Last week I wrote about consumption on-demand, this week I am tackling the trucking crisis, small businesses, supply chains, ad spend, Zillow, and hyperinflation.

If you’re already subscribed, thank you! if you’d like to subscribe hit this button here:

YouTube/podcast up soon and piece is long, so might be snipped in your box

TL;DR We have a broken policy system that relies on levers to nudge innovation. Inflation is largely driven by a mismatch between consumer demand and broken supply chain, along with a mix of heavy stimulus. We have a nervous economy - but this is not hyperinflationary. However, there are increasing pressures (small business ad spend and corporate asset ownership) that could create a lot of harm. The final thought - the connectors have to play the game in order for the game to work..

Hyperinflation

Recap: What is hyperinflation?

Hyperinflation is defined as a rise in prices of over 50% per month to 1,000% per year - the price of a cup of coffee rising as you drink it kind of deal. People are way more focused on getting money to purchase food versus doing anything else - it’s essentially a crumbling of society.

Weimar Republic

The Weimar Republic, modern day Germany, is one of the best known historical instances of hyperinflation. At its peak the Weimar Republic was experiencing ~29,500% inflation per month and the mark was worth one-trillionth of its original value.

Weimar had decided to fund the war through borrowing and were saddled with a massive amount of debt when they lost. The Treaty of Versailles imposed a huge debt on them that could be paid only in (1) gold or (2) foreign currency. They were printing in order to manage that - inflation was a policy to pay for war.

Everything is fine: Inflation was fine w politicians because it kept unemployment low. In nominal terms, people were happy (for a bit) - the stock market “tripled” (until it fell 97% in 1922)

People started taking out loans - might as well buy a physical place to stay (hard assets) with depreciating currency and get your debt inflated away.

But the war debts kept coming. The government kept printing money. Tax revenues fell to zero because the government was illegitimate in the eyes of its people. They issued bonds and simply created more money!!! to try to fix.

German people realized that their money was rapidly losing value, they tried to spend it quickly, which led to increased monetary velocity, leading to higher prices —> a huge feedback loop.

The loop was broken when farmers stopped accepting money for food. Hyperinflation only “works” when the money is considered usable - once farmers, the people who feed us, strike, game over.

The connectors have to play the game in order for the game to work.

Germany ended up essentially re-doing their currency to the Rentenmark, which was backed by bonds indexed to gold. They had to revalue their currency, paid some reparations, and reinstated government bonds. As Cullen writes on his piece:

Hyperinflation tends to occur around hugely disruptive geopolitical events:

Losing a war that results in money printing to fund the effort.

Large foreign denominated debts that require domestic money printing.

Regime changes generally coinciding with civil war or social upheaval.

Is the U.S. the same as Weimar Germany?

No. Visa, Mastercard, American Express etc all have the spend data that Square has too, and none of them are calling for hyperinflation in this same way on Twitter.

Could the chips be falling in a direction where we do have higher inflation (> 10% per month) for a while? Maybe. But I don’t think we are in an environment where inflation will reach > 50% per month. You can see hyperinflation in the countries below -

Also, the US is also still reserve currency - if we experience hyperinflation, it would cause pressure for the entire world economy. It would be Very Bad.

The U.S. does have a lot of money circulating right now - recovering from a pandemic does require an element of monetary and fiscal easing and the Fed has yet to taper from their side (they keep promising that they will).

But this isn’t Weimar Germany spending in terms of $$ entering the economy

I am going to discuss this through the lens of velocity and deflationary pressures.

Velocity of money

Velocity is how much money is moving throughout the economy (“frequency at which one unit of currency is used to purchase domestically produced goods and services”).

If low, people aren’t buying stuff at a fast clip - they are saving (or investing)

If high, people are buying stuff at a fast clip - spend! spend! spend!

As you can see in the above graph, money isn’t moving through the economy in the same way. People are saving. Rich people have a LOT of money (and they spend less, hold more).

I also think that there are certain sinks in the United States that contribute to this.

The Sinks

We have various sinks that exist throughout the economy which act as absorption tools for the money we do have floating around. I wrote about this a bit last week: How does excess escape in an economic structure? I think crypto, VC, etc actually serves a really important role here in this consumer-oriented society.

Sinks reduce inflation: In video games, there are different sinks that exist in order to take currency out. This reduces inflation so the ~in-game economy~ can stabilize. Few examples:

Fees - paying a certain amount of in-game currency to access part of world. Money gets taken out of circulation, funneled into fees. (gas fees)

High priced items - Pay money into rare collectibles. (NFTs)

Some examples:

Crypto: People funnel USD into crypto, where they either buy NFTs or keep that money in the crypto economy because they expect it to appreciate in value.

From a high level, crypto takes money out of the economy and puts it into a more static system.

VC: There is an increasing amount of VC dollars going into crypto (functioning as a sink)

Collector Society: You can see in how people consume right now - we are collecting things (Pokemon cards, sneakers, etc). Collecting goods acts as a sink.

You’re also starting to see the consumer slow down (which will happen into Q1 2021) as people spend into the savings glut accrued

Deflation and Overproduction

In addition to flat velocity and sinks working against hyperinflation, there are also deflationary aspects.

Cathie Wood did a quick thread on how velocity impacts things, noting that she thinks that there will be *deflation* which is antithetical to Jack’s tweet about hyperinflation.

Tech-enabled deflation: AI example here, making everything more efficient

Creative destruction: Companies have prioritized share buybacks and dividends over actually being *good* companies; they will die

Cyclical: Companies took on too much to try to solve the current supply chain crisis that we are in, so we will have too much supply on the other side of this

Demographics: We are aging. We are not having babies. If there are no babies, we will not consume as much.

So rather than there being hyperinflation, all these levers result in things being deflationary - or at least not super -flationary either way.

Supply and Demand

With all that being said, the current market *is* looking a bit frothy around inflation, and its important to recognize that. We do have a lot of pressure, both in terms of consumer demand, monetary and fiscal stimulus, and rickety supply chains.

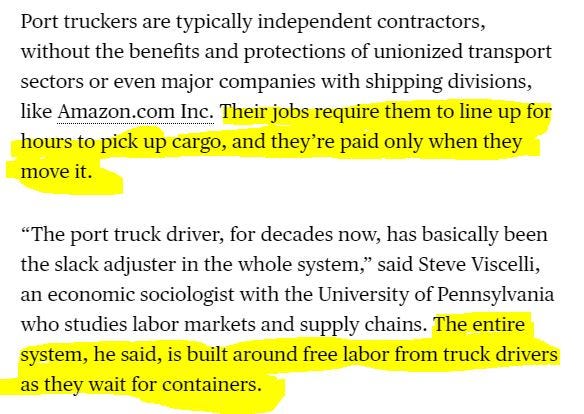

Supply Chains: Demand is clearly outstripping supply. Not only are there not enough truck drivers (and they get treated poorly), but there is also not cargo room, etc to take stuff to where it needs to go.

The demand side of the equation is very high - and theoretically, the supply side should be able to keep up.

But it can’t because the supply-side is fundamentally broken.

The Breakdown of Supply Chains

There are so many pieces to this puzzle - if one of them breaks, the whole thing breaks.

A lot of this is because of broken policy.

Misdirected incentives: Capital investment should be funneled into logistics, into trucks, cargo ships, etc but it isn’t because there isn’t an incentive to revolutionize this industry - just a lot of political red tape

The connectors have to play the game in order for the game to work.

Inflationary pressure: This is where we get an element of inflation - the supply side can’t keep up with the demand side. (even if temporary)

Policy: The issue here isn’t *just* the capital investment, its the policy *around* the capital investment.

They say to truck drivers, crane operators: “We are going to underpay you, we are going to expect you to do x amount of work, and create a totally misaligned incentive structure”.

Policy isn’t directing dollars to where it needs to go and isn’t moving capital in the right way.

And to this point - a LOT of the problems from the supply shock compounded due to a lot of fiscal stimulus and a sheer amount of demand.

Policy Needs to Change

This is the perfect example of policy not working the way that it should, which is a very top-bottom problem in our society. We see it with the Fed and interest rates.

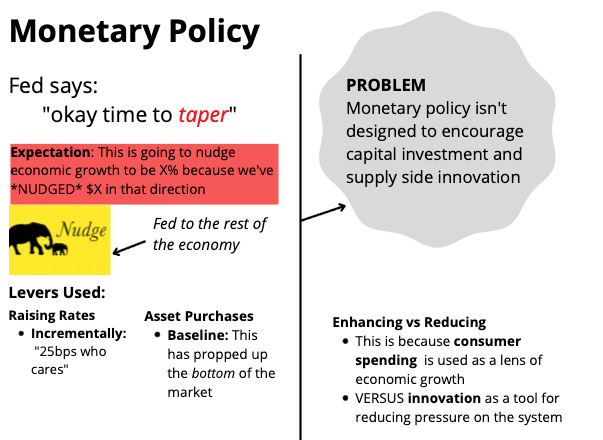

Nudge nudge, wink wink: The Fed says, “okay, we're going to move rates and that's going to nudge dollars in a certain direction. And we expect economic growth to be X percent because we've nudged rates this much.”

Rates are a lever. If they raise them, it becomes harder to borrow, which should reduce capital spend and make everyone slow down. If they lower them, it should increase capital spend and make everyone invest in new projects (hypothetically)

But the problem is at this point the market is like okay???? whatever

This is not working.

The main thing is that monetary policy isn’t designed to encourage capital investment and supply side innovation

This is largely because we are so dependent on consumer spending as a tool for economic growth, so it isn’t about what can be *enhanced* (encouraging innovation) rather about what can be *reduced* (spending).

Enhanced policy would DIRECTLY encourage dollars to go towards productive units like R&D or education for employees - lets do this!!!

Reduced policy (like we have now) aT A HIGH LEVEL just makes it harder/easier for people to borrow money to WORK towards productive capacity - it nudges

The connectors have to play the game in order for the game to work.

The policy mismatch is the same thing in supply chains.

Policy Incentives

It isn’t enticing for those dollars to revolutionize supply chains, so you have misaligned incentives from the top. The problem with supply chains at large is policy, which results in misdirected capital. It deteriorates at the macro and micro level - you have a clear breakdown of both.

Turns out if you’ve been cost-cutting a main line in the supply chain for the past twenty years, it’s going to break. Its railroads, its ports, its cranes, it’s small things like how long the boat is tied down and the touchpoints for the RTG/RMG operators, crane operators, truck drivers, clerks. Its how long the containers are sitting without truck drivers, the maintenance of the yard equipment, package unloading etc.

The connectors have to play the game for the game to work.

It’s EVERYTHING. As Huntsman highlights in his piece, here are some of the problems:

High throughput on dock for ships at berth

Heavy density of major importers with local distribution center operations through Los Angeles and Orange Counties, as well as the Inland Empire

Ocean carriers refusing to allow for inland rail service due to slow rail turn times

Huntsman again:

A plan of this scale and complexity necessarily requires a whole-of-government approach combined with the ingenuity and flexibility of the private sector. It will require vested interests to set aside their intermediate- and long-term agendas, from upcoming labor negotiations to quarterly earnings statements to political electioneering.

The supply-chain breakdown is policy failure. And it will require policy to save it. I do think it will normalize over time in terms of cost pressure, but we need to fix a lot of it. It’s becoming increasingly clear that our systems are no longer working.

What could lead to (an element) of hyperinflation?

So supply chains will likely normalize (and we still need to revolutionize policy there), but what could result in long term pain?

The cost of being a small business

(this is more something to keep an eye on than anything)

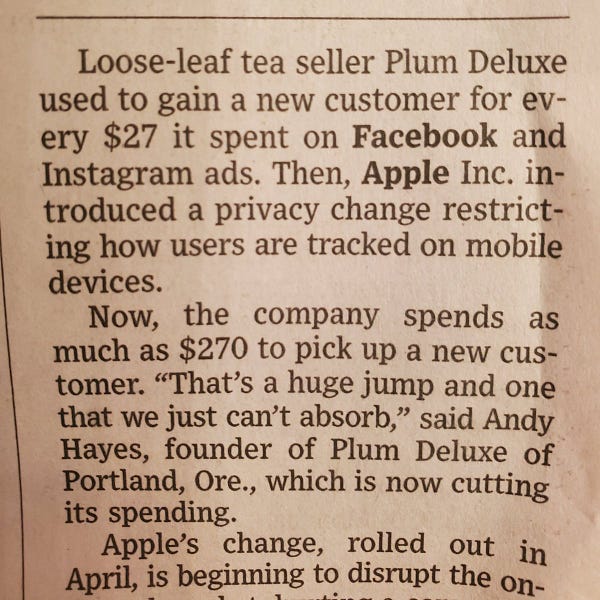

Small businesses have been really hurt by the pandemic, not only from the supply chain perspective, but now from the ad spend perspective due to Apple’s privacy change. Businesses are completely crunched as how to proceed.

We could see small businesses setting higher prices because they can’t afford their customer acquisition costs anymore. Not great.

The connectors have to play the game in order for the game to work. If we have small business dry-up, it would be detrimental to how we move forward.

There is also a bunch of companies buying up things (corporate asset ownership)

You saw this with Zillow - they bought up a bunch of homes, and now they are losing money on those homes because they don’t know how to flip for a profit.

But if we keep having intervention like this in the market, it could skew market mechanics and distort prices.

From Rick: “A lot of speculators in the build-for-rent space that are tying properties up & going through entitlement process, then flipping the property for an increased price. Equity requirements for the build-for-rent projects are getting larger.”

????? how is anyone in the next generation able to afford a home (excluding those who can inherit property)

Increasingly, market mechanics are skewed where the little guy gets squished, which will put pressure on innovation.

Is crypto the answer?

I just want to address this quickly - if we have hyperinflation, is Bitcoin the answer?

Maybe? In a hyperinflationary environment, you could theoretically take your Bitcoin, go to Walmart, get your stuff, and leave, but there are some headwinds to that process.

More simply, here is what would likely happen:

USD loses reserve status

People freak out and resource controls implemented

Crypto would suffer - everything would suffer

HOWEVER It’s important to keep building. But we also have to recognize that there is a physical society (however flawed) that requires upkeep to a certain extent. I am bullish crypto, but the U.S. going through hyperinflation would be near-catastrophic for a lot of things, which everyone knows, I think.

Perhaps its naive, but fixing policy (and integrating crypto into that policy) would be the best path forward, as so many are trying to do (such as CoinCenter).

Final Thoughts

So whats going on here? We have bad policy (and we CAN fix this, as Huntsman outlines, as CoinCenter advocates for, etc).

We have inflation - We do have rising prices in the U.S., and this is mostly a function of high demand and constrained supply chains, as well as outsized fiscal and monetary stimulus.

However this is not hyperinflation - what happened in Weimar is that they were trying to spend their way out of a war debt situation, with the assumption that they would win the war (which didn’t work) and instead they inflated away their economy

The main takeaway from this piece is:

Policy is fundamentally broken (and we already knew that). And we know that we can fix it. We just have to engage.

But policy is broken because we have forgotten about the connectors. We have become so accustomed to the “consumption on-demand” society that we operate in that we have forgotten that this society hinges on people.

We have to remember people are behind EVERYTHING. Take care of each other.

The connectors have to play the game in order for the game to work.

As I proofread this, Tesla hits $1,000 (split-adjusted). How? Doesn’t matter

Maybe policy should be memed.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.