The Fedconomy

what is happening

I am trying to make these very succinct - there’s a lot to read, and I value your time! I also have no idea when to publish this newsletter, so if you could fill out this form on your preference, that would be wonderful.

This article will primarily be a summary of what happened over the past week.

FOMC Meeting

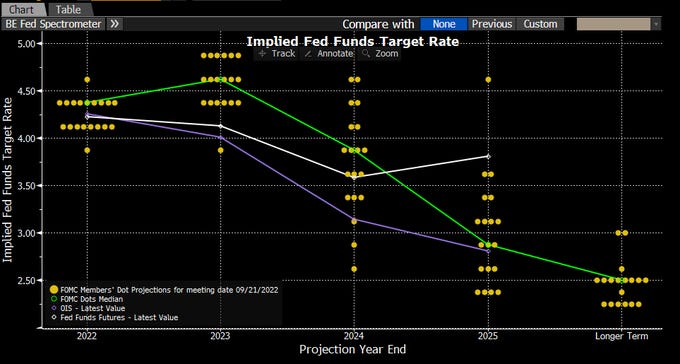

The Federal Reserve raised rates by 75 bps this week in order to battle inflation, and they made it very, very, very clear that they were not going to stop raising rates until the “job was done” - when this inflation beast is tamed. They expect rates to go up to 4.4% by the end of the year, meaning more mega hikes on the way.

Baby recession incoming: They also released their Summary of Economic Projections, which boiled down to “a baby recession is likely, with slowing growth and higher unemployment - but don’t worry, we will cut rates in 2024, and things will be okay again!”

But no one really knows: Powell also said “no one knows whether this process will lead to a recession” which is very true - no one knows anything, and monetary policy is money alchemy at this point.

You can just look at the dispersion of dot plots to catch the vibe here - the more spread out they are, the less certain the path forward is.

The Fed’s main tools are

Raising rates

Shrinking the balance sheet

Talking

Right now, they are doing all three. They have raised rates substantially over the past several months, they are shrinking the balance sheet (at a quick clip, however, they have no plans to sell soon, which is slightly dovish) and they are communicating *heavily*.

The effectiveness of their policy largely relies on Fed Cred - and if their credibility begins to sink, so does the power of their toolkit.

Their goal is to slow demand. They want to slow demand because that should theoretically slow inflation. The main mechanism for slowing demand is to make it more expensive for people to exist - higher borrowing costs, slowing wages - so people spend less. Poof, inflation dissipates.

I wrote about this last week but a lot of the problems we habe are supply issues. But the equation here is that if people *stop demanding* then supply will have more time to get itself in line - which like, sure, but maybe it makes more sense to go after supply directly?

But of course, toolkit limitations. What the Federal Reserve seems to be doing is trying to pummel the labor market with a hammer in order to get inflation back down. When you have limited tools, everything is a nail. 1

Treasury Yields

The Treasury market believes the Fed will hike rates, but is uncertain about the consequences of that! Yields have been freaking out since the Fed meeting, with the 2Y soaring above 4% (it was at 0.25% a year ago) and the 10Y above 3.5%. Few things here -

2Y > 10Y - That’s not great. The yield curve has been inverted for a while, but it keeps getting *more* inverted, which basically means that people are feeling worse and worse about the economy.

Policy - The 2Y is very policy sensitive, so when the Fed comes out swinging, the 2Y is going to respond to that momentum. It is reflective of what the fed-funds rate over the ~next two years, so the market clearly expects higher rates from the Fed moving forward.

Inflation Expectations - The 10Y is sort of reflective of inflation expectations, so the market is expressing general uncertainty here - but the climb in the yield on the 10-year TIPS shows that investors expect inflation to fall somewhat over the coming years.

Rest of the Economy - What treasury yields do impacts the rest of the economy (such as the housing market, stock market etc)

The yield curve is essentially saying “ok wow, we see you Federal Reserve, and we are sort of afraid of you right now”. The Fed is going to keep raising rates, which should push inflation down, but the risk of breaking stuff is increasing.

Housing Market

When the Fed nudges around the fed funds rate, that moves treasury yields, which moves mortgage rates. This week mortgage rates went over 6.5% - which has disqualified 18 million households from qualifying for a $400k mortgage. Spending power has essentially collapsed (and still somehow, home prices ticked up 1% last week).

There has been a ~30% decline in affordability since the beginning of the year - which of course, will hurt home sales.

But this isn’t just about home sales, it’s about wealth building.

Home ownership in the United States is one of the top ways to become “rich” - your house is an asset that you live in.

Of course, this was fine in the 1960s when houses were $10 and you could afford one with a 9-to-5, but now, more and more people are priced out of the housing market.

It’s the ghost of supply and demand - we simply don’t have enough housing in places that people want to live in - but it’s also a “New Weird” as RedFin titled it.

People that locked in *super low* mortgage rates are like “welp, i don’t want to move” so new listings on the market have softened. But also almost 40% of homeowners (~32 million people) have NO mortgage on their house, meaning they have absolute moneybags in home equity.

The typical home was bought for $240k in 2018 (can you imagine???) and that house is likely worth well north of $400k.

A lot of people have no mortgage, and are sitting on hundreds of thousands of dollars of gains. The question will be if they want to cash in - or if they are going to wait.

If they continue to wait, the supply ghost is going to continue to haunt the housing market. Homebuilders are not feeling great about building new homes because homes are expensive and they are worried no one is going to buy them - and also they keep building *more* multifamily homes versus single family homes, which doesn’t help the issue at hand. The spread between housing completions and units under construction continues to widen.

What the supply and demand misbalance does is keep more people as renters, when they should probably be homeowners, which mechanically ends up exacerbating apartment prices too because of !!supply and demand!!

Adding to the demand, the millennial generation of mostly those in their thirties continues to live in apartments and is unable to purchase homes… They’re sort of stonewalling the new rental population that was behind them - Michael Keane

That’s why you see things like this - “NYC may have sky-high median asking rent of $4,102, but y/y change of +17.7% is slower than Cincinnati and Pittsburgh, at +25.8% and +22.1%” - it’s everywhere.

And of course, higher rents hit those that can least afford it the hardest. There are so many pressures on the housing market - home flipping, private equity, regulatory headaches, and the Fed’s actions to fight inflation. The idea is a baby recession might reduce home prices but mortgage rates are going to keep a lot of people out of the market.

Stocks are Feeling Bad Too

Yields are also a wrecking ball to stocks, another vehicle of wealth. Real yields are soaring, which does two things -

Hurts valuations - If you’re a high flying tech stock, you love low rates! It’s great, your little excel spreadsheet looks incredible. So when rates start to tick up, that’s very bad.

TINA - With yields at 4%, it kind of doesn’t make sense to invest in stocks. So people are more likely to go into bonds.

The regime is shifting! Why take on extra risk when you don’t have to? I doubt it will become a Big Thing to invest *only* in bonds, but there are continuous shifts in how asset management works now (which hopefully, asset managers are paying attention to).

I wrote all about the dollar last week, but it continues to dance on the graves of everyone else. Japan intervened to support the yen this week, which has weakened substantially over the past year as the BoJ and the Federal Reserve diverge in monetary policy. The dollar will continue on its mad gainz path too - people want dollars, but that hurts many countries have dollar-denominated debt and countries that import energy.

How will the Federal Reserve think about that? It’s uncertain.

I made a TikTok (and Instagram Reels, YT Shorts) about everything going on in the U.K. - how monetary and fiscal policy connect is extremely important.

Energy Update

And when everything gets hammered, you start to walk back on previous commitments.

Jamie Dimon hosted a roast session in front of Congress, stating that crypto was a ponzi (I also would say this if I had my own JPM Coin) and that ESG was also a ponzi. He said “you can’t have green energy policy without green energy investment” which is true.

This week, the “European Commision has eased its coal sanctions on Russia”. When there is risk of people dying, you have to do what you have to do.

But you also don’t need to shut down your nuclear reactor? For the first time? In the middle of an energy crisis?

There is so much grandstanding around making the world better, but in order for the world to even become good, we have to phase out of the bad properly.

Final Thoughts

I really liked this from Flo Crivello -

Forgot who said that "when Western people become wealthier, they buy more loneliness." Nomadism seems like the epitome of this — single people forego all connections, networks, relationships, to solo backpack through Asia, making themselves miserable to please their IG audience

I have been thinking a lot about American Individualism, and how prevalent it is in everything that we do. The way that we are encouraged to take care of ourselves is by being alone, which is quite absurd if you think about it! I am an introvert (as I know many of you are too), so I need to be alone sometimes, but there is still something healing in being around people.

That’s sort of my issue with economics - people are treated as commodities, which they sort of are as economic entities, but there is something blatantly unhuman about it.

The way we communicate things too was so frustrating - I think Jerome Powell does an excellent job (I am a Fed simp after all) but I also think that putting these things in more human-centric terms is important.

One of the Fed’s main tools is communication, whether that be their press conferences or the Nick Timiraos column in the WSJ - they should make it as clear as possible, for everyone, not just market participants.

Of course, when you say things like “Fed communication should be a bit more understandable” people are like “well well well aren’t you a little delicate flower baby cry cry” but that brings me to a Tennessee Williams quote I liked -

All cruel people describe themselves as paragons of frankness. They shout ‘we don’t love you anymore!’ as they run into the sea. What else are you supposed to do on this earth but catch whatever comes to you, with all your fingers, until your fingers are broken?

The paragons of frankness are shouting again. This time Life is an unaswered question! and now we shout back But let’s still believe in the dignity and importance of the question!

Thanks for reading.

Newsletter Subscriptions

The goal of my newsletter is for it to *always* be free - but there is work that goes into writing, of course! If you think the content is valuable or would like to buy me a coffee once a month :-) I would sincerely appreciate your support.

There are three options:

The annual subscription: $110 annually

The standard monthly subscription: $10 monthly

Founders club: $220 annually or any other amount

What do you get as a paid member?

Q&A drop box + links roundup - This will be sent out in a biweekly email (sent out next week) which will include a place to ask questions (which I will *search* for answers to!) as well as links of what I’ve been reading recently, ranging from Dostoevsky to Deese.

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

I’ve written about this before, but a weaker labor market doesn’t necessarily have to be layoffs - it could be more people entering the market, an increase in labor force participation.

This is an excellent way to start the weekend, a recap and deeper dive on everything economic this week. Thank you Kyla for your work, I share it with everybody I can. I definitely have a much deeper understanding for our economic position and outlook thanks to you.

Required reading for most Americans. You did a wonderful job of simplifying the multiple variables and dilemmas facing our economy. Thanks for your hard and work and talented mind.