there is a clear methodology that we can use to get to that answer (Reason)

When we get to this Answer, we will have a great pic of what the ~universe~ actually looks like - bc we know everything

But of course, Englightenment thinkers thought they could just treat everything like a math problem and *solve it* which tbh does not work in our increasingly complex world. That is what seems to be happening with NFTs to an extent - we are trying to solve them. We are trying to rationalize *why* people do what they do and get to the Answer.

Rationality is not something to be solved for.

We spend much of our lives focused on the Individual.

Crypto is the deviation from that, as many have written about before - crypto and other ways to think about finance as a culture and a representation of your *community*.

Pluralism and Communities

So another story- (because that is how humans communicate) - the Hedgehog and the Fox by Isaiah Berlin - Monists vs pluralists.

The Hedgehog is a monist - they see things from one POV, they squish it into their world view, and they see in one single direction.

The Fox though is a pluralist - they know that the world is big and that someone somewhere is going to have a massively different experience than them - being a human is COMPLEX, and thus we can’t even begin to squeeze it down to a framework.

So basically the hedgehog is like “there is ONE WAY to see the world” whereas the fox says “ACTUALLY, there are many different ways to see the world- and because of that, none of us are going to see things the same way”.

I think NFTs fall into this boat of hedgehog vs fox.

I think that we are shifting from the sort of hedgehog society into this very fox-like society that everyone is basically like “whoa wtf, where did this come from! i didnt know we could band together for a collective benefit!?” - so people are wading through that.

Then the question becomes -

Are we foxes?

And if so, can we ever fully align incentives?

Do we understand equity structures and collective ownership?

Is it more natural for us to operate as individuals or is it human nature to move as a community?

There is no single correct answer.

The Intersection of Fiction and Reality

When we don’t have the answer, we turn to science fiction. Isaac Azimov on the concept of change:

It was only during the Industrial Revolution that the rate of change became fast enough to see in a lifetime. Not only are things changing, but things will continue to change after they died… It is ridiculous to make plans now on the assumption that things will remain the same… Futurism has become an important part of thinking (in everything).

Things are moving SO QUICKLY and our framework for processing these things is just not as speedy as the world around us.

The main thing here is that NFTs are not just jpegs - because in this futuristic world where we own the online, it represents more than that.

The TLDR from the beginning is that we have been online for a LONG time but we’ve never OWNED our online space. This is when we BEGIN to do that, and the euphoria is a growing pain.

The Connect the Dots: It’s an ecosystem - and just like the Gold Rush, it will be interesting to see who the winners are.

Probably platforms and marketplaces, things that enable all of this. Not the dots themselves, but the things that connect them.

The winners are the parts in the middle. They are often the most valuable.

Humans: Another thought is that we think that we crave decentralization and that this is the answer to everything. That a node-to-node economy is the answer to what we have.

But our system is designed by humans. We not only need the backbone SERVING the decentralized world, but we also need humans. This is really important to remember.

And don’t think that this is just crypto. Traditional finance doesn’t “make sense” (to an extent) either.

Owning the Online

But all in all, we have a lot of people exploring this decentralized, tokenized world. Money is an abstraction of value. We want to own stuff. We want to build stuff. NFTs and their weirdness are the beginning to us figuring out what that might look like. It’s cool.

But there are still hurdles. We still don’t own the Internet (to an extent). But we are iterating into a world where we become the vortex - and along the way, we have to redefine what our frameworks and values are in the light of community, ownership, and finance as an increasing part of our narrative.

So yeah. That’s the long answer. The market is calibrating, and euphoria is a part of that. We are figuring out how to Own the Online.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

Kyla quick question during your research what led you to Marshall like how did you find him? I am so intrigued at how you perform some of your research, your newsletter is pretty dope by the way

The financialization / securitization of the metaverse. When have incentives around securitizing, then packaging and selling, assets ever caused systemic problems?