The Fed minutes - the clock is ticking! Podcast and YouTube up soon

Most mountains have switchbacks built into them, so the slope to climb isn’t as steep. It takes some effort out of the hike, and is essentially a zigzag up (and down) the side.

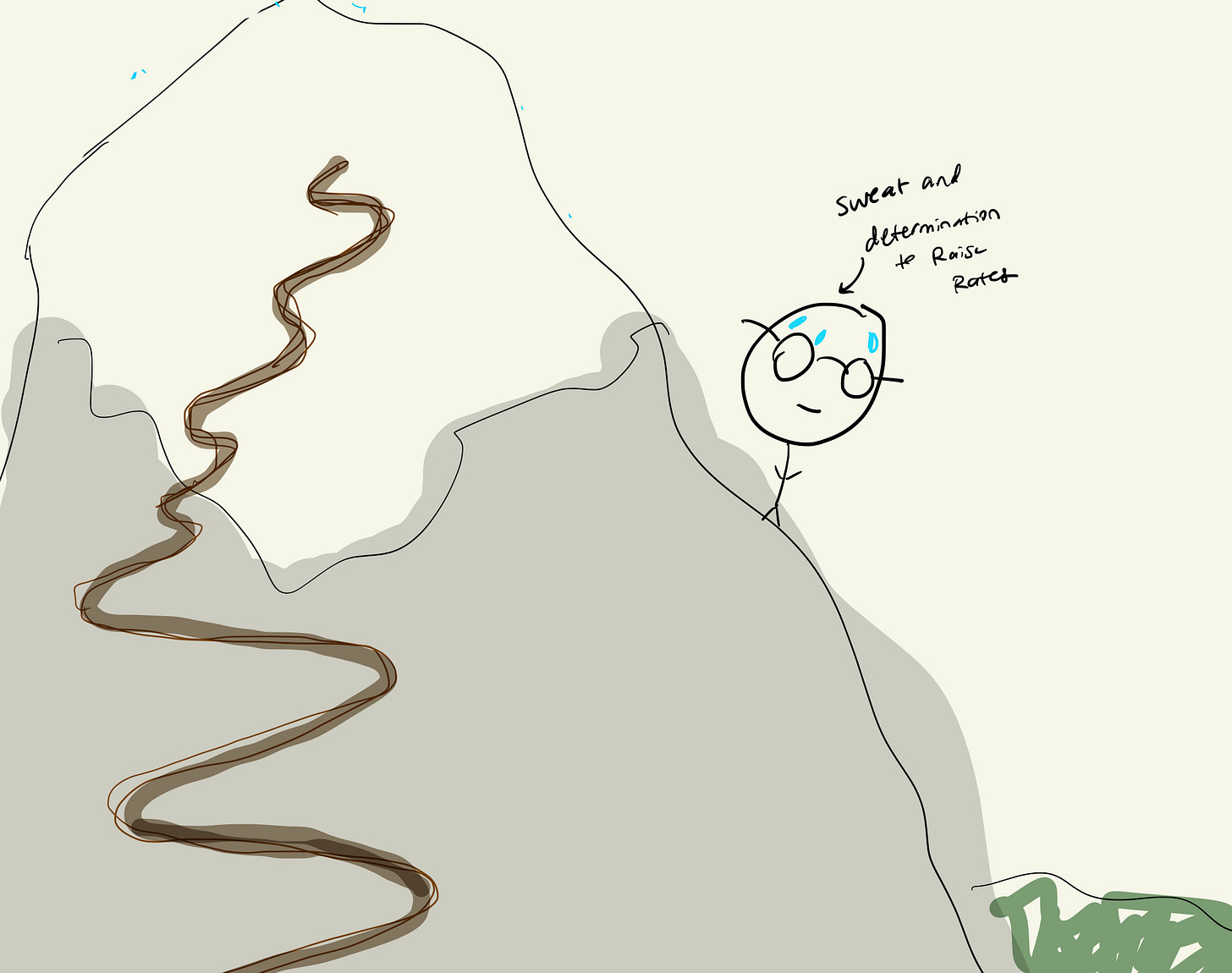

The Fed has been directly climbing the mountain over the past year or so - no switchbacks, no walking poles, just pure love of the grind.

Now, they are approaching some economic switchbacks - data that will make them slow their roll (like inflation slowing down) and might make the overall endeavor of a soft landing easier. Still hiking but mindfully.

However, switchbacks can also make the climb more difficult if you choose to ignore them entirely

The big question for 2023 will be how the Fed approaches their hiking path - will they incorporate switchbacks into their climb or will they just straight up rip the side of the mountain?

Fed speed

For now, the Fed appears to be cognizant of the switchbacks, but they are not slowing down. They have more mountain to climb, and yes, they do notice the potentially disinflationary storm clouds rolling in from the auto sector, rents falling rapidly and US manufacturing activity going into a recession but hey, onwards.

They might not hike by 75 bps - likely 50 bps or 25 bps - but you better bet that they are still climbing that mountain with all they have, with furious energy. Don’t you dare suggest otherwise.

Fed climb

The top of the mountain is that 2% inflation target and what’s cool about the mountain that the Fed is hiking is that literally no one knows where the top of the mountain is. It’s vibes, it will end eventually, one day, maybe.

The Fed plans to get rates up to 5%+ this year according to their recent Summary of Economic Projections. This will be the terminal rate - the point at which they stop their hiking journey (peak inflation, literally). But of course, staying at the top of the mountain is also tightening - the only way that the hike really ends is if you come back down.

Fed foes

Market vs Fed: They are squaring up with the market (here represented by unruly and unpredictable snow that could potentially lead to an avalanche) - and making sure that the market understand that even *if* the Fed rolls up to a yield sign on that mountain - that doesn’t mean they are turning around

Of course, the natural question is if the Fed is becoming too focused on the market response versus the economic response (the two are different, surprisingly).

As the Fed themselves said “An unwarranted easing in financial conditions, especially if driven by a misperception by the public of the committee’s reaction function, would complicate the committee’s effort to restore price stability” - translation? F*ck off, markets.

The question now is how fast inflation cools and how the Fed responds to that

What does the Fed really want?

For the Fed, it’s a balance of ego and effect. They have to make sure that they don’t become too focused on earning back Fed Cred on this mountain hike.

The Fed wants things to slow down.

The Fed wants to kick the labor market billy goat off the mountain.

Jobs are Strong which the Fed is absolutely not stoked about. The Fed wants the labor market to cool off, and that can either happen through

More people returning to work

More people losing their jobs

One is simpler than the other, and that’s the harmful one.

The reason that the Fed is freaking out so deeply about the labor market is that nominal wage growth is tied to “core services ex shelter” (basically things that we need to do to survive) so they are worried that if wage growth doesn’t soften, inflation won’t soften.

What the Fed is doing is trying to blow up the labor market so people stop spending money so inflation goes down.

A Brief Aside on the Labor Market

With the labor market, it’s really become clear that workers are really not respected. And one can bemoan and say “well well well i personally think i should be paid millions of dollars for My Job and no one else should have any shred of happiness” but like, come on. There was an article in the WSJ asking where all the go-getters had gone -

Since the onset of the pandemic, several employees have asked for more pay when managers asked that they do more work, she says. “It was not like that before Covid at all,” she adds.

The article examines each generation’s relationship with work - highlighting that Boomers are all about going above and beyond, but Gen Z and Millennials are just focused on getting the work done.

And of course it’s this way! We just went through a global pandemic, where life collectively flashed before everyone’s eyes. Most people’s passion is not going to be digital ticket scanners, despite what the CEO might want. I’ve written extensively about the collapse of the American Dream but that’s sort of what this is too.

Boomers could work for 40 years for the same company, support 2.5 kids, and buy a house out of college on that same salary. It isn’t the same anymore. There is perhaps an element of complacency, but that’s only a response to the environment.

There is a research paper that dives into this on a scientific scale - Papers and patents are becoming less disruptive over time - that discusses growing complacency in the scientific universe. The focus on publishing has led scientists to focus on narrower knowledge - evident in a decline in works cited and more citations to the top 1% of papers. Because of incentives, we are pressing the pedal of disruption less.

Complacency is pervasive, in many different aspects.

There’s a clip from CNBC where someone is talking about the “slog” that the Fed faces because lower income consumers are doing decently well - and of course, the Fed has to put a stop to that so inflation goes down. And it just is so jarring because the Fed doesn’t want joblessness per se, but they also don’t not want joblessness. Neel Kashkari wrote a bit about this yesterday - “Monetary policy is the appropriate tool to bring the labor market back into balance.”

And maybe it is, but also?

As Pete wrote:

“(There is a) need for central bankers to not ALWAYS rely solely on their faulty econometric models and instead throw in some human nature common sense sometimes”

Like my goodness, the economy is not “slogging” because lower income people are making a bit more money, it’s slogging because of wide underinvestment in key facilities and the people that keep the thing running. As many have said countless times, the Fed can’t make more things, it can only encourage other people to invest in the capacity to make more things. More direct fiscal policy would be great here, but we can’t even vote in a Speaker so it’s a bit grim on that front.

We are seeing some aspects of weakness in the labor markets. Tech is going through a reckoning right now with Amazon cutting 18,000 jobs - roughly 1% of their employees - and of course,

“Amazon investors gave a positive reaction to the latest belt-tightening efforts, betting it may bolster profits at the e-commerce company.”

Phillip Fisher (h/t Barry Ritholtz) said it best here - "the stock market is filled with individuals who know the price of everything, but the value of nothing." Money is not a moral compass, and the stock market is a mechanism that prices profits and growth, and literally nothing else. Bolstering profits should not be the end-game but it is, right - that’s just how the stock market works.

That’s how a lot of markets work.

As Casey Handmer said, “In 2023 it's still insane that we've decided to make housing, a technology at least 100 centuries old, scarce enough to consume a major fraction of GDP in a speculative unproductive deflationary asset that we could otherwise allocate to solving real problems. It is a huge and ongoing tax on the future.”

Albert Camus said it best when he said “real generosity toward the future lies in giving all to the present.”

Hopefully we can begin to implement policy that is thoughtful around preserving labor market billy goats (which the Fed is trying to do but policy hammers send shockwaves) and is mindful of the storm clouds on the mountain. The Fed has an incredibly hard job - hopefully they hike with switchbacks instead of straight up tearing up the mountainside.

Thanks for reading.

Other things

Lensa AI revenue is down to ~$206k per day, down 92% from its peak

The Fertility Crisis Started in Japan, But It Won’t Stay There

(How) does index fund dominance change the political economy of corporate governance?

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

Love your visuals and the billy goat cracks me up! 🤣 Rock on 🤘🏼

Once again Kyla proves to me that, like the Hungarian Circus performer who could keep 20 plates spinning on 20 sticks without losing one of them; she is able to read Albert Camus, CNBC and Casey Handmer and yet integrate so many key concepts into a cohesive blend. You are amazing Kyla and I just love Phil Fisher's statement: the stock market is filled with individuals who know the price of everything, but the value of nothing." Money is not a moral compass, and the stock market is a mechanism that prices profits and growth, and literally nothing else. . Kyla, you are a tour de force and I suspect all of your readers love you!