The Eggconomy

Inflation, eggs, the bifurcession

eggs are expensive and are emblematic of the economy - which is in somewhat of a bifurcession

The Eggconomy

Eggs are pretty expensive right now - but they are actually less expensive than they *were* - according to Brighton Capital1, the wholesale price for large conventional eggs has fallen from $5.10/dozen to $4.63. But why are eggs so expensive?

Bird food is expensive

Birds are sick with HPAI

The holiday season2

Eggs are actually very volatile in general - more than natural gas (!!!)

And refrigeration is a bit wacky

Supply and demand. And there could be more supply problems down the road - the hen/human ratio is at a 15-year low and more than 11 million hens have died in the past 3 months.

There’s a Reddit fan theory about the price of eggs in the land of the Beauty and the Beast. Gaston sings the following song

When I was a lad I ate four dozen eggs

Every morning to help me get large

And now that I'm grown I eat five dozen eggs

So I'm roughly the size of a barge!

A hen can lay about one egg a day, and this guy was eating 60 of them! Imagine that Gaston is the global economy -

There are roughly 50 people in Belle’s village, so maybe 45 hens if you apply the same hen/human ratio we have today. Not nearly enough supply.

Gaston was spending ~$23 a day on EGGS (in today’s prices of course, back then it was $0.1 a dozen). Way too much demand!

Of course, it’s a supply and demand problem on our level too - not enough laying hens, too many people wanting what the hens lay. The issue with eggs is emblematic to the broader economy - the eggconomy, if you will.

Other Household Items: Inflation as an Onion

John Williams, the president of the NY Fed, compared inflation to an onion earlier this year - and said that there were three distinct layers.

Outermost layer - Prices of commodities- lumber, steel, grains, and oil

Middle layer - Products like appliances, furniture and cars

Inner layer - Underlying inflation like the pressure in the labor market and the fissure that is the housing crisis

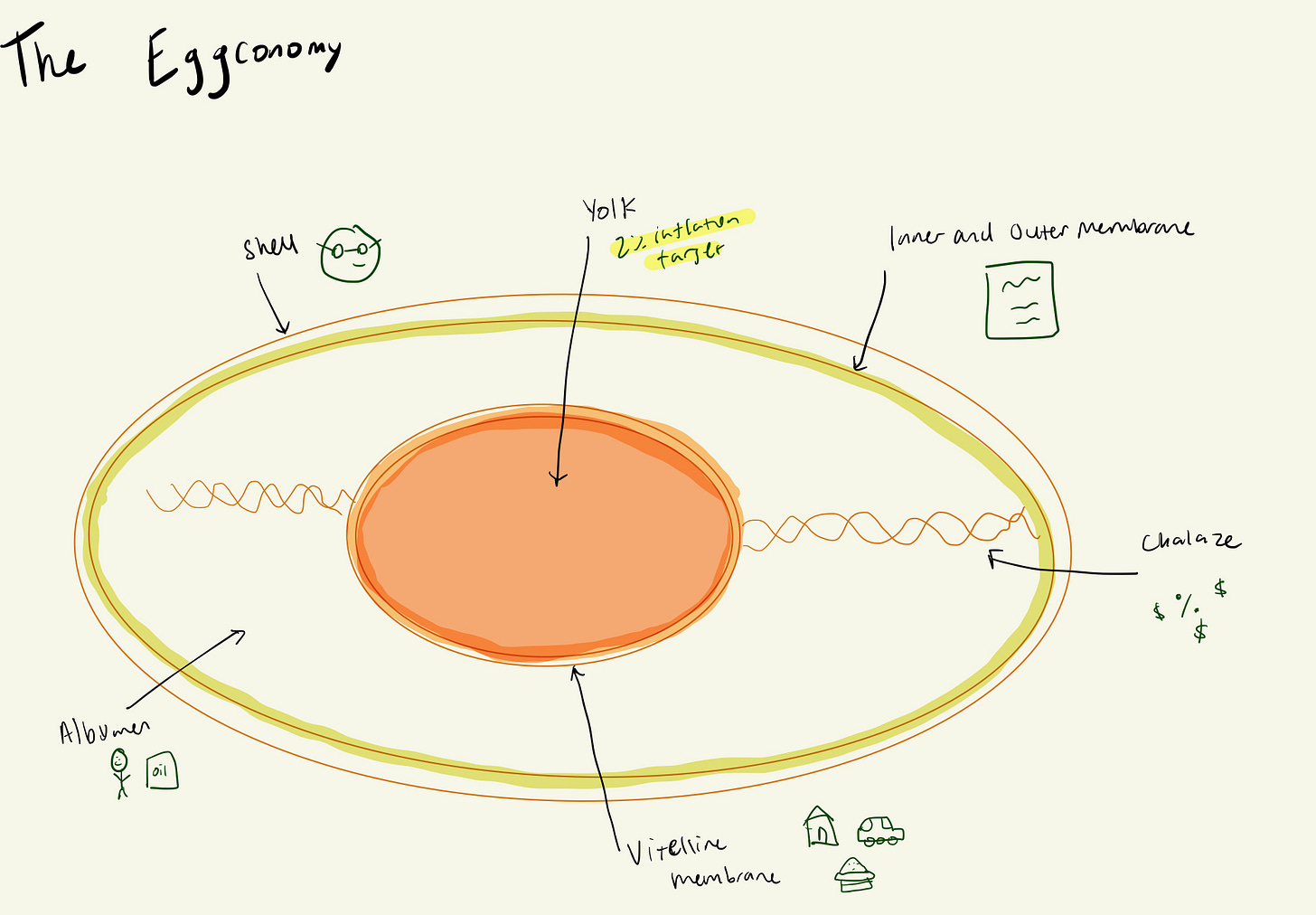

If inflation is an onion, the economy is an egg3.

Both on a meta level and a fundamental level. Eggs are driven by the laws of supply and demand and at a fundamental can completely rupture because it is covered in a thin shell that is meant to protect a cell until it can hatch and carry forth the bloodline. It’s a vessel meant to carry its contents to growth, just like the economy!

Shell - The semipermeable membrane, meaning that things can pass through its pores.

This is the Federal Reserve, the government, and global factors, like geopolitical relations.

Inner and outer membranes - These protect the egg itself, and are pretty strong.

This would be things like regulation and law.

Albumen - The egg white! This is the stuff that keeps the egg going.

Here, the labor market and commodities and other resources.

Chalaze - These are the ropes that hold the yolk to the membrane

It would be monetary and fiscal policy

Vitelline membrane - The clear casing that holds the yolk

Things like shelter costs, food costs, auto costs etc.

Yolk - The vitamin and minerals of the egg.

This might normally (?) be things like GDP growth or a low unemployment rate, but right now, it’s 2% inflation. I know this is technically policy - but this is the Economy right now, 2% inflation.

So the Federal Reserve wants to protect the yolk. 2% INFLATION TARGET.

They have their 2% inflation goal, and they are designing the entire economy around that by potentially sledgehammering the labor force. The egg has become nothing but a 2% inflation target.

Balancing the Egg on a Spoon

The Fed is focused on a few things within that 2% inflation target. They are balancing the egg on a spoon.

Fed Cred: The Fed really does not want to be Arthur Burns. Randy Quarles told the Burns story at Stanford back in 2022, and was like “to be remembered for inflation? nay dear sir, i would rather be remembered for invoking a devastating recession because of the limits of my toolkit” One can imagine that the rest of the Federal Reserve feels the same - no one wants to be the guy that messed up.

Fed Recession Goals: EmployAmerica came out with a piece talking about the Fed engineering a recession via high unemployment rate. The unemployment rate that the Fed is expecting us to get to is brutal and runs a high risk of a recession. Bad!

Fed Beef: The Fed is trying to put the market in its place. They have major beef with the stock market and directly stated in their most recent meeting minutes that “an unwarranted easing in financial conditions” (aka market celebrating that the Fed might cut) would result in a punch to the face

Neel Kashkari went right after the market and said

“I’ve spent enough time around Wall Street to know that they are culturally, institutionally, optimistic." Kashkari laughs: “They are going to lose the game of chicken."

Which is sort of wacky because like ?? maybe let’s not square up with the market but also that’s what the Fed has to do to preserve Fed cred so it becomes this endless feedback loop of protect-fed-cred-yell-at-markets-predict-recession-raise-rates etc

2% inflation - The Fed is hellbent on getting to 2% inflation. And the main way that they are going to go after that is through the labor market, which is softening but in a way that isn’t as soft as what the Fed probably wants.

Quits are speeding up and the ratio of vacancies to unemployed workers is holding around 1.75 and the Fed wants that to fall.

It’s a bifurcession - a recession in tech and finance jobs, but growth in construction and other jobs. Lower income earners have experienced the largest earning gains in 2021 and the top quintile saw declines - which the opposite of what happened after the recessions in 2001 and 2008! This is good in terms of equality and access. But the Fed still wants the labor market to chill out - and there are two ways -

Labor force participation rate increases

Unemployment increases

Lots of people retired according to Fed research - accounting for almost all the shortfall in labor force participation rates. So we’ve got to go to other methods if we don’t want to resort to pushing people out of work - immigration reform, working parent support, and support for people with disabilities are a great place to start.

What is a soft landing?

Everyone wants the bird to get out of the nest eventually, and ideally, not rocket to the ground in the process. That’s the same with the economy - ideally, we can have a soft landing which essentially means that the economy does not blow up, millions of people don’t lose their jobs, and inflation eventually subsides.

The definition of a soft landing would be - ‘vacancies can decline substantially taking pressure off inflation without driving unemployment way up.’ Basically people get back to work - but inflation is softening on it’s own too.

We are getting closer to the idea of a soft landing! - inflation expectations have fallen, wage growth has slowed, freight costs are recovering, rents are collapsing, consumer credit is increasing, etc. CPI came into today right at expected - which is good! And the number that the Fed really cares about - core services ex-shelter - came in negative month-to-month for the third consecutive month! Like yes! This is GOOD. There’s probably more data pointing to things relaxing versus things heating up.

The Fed’s whole thing is to crack the consumer - make it so people can’t spend as much money. And it’s working! The egg is balancing on the spoon!!

The Cost of a Nest

The housing market is just bonkers, honestly.

Housing inflation: Housing was such a big driver of inflation - according to Fed economists, it potentially drove 1/3 of the increase in the CPI which is just massive - and also highlights how important it is to have housing supply.

Consumers are freaking out right now: KB Home, a very big homebuilder, reported a 68% cancellation rate which is WAY up from a 13% cancellation rate in Q4 2021. This is largely a product of mortgage rate shock and a 40% run up in U.S. home prices as Lance Lambert highlights.

Rents are slowing down: Rent growth on a 12-month basis for single-family homes slowed in December to 4.8%. Goldman thinks that home prices will fall -7.5% in 2023 and another -2.2% in 2024 but then bounce back to +3.8% in 2025.

We are seeing easing in the housing market - but with sky high prices and sky high mortgage rates, it will probably take a while before things recover. Buyers and sellers are having a standoff. A lot of people pulled forward housing formation in the pandemic (WFH) but now it’s just way too expensive - and people are not vibing.

Flight delays

When you think about a bird that hatches from an egg, it can’t quite fly at first. It has to grow feathers, walk around a bit, then maybe, it will launch off this Earth. It’s little bird technology needs to develop.

Same with our bird technology.

NOTAM, the Notice of Air Mission for pilots completely failed this week. No one really knows why (yet) it just broke. A critical piece of infrastructure - but an ancient piece of technology. It’s emblematic of a lot of American infrastructure, something that should work and did work 20 years ago but desperately needs an update.

The FAA has been trying to update it since 2019, but the Bureaucratic Bloat stands in the way of most efficiencies. And now it’s becoming mission critical that we *remove* said Bureaucratic Bloat. The airlines getting halted because a core piece of technology broke is not unique and it likely will not be the last time something like this happens.

Debt Ceiling Debate

The dodo bird couldn’t fly and neither will the economy if we do not raise the debt ceiling. This is a stupid bargaining chip in a larger stupid circus that is more focused on speculative awe than any sort of governance.

To get elected speaker, McCarthy had to yield to 5 people who were like “hehe I have no plans on how to make the world better, I exist only to cause chaos” and one of the things he had to yield on was the debt ceiling. He promised to not raise it so they would stop being morons.

A lot of people have written about how we can sort this out - mint a coin is a semi-popular one. But the thing is, we can’t not raise the debt ceiling. If the United States defaults on the debt, we become a laughing stock - and technically defaulting on the debt is unconstitutional according to the 14th amendment. So.

Final Thoughts

So I know this piece was a little goofy and metaphorical but when we think about an egg, it’s this really fragile piece of technology that carries forth life. When we think about the economy, it’s also a relatively fragile piece of technology that is the undercurrent for our lives.

Things like refrigeration, bacteria, chicken feed, light exposure, and stress all impact eggs. There are analogies to the economy too - things like supply chain maintenance, geopolitical turmoil, commodity costs all have a huge impact on functioning. But everything is happening all the time, you know? There is a list of popular reasons for buying bonds in 2021 to 2023:

central banks will never raise rates

central banks cant raise rates much

central banks will raise rates too far

central banks will pivot

Like no one really knows what is going on. Ever.

Everyone is balancing the egg on the spoon and we can keep the egg on the spoon! But if we try to run with the egg and try to really test that shell - it’s going to crack. But the egg is DOING OKAY. We just need to be CAREFUL with it.

Finally, a beautiful passage from Rebecca Solnit

To hope is to gamble. It's to bet on the future, on your desires, on the possibility that an open heart and uncertainty is better than gloom and safety. To hope is dangerous, and yet it is the opposite of fear, for to live is to risk.

I say all this to you because hope is not like a lottery ticket you can sit on the sofa and clutch, feeling lucky. I say this because hope is an ax you break down doors with in an emergency; because hope should shove you out the door, because it will take everything you have to steer the future away from endless war, from the annihilation of the earth's treasures and the grinding down of the poor and marginal. Hope just means another world might be possible, not promised, not guaranteed. Hope calls for action; action is impossible without hope. At the beginning of his massive 1930s treatise on hope, the German philosopher Ernst Bloch wrote, "The work of this emotion requires people who throw themselves actively into what is becoming, to which they themselves belong." To hope is to give yourself to the future, and that commitment to the future makes the present inhabitable.

Thanks for reading. Podcast and YouTube up soon.

Some Links

Solar manufacturer Qcells will invest $2.5B in building out US solar supply chain. The public is creating monumental granite statues of Snoop Dogg with AI. Microsoft looking at a $10B investment into OpenAI. The IRS Finally Got Some Funding. Now Republicans Want It Back. How to Write Research Articles that Readers Understand and Cite. Revolutionary Violence and Counterrevolution. SBF has a Substack.

A really great follow for all things agriculture! The sort of person that makes Twitter worth using

Grocery stores normally charge a 70-75 cent spread over farm price and a nice map of egg production by state

This will not be a perfect overview of egg anatomy.

I was reading an article about a chicken in the 1960s that could reportedly lay 17 eggs in a day. A scientist examined the chicken and said that he thought the claim by the farmer was a lie. I have no position on this chicken but support her anyway.

The eggonomy is in scrambles.