The Disruption of Stability

Crypto, housing, Zoltan, dollar dominance, and of course, Elon Musk

If you’re already subscribed, thank you! If you’d like to subscribe, please do so here:

😎YouTube and podcast up tomorrow!

⭐️A quick housekeeping item - if your company would like to partner on a project with me, please fill out this partnership form!

The Disruption of the Grindest

There was a thread that highlighted the 20 books to read in your 20s.

People did not like it.

The QTs and replies were negating hustle culture and the grindset and the hyper-individualistic entrepreneurial force that is the “I am nothing if not Work”.

I think a lot of these points are valid - yeah it’s really not great to Always Be Optimizing - reading fiction and diverse subjects are both really valuable

The inherent assertion was that self-help books are the cookie cutter template of what Success™️ is meant to look like. These books largely don’t leave room for nuance, drag out assumptions, and just copy-paste-progress generalizations.

And that’s a bad thing, because we should want to be our own Person, right? As Colin Wilson wrote in A Criminal History of Mankind:

“The worst crimes are not committed by evil degenerates, but by decent and intelligent people taking 'pragmatic' decisions.”

The Disruption of the Home

But almost ironically? Paradoxically? Our housing structures are increasingly becoming non-individual, which sort of disrupts the whole individuation process (i promise i have a point)

There was a really good YouTube video titled Why Everywhere in the US is Starting to Look the Same that talked about this - the Franchisation of the United States, how we seek stability in the strip malls (a McDonalds in Cleveland is about the same as one in Miami), and how we encourage societal sameness.

It’s much easier to build apartment buildings that look the same versus individual houses (much more profitable too).

This shows up in the advent of built for rent versus built for sale

Which leads to a lot of 5-over-1s, 5 story wood-framed buildings on a concrete platform that are cheap to build, more profitable than single family homes… and look the same.

Because we literally just don’t have enough housing - so it’s a tradeoff. You can live in the cookie cutter, and that’s that.

We end up packaging everyone into the same apartment structure styles and say “hey this is for you, this is what you can afford, and this is where you can live”

And it’s really easy for builders to build these homes - 5-over-1s are simple, quick, and house a lot of people.

Housing is scarce - and mortgage rates are above 5% for the first time in 11-years so… good luck out there - because demand isn’t stopping and shortages aren’t resolving.

So it’s interesting because we have this rebellion of sameness (“self-help books want to make you a literal carbon copy Silicon Valley Bro”) juxtaposed with housing structures that are increasingly homogeneous.

Fear of Sameness: And I think there is so much opposition to the grindset mindset because of *that* immense fear of sameness that is showing up in housing - the loss of a sense of self-identity fading away, of becoming a dust mote just sort of blowing around. So people react viscerally to being told to do xyz, as evidenced by the quote tweets from the aforementioned reading list.

We want to remain ourselves, but it’s increasingly difficult to find who we are.

If most had to point to something that underscores the sort of “4-hour Workweek, Copy Your Own Path With A Shovel and Brick” mindset that shows up in these self-help books is that people who read them want to adapt their personhood to what they think society defines as success.

Because the homogeneity is seen as quick way to access and opportunity. Just do these five things and you can be rich too!!

That boxing of ourselves - the forcing function of becoming the reflection that you see in the mirror - skews what we actually can become. Because we become these build-to-rent homes that are homogeneous and built from different foundations but still end up looking the same.

And people… are rebelling against that, at a micro level.

On a macro level, many think that we are sort of on a similar cusp of things changing.

The Disruption of Stability

So Zoltan Pozsar has sort of been calling for a huge change, even bigger than the 5-over-1 apartments:

Zoltan’s thesis, boiled down

USD is not cool: Countries are going to shift away from the USD and go to things like the renminbi, gold, and commodities. The weaponization of the US dollar is bad, and countries are just not going to vibe with that anymore.

Fed yikes: As a consequence, the Federal Reserve is no longer going to be able to maintain price stability which is a core thing that they need to do.

USD super not cool: So you have state intervention (governments) that are disrupting the flow of money and how we think about structural stability because of economic warfare. Everyone’s like “dang the U.S. is gross and we don’t want to deal with that”.

Crisis: There is a crisis of credibility because there is an inherent assumption in the USD of 1) price stability but also 2) rule of law

Weaponization of the dollar disrupts both of those.

China?? Everyone is going to peace out and China will be a main benefactor from that - and the U.S. will not.

This is interesting from the sameness perspective that I spoke about for individuals-

Things seem like they will remain the same forever: Even when I write out these words, I’m like “oh well no, USD will be reserve currency - military power, and China’s autocratic - why would countries deal with that?”

But things always change: Zoltan would say “well well well China is an ex ante closed capital account but the US is a ex post closed capital account so like it’s basically the same. Also China is the only one that can mop up the Russian commodity situation.”

See, both Zoltan, Luke Gromen, and other guys who are sometimes right about things think that the Russian sanctions are essentially the equivalent of the U.S. going off the gold standard. This is the Regime Shift, the Triffin dilemma, the reckoning of Bretton Woods III where both trade alliances and money alliances shift.

And like, maybe?

Dollar Dominance

Dollar dominance could be at risk. I’ve talked about this before when discussing the displacement of the USD as reserve currency where the IMF was like “well it’s not going to be RMB taking over, but rather a lot of small little currencies as reserves”

And I think this is broadly true - that what we are seeing might not be (1) the amalgamation of everything around China but (2) rather the fracturing of the geopolitical system of affairs.

Disruption of sameness: No longer will be it be “hey this is my buddy United States of America and I peg my currency to that USD” but it’s going to be countries trying to refocus reserves and geopolitical partners as Zoltan points out, with a focus on “restocking, reshoring, rearming, rewiring” - and all of that underscores domestic protectionism etc.

But this isn’t an easy transition.

Nature is a forcing function too: As Dan points out - not every country (in fact very few) are going to be able to build their own “semiconductor factories, satellites, capital goods and even media” - like the underlying value of commodities *is* the “value of claims on industrial production”

Saudi Arabia is always going to have more oil

TSMC is always going to be banging out semiconductors

India is always going to be a good place to grow wheat

Those are just structural components of the global supply chain. Sure, the U.S. has fracking but that’s a well that will dry up eventually, and sure we can build semiconductor factories but that takes time, and sure, etc etc etc.

So there are elements of sameness that have to remain - because *structurally* the industrial process requires sameness (unless we all start eating bugs and powering things with our body heat or something).

The Forced Changing of Structural Homogeneity

But this is interesting - Zoltan’s broad narrative is Thing Need to Big Change to Be Fixed.

You see this with the Fed too - when asked if the Fed should shock the market to get inflation under control (a la Dudley and Zoltan) Governor Waller said “no, that’s not something I personally am thinking about.”

Dudley advocated for inflicting losses on the stock market as a way to get things to cool off.

The Fed was like “no”.

Most likely, the Fed is going to proceed carefully - raise rates by 50 bps a couple of times, shrink the balance sheet, hope that slows stuff down, and try to avoid a recession at all costs.

But it’s challenging to disrupt the status quo of easy money: For the technicals on this - the Fed is mechanically a Big Boi in the markets. They hold 24% of the Treasury market, and 31% of the mortgage bond market. And so they have to ease out of all of that - the plan is to roll of $95b off the balance sheet and then begin outright selling but like - can the market handle that? Maybe?

There’s a good post on Liberty Street Economics about the mechanics of all of this - and like it *matters* from a funding perspective and a stability perspective and a “ah yes, things are not a Recession” perspective.

And hopefully… that all works. Hopefully the Fed maintains credibility, hopefully they don’t cause the labor market to swing around (Janet Yellen herself expressed her fears on that yesterday) and hopefully inflation tempers back.

Hopefully.

The Response to Forced Changes: Crypto?

Hopefully is sort of fluffy.

I know there are a lot of crypto skeptics out there - but just like *countries* are rotating away from USD for their reserves because of weaponization of the dollar, one could say that *citizens* are rotating away from USD and into crypto for the same reason

Fragmentation: That’s where crypto sort of fits into the Zoltan thesis (which he expects to benefit from all this commotion “if it still exists”).

But just as we see the fragmentation of reserve currencies in countries, we see the fragmentation of wealth and ownership into crypto.

And I think that !crypto! kind of has a role in this sameness/stability narrative. Crypto erupted because it was meant to be this concept of Economic Freedom and Fight the Man - it also allows for a level of monetized self-expression that somehow (1) allows you to find who you are and (2) diversify your reserves.

Ingroup Calibration: People become cultish around whatever they are super into - Solana, Ethereum, Bitcoin maxis, etc which is yikes but largely speaking, crypto is giving people on ramps into discovery.

Financial Incentive: There isn’t much that you can do with stocks in terms of exploring who you are - like sure, you can buy Apple because you have an iPhone and that’s good and great, but in crypto you can sort of design what you want your own world UI/UX to look like

Right now at least (crypto exchanges are becoming a little too consolidated) you can express yourself with different NFTs, different wallets (Rainbow for example), different investment processes, etc.

And this solution for an element of self-expression AND diversification of wealth is important. There was a great article in The Atlantic, Americans Are Living in an Alternate History, where Megan Garber writes:

To be an American in this moment is often to be beset with a sense of ambient fragility—not just because life itself is fragile, but also because the systems we navigate keep us in a state of constant precarity.

Like the system has been kind of icky for a while?? We are supposedly at the end of a pandemic, but are we? Inflation is harmful and bad and largely not the pure fault of policy support, but also wow??

And in the U.S. you’re sort of meant to lean into the hustle grindset mindset that I talked about earlier - you don’t *really* have housing security or medical backup plans and you’re just one step away from going bankrupt - and that’s scary.

Wealth Inequality

And things are getting worse. It feels like the rich are getting richer (because they are). There’s a really good research paper from Bauluz, Novokmet, and Schularick that addresses the broad problem of wealth inequality, underscoring that top-10% savingd comes from corporate saving and that-

The increase in retained corporate earnings accrues to equity owning households at the top of the distribution: “a global corporate saving glut of the rich” that underscores that the rise of profit shares and corporate earnings had major repercussions on global saving supply and its distribution.

And so it’s ownership that accrues wealth, which is what crypto underscores as a core component of the value prop. Many have written about this - Bankless wrote a great piece around what crypto *means* highlighting:

The tolls that intermediaries take limits how far this value is able to permeate through society. Every intermediary adds friction to this outbound value flow and prevents it from reaching the margins… Because of this paradigm, the world is one of inwardly concentrating wealth.

Supply Chain Overload

And of course, all of these problems are not unique just to the U.S. “Google searches for “payday loan” in the U.K. have surged since the start of March, and now stand at the highest since late 2020” according to Bloomberg.

The whole world is sort of hanging in an imbalance, which is underscored by Zoltan’s work, with global food costs rising more than 50% since mid-2020, with Egypt and other nations scrambling to find sources because of the continued broad and horrific pain of the war in Ukraine.

And that isn’t just a not-enough-food problem, it’s the disruptions from Russian violence, resulting in boats not able to deliver what they need to, from truck wheels not being changed, just the pure logistical bottlenecks of commodities that come from a just-in-time supply chain system.

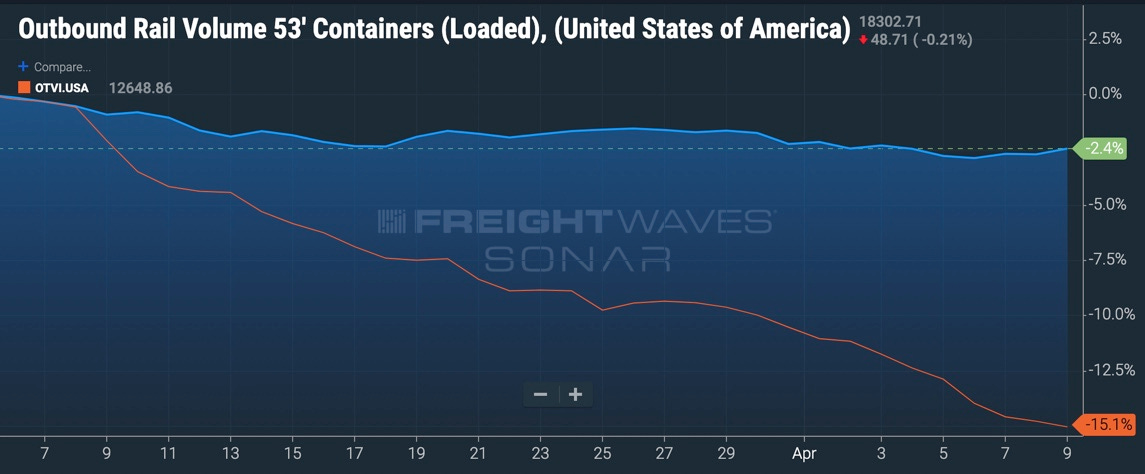

This reverberates across the world right - but almost paradoxically, we are starting to see the bullwhip effect play out where companies were like “oh dang let’s build up our inventories” and then all the sudden companies have too much inventory, and not enough demand to match it. As shown below, truck volume is slowing whereas containerized freight on rails (intermodal) is remaining relatively steady - it’s overcorrecting.

But there’s always a dark horse.

What’s going on with China?

China is currently going through intense lockdowns -

It’s really sad and scary to watch and hear anecdotes from people living in Shanghai. And China’s Covid-Zero policy has made them increasingly unreliable as a supplier, as Craig Fuller highlights - and will make U.S. companies switch over to a new sourcing strategy, which we’ve already seen with the uptick in suppliers from Mexico and the 29% decline in suppliers from Asia.

And all of this underscores that China is likely in no place (no offense Zoltan) to take on a reserve currency I think. As MacroPolo Econ highlights, they’ve “invested too much in the wrong things and the wrong places” - construction and low growth regions.

China’s bond yields have begun to converge with the U.S. (nominally) which makes them a bit unattractive

And they keep cracking down and their property companies keep defaulting - and they are going to ease policy - but it’s looking increasingly precarious for them economically

Globalization

So China is in a tough spot economically, compounded by Covid, Ukrainians are still fighting for their lives, people in developing (and developed) nations are facing food insecurity, and Europe simply can’t stop buying Russian gas.

Things are messy.

Janet Yellen, the Treasury Secretary spoke to the Atlantic Council yesterday and basically came out absolutely swinging at globalization -

“Let’s build on and deepen economic integration and the efficiencies it brings—on terms that work better for American workers. And let’s do it with the countries we know we can count on. Favoring the ‘friend-shoring’ of supply chains to a large number of trusted countries, so we can continue to securely extend market access, will lower the risks to our economy, as well as to our trusted trade partners.”

This was all a relatively thinly veiled threat to China, as Politico higlights.

Yellen basically said “we are only going to work with people we trust”

And “China, be careful about who you become buddy buddy with”

It was sort of a recognition that globalization is a bit iffy right now - she told countries that were sitting on the fence basically to “get it together right now and don’t even think about having a relationship with Russia”.

So.

She also spoke about the Fed, saying that they would need skill and good luck to rein in inflation without thunderstorming the whole economy.

Yikes.

Inflation.

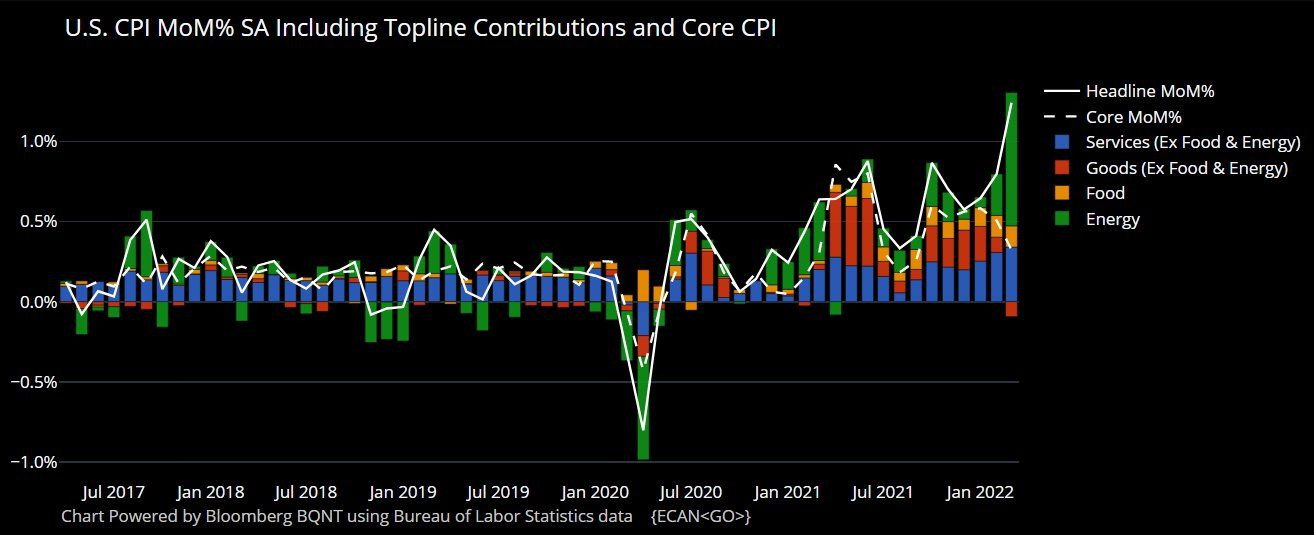

Then you have just wacky inflation metrics that are good because they aren’t that bad. Food is incredibly expensive, gasoline prices are a monster (SPR releases might help? E15 might help but might cause a corn crisis?)

CPI metrics came in not that hot at 8.5% headline, but PPI came in at 11%!!

Meaning that companies are facing some spicy costs, which will get passed onto consumers eventually.

Amazon is already charging sellers a 5% fuel and inflation surcharge!!!!!

But Used car prices did fall by almost 4%, so that’s good. Ah.

More to come.

Elon Musk

How could I not discuss? This is sort of a disruption of stability within itself.

I’ve written about him before - for however you feel about him, guy has game.

But this is like the meta game where Guy Decides to Buy Thing because Why Not. And like, sure, fine whatever I guess. But it’s just funny to me. Like all you can do is sort of chuckle because look at all the stuff we just dicsussed! Inflation! Food shortages! Lockdowns in China! And yet, Elon still manages to become the front page. Incredible.

So what’s going on?

April 4: Elon announced that he had purchased 9.2% of Twitter, making him the largest shareholder. He was then appointed to the Board of Directors where everyone was like “you can’t buy more Twitter or try to take over okay” and Elon was like “no THANKS”

April 10: Parag Agrawl (Twitter’s CEO for now) announced Elon would not be joining the board, so now Elon can buy more AND tweet about Twitter, his favorite thing.

He is Carl Ichan but in a weird way- tweeting out edit button ideas, ruminating on Twitter’s death, declaring that it should be called “T*itter”, and proclaiming the downfall of free speech on the platform.

April 14: Today! He tweeted that he would be making an offer to buy 100% of Twitter at $54.20 per share in cash, a $43b valuation versus his $260b net worth.

Twitter says no? He could leave completely as a shareholder.

Twitter says yes? He promises to unlock Twitter’s “extraordinary potential… as a platform for free speech around the globe”

Now: ???? Twitter board met this morning, the company is meeting again later today. Lots of speculation on if he can even do this - as Bloomberg writes, “Musk’s ‘best and final’ $43 billion non-binding offer has numerous conditions, including completion of financing, which we believe give it a low probability of success”.

He could sell ~20% of his Tesla holdings to finance it (yikes)

He could take out a max $35b loan against Tesla and SpaceX leaving roughly a $8b funding gap due to limits on borrowing

He could bring in partners with outside financing - I mean, he is the world’s richest man, so

Twitter is a little company - but they have people like Kingdom Holding Company in Saudi Arabia saying “no thanks Elon” - so, I think it will just boil down to the idea that “Elon’s playground doesn’t exist in a vacuum”. I don’t know. Twitter is going to fight it.

During a live interview, he did say there was a Plan B? But said it was for another time?

Like

I don’t know

Final Thoughts

There’s a lot changing.

BlackRock is investing in Circle, the company that issues USDC, the second largest crypto stablecoin, and now Circle is now applying to become a bank - there’s your CBDC everybody.

Tradfi is slowly entering crypto, which will likely change what it does and how it acts. But I think to this point of stability-

Things have been weird.

But there is always this underlying thread of sameness, like “ah the global financial system will remain backstopped by the Federal Reserve and they will support commodities somehow, and things will be okay”. Right? Maybe?

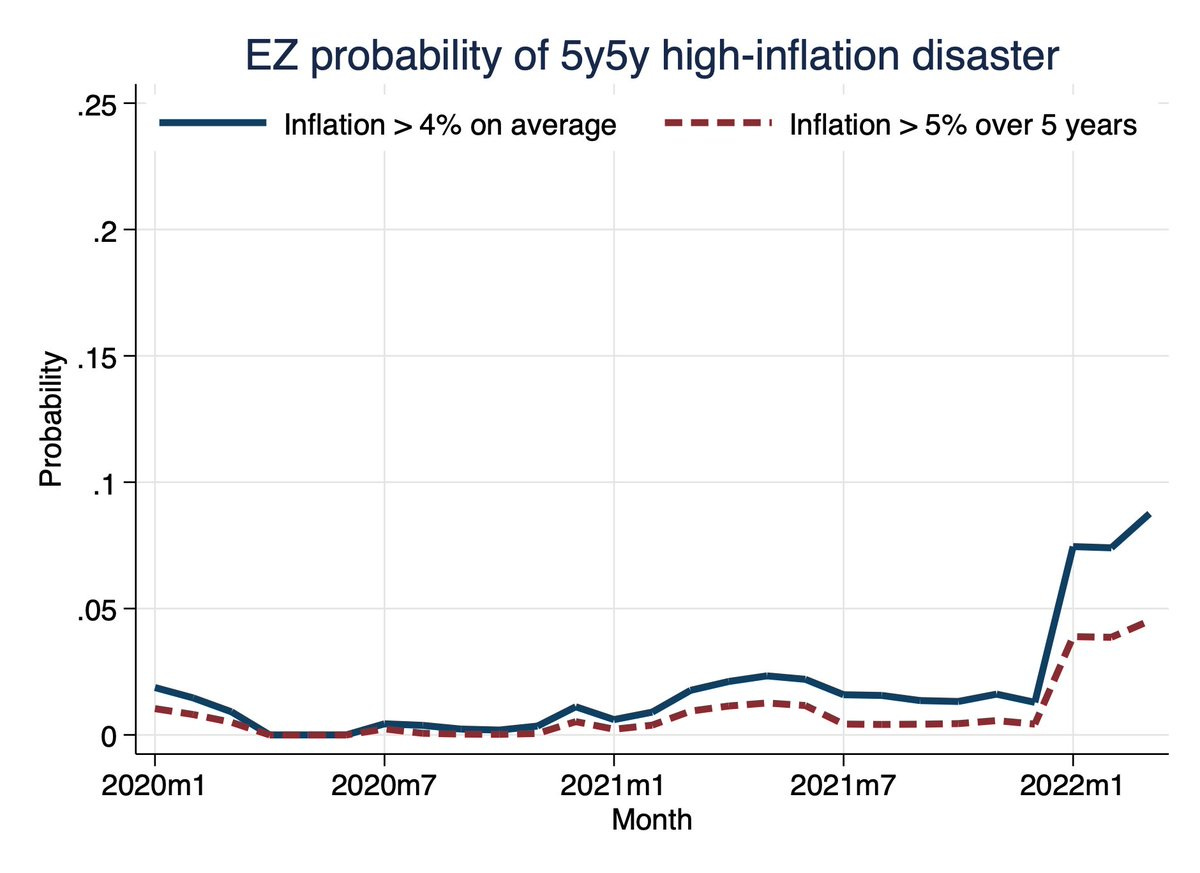

And largely, things will be okay. Change is inevitable. But I do think that things have probably fundamentally shifted as a result of the pandemic and the war and inflation is not just going to magically go away - Reis, Hilscher, and Raviv have a good paper titled “How likely is an inflation disaster?" and the answer was essentially “a storm is a brewin”

The world is changing. Even on a micro level. As Jim Bianco highlighted “The entire economy is built around 160 million people going to an office five days a week. If this is changing, and again I think it is, the foundation of the economy changes.” So we just as countries will be “restocking, reshoring, rearming, rewiring” as Zoltan wrote - we the people likely will be “relearning, rebuilding, reevaluating, reframing”.

Our apartments are becoming identical. But I think a lot of people are going to be trying to define themselves in the uncertainty of the future.

And of course, as Albert Camus wrote,

“But in order to speak about all and to all, one has to speak of what all know and of the reality common to us all. The seas, rains, necessity, desire, the struggle against death--these are things that unite us all. We resemble one another in what we see together, in what we suffer together. Dreams change from individual, but the reality of the world is common to us all.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

Thought this was brilliant! The symmetry of the micro (feelings of the individual) and the macro (feelings of society) is something I've never really thought about. Thanks!

okay your writing is so dense (thankyou) that i might pop back on here but first off we literally just don’t have enough housing? you know that this induced demand is just a gateway to creating more opportunity for profit and ultimately ends with massive amounts of waste. (and really? NPR?)

Lets be real we don't need more houses, just as we don't need more roads or more food. we need to change our relationship to how we preserve the basic human dignities that everyone should have a right to a safe and private space, nutritious food and clean water and the ability to be in relationship with place.

I love the fact that you write based on being in the thick of it, the what if we paint the wheels this colour can we keep the bus still going mindset, because you are very smart about how you perceive the bus, the wheels and the roads. more than me so i always learn something. However I am always curious if you are interested in other paradigms, other ways to live and be in relationship with place and your resources around you. Not everyones cup of tea, for sure a huge amount of folks think life is great right now, but something in your words tells me you're curious.