The Debt Ceiling, Expectations, web3 and the Energy Crisis

the irreconcilability between the physical and the online

This is a broad market though piece on the debt ceiling, inflation expectations, supply chains, and the role of crypto.

YouTube will be posted here soon (sorry)

AN UPDATE $$$

A lot of people have asked me to enable paid subscriptions, so I’ve done that - but my work will remain free and accessible to everyone, forever. My goal is financial education, always - and this model is one way to help me achieve that. So sub if you’d like, and thanks for coming on this journey with me :)

also piece is long and will be cut off in ur mailbox

The question that we are all trying to solve:

why market go down?

The other question:

What am I *doing* here?

There is a lot happening - and when a lot happens, we and the market have to ~digest~ that. So I will be talking about:

The debt ceiling

Inflation and supply chains

Crypto and web3

Energy crisis

The Debt Ceiling

Congress is currently battling it out over the debt ceiling - trying to decide how to pay off debts that they’ve ALREADY accrued (mostly because of COVID etc). ‘How do I pay my rent this month’ vibes.

Funding: These debts are normally funded by (1) tax dollars and (2) selling bonds (taking out debt).

Limits: The big problem is that the U.S. says “hey we can’t have ~too much debt~” and puts a limit on it (for posterity reasons, ofc).

Blocked: When they reach that limit - (1) can’t take out more debt and (2) can’t cover their past spending. Bad!

Every time this happens they end up raising the debt ceiling, but this time around, politicians are in a silly goofy mood. Here is how I picture the conversation:

Now we are severely flirting with the debt ceiling (which they always end up moving, in fact have moved 78 times since 1960). And this is definitely about dysfunctional bipartisanship, but its also like ?? why do we keep DOING THIS.

Republicans have also pointed to the fact that Biden and Democrats want to spend more money in their new policy plans to fund things (which is what government is designed to do at a base level) but Republicans don’t vibe with that level of spending (it’s “irresponsible”). They are flexing at the absolute worst moment, because there is a potentially severe fallout from not solving the debt ceiling problem.

What are the consequences?

Treasury stops functioning: Yellen said that Oct 18th is the last day that the Treasury can prop this up without a plan moving forward

If the Treasury can’t keep money flowing back and forth, that’s bad. The government would need to shutdown, which would have cascading effects (spooking market, lost wages, etc).

So the Dems are going to have to figure this out by then - and they have a few options to skirt around the Republicans (like a trillion dollar coin??)

The U.S. could go into default: This would be very bad, because then people would not trust the U.S. —> this would threaten the USD as reserve currency.

At a time of very delicate geopolitics (China, Afghanistan, etc) this would be not good.

Also, a government showing weakness like this is not good.

This is bad. It is simply objectively bad.

It’s bad for a few reasons, not only because this is glorified paper-pushing (we seriously don’t need a debt ceiling, it’s like that one friend that always threatens to breakup with their boyfriend but never does) but also because it’s about confidence and expectations.

Inflated Expectations

Similar to inflation.

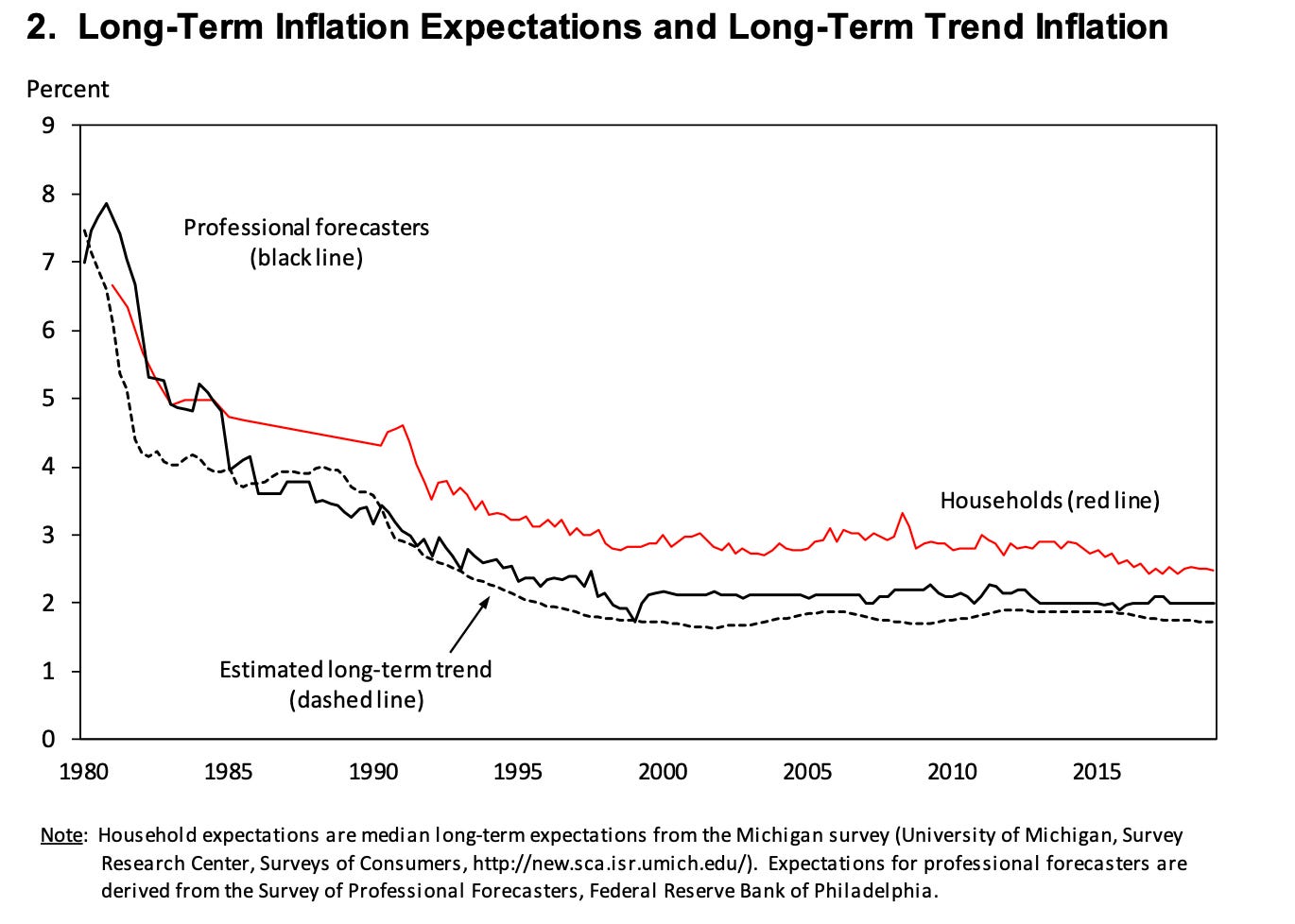

Jeremy Rudd, a senior Federal Reserve economist came out with a paper on Friday that talked about how inflation expectations don’t really matter anymore (and they never really mattered at all, at least short term).

The things is that the Fed sort of *manifests* that 2% inflation expectation number into existence (sort of, but they never really get it). Their job is to 1) focus on full employment and 2) maintain price stability, and they do that by moving economic levers:

Through open market operations, or buying and selling securities on the market.

This gently (sometimes less gently) nudges the market. But they don’t really know what is going on -

From Rudd’s piece:

Economists and economic policymakers believe that households' and firms' expectations of future inflation are a key determinant of actual inflation. A review of the relevant theoretical and empirical literature suggests that this belief rests on extremely shaky foundations...

!!!!!!!

Rather than trying to say “oh yes, we all know exactly what is happening” Rudd is essentially saying “actually, we don’t know what is happening and using expectations as a policy tool is highkey concerning”.

Because when you when actually zoom out - the Fed is wrong all the time (we all are).

It’s here: when you look at the actual hard data right now, you can see inflationary worries begin to creep in. Inflation is here, to an extent.

Rudd’s paper was a callout to the structure that the Fed has been using for a long time. Expectations are not the way, because they are so foggy - it’s TOUGH to forecast.

Unrest: An important point here is that a key part of dissent and anger is to see mismatch - when the Fed says that there is no inflation, but then you have almost every single metric of inflation elevated, it feels bad. People get frustrated.

In the long run, inflation expectations are important - and almost every market *to some degree* is driven by expectationary behavior. How people *expect* stocks and crypto to perform has a role in how they eventually *do* perform, in the long run.

But what Rudd is saying according to Claudia Sahm:

“Don’t lean on inflation expectations. And stop talking about them. No one likes to talk about inflation. Stick to studying actual inflation and the supply and the demand factors in the real world that are pushing it around right now.”

Because people PAY ATTENTION to this stuff. And if you pay attention, you can ~manifest~ things into existence, which is what Rudd is stating below. Expectations aren’t everything - but they are playing an outsized role in policy decisions that needs to be evaluated.

A Tight Labor Market????

As a quick note, the Fed is in sort of an interesting position

Warren squaring up with Powell was a shock

~unusual trading activity~ at the Fed caused both Fed Presidents Rosenberg and Kaplan to step down, which has led to speculation that Powell might step down. Brainard seems to be speaking out more and more, so it could be really interesting to see if she ends up taking his spot.

When we think about inflation and expectations, we have to think about supply chains. We consume goods. That is one of our primary modes as economic entities and our role in society. But what happens when it becomes too expensive to consume?

The Issue of Demand

This of course ties into Evergrande and China.

Michael Pettis had a great thread talking about the demand economy in China - and how people are buying homes to speculate. Beijing is trying to figure out how to grow its economy beyond this style of gamble-hacking (speculation as a form of allocation).

Beijing knows things aren’t great, but they are trying to figure out what a growing economy means in the context of a changing world and the Common Prosperity plan (where everything is meant to get distributed evenly)

China has grown through debt (Evergrande is not the only one!!) and empty buildings (ghost cities)- and that model is no longer sustainable

Here in the U.S., I think a lot about how ~consumer demand~ is 2/3rds of GDP growth - and what that means when we reach essentially a flatline of supply that can’t match this demand - what happens HERE when we face our own debt issues and ghost cities?

How does the demand curve respond to excess demand, coupled with not-enoughness of supply? What does it mean if demand cannot be fulfilled because:

Production doesn’t match the level it needs to (we can’t produce to match the stuff that people want)

Supply chains are absolutely wrecked (the stuff can’t get where it needs to)

We are facing that crisis of not-enoughness right now.

I am still thinking through what the theory of excess means (a good thread on that here from John Manoochehri) as I think we are entering the age of excess.

We have always had a world where we are focused on the idea of the !consumer! as a tool for economic growth, and now the question becomes - how does a !consumer! function in the light of broken supply chains, ghost cities, and an inflationary environment?

What is GDP, if not consumer spending? How do you deal with demand when supply chains are so rickety?

Zooming in on supply chains, with increasing demand as the holidays approach, and all the boats are becoming stucky bois.

Crypto as an Answer to Physical?

I think that there is an interesting compare-and-contrast to crypto/web3 (wow, i know).

Crypto/web3 exists primarily to (at a very, very high level):

Store wealth

Be a community

Have functionality as a platform and exchange

There is a metaphysical element to the supply chain crisis. e-girl capital wrote a great piece “Self Sovereign Symbiosis” based off the Sovereign Individual that dives into the “privatization and commercialization of the sovereign individual”.

The main idea is that DAOs (read this primer if needed) and other online communities will result in some element of the individual shifting away from alliance to the nation-state (which I think we’ve already seen a lot of).

We will find other ways to identify and belong, ones that go beyond physical national borders, ones that allow us to identify in modes of true symbiosis rather than predation. We will seek out DAOs, online groups or chat rooms, and ways to identify via online modes of interaction rather than geographically-bound ones.

We are too globalized to belong to any one entity - so we move to the internet, where there is a sense of belonging

Rather than belonging to the state, you belong to a group of geographically dispersed people.

An interesting contrast to that is what China is trying to accomplish with the Common Prosperity plan - trying to get people aligned with the state.

So you have two opposite sides of the normal distribution here - you have crypto in one side of the tail-end (decentralized) and China promoting Common Prosperity (very centralized) in the other tail-end.

The U.S. sits in the middle of that curve. Mostly.

But the more interesting contrast here is the physicality of centralization - what does it mean to geographically not belong like in crypto? Where does the physical tie in?

Crypto can deal with infinite supply and demand (to a certain extent) because it exists online.

But the infrastructure of crypto - the networks, the Internet, the power - all is reliant on the PHYSICAL - the physical goods, the broken supply chains etc.

Everything boils down to how x gets to y - and right now x isn’t getting to y. How does the online reconcile with the physical?

The Problem with the Physical: Energy Crisis and Supply Chains

A lot of the things that we talk about are a function of the online space - crypto has physical backbone, but overwhelmingly exists within the walls of the Internet. But China is going through a massive power crunch, which is biting into already weakened supply chains.

Energy crunch: Nat gas prices have essentially gone vertical in the U.S. We use natural gas for a lot of things - heating, plastic production, and in fertilizer, which is still the backbone of our food production.

Those prices are skyrocketing and there is a lot of not-enoughness going on

There is limited supply, bottlenecks in production, all those things, which is now impacting CO2 (also essential to food production etc)

Supply and Demand mismatch: EVERYONE is struggling with this. China is both the largest renewable energy producer and the largest coal producer, and it takes time to shift away from the latter - too much time, evidently.

To summarize - it’s incredibly hard to organize the physical. Supply chains are constrained, energy crises are seeping through, and that’s HARD to solve for.

There are too many things and not enough paths for the things to go through.

There are not enough people to manage the things, and there are not enough things to carry the things to where they need to go thing.

So there are going to be shutdowns and rations, to manage the supply and demand mismatch.

There are going to be alternative solutions (one day we will lean into nuclear) but for now, it’s going to be a interesting few months.

China plans to increase coal imports, buy some spot LNG, etc - but we are quickly learning what it looks like when demand outpaces supply.

Decentralized Solutions to Centralized Problems

Okay so that was a lot of problems, and not a lot of solutions. And i don’t really have much, so here is a short ramble of maybes.

So, how does this get fixed?

There are a lot of solutions to a lot of problems -

Crypto/web3 is a proposed solution to the centralized and oppressive nature of how the Internet and society is structured now

But what happens when the physical can’t support that? I don’t think that we are to the point where the not-enoughness will seep in, but it’s interesting to reflect on.

A one trillion dollar coin is the proposed to solution the debt ceiling.

Simply getting rid of it is the proposed solution to inflation expectations.

Both of these have ended up being fake guardrails that end up messing up more things than they fix

The coin is essentially an accounting hack - but it’s really interesting because it’s a HACK. That’s what it is. It represents $1T but it isn’t ~really~ one trillion (but it is ??).

Supply chains are a bit tougher to solve for - energy is a bit tougher to solve for because of the physical. Rationing, new forms of power (NUCLEAR ENERGY) are going to have to be solutions that we actively explore.

How do we solve for “Self Sovereign Symbiosis” if there isn’t a centralized entity managing everything, and is decentralization the answer? What exactly happens when we become the sovereign individual?

Is this the beginning of the “Roman Republic” decline of the United States because it can’t solve for the belonging of the individual?

How do we manage a demand-driven economy in the light of not-enoughness, and put guardrails in place to manage that?

How does the physical world get managed in a decentralized way?

What happens if web3/crypto belonging becomes default - can you govern the ungovernable?

What role do expectations play in policy, and how do expectations shape markets?

How do you manage an energy crisis?

If the government defaults on their debt, it’s a clear acknoweldgement of a breakdown in the system (obviously). But (less obvious, and I am reaching here) it’s an acknowledgement of the current irreconcilability between the physical and the online.

This thesis is not entirely fleshed out, and it’s very easy to ignore the world around us when the world on the Internet is so enticing. But it will become increasingly important as we lean into decentralized governance, to understand how the physical plays into our “real” world.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

Out of interest, you mention Gov spending is based off of tax collection and debt creation, whats your thoughts on MMT, and the printing of money to productive expenditure (till the last man/women is hired/working)

In regard to the debt ceiling, I'm falling back on the axiom "if something can't happen, it won't".