This is a macro piece. I publish these once a week (beta phase), as well as single stock pieces (1-3x a month) and weekly market updates. I also publish on TikTok, Youtube, and Twitter!

Minor update: I am almost done moving and the weekly market update will be back then!

YouTube Here

What is happening in crypto land?

I spent a lot of time trying to understand what was going on with the infrastructure bill this week - which was a funny juxtaposition to watching NFTs explode again, getting my own kyla.eth address, and watching the market continue to tick upward.

There are really three parts to the narrative that happened this week (that I can tell)

Government Regulation (and its slowness)

FOMO

Consumer Experience and Ownership

All of them combined into a strange fruit smoothie this week, with penguins and defense spending being discussed in the same sentence.

Government Regulation

TL;DR on this is that the Senate needed to pass a massive Infrastructure bill, so of course there were many last minute amendments (U.S. politics ftw).

One of those amendments was regarding crypto and crypto tax reporting

The language forced a lot of crypto people to report taxes as brokers - which is essentially impossible for a lot of people to comply to

There was also language that singled out Proof-of-work versus Proof-of-stake versus other consensus mechanisms and chose winners and losers

The Treasury was also somehow weirdly involved to try and Yellen seemed to have a personal vendetta to kill the improved amendment

The whole thing boiled down into: U.S. politicians do not understand the crypto markets, but they are making regulation around it.

But of course, the crypto community wasn’t going to go down with out a fight.

Senators got phone calls, things got stalled, things improved, things got worse, and then Richard Shelby decided to give his two cents.

Our guy just wanted some DEFENSE SPENDING. $700B??? NOT ENOUGH. MORE.

So the bill passed with the original crypto tax provision. The snake ate its entire tail.

The best part is Shelby is retiring at the end of his term, so everything just felt ~really bad~. There is really a broader problem here with how our politics/infrastructure system works.

We spend a lot of money to get not a lot of stuff done

We write a check and say “okay, we will figure it out later” but later never really comes.

The can just gets kicked down the road, until eventually it has enough dents in it to where it’s full of cracks and basically irreparable

But the question now becomes - what does this attempt at regulation mean for crypto?

There are two answers:

It’s time to take it seriously (if you haven’t already). Positive. The crypto community showed clear strength in battling this. And because of this, it will get even stronger -

Lobbying efforts will likely double

There will be more politican-cryptoinvestor discussions

There is an increase in general awareness for the space

But also, the U.S. Government is very powerful. Negative

The U.S. Government can kill good things - over-regulation, slowness to react, and bureaucracy seem to be its preferred combo to stamp out innovation.

FOMO

The thing that could protect the crypto industry (for better or worse) are LEGACY INSTITUTIONS.

Oh yeah.

When that institutional money starts flowing, it’s a bit hard to disrupt the backbone of the business (unless it literally implodes, like mortgage backed securities). The thing is a lot of people are FOMO’ing into crypto - especially the institutions.

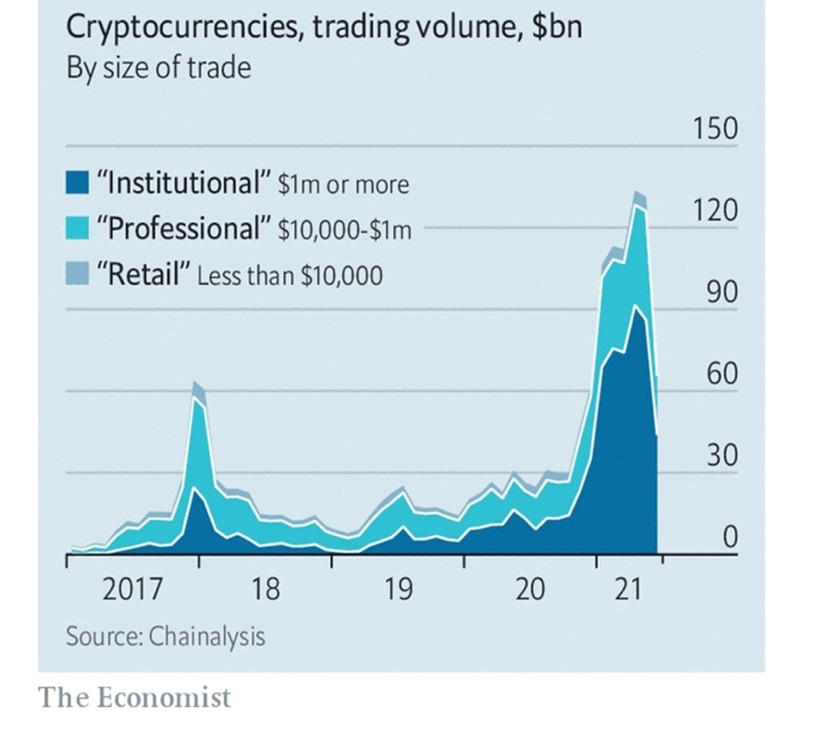

Institutions are filing for ETFs, getting direct exposure (if they can) and quick moving - they now account for 63% of trading value in crypto, pushing the total market cap up to $1.6T for the entire space. Just look at that dark blue chunk.

This isn’t 2017 again - most of that was “Professional”. This is the big dogs.

Coinbase reported their quarterly this week and they have HUGE clients in its arsenal.

That validation goes a long way in confirming the power of crypto as:

Something that is an investment in the portfolio of the top managers

And thus, something that needs to be regulated - and to be clear, regulation isn’t always a bad thing. It means something is “real” and equates to legitimacy (to borrow language from my friend Tom)

And beyond that, there are extensive private investment deals.

There is MAD MONEY flowing into the crypto space (I don’t know how much of it is laundering (this is unavoidable for all money/investment sectors imo) institutional, retail, etc) but the *point* is the Government follows where the money goes.

So regulation follows the flows.

Consumer Experience and Ownership

People also follow the flows. As Fred Wilson wrote -

“I am not saying NFTs are the next big thing. I am saying that consumer experiences built on a crypto stack are the next big thing.

A squiggle sold for $785k.

Rocks are selling for north of half a million. Chubby penguins are on a fast-track to being a currency.

There is talk of NFTs being a status symbol - which makes sense.

Packy broke out in his piece as:

Social Capital: “Investment-as-a-Status” - there is no better way to show that you are rich than to display a Chubby Penguin as your profile pic. It’s a HUGE signal (especially for those that mainly exist on Twitter/Discord, like myself).

Utility: You get to hang out with cool kids. Exclusive access to discords, community, and unlocking some cool stuff in games.

Entertainment: It’s just fun. Stonercats is building a whole show out of their NFTs - what’s more fun than watching YOUR NFT interact with other NFTs? Nothing that I can think of.

It all boils down into ownership.

As we shift into an increasingly online world, how do you ~signal~ your wealth to others?

What does community really mean and how do you define it in the light of a decentralized world?

I wrote about NFTs a bit back in January

The value to NFTs comes in three parts (highlighted in Santiago’s tweet thread):

Ownership and Authenticity: NFTs are a noun, not a verb – they point to the asset, they aren’t the asset themselves. It becomes property that you can buy or sell just like any other property (the legality of which still needs to be worked out). The inherent basis of supply and demand makes the market.

Abstraction: Money is just an abstraction of value. Art an abstraction of emotion. Digital assets an expression of code. NFTs are an abstraction of all three. Noelle Acheson describes it really well in her recent piece on emotions in the market – “If NFTs, in theory, give us price discovery on feelings such as “pride of ownership.”

Purpose: Its not about the merits of the medium, but rather the merits of talent. Just because it isn’t a painting doesn’t mean its not art

Broadly, it’s a mix of FOMO and memefication, with people NFTing ridiculous things (like a fart) but also beautiful works of art. That’s the hard part about memes – they are inherently clever and valuable in disseminating information to people, whatever we choose the information to be. Perhaps a fart is art.

We want to own. We want to understand.

The idea of value is so abstract - as are our online identities. NFTs tie us into a broader narrative where we begin to define ourselves through digital assets.

Who are you?

Well, I’m Pudgy Penguin #6873 (I’m actually not but wish I was)

*small note* I do think something weird is going on with NFTs right now - something to do with Binance withdrawal limits falling to 0.06 BTC from 2 BTC - but that’s a different piece.

Final Thoughts

Net-net, regulation isn’t a *bad* thing (bad regulation is a bad thing, but regulation also equates to validation). Crypto is a funny space because there are a lot of people that got very, very rich in the past few years.

And as Corey points out below - when very, very rich people decide that something is worth something, that can provide support to prices. They don’t need to sell because they don’t need the money.

So despite the very clear shouts of regulation, the market didn’t move much. I still can’t parse through whether or not that was an underreaction. But even if the bill does pass, the impact won’t be felt until 2023 - so in a space that moves as quickly as crypto, that’s basically ten to fifteen years worth of innovation.

So there is time. And time is value.

There will be a lot of work to do, as Adam highlights in his thread below.

The concept of regulation does bring validation, but the U.S. Government is notorious for slowing down innovation (like it did in the space industry, the energy industry, and more) - and they have the power to do the same in crypto.

But as we continue to become more online, crypto provides the tools that we will need to define ourselves. We are entering a space where we don’t really *know* what is next (yes, the metaverse). The stickiness of community is something we fundamentally crave as humans, and crypto is building on top of all the existing community stacks.

Gaby Goldberg wrote a piece on curators versus creators - and the power of separating signal versus noise in an increasingly loud world.

But community is the underlying foundation of culture, of creators, of curators of it all - and that is the fundamental essence of crypto - community.

And that is why when the space is confronted with regulation, when confronted with politicians that don’t understand it yet, it persists. Because of the power of the people behind it.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.